The negative externalities that emanate from central planning are very predictable.

This tweet was sent in the middle of the rapid monetary base expansion that followed the COVID lockdowns.

— Marty Bent (@MartyBent) August 20, 2023

3.5 years later and this passage from the Ethics of Money Production is almost comical to read considering everything that’s happened since. This was all very predictable. https://t.co/76s701tXWM

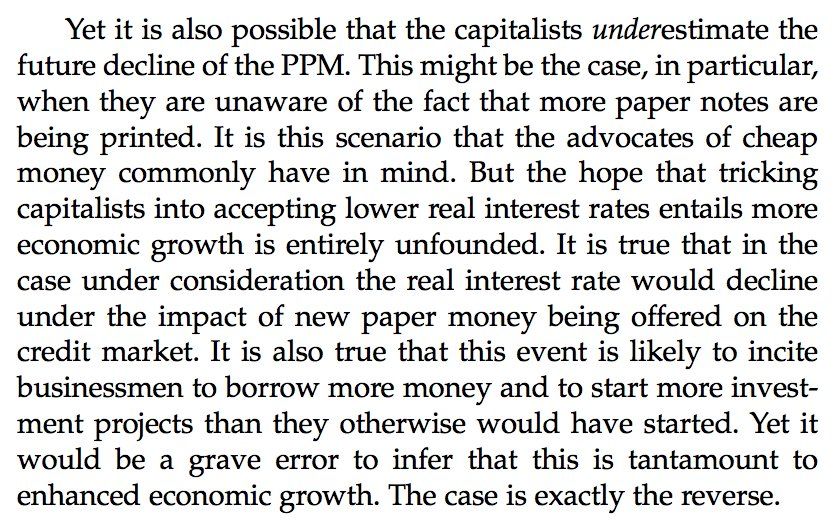

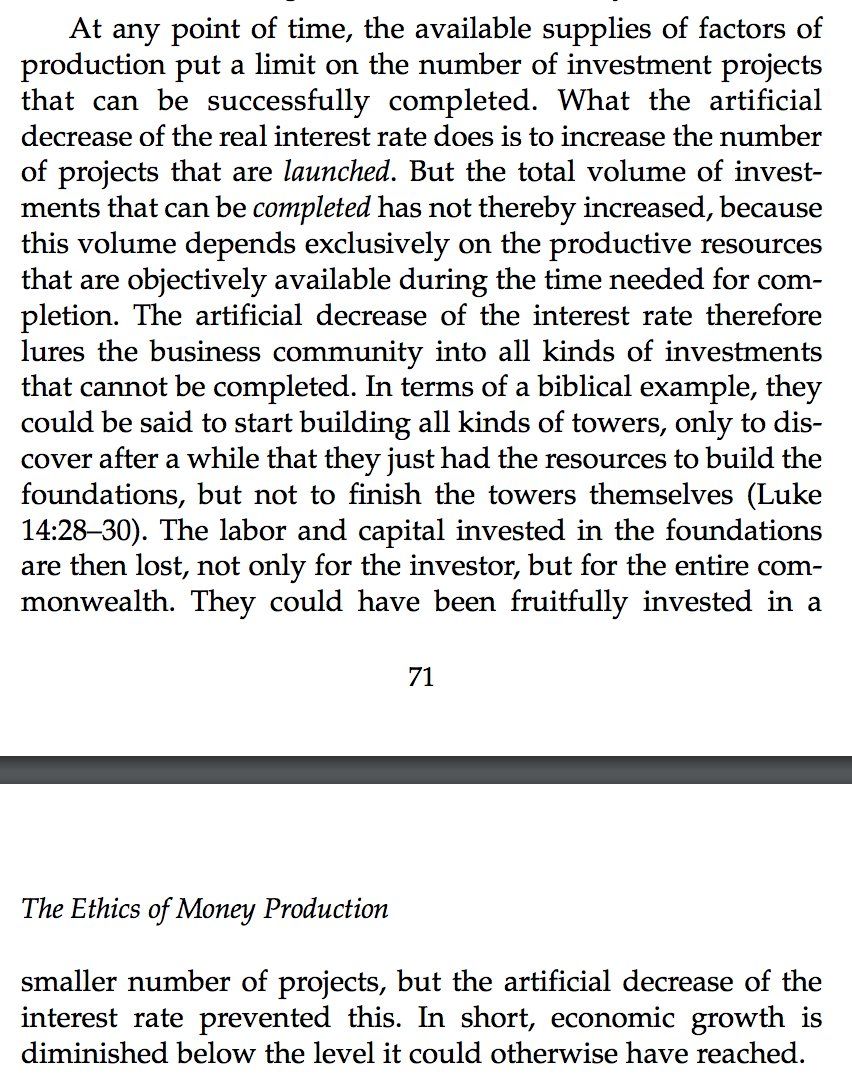

Over the weekend someone resurfaced a tweet I sent in April 2020 warning about the ill effects that would follow the unprecedented explosion of the Federal Reserve's monetary base in the wake of the COVID economic lockdowns. The warning came with a snippet from Jorg Guido Hulsmann's The Ethics of Money Production which perfectly and succinctly explains how unfettered money printing leads to a misallocation of capital and resources that leads to terrible real world consequences. Mainly, that humanity is prevented from reaching its full potential because capital is squandered on fruitless endeavors that waste resources and distract and even prevent productive endeavors from being fruitful. Now that three-and-a-half years have come and gone since this tweet was sent, it's probably a good time to do a retrospective dive to highlight just how dead on Hulsmann was with this explanation and just how crazy the world went in 2020.

To start, you should read the short passage if you didn't click on the tweet above.

When rereading this passage I couldn't help but think about the landscape of venture capital, the PPP loan program and the green energy bill hiding behind the name "Inflation Reduction Act". The tech sector experienced a massive boom in the wake of the lockdowns and money printing in the Spring of 2020.

As rates were dropped to the zero-bound and trillions of dollars were pumped into the system, venture funds raised billions of dollars and funneled those dollars to tech start ups at insanely inflated valuations. Later stage companies received a timely lifeline that allowed them to extend and pretend and earlier stage companies were given a chance to prove themselves. As it stands today with rates well above 5% as the Fed attempts to bring down inflation, many of the companies that benefited from the money printing have absolutely nothing to show for it in the form of a profitable business that is sustainable. Higher rates are exposing the fact that most of these businesses should have been funded in the first place. Their viability only makes sense when the cost of capital is as close to 0% as it can get, which is a scenario that can only be manufactured with central planning.

There was no sector of the venture landscape that highlighted the degree of capital misallocation more acutely than the crypto sector. Billions upon billions of dollars were poured into DeFi protocols, "L1s", "L2s", NFT platforms and other terrible projects. As it stands today, there is virtually nothing to show for it. DeFi protocols are imploding as the lack of easy capital is making it hard to prop up the tokenomics dependent on perpetual capital flows and asset appreciation. Newer L1s and L2s have little traction. And NFT platforms that were fetching multi-billion dollar valuations are absolute ghost towns. The amount of time and capital wasted on "crypto" is absolutely astonishing. People could have been working on much more productive things (like bitcoin). Instead, we're left with a bunch of useless GitHub repositories.

The PPP loan program injected tens of billions of dollars into the economy with very little due diligence. The result of which was opportunists siphoning off billions of dollars for themselves without ever reinvesting that money back into actual businesses and supporting the workforce the funds were supposed to be allocated to. This was a direct confiscation of wealth from productive taxpayers and toward the opportunists. You can't really blame the opportunists though. They were simply playing the hand they were dealt in a very poorly designed game.

Lastly, when the effects of the expansion of the monetary base by trillions and the lowering of rates to zero finally hit the economy a bout of high inflation the likes of which have not been seen in the US since the 1970s and 1980s was unleashed on consumers. The federal government, being the opportunistic leech that it is, saw this as an opportunity to use politik talk to pass a spending bill masqueraded as a bill that would reduce of cost of living for consumers. In reality, it is a bill that is allocation billions of dollars toward unreliable green energy initiatives that will have the government picking favorites via subsidy programs and force the market to misallocate even more money as the incentives have been unnaturally skewed. This is sure to result, as it has for the last few decades, with chronic over investment in energy infrastructure that is less reliable and more expensive than alternatives like natural gas and coal generation which have been wrongly maligned. Consumers will lose out massively and capital will be burned in the process. Leaving humanity worse off than it would have otherwise been if the central planners allowed the free market to properly price risks and opportunity costs.

Not only is all of this bad for the economy and the consumers who operate within it, it is extremely unethical. The negative externalities that emanate from central planning are very predictable. 4,000 years of recorded history has proven this time and time again. The Ethics of Money Production was written in October 2008 before quantitative easing was a well known phrase. Jorg Guido Hulsmann predicted everything that would ensue after the bailouts during The Great Financial Crisis before TARP was even passed. The effects of money printing and artificially manipulating the cost of capital are well understood, yet those in power choose to abuse those levers because they are politically expedient and conveinent. They refuse to take the hard medicine and instead opt to create a much larger problem over time because they don't want to be remembered as the group that got left holding the bag.

Unfortunately for our current crop of central bankers and politicians, the weight of the bag is growing so heavy that it is going to be impossible to hold. The amount of debt that has been accrued, the amount of capital that has been misallocated and the amount of wasted time and effort that has accumulated over the last 15 years is becoming too much to handle. The fact that the consumer is under as much stress as he is right now after the extraordinary measures that were taken in 2020 should send shivers down the spines of the central planners. The monster they have created is going to force their hands to again act unethically by printing even more money lest they let the system collapse. However, when you consider how heavy the bag (their burden) is, I don't think they'll have much success.

The only long term solution to this ethical problem is to adopt a system that makes it extremely hard to act unethically. A system that will immediately reprimand you if you attempt to act outside of the ethical ruleset it abides by. That ethical monetary system is bitcoin since its supply cannot be manipulated and the cost of capital is determined by the market.

Final thought...

My son has the craziest hair of any one year old I've ever seen. It's cute as hell too.