Each individual making these decisions independently, at the same time, all across the world. It really is a beautiful thing. Truly free markets for block space with real-time, dynamic pricing signals.

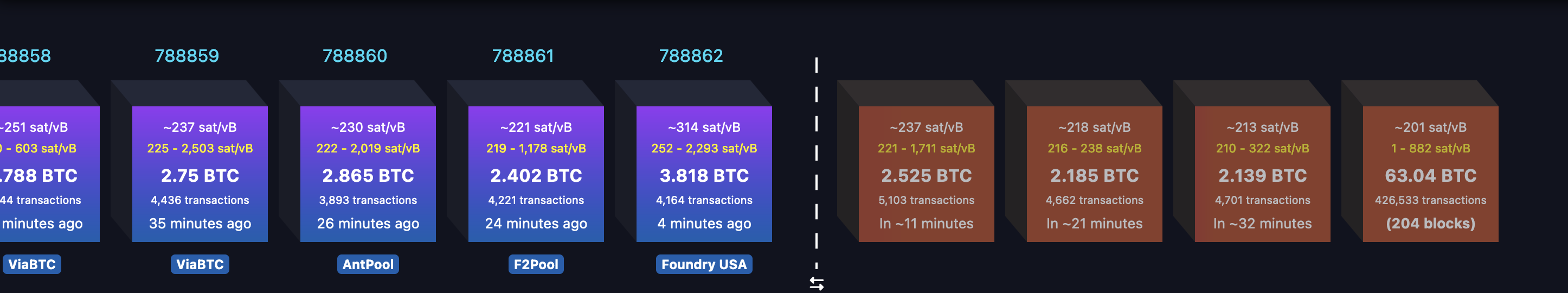

It's been many years since the bitcoin network has seen "congestion" as high as it has been over the last week. As you can see from the the screenshot above, there are currently ~426,533 transactions waiting to be confirmed and miners are enjoying the fruits of the congestion in the form of a material boost in revenue due to the fees being attached to transactions looking to get confirmed in a timely manner.

What's causing this, you ask? There has been a flood of small 546 sat transactions (546 sats is the smallest amount of bitcoin an individual can send on-chain without it being recognized as "dust" by nodes running Bitcoin Core) paying many multiples in fees to get the transaction confirmed. This seems to be stemming from the rise in activity on the BRC-2o protocol, which is leveraging the Ordinals protocol to enable individuals to issue tokens on bitcoin. Whether you like it or not (I'm not particularly fond of it), there are people launching tokens on bitcoin in hopes of dumping them on greater fools at some point in the future. These token issuers seem to be spending a lot of money to peddle their grifts too.

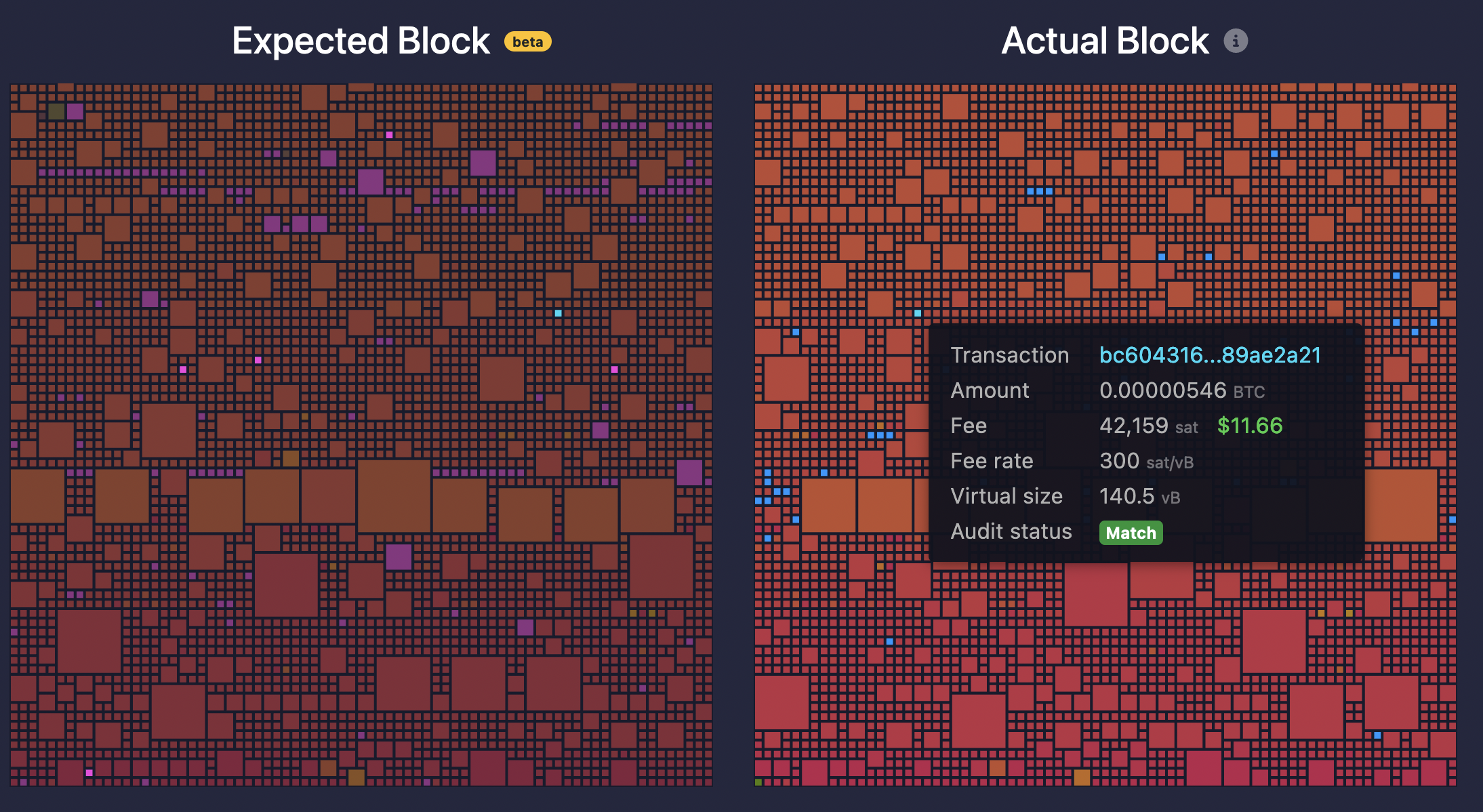

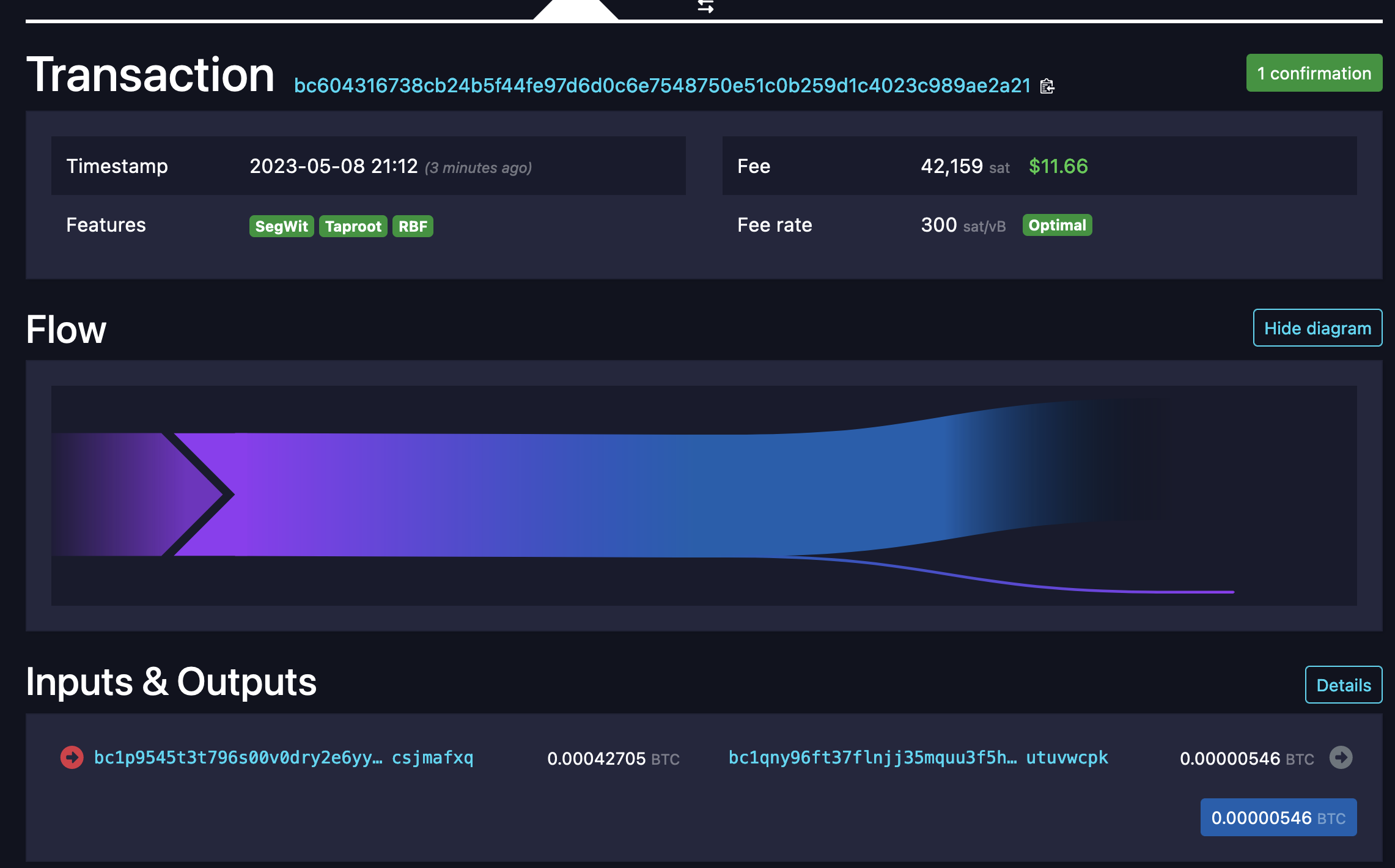

Let's look at one of these 546 sat transactions below:

As it stands as of the time of writing, 546 sats is worth a little over $0.15. And as I mentioned earlier 546 sats is the smallest a UTXO can be within the bitcoin ledger. Those spinning up these BRC-20 tokens are creating UTXOs that likely won't be able to be spent in the future and are paying, in this particular case, 77.2x more in fees than the value of the UTXO they're creating, which seems like quite the risk. My guess is that token issuers are looking for the smallest amount of bitcoin necessary to embed their token data into the chain, paying up to do it, and hoping that they make it up on the back end when they find greater fools to buy their grift tokens. If history has taught us anything, the grifters will make their money and the token projects will die out eventually. Again, love it or hate it, this is now possible on bitcoin. You simply have to deal with it.

This bout of congestion has brought back the "security budget" debate, which revolves around the question of whether or not bitcoin will be able to secure itself in the future when miner revenue derive solely from transaction fees because the block subsidy has dwindled down to zero sats per block. The congestion acts as a pheromone that only affects concern trolls and signals to them that it's time to stop running with the "bitcoin doesn't have a fee market that is healthy enough to sustain the security of the network in the long-run" and to turn on a dime and start leaning into "The fees on bitcoin are too high. It's unusable. There are faster and cheaper chains, bro."

The speed with which this flip happens is always hilarious.

I won't say "you shouldn't be shocked by this" because there certainly is some shock involved when the mempool swells out of nowhere and takes the fee market to levels it hasn't seen since December 2017. Making it impossible to get the 1 sat/vbyte transactions you had become so accustomed to over the last couple of years included in a block. However, you shouldn't be shocked by this. If you truly believe that bitcoin is an extremely powerful and systemically important tool that will see massive waves of adoption, then you must accept that bitcoin fees aren't very likely to stay around the 1 sat/vbyte bound for long periods of time, if it all. Block space is scarce and demand to get transactions confirmed will continue to rise. On top of that, the Ordinals protocol - even though it doesn't particularly interest me - does add credence to my belief that you can apply Jevon's Paradox to a bitcoin UTXO. The more efficient and useful a resource (a UTXO) becomes, the more it will be used (people will send transactions). The addition of SegWit and Taproot made this form of a particular utility (inscribing data in the chain) possible.

As people discover more things they can do with bitcoin because the usefulness of a UTXO has increased, they will do those things, take up block space, and drive up fees in the process. It's a beautiful thing. Particularly the market for blockspace that arises out of the madness. Individual users forced to act hyper-consciously when transacting. Weighing the different tradeoffs on the go.

Is the thing I'm exchanging my sats for worth the cost plus the transaction fee? Do I need to have this payment confirmed in the next twenty minutes or the next twenty days? Which UTXOs should I combine to make the fee as low as possible? Are fees going to keep rising? Should I set my fee higher than the latest "high priority" estimates?

Each individual making these decisions independently, at the same time, all across the world. It really is a beautiful thing. Truly free markets for block space with real-time, dynamic pricing signals.

Will Ordinals and the BRC-20 tokens they spawn corrupt the bitcoin blockchain? I don't know, but my gut tells me no. Will the Ordinals hype persist? I don't know, but my gut tells me no.

What I do know is that the market is learning a very valuable lesson about bitcoin's limits, where they exist, how the market reacts when they are reached, and what happens to the health of the network. These lessons are important lessons to learn. Especially in bitcoin's early days. Reaching these limits helps to highlight pain points, seed urgency, and breed creativity. Many who are feeling uneasy about spending right now because they can't justify the fees are probably wishing they had a lightning wallet set up and sufficiently funded. Many business and individuals with poor UTXO management are wishing they would have consolidated when miners were still accepting 1 sat/vbyte transactions. Many people building applications are thinking about how they can communicate to their users via UX that they should be aware of this possibility and how to be ready when it happens.

As it stands today, my gut tells me the Ordinals craze is something that will be temporary in the long scheme of things. Those spinning up these BRC-20 tokens have spent billions of sats in fees. If the market for ordinals doesn't garner genuine and sustained economic activity it will prove too expensive to persist. At which point, the fee market should subside. With that being said, I won't hold my breath for that one. For now, as someone who has ASICs plugged in, I will enjoy the increased revenue.

I believe that in the long run, an overwhelming majority of bitcoin users will be using bitcoin for its monetary properties. The demand to use bitcoin as money will be so high that peer-to-peer payments will far outpace and price out the demand to inscribe data or issue a scam token using a UTXO.

We're simply not there yet. Most people are still living their lives tethered to their cuck bucks. That won't be the case forever though and you should prepare accordingly.

Final thought...

Taco Monday is better than Taco Tuesday.