Essentially, the Fed's chaotic policy bakes in sudden cascading sells into the balance sheets of the banks.

What a week, freaks! Bank runs, bailouts and bitcoin have been all over the news and it seems like everyone and their mother is attempting to get a grasp on the situation. What is causing this crisis? How could so many prominent, respected and trusted banks fall into insolvency so quickly? And why does it seem like bitcoin has disconnected from markets and is trading like a true risk-off asset? Let's take some time to walk through these questions.

What is causing the banking crisis? Did the collapse across the "crypto" industry present a systemic risk that led to the contagion event we are watching play our right now? Or was it a matter of poor risk management by the banks in question? The reality of the situation is this problem stems from the Federal Reserve and their chaotic monetary policy that forces players within the system to continuously manage a portfolio of debt instruments and cash balances depending on the particular policy the Fed decides to pursue on a month-to-month basis.

The Fed will lower rates and hold them down for extended periods of time while pumping money into the banking system. Banks will allocate to debt instruments with varying duration risks to account for this particular policy regime. When the Fed reverses course like it did last year and begins raising rates and taking money out of the system, banks who did not employ an active rebalancing or debt-hedging strategy will get caught off guard and find themselves in a position where they have debt instruments sitting on their balance sheets with massive unrealized losses and falling cash balances as their customers pull their money from the bank to service more debt that has become more burdensome as the interest expenses attached to them have risen significantly. When enough depositors pull enough cash from a particular bank that bank is forced to begin selling their debt instruments, realize losses on those products, and exacerbate the problem at the same time by driving the price of those products down further.

Essentially, the Fed's chaotic policy bakes in sudden cascading sells into the balance sheets of the banks. When rates are kept high for a long enough period and enough dollars are pulled out of the system the inevitable bank failures materialize. This is your banking system run on a fiat money standard.

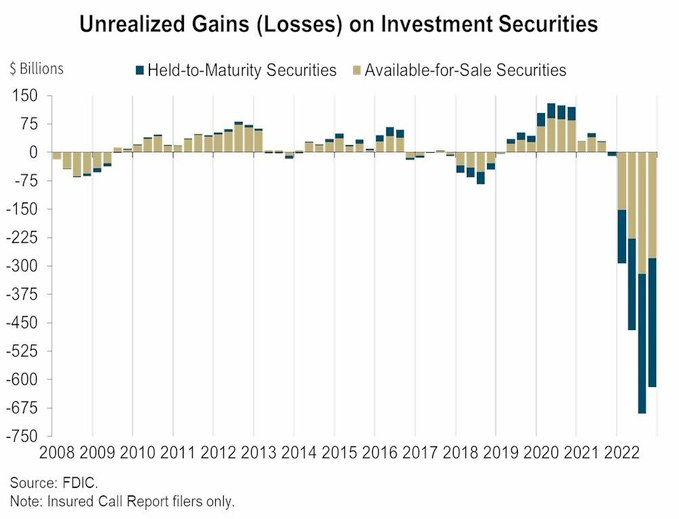

How could so many banks fall into insolvency so quickly? As described above, if a bank has unrealized losses that they have to suddenly realize coupled with a material rise in customer withdraws this outcome is inevitable. The thing that shocked people the most about Silicon Valley Bank failing is just how prominent it was. The reality of the situation is this type of failure could happen to any bank, even the ones that are considered systemically important like JP Morgan, Wells Fargo and Bank of America. Just take a look at the aggregate amount of unrealized losses of investment securities that are sitting on bank balance sheets right now.

These numbers absolutely dwarf the losses that existed on their balance sheets in 2008, which makes sense when you consider how much money has been printed and how many treasuries have been issued over the last 15 years. This is not a problem that is isolated to the regional banking sector. If the Fed keeps up their aggressively hawkish policy the problems faced by Silicon Valley Bank and others will reach the shores of the JP Morgans of the world. The only difference is the JP Morgans of the world have been deemed, by law, as systemically important banks that will always, without fail, be bailed out by the government if they fall under immense stress. The banking system is inherently fragile from top to bottom and this is a function of the structure it is built on top of; the Federal Reserve System.

Why is bitcoin trading so strongly in the face of all of this? I can't tell you the exact reason, but I can tell you that this is exactly why bitcoin exists. Banks that are short dollars cannot supply everyone who believes they hold dollars in their bank account with the dollars they believe they have. When you wake up on a Friday and discover that the bank you are holding your life savings in went under and you no longer have access to your money, the value prop of a digital money that you can easily self-custody and cannot be debased begins to make a lot of sense. Did people wake up this morning and realize this value prop immediately? Some certainly did. Those who were on the periphery and have done a cursory dive into bitcoin probably had the light bulb go off. But most who got caught up in the mess of Silicon Valley Bank and the others who followed its fall probably haven't seen the light yet. Bitcoin probably pumped today because it is becoming abundantly clear that the Fed is going to have to turn the money printer back on much quicker than was expected just five days ago.

If you want to take a deep dive into what went down and why the Fed is the problem, check out this podcast I recorded with Parker Lewis this morning. Very high signal.

Final thought...

I was not built for a heavy travel schedule.