I can say that this type of statement was something I was not expecting.

There has been a lot of pearl clutching in the "crypto" space over the last month or so over the perceived clamp down on the industry by the government by way of cutting companies off from their banking partners. Companies like Circle, Kraken and Paxos, who offer stablecoins, staking services and deal with crypto casinos that operate in regulatory grey areas all received a combination of requests for more information, fines, and requests to stop operating certain parts of their businesses from various government agencies. However, it doesn't seem like the attack has been as vigorous as many claimed it to be just weeks ago.

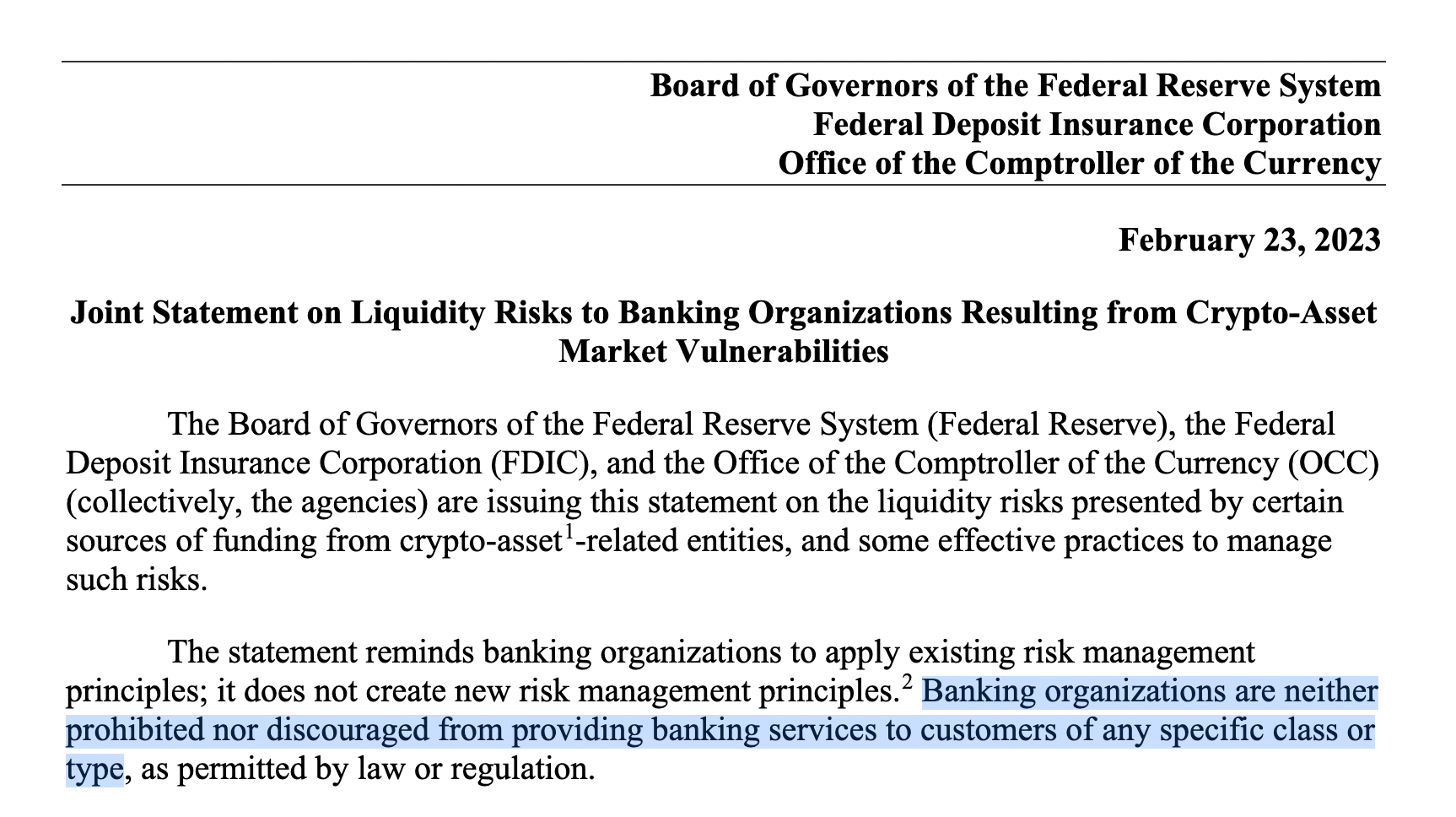

And it seems like the Federal Reserve, the FDIC, and the OCC felt compelled to come out with a joint statement this morning to quell any fears that a banking Armageddon for the "crypto industry" is imminent. In there statement they made it clear that Federal Reserve licensed banks "aren't discouraged from providing banking services to customers of any specific class or type" and made it clear that they expect banks to perform proper due diligence to prevent any potential systemic risks an individual customer may pose to the rest of the bank's clients. Seems pretty straightforward and common sense to me.

Much of the pearl clutching in "crypto" circles over the "Chokepoint 2.0" crack down on the industry seems to be overblown cope from people who are butt mad that the powers that be are beginning to proactively punish companies in the space who enable scammers. To be clear, I am not cheering on the "authorities" here. I am simply pointing out something that should have been obvious to anyone with a brain in this space. It is obvious to many that a lot of the shitcoins and a lot of the companies that grant retail investors access to those shitcoins plus some "value added services" like yield or access to "stablecoins" controlled by companies deemed to be acting outside the good faith of the law by the long arm of the American government are going to be targeted by the authorities. I'm not really pumped that his is happening, but that doesn't perturb my ability to deduce that these actions were always highly likely considering what we know about the government's ability to play economic policeman.

Today's joint statement seems like the Fed, the FDIC, and the OCC have witnessed the pearl clutching and kvetching from some in the industry over the last month and they felt compelled to come out and say, "Hey assholes, we're not trying to cut off the industry from the banking system, we're just trying to make sure banks are aware of their duty to institute due diligence measures that weed out the overt scams before they pose a systemic risk to the banks entire customer base."

I can say that this type of statement was something I was not expecting, but has made me cautiously optimistic that some of the crusty suits who have made a living regulating instead of building aren't trying to knee cap companies who are acting in good faith and actually providing valuable services to their customers. It also makes me extremely happy that my exposure to regulated entities in my personal and professional life is to bitcoin-only companies that are providing relatively vanilla services that are a far cry from the overt scam-enabling that goes on in the "crypto industry".

Maybe the powers that be are aware of the fact that the economy is standing on a sinking ship that ran into an iceberg they created and they are attempting to signal to people what lifeboats they should be getting on; those with "bitcoin" written on the side of them. Because if we're being honest with ourselves, the best move for the counterproductive central planners to make is to usher people toward the best asset on the planet to induce the soft landing they are looking for.

Final thought...

Thankful for my mother and wife.