Here's a great piece to check out when you get a spare ten minutes. Drew Armstrong, President and COO of Cathedra Bitcoin, wrote a guest piece on Braiins' blog laying out the different debt financing options available to miners since 2017. If your curious to learn more

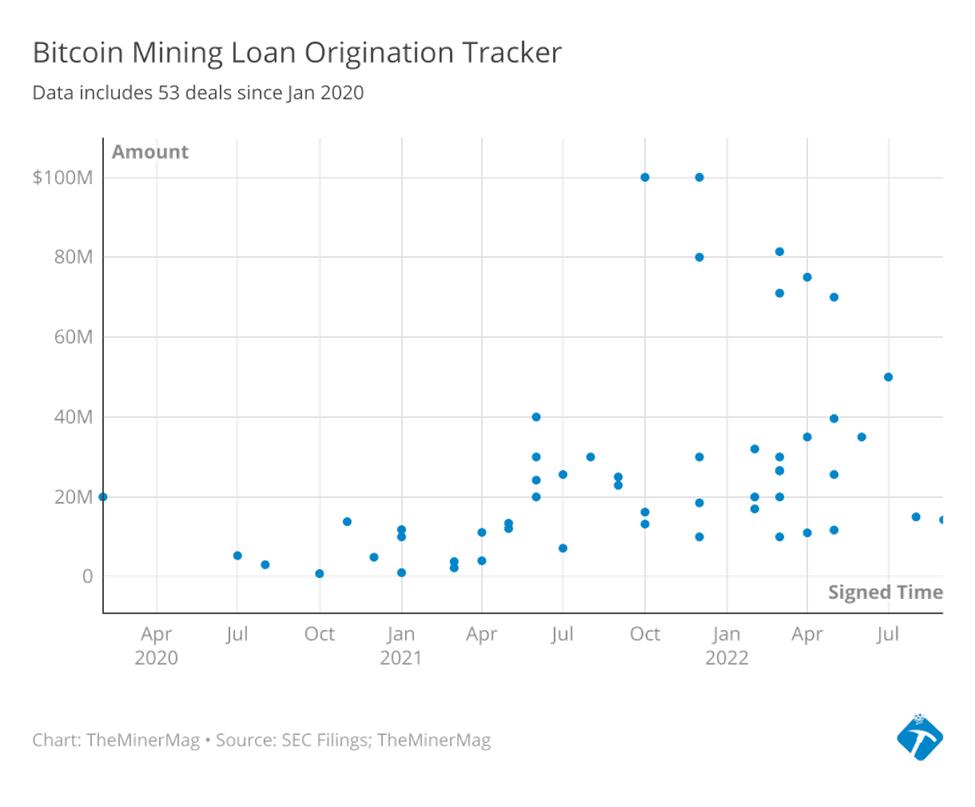

Here's a great piece to check out when you get a spare ten minutes. Drew Armstrong, President and COO of Cathedra Bitcoin, wrote a guest piece on Braiins' blog laying out the different debt financing options available to miners since 2017. If your curious to learn more about the history of financing options in the mining industry, how some of these loans structures are underwritten, and the risks involved this is a great primer. There have been plenty of (hard) lessons learned in the short history of bitcoin mining debt financing by both lenders and borrowers.

If this bear cycle has taught us anything it's that collateralizing these loans with ASICs or ASIC futures orders is a bit nuts. The volatility of the hardware value and the uncertainty around delivery of futures orders makes these types of loans particularly risky. Especially for lenders who do not have the chops to take posession of the ASICs and plug them in in a timely manner. I believe the trend of collateralizing loans with ASICs as well as more stable hard assets will be more common.

Another theme to pay attention to is the quality of new machines that begin to hit the market. As ASICs get more efficient and durable their lifecycles will extend and they will become more commoditized, which makes them better forms of collateral within these loan structures. This trend will be accelerated by two things; new entrants in the market like Intel who will light a fire under the asses of Bitmain and MicroBT to produce the highest quality machines possible, and more stable hydro mining set ups becoming more popular.

Little #bitcoin mining teaser for you

— Steve Barbour (@SGBarbour) December 15, 2022

'Hydro Hash Generator'#ohmm #bitcoinmining @denverbitcoin @upstreamdatainc pic.twitter.com/g2htNXHWF8

On top of this, I believe we will begin to see the emergence of hashrate derivatives markets that will enable miners to sell forward hashrate to hedge revenue risks that will offer another financing vehicle to either bolster their cash positions or expand their operations.

All in all, the bull to bear cycle of 2020-today has brought with it a lot of valuable lessons for the mining industry in regards to treasury management - many miner were caught getting greedy during the bull market when they should have been locking in cash on their balance sheets and were forced to sell > 50% below the all time high - and the correct way to finance their operations via debt. Swimming naked with ASICs as the only collateral proved to be a pretty terrible move.

Look out for Part II of Drew's series with Braiins on this subject, which should drop in the coming weeks.

Final thought...

No one told me how messy potty training would be.