Despite what many pundits would lead you to believe, the signs of overwhelming stress throughout the economy are staring you right in the face.

If you take a step back, look around, and hone in on some key sectors of the economy you may notice some glaring alarm bells that signal some rough times are ahead for the economy both here in the US and abroad. I wanted to take some time to highlight areas of the economy that are particularly alarming, especially in an environment of rising interest rates. Many pundits are looking into the cameras and exclaiming that it seems like a recession will happen later this year, but I wouldn't be surprised if we are already in one and the government is simply using manipulated economic data to make it seem otherwise.

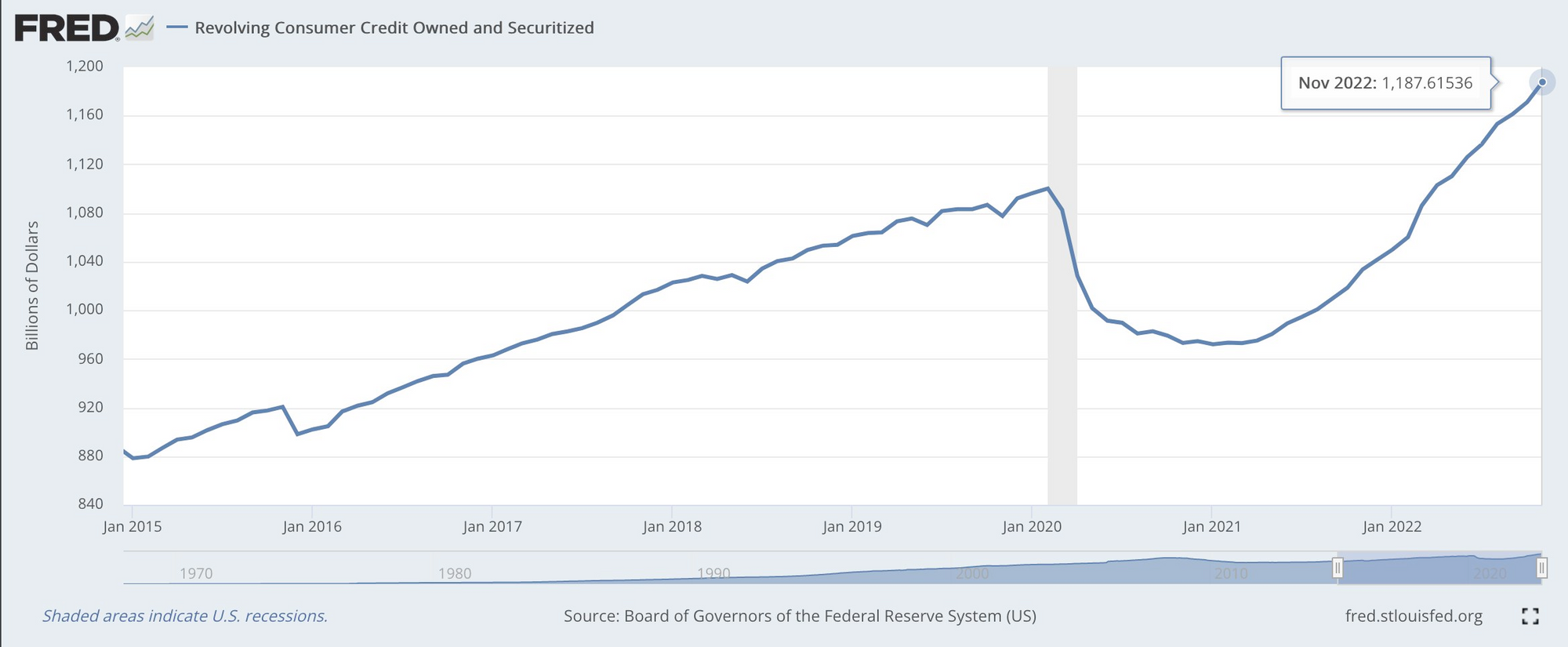

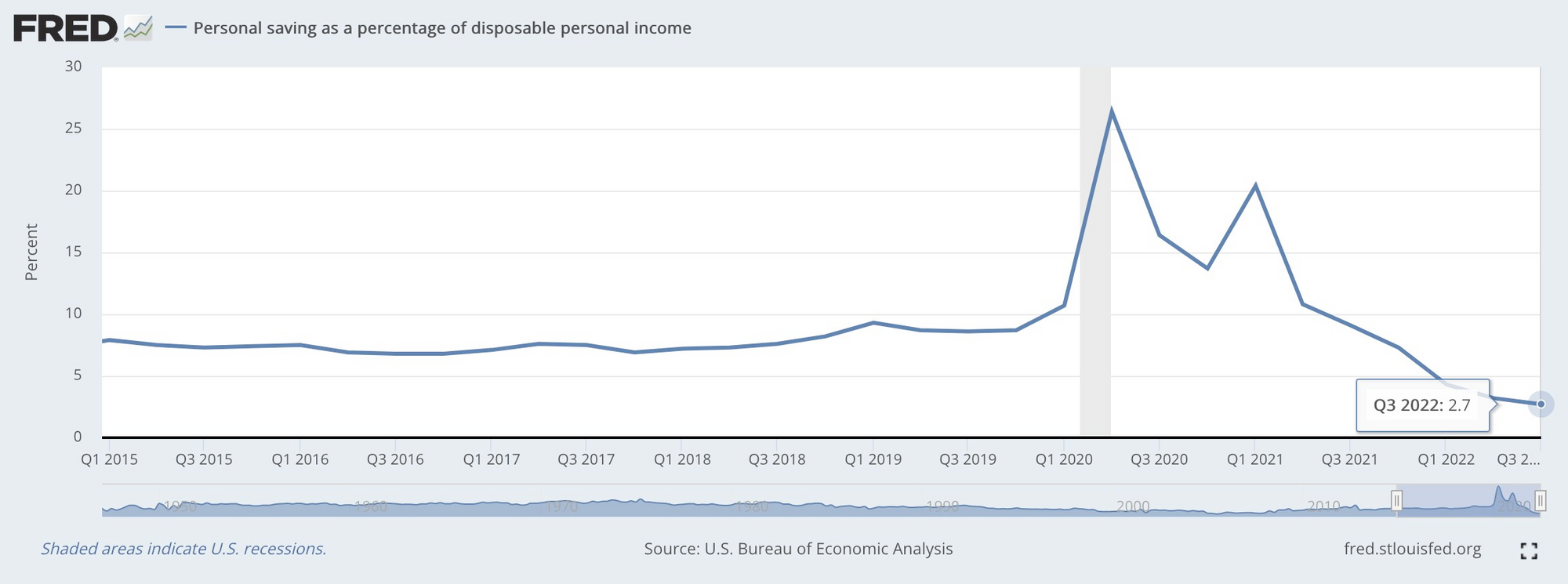

First up, consumer credit and savings rates.

As inflation has soared over the last year, so has consumer credit. The average American is finding it hard to get by and has been forced to load up their credit card to get by. One may point out that consumer credit has always been expanding pretty consistently since the 1970s without any material slowdowns outside of the Great Financial Crisis of 2008/2009 and the COVID lockdowns from a few years ago, and this would be a valid point. However, if you look at the slope of the latest run up in consumer credit that commenced in the middle of 2021 when the economy began to open back up you may notice that the slope of the increase is a bit steeper compared to the run up that began in earnest in 2013/2014.

On top of that, the American consumer is racking up insane amounts of debt as they are depleting their savings which is highlighted in the second chart above. Personal savings as a percentage of overall disposable income was sitting at 2.7% as of the end of Q3 2022. This is the second lowest savings rate since the Fed started reporting the data in January 1947. With the lowest being 2.4%, which was hit in 2005 as individuals plowed their money into the housing market. When you add the insane pace of consumer credit growth with collapsing savings rates and increasing interest rates, it paints a pretty gloomy picture. The American consumer is extremely overextended and out of reserves. At some point as interest rates continue to rise and cash reserves continue to dwindle away, push is going to come to shove and there will be a gap up in delinquency rates. The only hope the consumer will have to stay afloat is to get a raise or get a second or third job (if they're available).

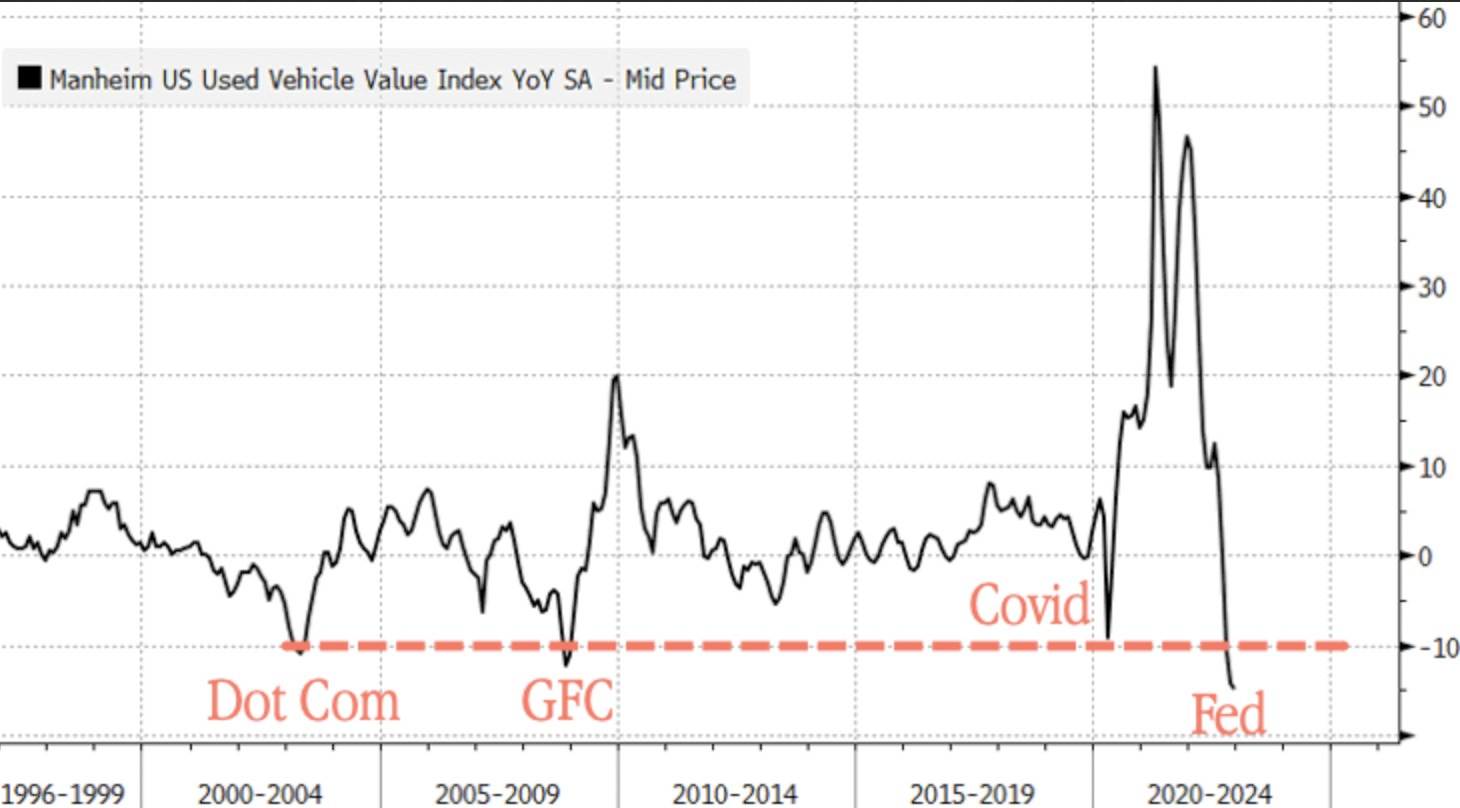

Second up, used car prices are beginning to correct materially as interest rates continue climb.

Car market update:

— The Kobeissi Letter (@KobeissiLetter) January 15, 2023

1. Used cars down 15% in December

2. 16% of buyers have $1000+ monthly payment

3. Carvana near bankruptcy with $7 billion in debt

4. Average used car loan rate near 10%

5. Interest over life of car loan at all time high

The worst part? Rates are going up.

Used cars were one of the first assets to see material price increases as tyrants locked down the economy and people fled cities for the suburbs and found they needed a way to get around places where public transit is nonexistent, or simply had more disposable income and decided to purchase another car. When times were good, interest rates were hovering around the zero-bound, and cash in the bank account was flush, this probably seemed like a good idea. Fast forward a few years and those who bit off more than they can chew are finding that they may not be able to pay that monthly payment as more essential expenses like food and energy have eaten into their disposable income and their car payments have gotten more expensive if they had a variable rate loan.

Typically used car markets are leading indicators that something is broken in the economy. Cars aren't necessarily essential, especially in the age of Uber, so people begin offloading them first when they begin to experience economic stress. The rate of decline has hit its quickest pace in the last 30 years. Yes this decline is happening after an abnormal run up in the market for used cars created by extreme demand and supply chain problems that disrupted the market for new cars, but I think there is still signal in this indicator.

Lastly, real estate markets have been taking a hit. Both commercial and residential.

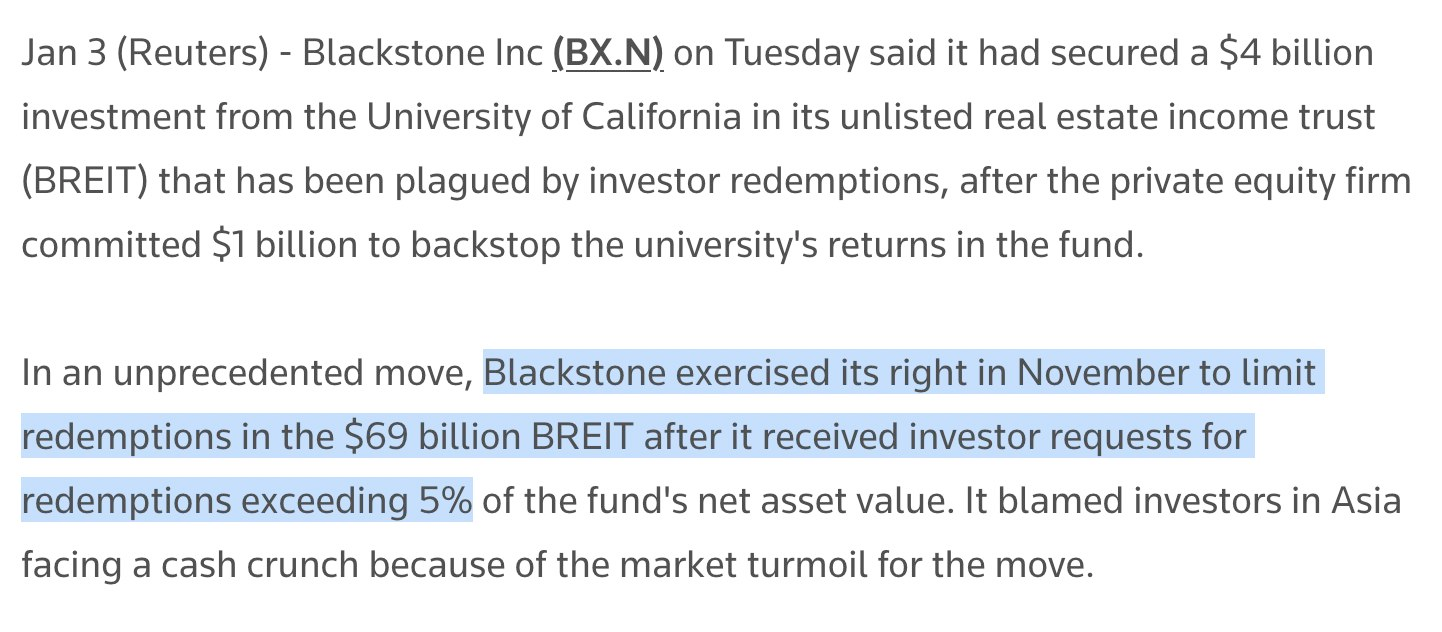

We'll start with commercial real estate, particularly nontraded REITS.

Some of the largest nontraded REIT funds that have performed wonderfully in recent years have had to pause redemptions as investors have been attempting to pull their money out en masse. Blackstone closed the exit doors on their $69B BRIET product before getting a $4B capital injection from the University of California. Similarly Starwood Real Estate Income Trust curbed their redemptions after the limit was hit in November. Both funds are saying that the redemptions are being driven by a desire from their current investors to take money off the table. But I'm reading it as a signal that these investors are turning extremely bearish on commercial real estate as layoffs at big tech firms have become the latest fashion. Why keep your money locked in a fund looking to eek returns out of tech companies who need office space if they're clearing out their offices?

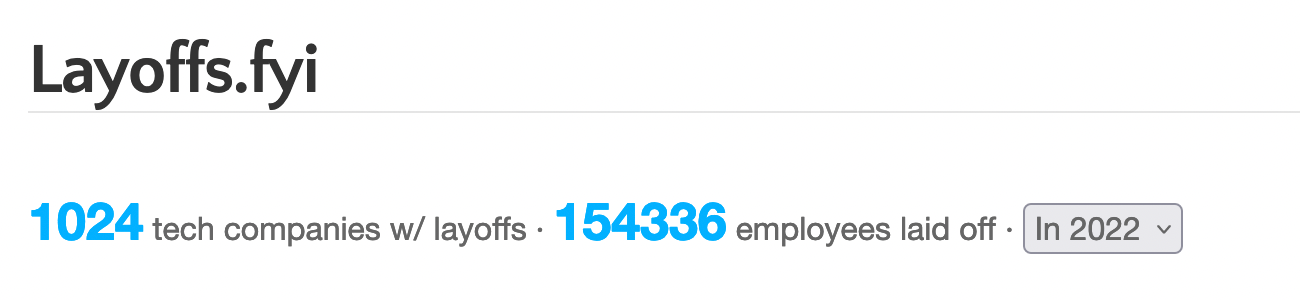

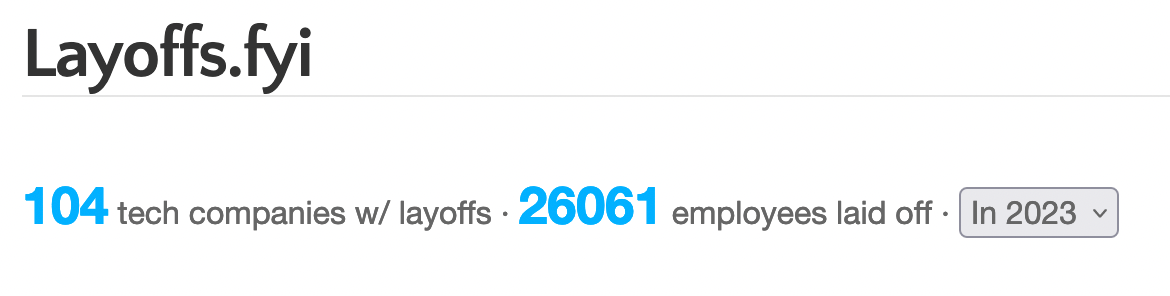

Here are some interesting stats from layoffs.fyi:

In 2022, 154,336 tech employees got laid off. Most coming during the back half of the year. We are currently 17 days into January and 26,061 tech workers have already been laid off. As venture capital dollars dry up, publicly traded tech stocks continue to take a beating, and cost cutting becomes the norm it isn't hard to believe that 2022's total will be surpassed in the first half of the year. That's a lot of empty office space.

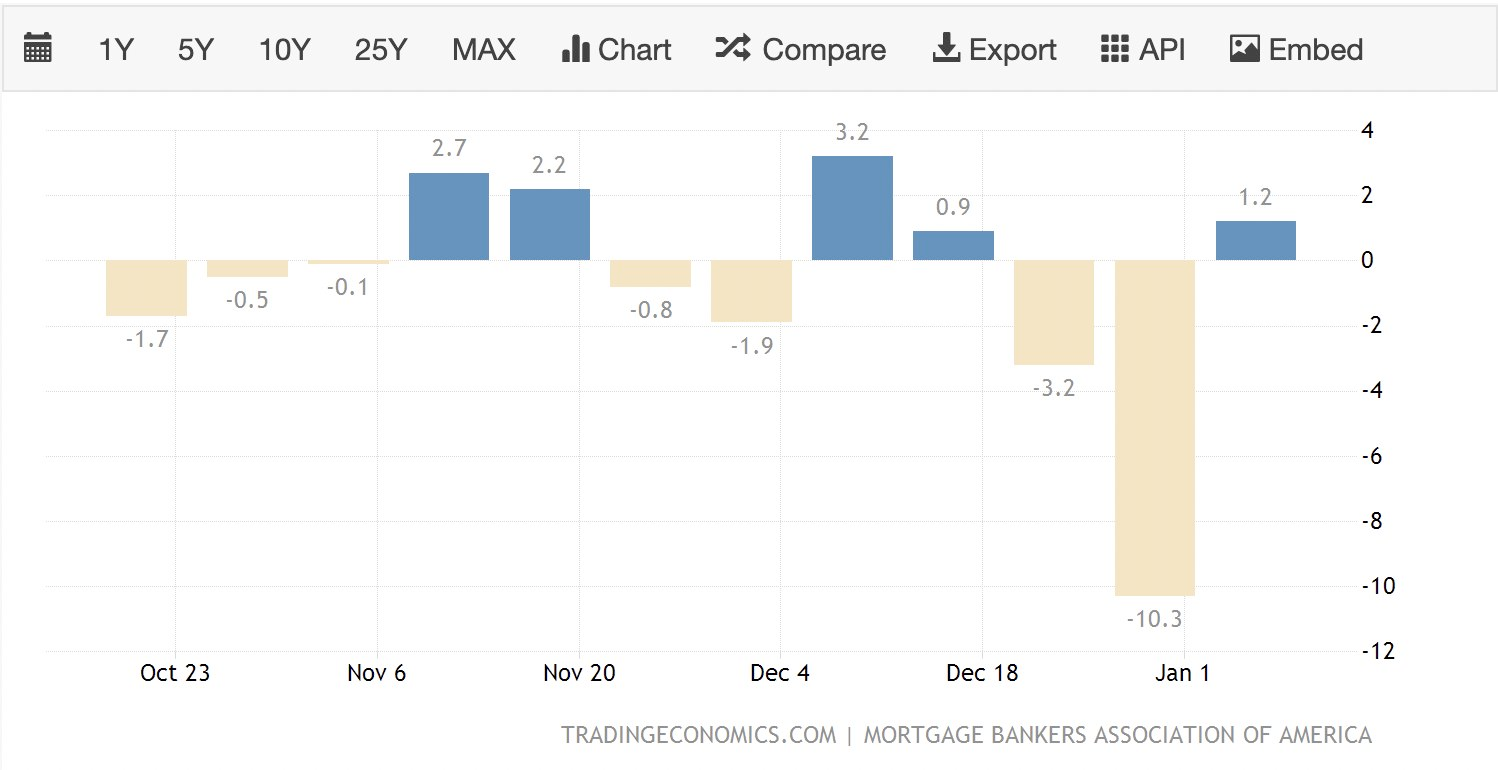

Moving on to residential real estate. New mortgage applications have experienced a material net decline since the middle of October.

As mortgage rates rise alongside the Fed Funds rate people have become wary of entering the market despite the fact that prices have begun to come down. Even with prices falling, the rate of increase in mortgage rates is such that it is becoming harder to justify purchasing a home at the moment. Even with lower prices the monthly payments are still higher because of rates. This wariness is being exacerbated by inflationary pressures in other parts of the economy. Yes, inflation has stopped increasing as quickly as it was last Summer, but it is still increasing well over 2.0% month-on-month. People are having to make harder and harder budgeting decisions. Potential buyers are likely deciding to stay on the sidelines as they wait for sellers to continue lowering their prices, which will materially impact the net worth of those sellers.

Despite what many pundits would lead you to believe, the signs of overwhelming stress throughout the economy are staring you right in the face. Don't let manipulated economic data like the "official" unemployment data tell you otherwise.

Clip of the day...

Dave Collum breaks down some alarming birthrate data out of Australia. Subscribe to the TFTC Clips channel to get high-signal-bite-sized pieces of content.

Final thought...

Vibes are high at the Bitcoin Commons in Austin, Texas.