Bitcoin is beautiful. Most don't realize this yet.

Last week we discussed how the arctic blast was materially affecting bitcoin's hashrate as on-grid miners engaged in demand response programs powered down their ASICs so that electricity could be delivered to residential consumers as demand rose significantly in a short period of time. Well, a week has come and gone, temperatures across the US rose back to normal levels, miners turned back on, and the difficulty adjusted downwards by 3.6%.

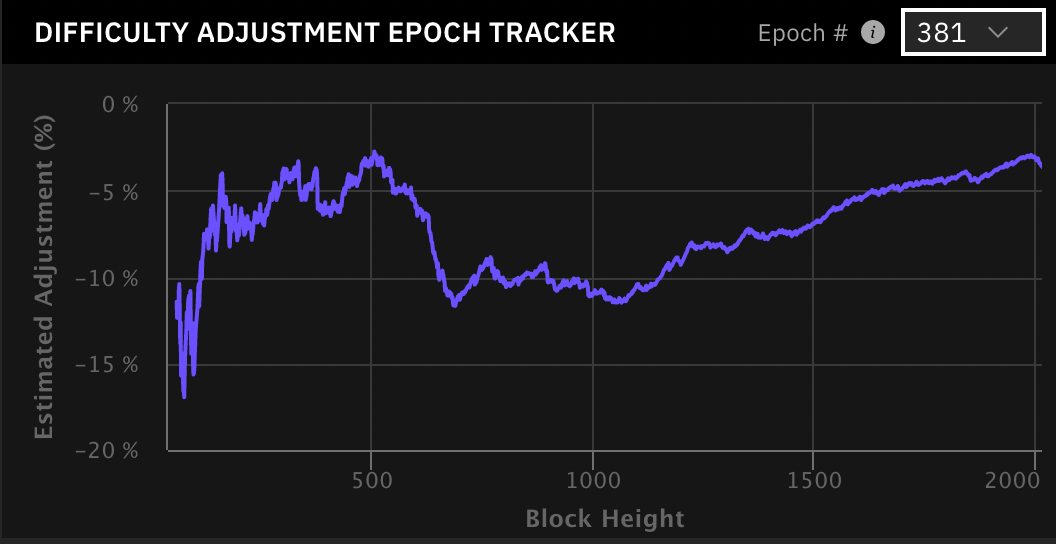

As you can see from the chart above, at the peak of the arctic blast so much hashrate came off the network that the difficulty adjustment that occurred yesterday was estimated to be -11.6%. Today marks the 14th anniversary of the network's genesis block and it seems fitting that we've been gifted an opportunity to highlight how dynamic the bitcoin network truly is. The fact that yesterday's difficulty adjustment wound up being -3.6% is a testament to the creativity of Satoshi's design of the bitcoin network, particularly Proof of Work conensus with a difficulty adjustment.

When miners began shutting off en masse over the Christmas weekend hashrate temporarily fell as low as ~165 EH/s. For context, the average hashrate over the last 30 days is ~250 EH/s. The only effect this decline in hashrate had on the network is that blocks came in a bit slower than the 10-minute target hardcoded into the protocol. Users were still able to conduct transactions in a peer-to-peer fashion, they just had to wait a little bit longer for those transactions to be confirmed in a block. There was no central authority dictating the slow down of block production. The network was just reacting dynamically to raw inputs on the fly.

As temparatures rose, demand for electricity fell, and the demand response services of miners across the US was no longer needed they turned their ASICs back on and block production began coming in closer to the ten-minute target. When difficulty epoch 381 reached its 2,016th block the overall effect demand response proved to have on block production was relatively minimal. If the arctic blast lasted longer and miners were forced to remain turned off because of sustained high demand from the grid, the difficulty would have had a more pronounced downward adjustment and the network would continue to operate withtout any problems. This process is truly awe inspiring.

Another interesting thing to note is that bitcoin is uniquely suited for this type of on-grid demand response. Since bitcoin is a distributed network, miners are free to join or leave the network whenever they see fit, and the protocol was designed with this freedom of movement in mind temporary hashrate increases or declines do not materially affect the network. Other types of "data centers" aren't able to participate in these demand response programs because if they were forced to turn down their servers it would completely disrupt their business operations. Think Amazon, Google or Microsoft server farms. Each server facilitates a particular process for their customers. If they were forced to shut down specific servers connected to a particular grid so that electricity could be delivered to residential consumers it would mean the websites, applications, or monitoring systems their customers are running on those servers would go down. This is an untenable proposition for those cloud providers. They need 100% uptime.

Since the bitcoin network is a distributed system and hashrate is distributed geographically across the world it can provide grids with what is known as "interruptible load". Miners can turn off and on without causing the bitcoin network to go down or preventing particular users from accessing the network. I don't know if Satoshi understood the impact his design would have on energy systems, but what he launched has provided humanity with an incredible mechanism to build more stable and robust grid systems. Most of the world doesn't understand this yet but overtime the benefit will be undeniable.

With that being said, there is a right and wrong way to build bitcoin-enhanced grids. As we mentioned last week, bitcoin miners acting as interruptible load providers works best when grids have reliable base loads supported by reliable energy sources like nuclear, coal, and natural gas. In an ideal world, grid capacity is built out to a point that grid customers never have to worry about losing electricity when extreme weather events happen. The capacity will far exceed what will ever be needed, bitcoin miners will consume the excess capacity profitably, and in the event of an extreme weather event miners will shut down to ensure residential demand is met and make some money for doing so.

Bitcoin is beautiful.

Clip of the day...

Sjors Provoost explains why Senator Warren's proposed Digital Asset bill is nonsensical. Subscribe to the TFTC Clips channel to get high-signal-bite-sized pieces of content.

Final thought...

Day two of writing in front of the fire. I will own a house with multiple wood fireplaces by 2025.