As residential demand for electricity jumped some miners shut down their operations to ensure that residential demand could be met without throwing the grids they're mining on into crisis territory.

It's been a very cold week here in the US. An arctic blast tore through the country that produced record low temperatures from the Rockies to the Gulf of Mexico.

The great Christmas arctic blast of 2022 is marching across the US and has reached the Gulf of Mexico.

— Colin McCarthy (@US_Stormwatch) December 23, 2022

Millions have experienced the coldest day of their life. pic.twitter.com/EcJdqSRcAF

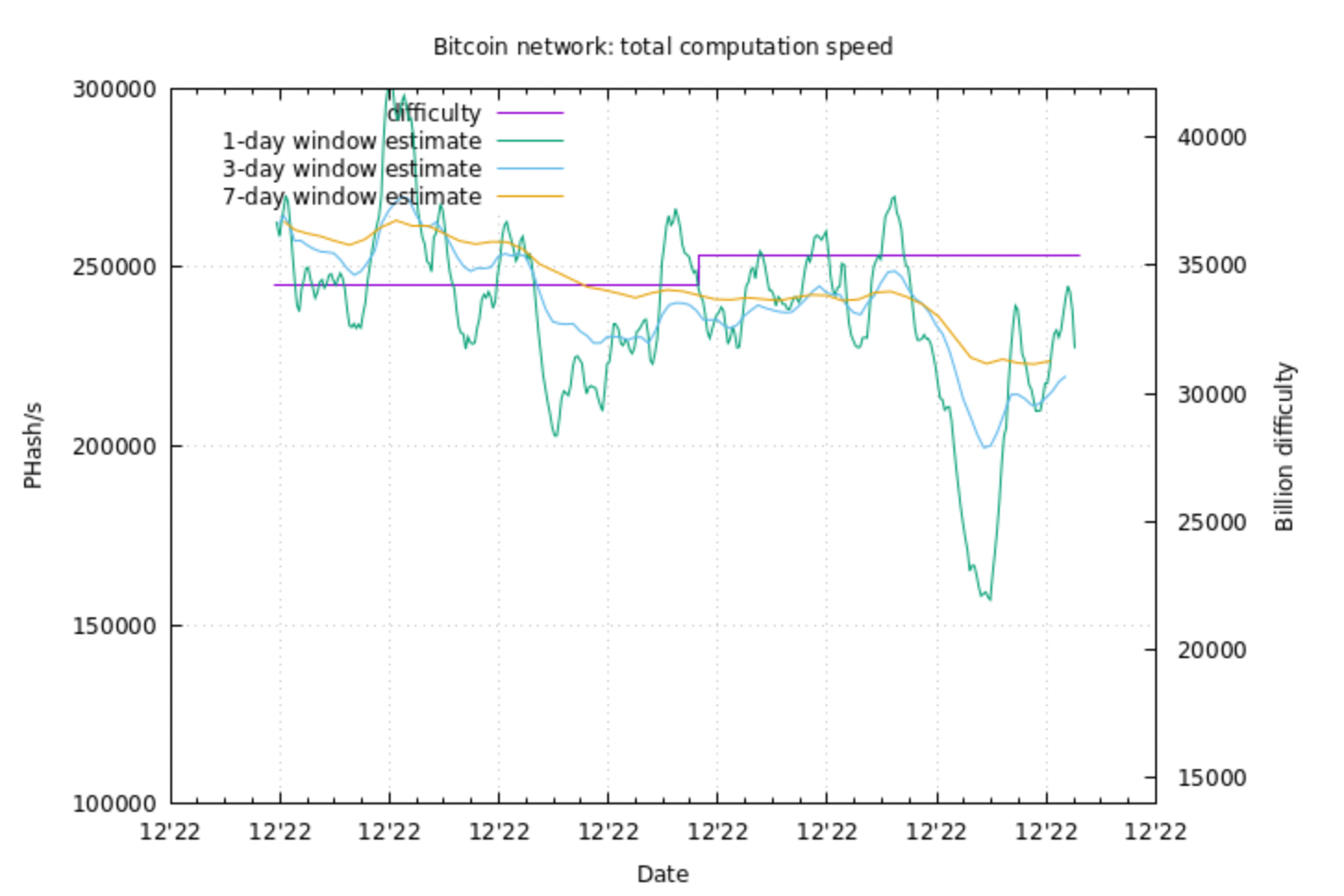

As a result, grid systems experienced significant stress as people stayed cooped up in their homes, turned up their heat and turned on their TVs, dishwashers, washing machines and other appliances while they waited out the cold. If you were paying attention to the bitcoin network late last week you should have noticed that block production slowed down materially as hashrate fell below 200 EH/s.

This was likely driven by larger mining operations that are involved in demand response programs within different grid systems across the US. As residential demand for electricity jumped some miners shut down their operations to ensure that residential demand could be met without throwing the grids they're mining on into crisis territory. This is a prime example of bitcoin miners playing a pivotal role in helping to stabilize grids when periods of peak demand arise. However, it must be made clear that miners aren't doing this out of the goodness of their hearts. There are economic incentives for miners to curtail their usage during these chaotic periods and the different incentives depend on the type of demand response contract miners agree on with the utilities companies they are working with.

One of the popular demand response contracts that miners are engaged in allows them to lock in a static low cost of electricity, typically below market rates, under the condition that they turn off when demand is high and the utility company asks them to. Miners enter in this type of contract after running a risk-analysis to determine if the expected downtime they will endure during peak demand periods over the course of the year is outweighed by the benefits produced from mining at a lower cost for a majority of the year.

Another type of demand response contract allows miners to sell power back to the market at spot rates whenever they decide. Within this agreement miners aren't forced to shut down their operations so that residential demand can be met, but are instead economically incentivized because they make more money selling their power back to the grid than they would via bitcoin mining. This is a popular agreement within ERCOT (the Electric Reliability Council of Texas). During the winter storm that crushed Texas and led to grid failures in early 2021, miners with this type of aggreement made a lot of money as spot power prices exploded. I'm sure the last week has been very profitable for these miners as well.

The optics of this set up are admittedly not ideal for the mining industry, as some will point at them selling power back to the grid at high prices as a form of price gouging. These optics are driven by a fundamental misunderstanding of Economics 101, and supply and demand dynamics. Not a concerted effort by miners to take advantage of a chaotic situation. If miners are able to incentivize the build out of more power capacity within grids so that electricity is available when desperately needed, even at a relatively high price, this is an overall good outcome for people who would like to be able to turn their lights on whenever they please.

If anything, these situations of high grid stress shouldn't be seen as opportunities to single out bitcoin miners and lambast them for being "price gougers". They should be viewed as opportunities to highlight how misguided energy policy in the US has been over the last two decades. Nothing makes this clearer than the breakdown of the different energy sources that were supplying power to the Texas grid as the arctic blast hit its peak on Friday.

Fossil fuels powering 90% of the Texas grid during the storm

— max gagliardi (@max_gagliardi) December 24, 2022

Nuclear powering more than their renewables & TX hasn’t built a new plant in 30 yrs

Over $70 billion spent on wind & solar and solar with 0% & wind 4.8%

Wind & solar aren’t serious energy sources when you need them pic.twitter.com/2E05VPXeqO

When the Texas grid needed them most, the two most heavily subsidized power generation sources were nowhere to be seen with solar producing exactly 0.0% of the overall energy mix at 7:00PM CST on Friday and wind producing 4.8% of the overall power generation throughout ERCOT. How anyone could look at this breakdown and think that doubling and tripling down on the build out of solar and wind production in favor of more reliable sources like nuclear, natural gas and coal is absolutely baffling to your Uncle Marty. It is literally insane to keep forging down the path of an "energy transition" led by solar and wind while complaining about overall grid stability. You can build out thousands of gigawatts of solar and wind capacity, but that capacity can't actually make the sun shine or the wind blow. If people are serious about making the grid systems throughout the US more robust they will focus all of their energy (pun intended) on the build out of more nuclear, natural gas, and coal power plants. The tenor of the energy systems conversation in the United States needs to shift as quickly as possible if people really want to fix these systemic problems. Here's to hoping that more sane heads prevail.

Back to mining. While hashrate was certainly materially affected by miners engaged in demand response programs shutting off their machines to send electricity back to the grid, it was not the only driver of hashrate falling. Off-grid natural gas miners also ran into some trouble as temperatures plunged, especially if they are using gas with a high BTU content. Higher BTU gas has higher conentrations of natural gas liquids. When temperatures fall below a certain point, those liquids can freeze and prevent gas from flowing through pipelines. Especially if those pipelines aren't properly maintained and the gas isn't properly treated. I know of a few off-grid miners who ran into this problem over the weekend.

Lastly, a factor that may have contributed to a fall in hashrate but is not directly connected to the weather is bankruptcies throughout the industry. We touched on this a few weeks ago. With the price of bitcoin being significantly depressed over the course of this year miners are feeling the pain, and many are in the express lane on the way to insolvency. Last week Core Scientific filed for Chapter 11 bankruptcy. However, they announced that they will keep their ASICs up and running as they wade through their bankruptcy proceedings. With Core it is important to note that even though they plan on keeping their machines on, almost half of their hashrate under management (at least earlier this year) is owned by hosting customers. Even though Core plans to continue mining themselves, it would not be surprising to learn that many of their hosting customers have decided to unplug due to the increase in electricity costs announced in late October coupled with the uncertainty that can come with your hosting provider filing for bankruptcy. I imagine there are a number of other sizable miners who are approaching bankruptcy as we near the end of the year. Whether or not they will decide or even be able to continue mining in the event of a bankruptcy is yet to be seen. Depending on what the individual outcomes are, this could exacerbate the decline in hashrate as we head into 2023.

The mining industry has learned a lot of lessons in 2022. Treasury management. Appropriate levels of debt. Using ASICs as collateral. Locking in strong power purchase aggreements with fixed costs. How to frame the message of grid stability and demand response. The blowback effects of plugging in on-grid in an area that favors unreliable baseload sources over reliable baseload sources. So much has happened and those who survive this bear cycle will hopefully apply these lessons to ensure that their businesses can thrive as the industry becomes solidified in the decades to come.

Onward!

Clip of the day...

Jesse Meyers explains why Bitcoin is the only "cryptocurrency that matters". Subscribe to the TFTC Clips channel to get high-signal-bite-sized pieces of content.

Final thought...

Feels good to be home with family.