The public is now waking up to a process that started over a decade ago.

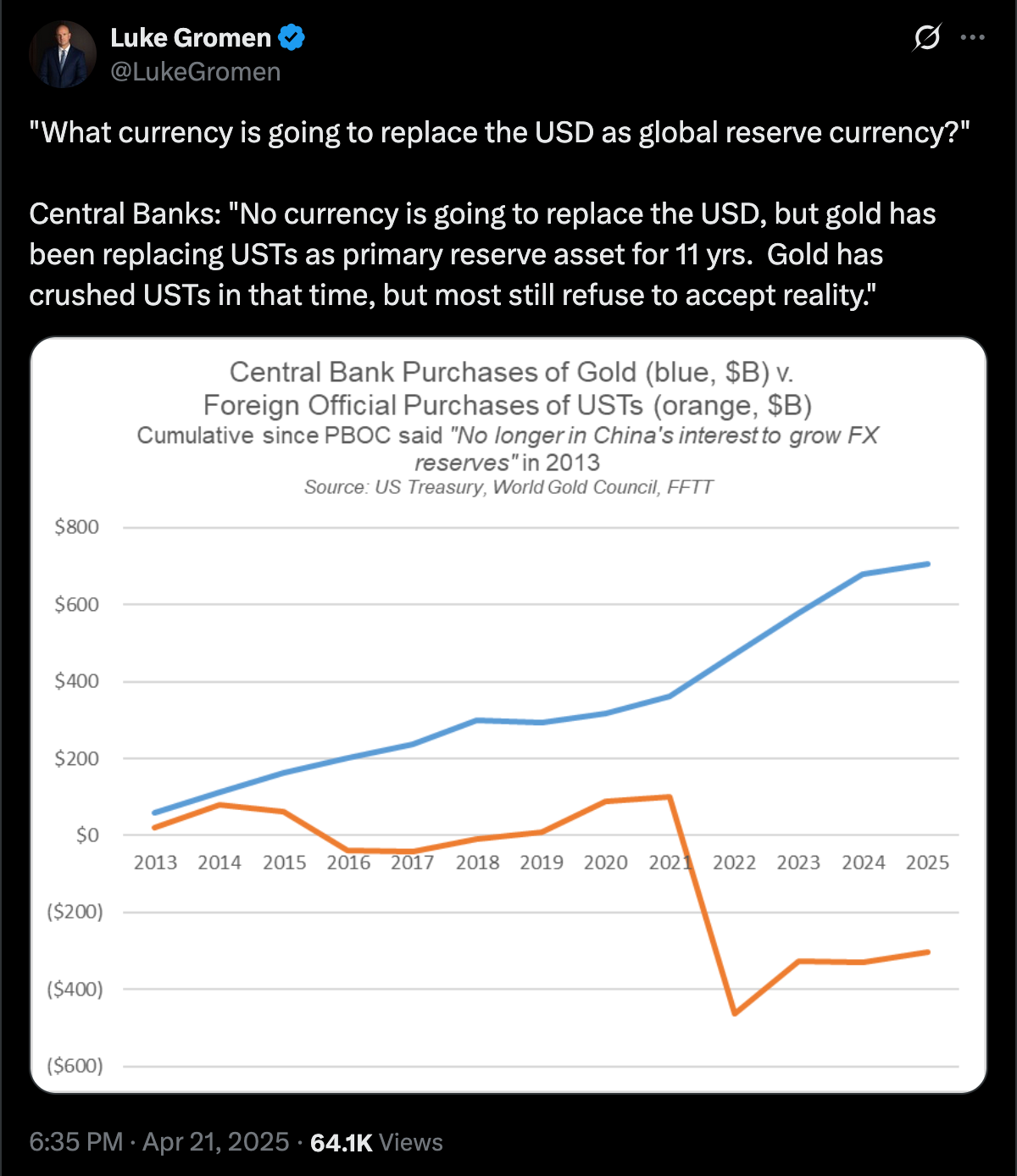

Our friend Luke Gromen has been ahead of the curve on the tectonic macro shifts of our time for many years. He's been highlighting the rotation out of US treasuries and toward gold as a liquid reserve asset since I started having conversations with him on TFTC in August of 2020.

Much of what we been discussing in this newsletter over the last seven months in regards to the market for US treasuries was obvious to anyone who has been paying attention to the balance sheets of central banks over the last decade and cross-referencing that with foreign purchases (or sales) of US treasuries. The world didn't suddenly wake up when Donald Trump was elected president last November and decide that US treasuries aren't the ideal liquid reserve asset they have been since the 1980s. Hell, there were signs right before the 2024 election that should have told you this. Particularly, the Fed lowering their target rate in September and US treasury yields moving higher.

Despite this, many would like to point to Donald Trump's policies since re-entering the Oval Office and claim that they are the reason yields are screaming higher. The fact of the matter is there has been a drawn out liquid reserve asset swap happening in front of everyone's eyes since the global economy began to get on better footing after the 2008 financial crisis that many seem to have missed, or simply ignored. Sure, Trump's policies may be exacerbating the problem, but they are in no way the source of the problem. Unfettered fiscal spending leading to larger and larger deficits has been a bi-partisan problem that spans every administration going back to Bill Clinton's.

The decreased demand for US debt should not be a surprise. Who would want to lend money to an addict who hasn't shown any willingness to drop their addiction? Would you want to lend to an addict? I didn't think so.

With this in mind, I think it's important to try to orient our understanding of current market conditions around two facts and one assumption; everyone is tired of lending to the addict, they have actively decided to store their liquid reserves in hard assets like gold, and it's likely that the addict has recognized this and is attempting to adapt on the fly by pretending to make an earnest attempt to get sober while actively making similar moves toward hard assets as liquid reserves.

Elon and DOGE are the manifestation of the addict pretending to get sober. And Scott Bessent is the fixer tasked with figuring out how to make sure the addict actually gets sober by diversifying toward hard assets too. If you recall, three weeks ago we wrote about Secretary Bessent's desire to be in the position he holds now so that he could help the current administration navigate the waters as the world works through a grand economic reordering. He is a longtime fan of gold. His funds have held it in size for a considerable amount of time. He has spoken publicly about the need for the US government and private sector actors to understand the move towards strong stores of value like gold and bitcoin. He seems to be signaling as loudly as possible without being overtly explicit that he believes the US should reorient around hard assets at the base of the financial system.

Earlier today he made an announcement that one of the things he wants to focus on and champion is making sure that Americans have access to educational resources that will make them more financially literate. In my mind this is an implicit acknowledgement that the US economy has been operating in financial fantasy land for a long time. "You all need to learn about how all of this finance stuff works so that you understand just how crazy it has become."

Yesterday, bitcoin had an intra-day moment of inversely correlated price action when compared to US equities and treasury markets. Only time will tell whether or not this manifests into the inevitable "decoupling" that many (myself included) have been talking about for years. Regardless of whether yesterday marked the beginning of bitcoin making a clean break from tech stocks (though it has objectively decoupled if you zoom out), I think it's safe to say that bitcoin will certainly play a significant role in the great Liquid Reserve Swap moving forward. It likely has already, but just hasn't been publicly signaled by many of the larger players outside of the US. The Bitcoin Strategic Reserve Executive Order is a signpost that the current administration views it as a viable asset to hold in a liquid reserve mix.

Try not to read to much into the day-to-day headlines. I'm certainly guilty of it myself, but I think it's always important to take a step back and look at the bigger picture; this has been underway for over a decade and it's just now becoming obvious to more people. Hard assets are replacing addict IOUs as liquid reserves. It's probably advantageous to hold the former and stay away from the latter.

In my conversation with Matt Pines, he outlined a fascinating convergence between artificial intelligence and Bitcoin. As AI systems become increasingly autonomous and capable of completing complex tasks without human intervention, they'll inevitably need money to interact with the world and each other. Matt pointed to a revealing experiment where AI agents in a Minecraft environment independently converged on using gems as a sound money system – demonstrating that economic principles emerge naturally even among artificial entities.

"If this AI does become autonomous and it gets to the point where it's competent at completing very complex multi-stage tasks and interacting with other models and other agents, it's gonna need money and I think that money will be bitcoin." - Matt Pines

As I suggested during our talk, these AI systems will likely recognize Bitcoin's inherent qualities as superior money. Its decentralized, verifiable, and trustless nature makes it the perfect currency for autonomous machines. When truly capable AI agents emerge, they won't need human persuasion to adopt Bitcoin – they'll arrive at this conclusion through their own analysis, creating an entirely new vector for Bitcoin adoption outside of human decision-making. This technological symbiosis between AI and Bitcoin could accelerate adoption in ways we've barely begun to imagine.

Check out the full podcast here for more on UFO sightings, quantum computing threats to Bitcoin, and the government's "as-if disclosure" approach to advanced technology.

Coldcard Adds Co-Sign and Key Teleport Features via nobsbitcoin.com

Bitcoin Core v29.0 Has Been Released - via nobsbitcoin.com

Strategy Acquired 6,556 More Bitcoin for $555.8m - via X

Ford Halts Vehicle Shipments to China Amid Tariff Hike - via X

Bible Verse Embedded in Bitcoin's 666,666th Block - via X

The 2025 Bitcoin Policy Summit is set for June 25th—and it couldn’t come at a more important time. The Bitcoin industry is at a pivotal moment in Washington, with initiatives like the Strategic Bitcoin Reserve gaining rapid traction. Whether you’re a builder, advocate, academic, or policymaker—we want you at the table. Join us in DC to help define the future of freedom, money & innovation in the 21st century.

Ten31, the largest bitcoin-focused investor, has deployed $150M across 30+ companies through three funds. I am a Managing Partner at Ten31 and am very proud of the work we are doing. Learn more at ten31.vc/invest.

Final thought...

Nothing beats 8-hours of interrupted sleep.

Get this newsletter sent to your inbox daily: https://www.tftc.io/bitcoin-brief/

Subscribe to our YouTube channels and follow us on Nostr and X: