The economic health of a nation can often be gauged by examining a variety of interconnected indicators. In the United States, a synthesis of lending standards, commercial lending, and employment trends provides a composite view of the economy's trajectory.

The economic health of a nation can often be gauged by examining a variety of interconnected indicators. In the United States, a synthesis of lending standards, commercial lending, and employment trends provides a composite view of the economy's trajectory. Recent data suggests that the US economy remains in a cyclical pattern, with indicators pointing towards a looming economic downturn. This article is based on a recent video published by Jeff Snider on Eurodollar University's YouTube channel.

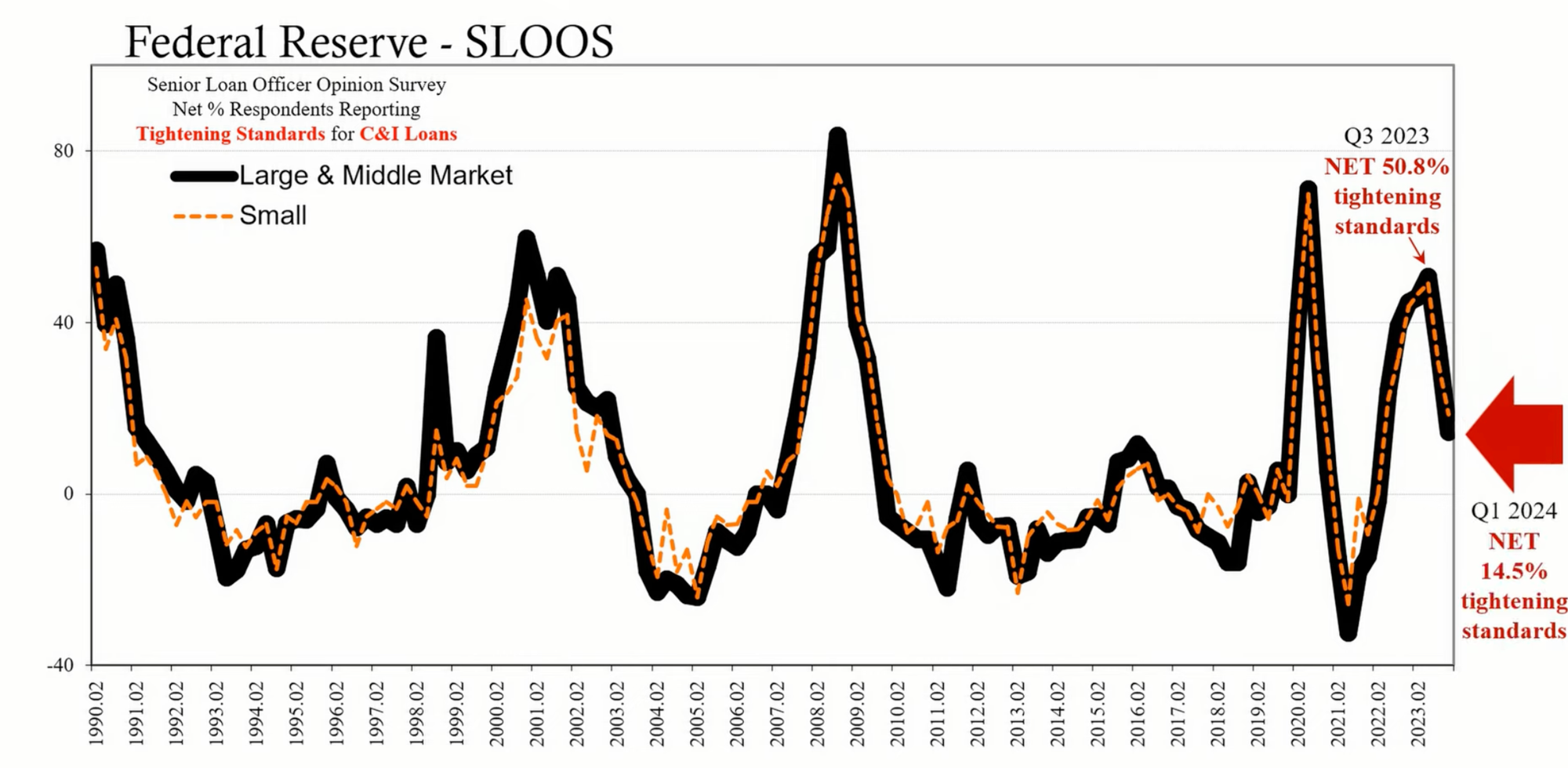

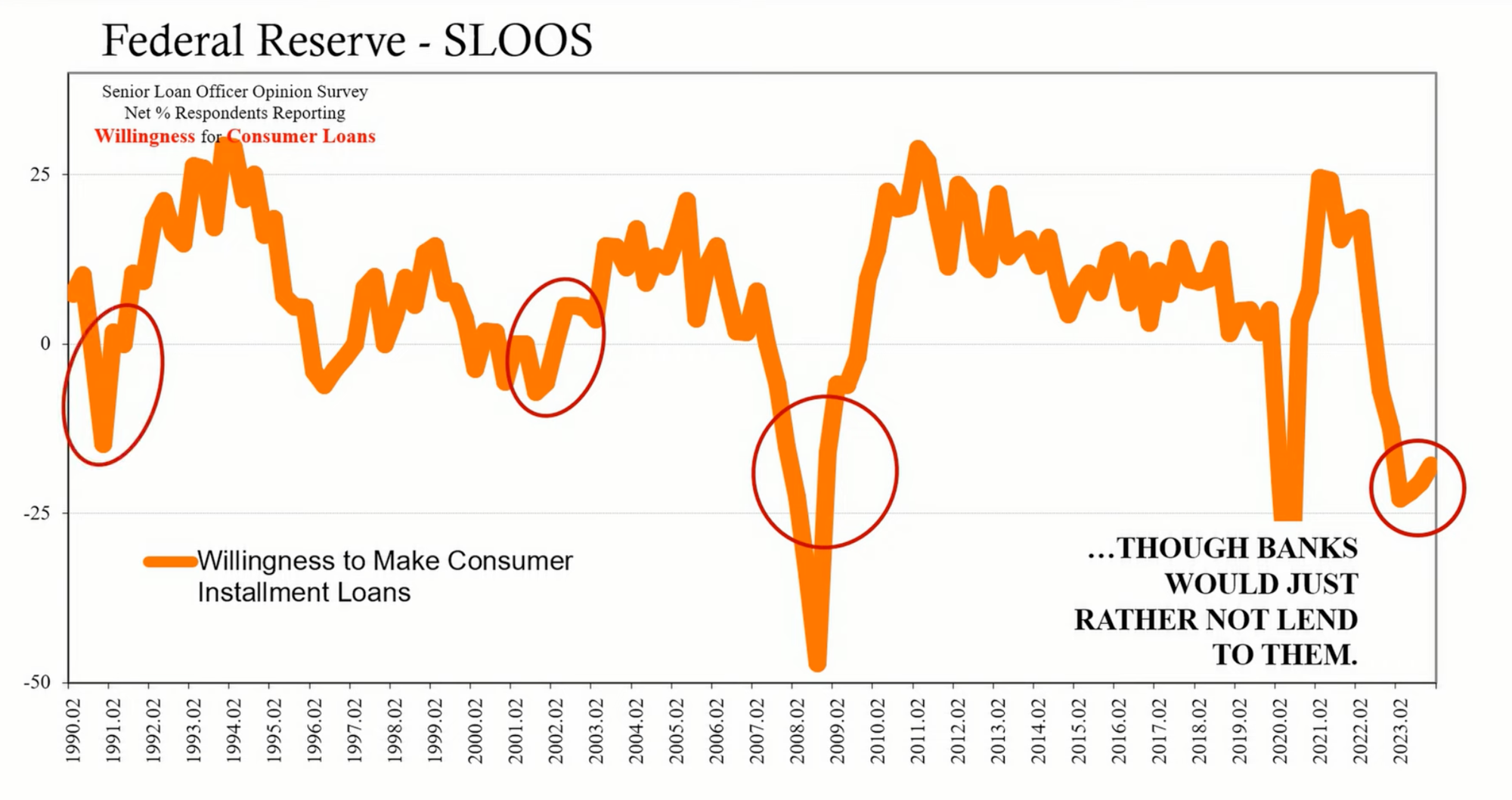

The Senior Loan Officer Opinion Survey (SLOOS) from the Federal Reserve is a critical tool for understanding bank behavior. It queries senior loan officers about their lending standards across various credit types. Focusing on commercial and industrial (C&I) loans, SLOOS data from the third quarter of the previous year reflected a net 50.8% of respondents tightening lending standards for commercial borrowers. This number has since decreased to 14.5% in the first quarter of 2024.

While this decline might seem positive, it does not necessarily indicate an easing of standards. Instead, it may suggest that the initial wave of tightening has already occurred, and the subsequent economic impact is pending. Historically, SLOOS data shows that maximum tightening aligns with the onset of recessions, with standards typically loosening much later.

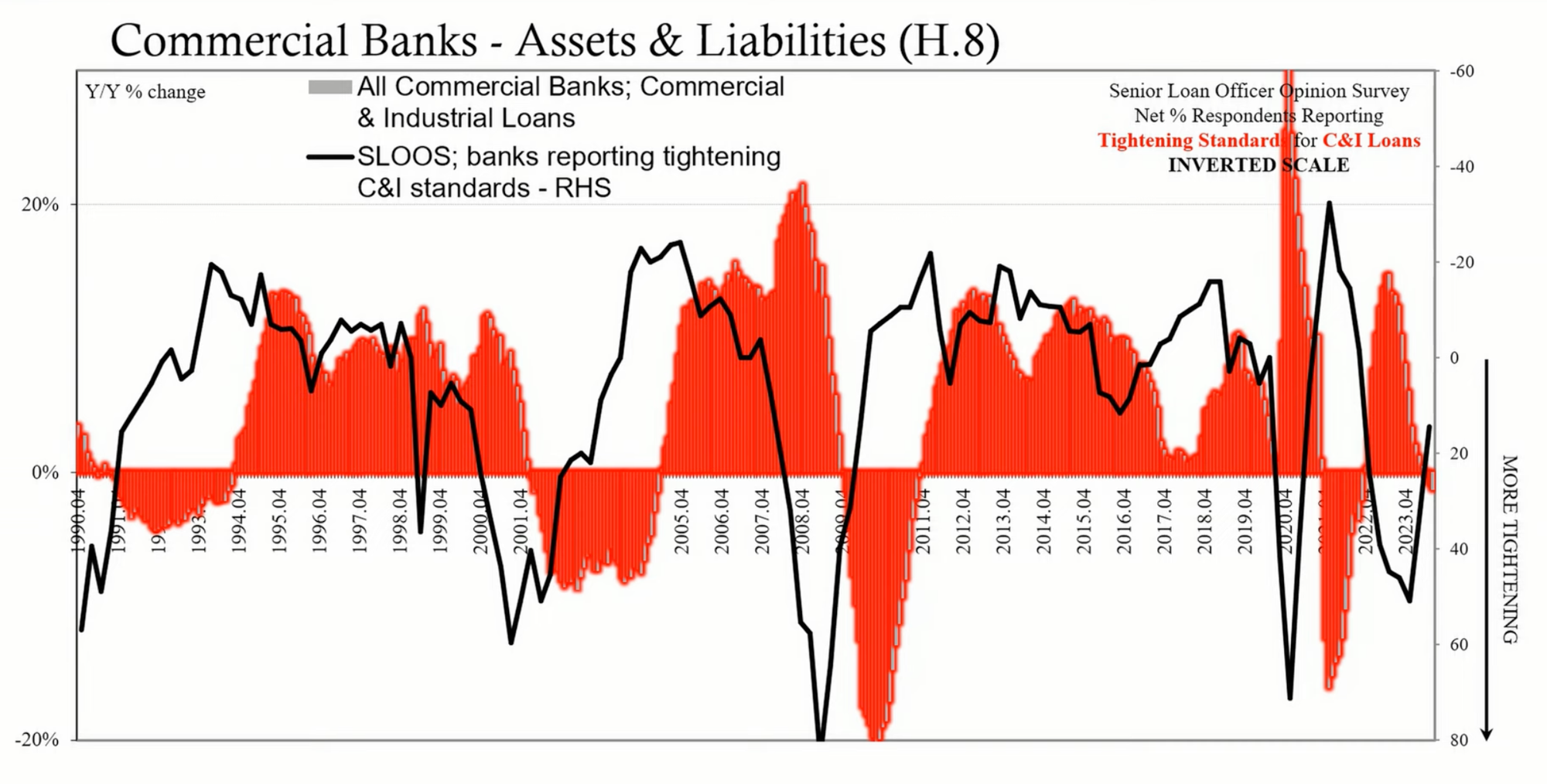

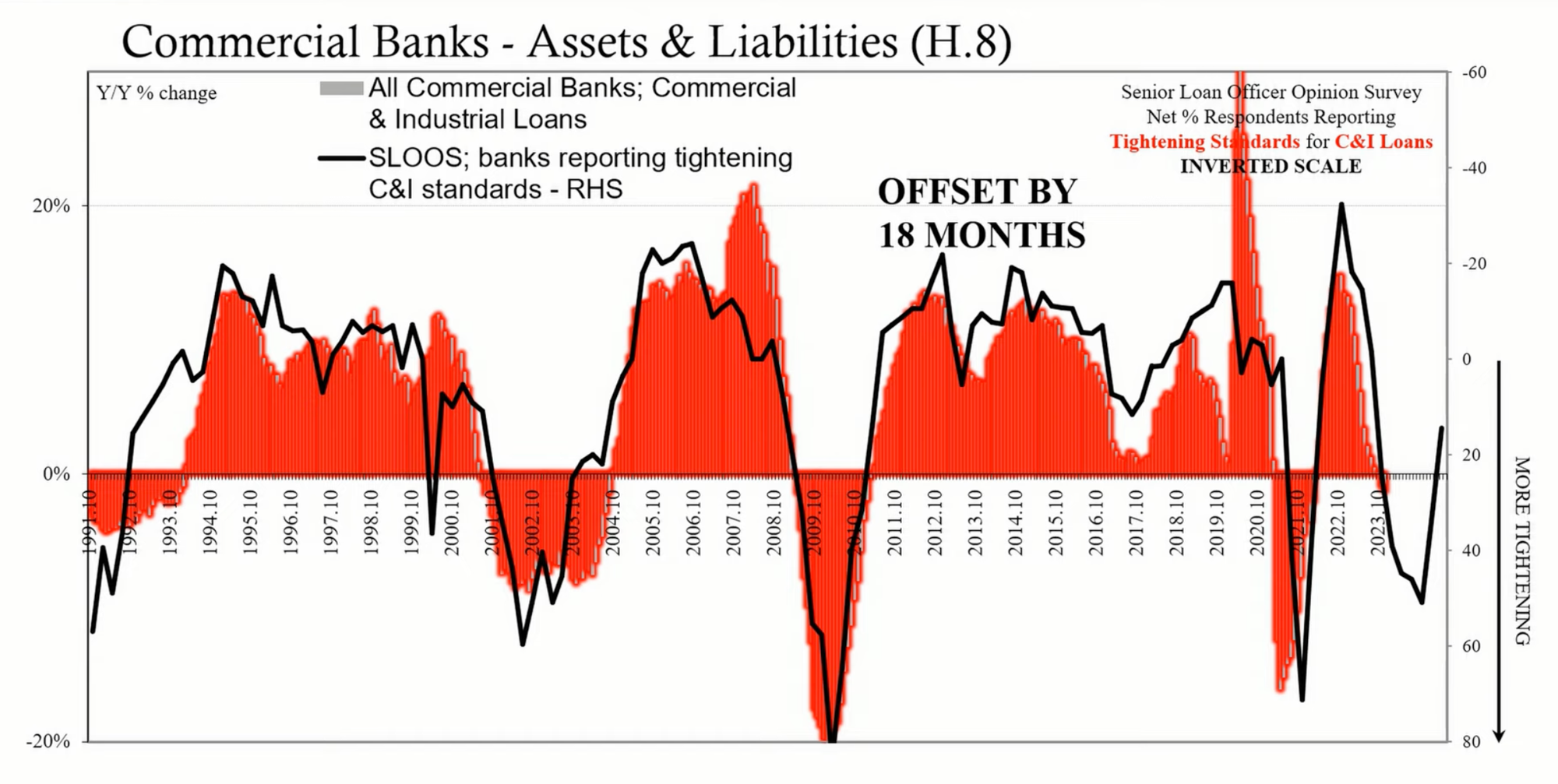

When examining the correlation between lending standards and the actual volume of C&I loans, a strong relationship is evident. Adjusting the SLOOS data to account for an approximate 18-month lag between tightening standards and reduced loan volumes reveals a near-exact alignment. This suggests that the full effect of tightened lending standards in the third quarter of the previous year will likely manifest by the end of 2024.

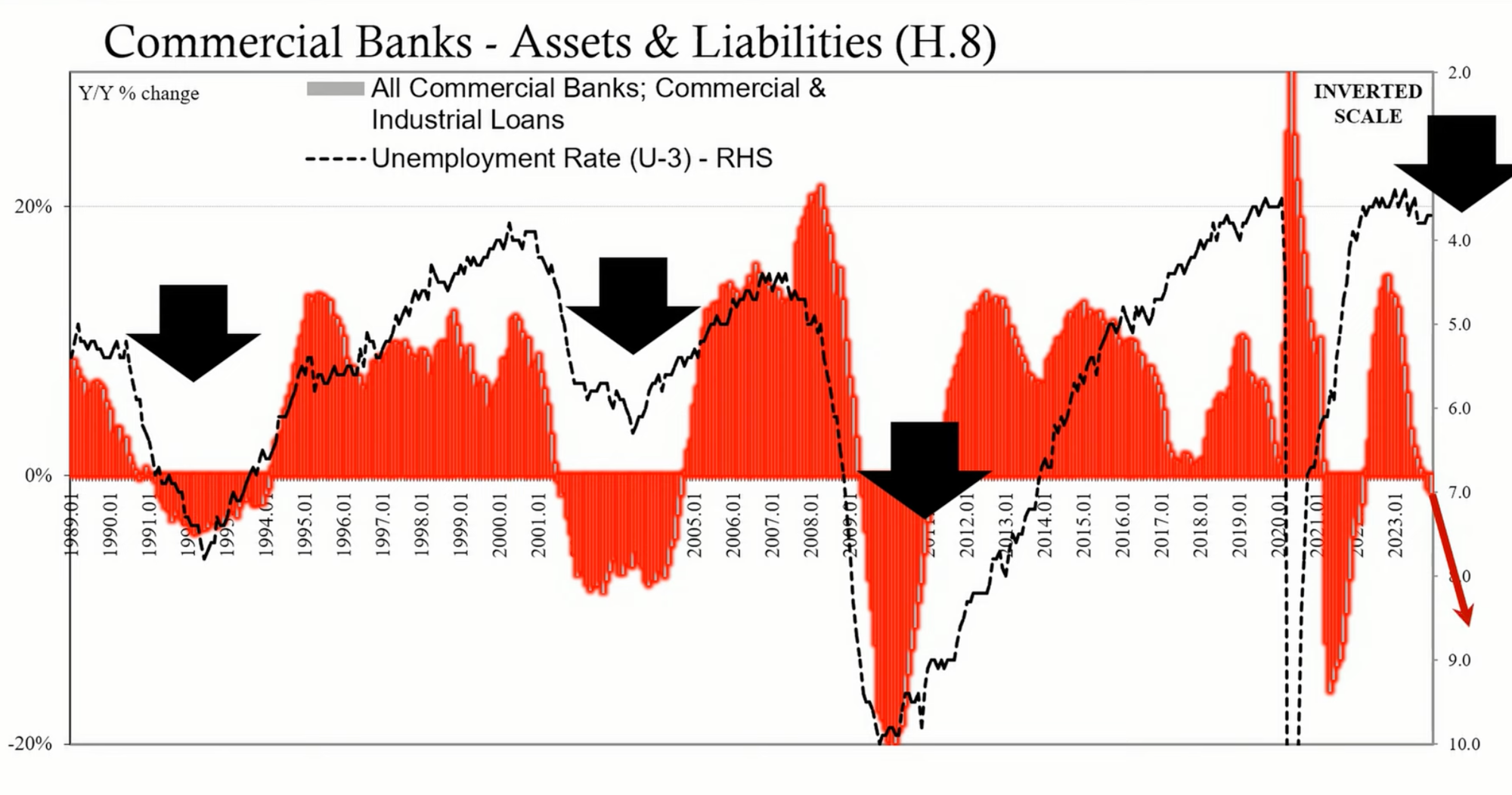

A significant correlation also exists between the volume of C&I loans and the unemployment rate. A decrease in C&I loans on a year-over-year basis tends to correspond with an increase in unemployment. The implication is that a reduction in commercial borrowing could lead to fewer employment opportunities, either directly or as a response to broader economic conditions.

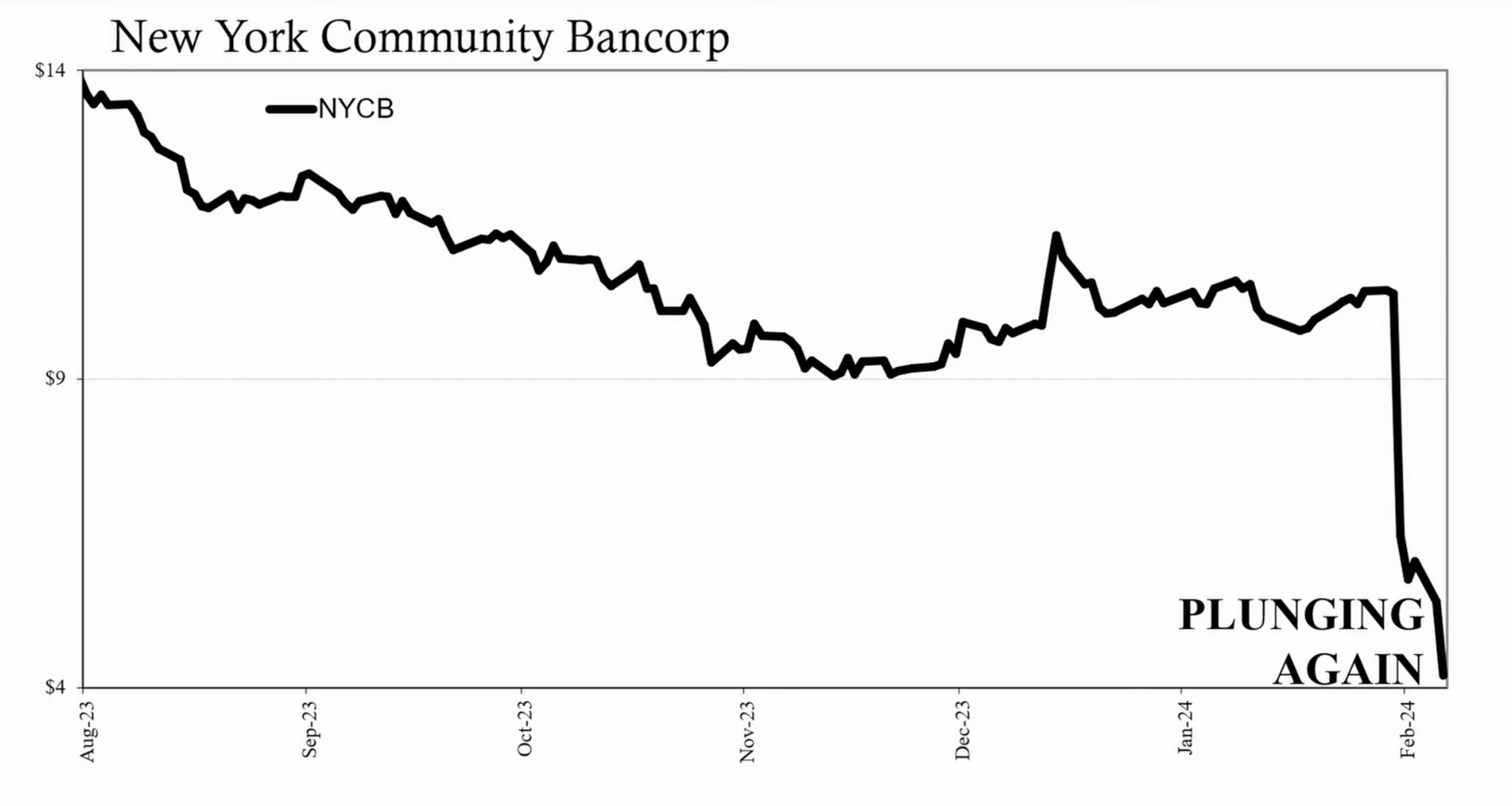

The SLOOS data also sheds light on other segments, such as commercial real estate and consumer loans. Recent findings, including those from New York Community Bancorp, have shown troubling developments in commercial real estate lending. Banks have reported a remarkable tightening of lending standards, and demand for these loans remains weak, potentially foreshadowing a crisis.

For consumer loans, banks have continued to tighten lending standards through 2023, with a slight reduction in the number of banks tightening in 2024. However, the willingness of banks to issue consumer credit remains low, reinforcing concerns about the state of the consumer economy.

The synthesis of lending standards, commercial lending volumes, and employment trends paints a picture of an economic cycle that has yet to reach its most challenging phase. Despite some positive labor market statistics, the historical patterns and current data suggest that the US economy may face increased difficulties by the end of 2024. The interplay between bank behavior and the broader economy continues to signal the potential for a recession, challenging the notion of a soft landing in the year ahead.