The melt up is accelerating and its leading to mass despair.

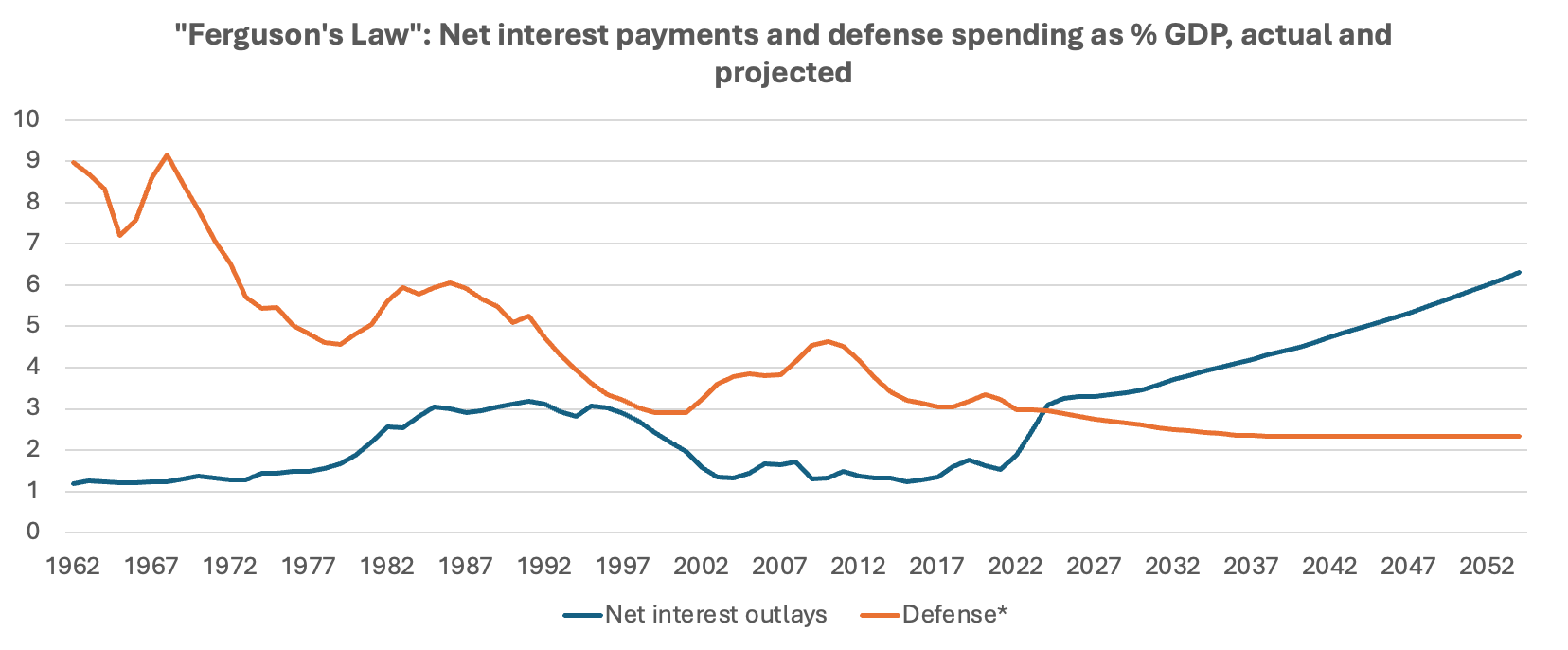

Ferguson’s Law states that any great power that spends more on debt service (interest payments on the national debt) than on defense will not stay great for very long. True of Hapsburg Spain, true of ancien régime France, true of the Ottoman Empire, true of the British Empire.… https://t.co/3jcblaGgqD

— Luke Gromen (@LukeGromen) June 18, 2024

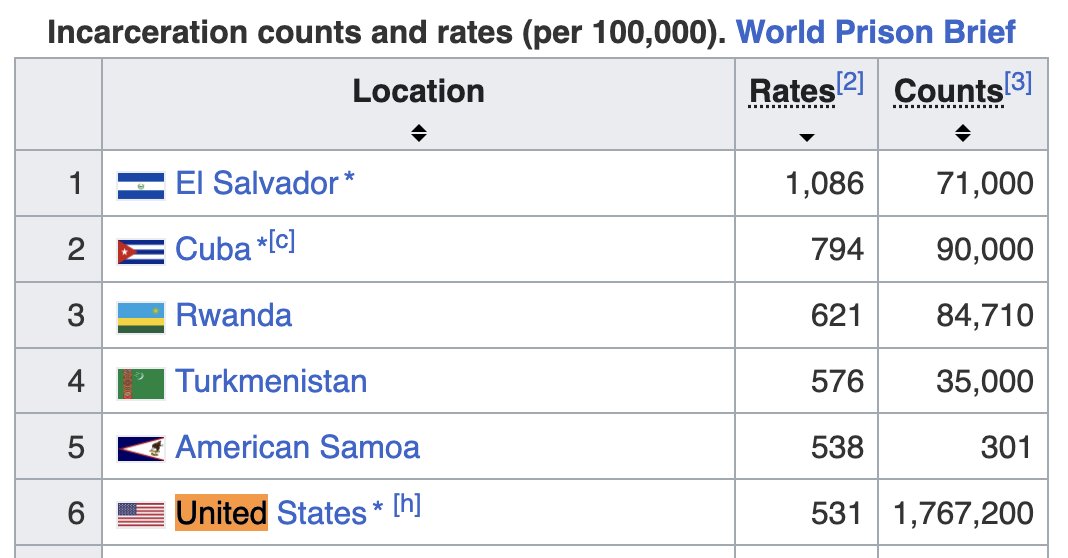

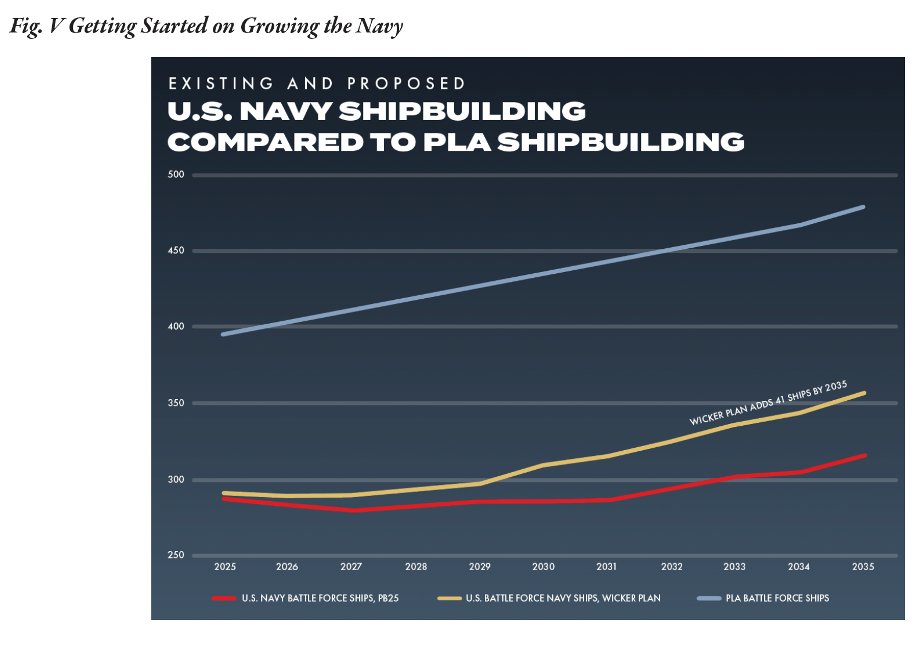

We live in the era of exponentials. One of the most alarming exponential charts floating around right now, which I'm sure you've all seen by this point, is the interest expense on the federal debt. The US government is now paying well over $1 TRILLION in debt expenses per year. A number that now surpasses the amount we pay on national defense. To make matters worse, the government is ramping up its debt binge at an alarming pace.

The US debt stampede is back: federal debt jumps by $70BN in one day to a record $34.750 trillion, the biggest one day jump since February.

— zerohedge (@zerohedge) June 19, 2024

At this pace, the national debt will be well over $35 TRILLION by the end of the year with no end in sight. For those of you who need a reminder, there is currently no debt ceiling, so this debt expansion can run as far as the government would like it to without even needing to stop to catch its breath for a couple of weeks due to a contrived debt ceiling "debate". The only line items standing between the interest expense and the top spot on the charts of expense line items for the government are medicaid, medicare and social security. All of which are semi-functional Ponzi schemes.

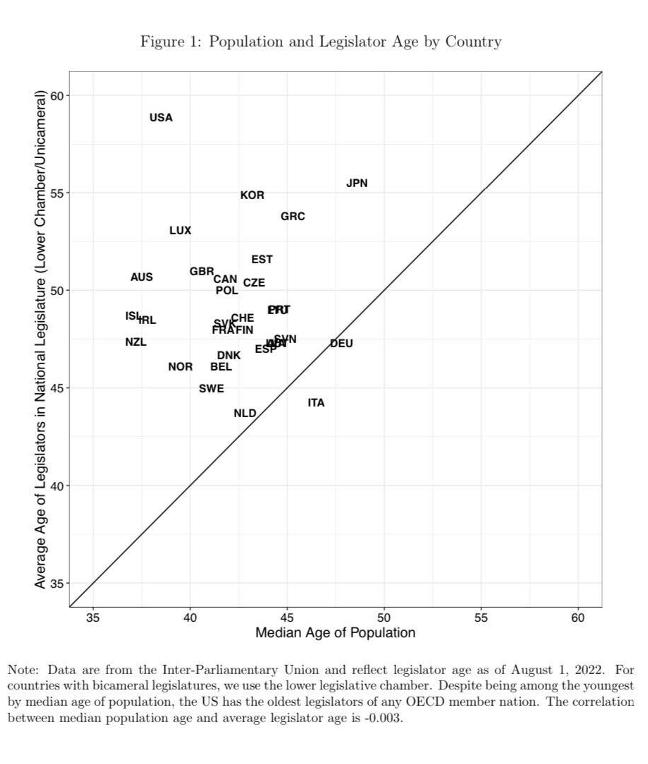

This is what a Late Stage Fiat melt up looks like and, as Luke Gromen points out, once a government begins spending more on debt servicing than it does on defense it typically marks the end of an Empire. Funnily enough, the law that Gromen references was put forth by Niall Ferguson and Niall came out with a banger of a thread this morning defending his assertion that the US is currently experiencing a Soviet-like decline induced by unfettered spending. The unfettered spending is leading to a melt up in despair and economic inefficiencies that are contributing to the rapid decline of the Empire.

.@JonahDispatch's response to my "Late-Soviet America" piece acknowledges that most of my argument is true but then says: "We're a non-evil empire; people want to come here, not leave; and we could fix all our problems if we just applied our founding principles." It's pure cope.… https://t.co/mbHh28aMvK

— Niall Ferguson (@nfergus) June 20, 2024

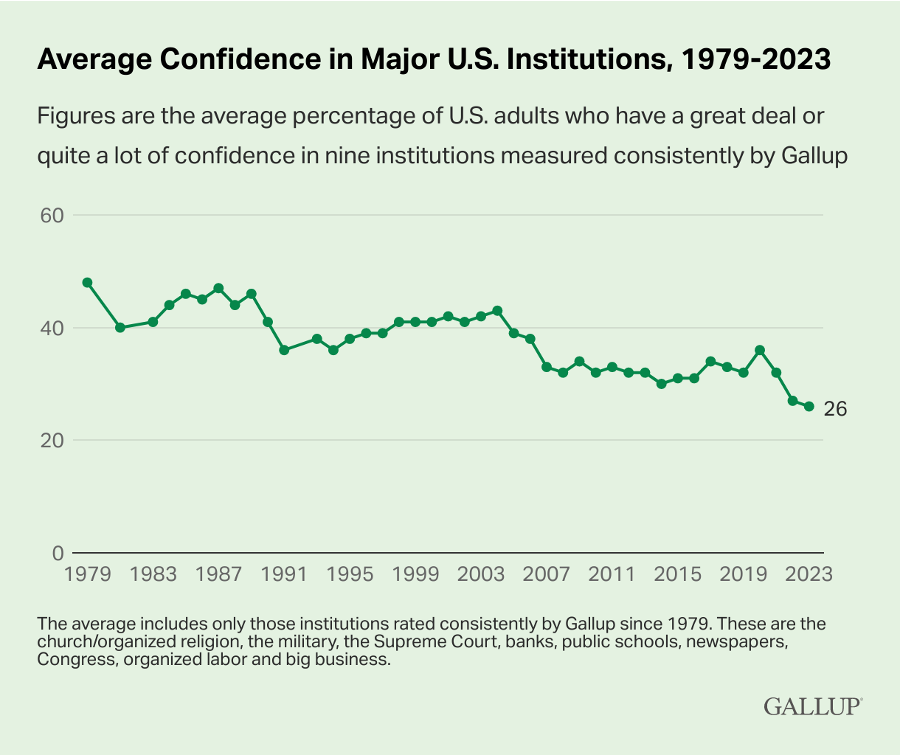

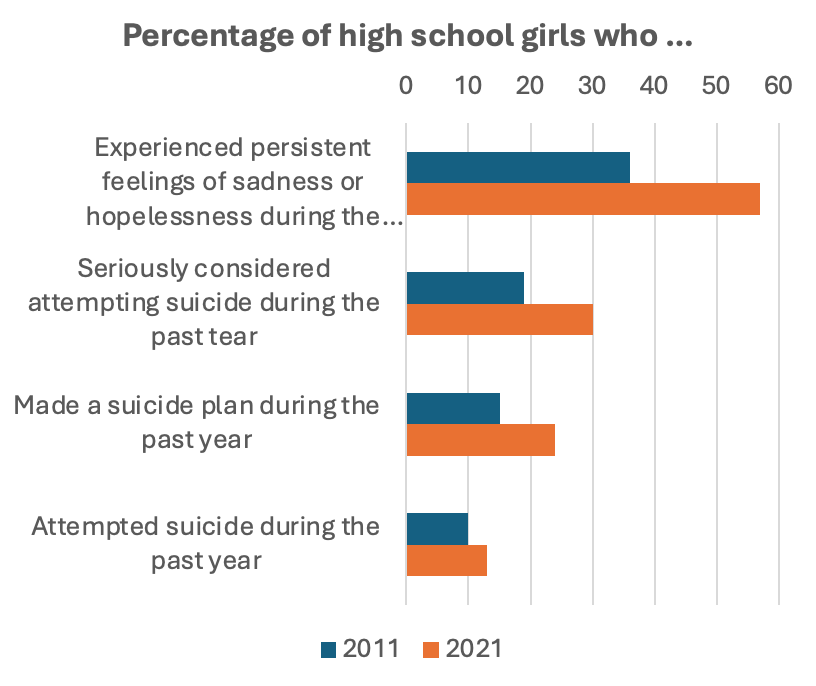

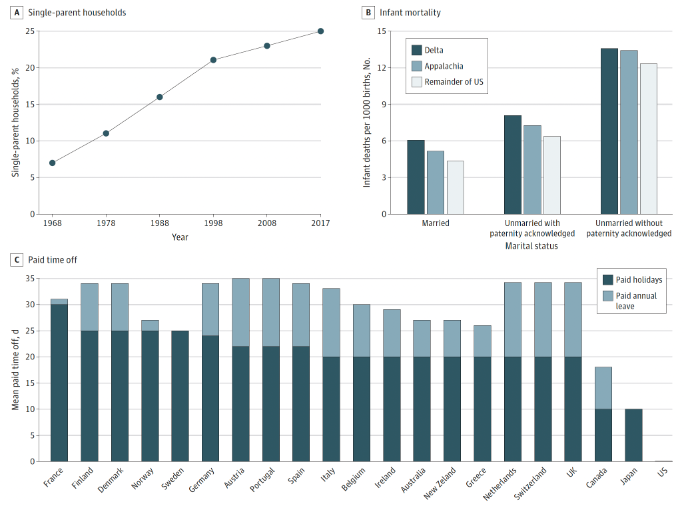

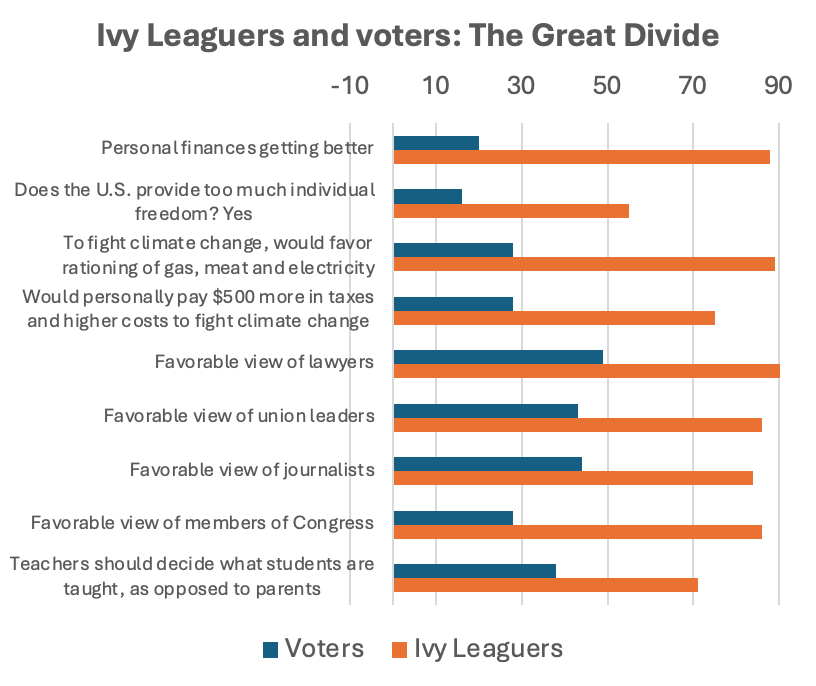

Here are the charts Niall shared deep in this thread that we think you should all be paying attention to.

All of this points to a populace that is desperate, lost, and completely dejected. This is the product of an economy and governance structure that has been rotting at its core for decades due to the unnatural manipulation of the price of money; the most important pricing mechanism we use as a society. When you manipulate the price of money it has profound negative externalities that ripple throughout the economy like a slow moving tsunami that slowly but surely destroys everything in its path.

"If you ask most people, are price controls are good? Most people that have a sense of free markets would say no, and yet that's exactly what central banks do. They set the price of money."

— TFTC (@TFTC21) June 19, 2024

- @LynAldenContact on @WhatBitcoinDid pic.twitter.com/gOyjAdPlWA

Despite the fact that it is abundantly clear that we have strayed far off the path of sensible fiscal and monetary policies that enable individuals to flourish and toward a hyper-controlled and centralized economy with decisions being made by bureaucratic administrators who have no true sense on what the market actually demands, there are ways to right the grave injustices that have been forced on the market. The problem needs to be attacked at its core, which means returning the market to a monetary system whose price cannot be manipulated by central planners. Bitcoin provides the market with this monetary system. The broader market has not yet recognized this fact, but it will in time. Especially as it becomes clearer and clearer that the Late Stage Fiat Melt Up is upon us and people will be left with no other option but to seek out a better alternative.

Final thought...

Productive week of travel for your Uncle Marty.