The recent figures emerging from the labor market are sounding alarms that a recession may be closer than previously anticipated, as job market indicators, once considered robust, begin to falter.

The recent figures emerging from the labor market are sounding alarms that a recession may be closer than previously anticipated, as job market indicators, once considered robust, begin to falter. According to an article by The Wall Street Journal, the employment landscape, previously the stalwart against recessionary fears, is now showing signs of strain, with unemployment on the rise, wages on the decline, and job seekers facing longer searches.

Adding to the concern, a report from ZeroHedge characterizes the job market as "imploding." A significant revelation that has jolted analysts came in the form of job openings data, which dropped by a staggering 800,000 in a month, falling short of expectations by more than half a million. This discrepancy raises questions about the reliability of the projections based on government figures.

This downturn in job openings is particularly disconcerting given that approximately 5 million Americans left the workforce during the COVID-19 pandemic, a factor that, if not for early retirements and government incentives, would have placed the unemployment rate between 6.5 to 7 percent – mirroring the early stages of the 2008 financial crisis.

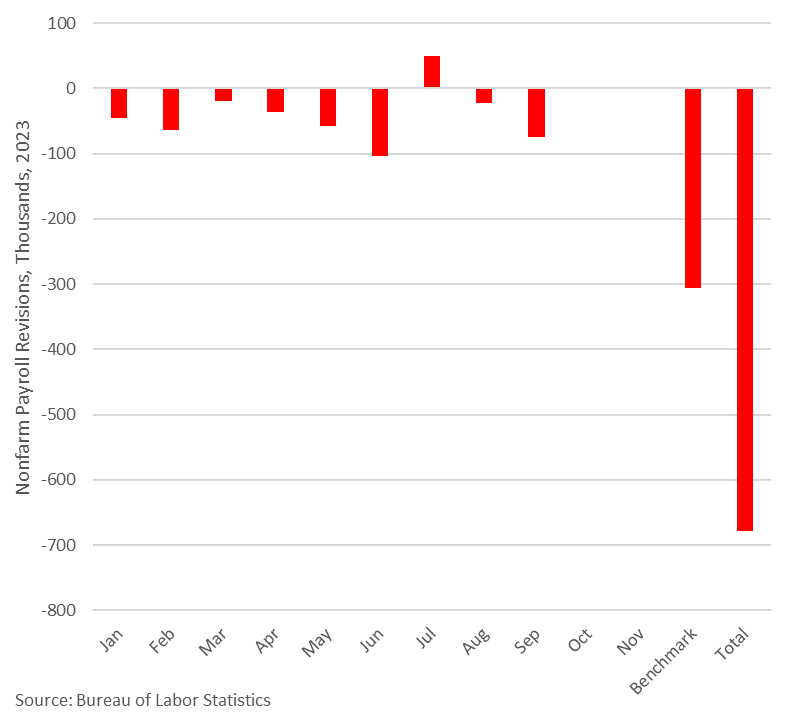

The Bureau of Labor Statistics (BLS) has compounded the concern by revising 848,000 jobs out of existence, adjustments that typically receive little attention compared to the initial, more optimistic reports. Since the Federal Reserve began raising interest rates, nearly 30 percent of job openings have vanished, equating to a loss of about 3.5 million vacancies.

Further indicators of a weakening job market include a decline in the number of workers voluntarily leaving their jobs, tepid holiday hiring, smaller raises failing to keep pace with inflation, and a steady increase in continuing unemployment claims since September, suggesting that more Americans are struggling to find new employment.

As the government continues to present a rosier picture than the data suggests, the real risk, beyond the possible misrepresentation of economic health, is that the Federal Reserve may continue to raise rates in the midst of a weakening economy. This could result in a severe policy error, triggering a reaction that could exacerbate the economic downturn. History has shown that the Fed has been prone to such errors in past recessions, a pattern that could repeat with dire consequences in the current economic climate.

In conclusion, the job market, once the bastion of economic hope, is showing cracks that could herald an approaching recession. The implications of this downturn are significant, and as the situation develops, it will be critical to monitor the Fed's response and the government's representation of economic data.

For the discerning reader, the message is clear: the job market's decline may be the canary in the coal mine for the larger economy, and the coming months will be crucial in determining the depth and duration of the potential recession ahead. Keep an eye on this space for further developments.

Jobs numbers “implode” as job openings plunge 800,000 on the month.

— Peter St Onge, Ph.D. (@profstonge) December 8, 2023

Even the cheerleaders at the Wall Street Journal think it’s bad.

This matters because jobs are the only statistic saving this economy from recession. If jobs go, it all goes. pic.twitter.com/K2Wggzn63y