Earlier today, Jerome Powell took to Capitol Hill to announce that the Federal Reserve will be holding rates where they are for the time being in an effort to get the inflation rate back toward its 2% target.

The Powell pivot begins.

— Nick Timiraos (@NickTimiraos) December 13, 2023

Dec 1: “It would be premature to … speculate on when policy might ease.”

Dec 13: Rate cuts are something that “begins to come into view” and “clearly is a topic of discussion.”

What a difference two weeks can make. https://t.co/Vox8LKSgf0

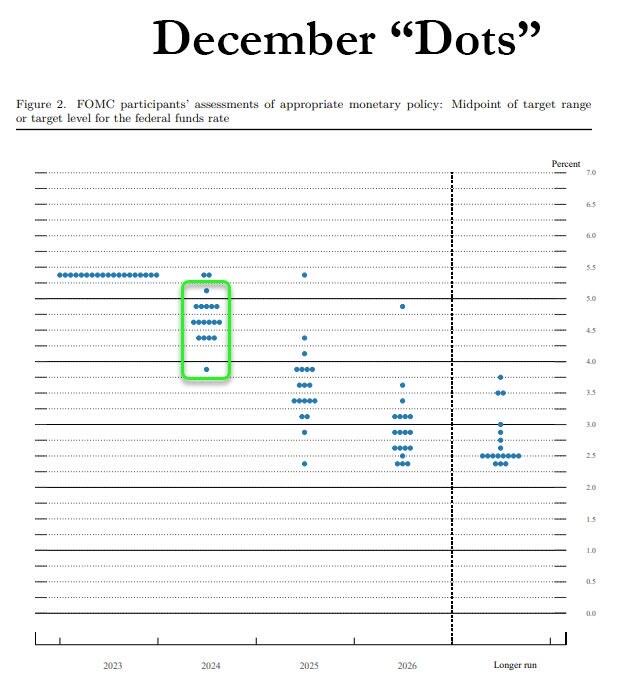

Earlier today, Jerome Powell took to Capitol Hill to announce that the Federal Reserve will be holding rates where they are for the time being in an effort to get the inflation rate back toward its 2% target. What was most remarkable about today's press conference was that Chairman Powell admitted via the infamous dot plots that showed a majority of FOMC expecting multiple rate cuts in 2024, with many expecting the Federal Funds rate to fall below 4.5%. This is a massive pivot from Powell and company. Who seemed keen on keeping rates higher for longer.

This begs the question, "Did Jerome Powell just throw in the towel?" It has become quite clear that the Biden administration has been trying to expedite rate cuts heading into an election season by aggressively leaning into the false narrative that inflation has been tamed and everything is back to normal. Going as far as to mislead the public by conflating a fall in the rate of inflation with a fall in prices. Janet Yellen has been hitting the mics hard to bad mouth higher rates and their effect on real rates. Consistently sending not so subtle messages that it is time for the Fed to reverse course on interest rate policy.

Today's comments from Jerome Powell seem to signal that he received the message and isn't going to try to combat an administration gearing up for a reelection campaign (or -more likely - a bait and switch with another candidate). The money printer will go brrr. At least, this is what seems to be the consensus among all of the Fed pundits at the moment. Only time will tell whether or not these rate cuts actually materialize.

The real signal here is just how insane this whole circus is. Markets were waiting with bated breath for Powell's comments and went absolutely berserk when a stupid chart with blue dots was revealed to the world. Hours were spent dissecting the psychology behind the comments and the inter-department war between the Fed and the Treasury. I just wrote ~300 words covering the event and I like to think that the world would be a much better place, at least certainly much more productive, if thousands of bright minds weren't forced to have their attention sucked away to see what the Fed is going to do next. All of this attention is diverted because the Fed, along with the Treasury, is the driving force behind how the world allocates its capital. Don't you think it would be much easier not to have to wait for some man to stand behind a podium to let you know how he is or is not going to manipulate an interest rate that affects every financial product on the planet? Wouldn't it be nice if the market operated on top of a monetary system that couldn't be manipulated by the whims of Federal Reserve board members who are constantly making emotional decisions driven by what their friends in the banking sector and politicians looking for better approval ratings want to see happen?

This is why we bitcoin, freaks. To rid ourselves of this insanity. To ensure that men can be productive and focus his intellect and time on more important things. Imagine what the world would be like if I never had to write a newsletter like this ever again. It would be beautiful.

Final thought...

Shout out to my wife. She's the MVP of this Wednesday.