Yesterday morning, executives from the largest banks in the nation were on Capitol Hill for a hearing with the Senate Banking, Housing and Urban Affairs Committee to give the Senate some perspective on what they are seeing in the market.

Projection. Jamie Dimon and @jpmorgan helped facilitate Jeffrey Epstein's sex-trafficking enterprise for 15 years.

— Marty Bent (@MartyBent) December 6, 2023

The people trying to besmirch bitcoiners as criminals are the worst criminals that exist today.

The system is so corrupt that they can get away with it for $75m. https://t.co/VnBSgGpYhO pic.twitter.com/uNcMRe8kuI

The other night we discussed the looming regulatory battles the bitcoin industry may face in wake of the Treasury Department sending a letter with some aggressive suggestions to he Senate Banking and House Financial Services Committees.

Yesterday morning, executives from the largest banks in the nation were on Capitol Hill for a hearing with the Senate Banking, Housing and Urban Affairs Committee to give the Senate some perspective on what they are seeing in the market. During the hearing our nations Chief Karen, Elizabeth Warren, took the opportunity to continue her uneducated campaign against bitcoin and the broader cryptocurrency markets. This led to an unusually friendly exchange between herself and JP Morgan Chase CEO Jamie Dimon, who took the baton from Warren and put forth that if he were the government he would move to "close it down". Citing that its only true use case is for criminals who are laundering money outside of the regulated financial rails dominated by big players like JP Morgan.

This line of reasoning is completely disingenuous for many reasons. Bitcoin is overwhelming used as a savings vehicle so that individuals and companies can escape manipulated fiat currencies like the dollar. This is very easy to see by looking at the chain data and observing the amount of bitcoin that has laid dormant in addresses for long periods of time. We covered this on Monday. Over 70% of the bitcoin supply hasn't moved in over a year.

I'm not a scientist, but I think it's safe to say that if 70% of bitcoin is being used as a long-term savings vehicle that would seem to be the true use case, not money laundering.

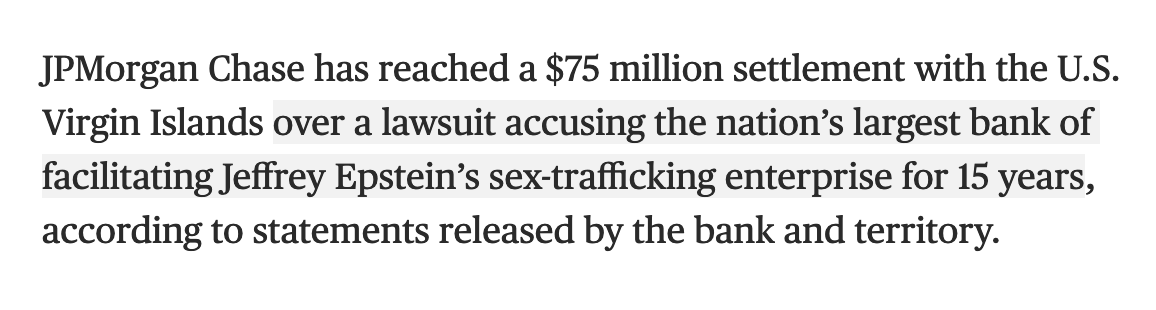

Beyond that, as we mentioned the other night, these types of statements from incumbent power brokers are pure projection. JP Morgan Chase paid a $75m settlement fee with the US Virgin Islands earlier this for openly facilitating Jeffrey Epstein's international sex trafficking ring for over 15 years.

Like Janet Yellen and Elizabeth Warren, Jamie Dimon recognizes that bitcoin presents a systemic risk to his business. A business which garners him a lot of control and easy profits. This type of posturing shouldn't be surprising. However, as with the Treasury Department, Jamie Dimon should be met with as much ridicule as possible for this blatant hypocrisy.

Final thought...

Had a lovely night at the light show.