Will these idiots ever learn?

Last September we here at the Bent warned of an interesting social attack vector that was popping up that we believe you freaks should be keeping an eye on; OFAC/FATF/[insert evil alphabet soup regulatory body here] compliant mining pools. Well, fast forward to this morning and it seems like we have the first "OFAC compliant" block that was mined by a pool controlled by the publicly traded bitcoin mining company, Marathon Digital Holdings.

MARA Pool mined its first 'clean' block today.https://t.co/v7WzKrzt9P pic.twitter.com/qTQOoQsq0D

— 0xB10C (@0xB10C) May 6, 2021

Marathon's attempt to create a "clean", "regulatory compliant" pool is nothing more than just that, an attempt. It is literally impossible to create an regulatory compliant pool unless you have enough hashrate to continually reorganize the chain to remove blocks that do include transactions the regulators don't want to happen. Marathon's very sad and small pool certainly isn't going to be able to accomplish this. The only thing produced from Marathon pool's mined block today was a pure virtue signal. They did nothing to comply with OFAC regulations. In fact, one can easily make the argument that they are helping to facilitate transactions that are "not approved" by regulators because the addition of the block they mined this morning adds an extra block of security to "unapproved" transactions in previous blocks. Here's a good thread that dives into this:

since a "compliant miner" is using an address blacklist, a "non-compliant" transaction involves an address that previously transacted before the block a "compliant" miner is mining. 2/6

— Jay Beddict 🟩 (@JBeddict) May 6, 2021

said another way, before even considering if such a miner would mine on top of a “non-compliant” block after they mine their first block, this miner is securing the “non-compliant” transactor’s transactions by simply coming to the table. 4/6

— Jay Beddict 🟩 (@JBeddict) May 6, 2021

that does not mean that these efforts should be ignored. complacency is how protocols die. censorship resistance is a key tenant of Bitcoin; a major part of its value. NGU, while fun, is not the underlying value of bitcoin. 6/6

— Jay Beddict 🟩 (@JBeddict) May 6, 2021

As Jay points out, the derelicts over at Marathon Digital Holdings have a fundamental misunderstanding of how the Bitcoin network actually works. They've accomplished nothing with this move outside of prove that they are bad actors who should be ridiculed and avoided. Bitcoin was created to bring a free and open source peer-to-peer digital cash system to the masses as an alternative to a corrupt central banking and political system. Onerous regulations that cause more harm than good by forcing individuals to give up very intimate personal information that eventually puts them in harm's way when databases holding that intimate information are breached. On top of that, the laws and regulations that corrupt governments attempt to force on individuals are subjective.

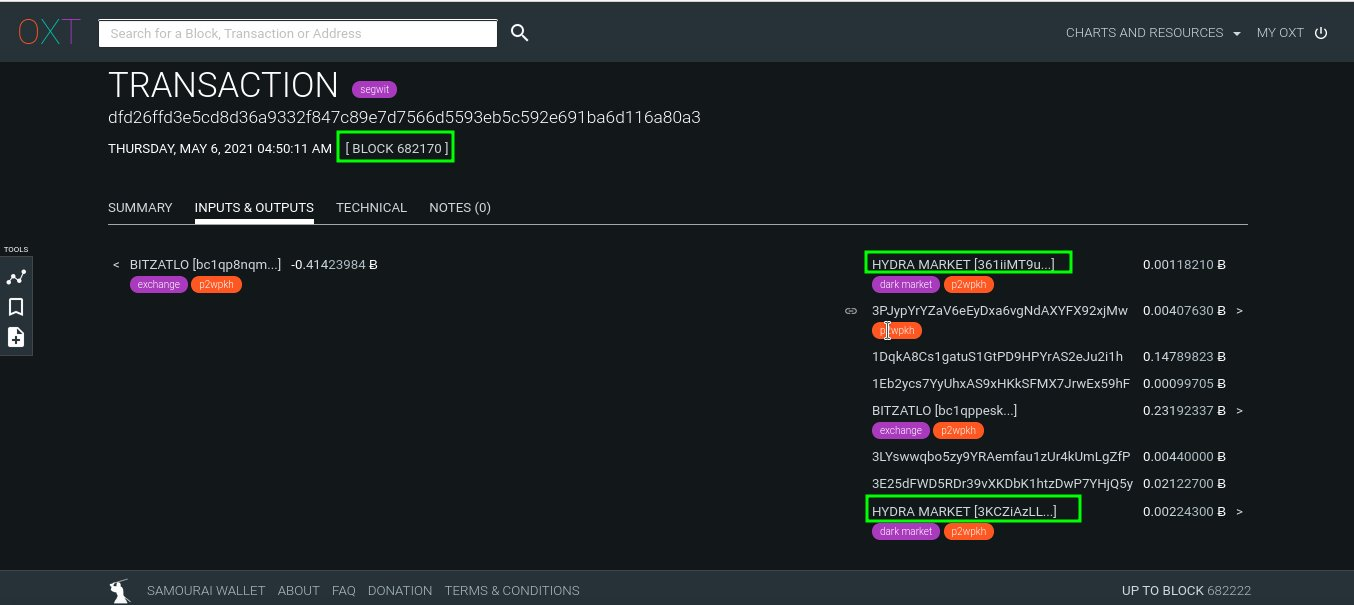

As we dive into this situation further, we'll find that Marathon wasn't even filtering transactions and may have actually facilitated the movement of UTXOs to a Hydra, a dark net market.

For example, it becomes apparent that #682170 did NOT filter transactions.

— 0xB10C (@0xB10C) May 6, 2021

All transactions missing from the block had only been in my mempool for a few seconds. None are sanctioned.

Differences between templates and blocks are to be expected!https://t.co/wJPD0gWeAr pic.twitter.com/9Qvy1r9iM6

This move from Marathon was nothing more than a weak virtue signal to curry favor with regulators and, I am guessing here, attempt to establish a premium on their mined coins by labeling them as "OFAC compliant". Something similar to the "blood-free bitcoins" that idiot Kevin O'Leary has been screeching about for a couple months now. These people don't understand how Bitcoin works and are doing nothing more than to confuse people about what the protocol makes possible and potentially increase the cost of compliance as mining pools may be forced to hire legal counsel to combat false claims.

Oh look, the Iranian central bank doesn't understand how Bitcoin works either... Shocker.

Iran's central bank has declared that transactions of cryptocurrencies which were mined outside of Iran are forbidden - in Iran, one can only transact with locally mined coins! https://t.co/YuOwdIkPG5

— Meh (@Fatalmeh) May 6, 2021

These idiots will learn in due time. Here's to hoping their loud virtue signaling doesn't confuse regulators into actually believing they can regulate Bitcoin at the protocol level. Who knows though? Maybe Bitcoin needs to fight this fight at this current juncture to further prove its value prop and put all of this nonsense behind us for good.

Final thought...

Left over shredded pork over two over easy eggs is a delicious lunch!