Keep stacking!

Despite the fact that we had a "significant" dip in the price of bitcoin today, the last 36-hours have produced some pretty bullish fundamental news for Bitcoin. In an effort to make sure I get enough sleep tonight I'm going to quickly attempt to highlight this news.

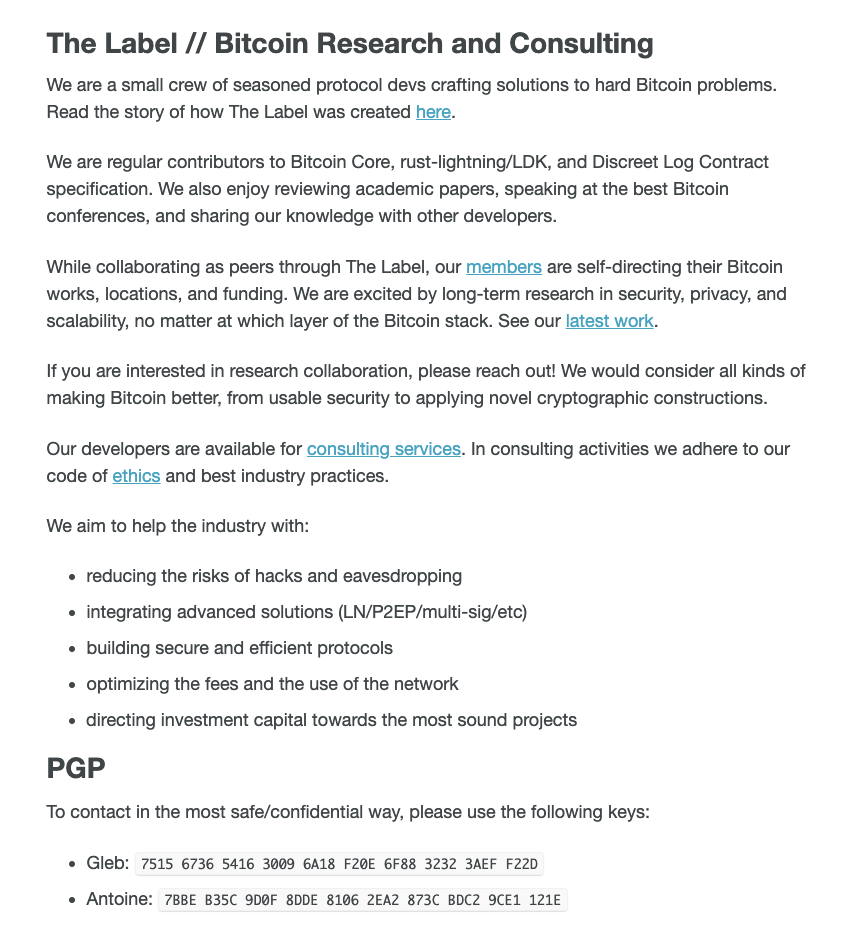

First up, we have the formation of The Label from Bitcoin Core contributors and all around excellent adversarial thinkers Gleb Naumenko and Antoine Riard. These two fine gentlemen, along with other developers, will be focusing their efforts on researching ways in which Bitcoin can become more secure, private and scalable at every layer and attempt to follow up that research with solutions to the problems they discover. Very bullish to have these minds focused on these areas.

Next, Lucas Nuzzi from Coinmetrics highlighted a paper from a team of researchers that claims to have found a way to create Lightning Network payment channels that are private by design, fair, and give individual users to increase the capacity of the channels they open. Beautiful.

Really interesting design for Lightning payment channels just came out.

— Lucas Nuzzi (@LucasNuzzi) February 22, 2021

-Private by design

-Safe even if all parties you opened your channel with are corrupt

-Increased capacity relative to other models pic.twitter.com/mQ51uJ1wp7

Moving along, the NYAG and Tether have agreed on a settlement that forces Tether to pay a fine for allowing New York residents to use the unregulated stablecoin, but also proved that Tether was telling the truth when they said their stablecoin was fully backed with one-to-one reserves. FUD debunked.

BREAKING: @NewYorkStateAG has settled its long-running inquiry into @bitfinex and @Tether_to. The companies will pay $18.5 million and provide quarterly reports about USDT reserves.@nikhileshde reportshttps://t.co/dULBeGRMT7

— CoinDesk (@CoinDesk) February 23, 2021

Last, but not least, Square announced that they added $170M worth of bitcoin to their balance sheet. Adding to the $50M allocation they made last year. Bringing their total holdings to 5% of their total cash and equivalents. On top of this, their bitcoin sales revenue continued its upward trajectory in Q4 2020 and totaled $1.76B in 2020 compared to $177.6M in 2019. Beautiful. (disclaimer: sponsor of the rag and the pod)

Today's purchase: 3318BTC for $170mm

— Conner Brrrrrrrrrrr (@ConnerBrrrrrrr) February 23, 2021

Last year's purchase: 4709BTC for $50mm

The trend will continue! https://t.co/0Kzkw5UPRh

Square's bitcoin revenue has grown from $177.6MM to $1.76BN Y/Y

— zerohedge (@zerohedge) February 23, 2021

Hope you freaks stacked the "dip"!

Final thought...

Getting up in 5 hours. Not too happy about it but not too mad about it.