Something is not right...

While everyone is fixated on the election that never ends and news surrounding the development of a vaccine for the coronavirus, the fact that the amount of negative-yielding debt recently hit an all-time high of $17.08T has received relatively little attention in your Uncle Marty's opinion. This means there are lenders out there carrying a collective bag worth more than $17T that represents a massive misallocation of capital. Money is printed out of thin air and centrally pushed to areas of the economy that are, at this point, destined to lose money over the medium to long term.

Market Value of Global Negative Yielding Debt up $358bln (5-day change) to record high $17.05 Trillion pic.twitter.com/TTCUBS5OFs

— Eric Pomboy (@epomboy) November 6, 2020

UPDATE: data for today just in...a new record high of $17.08 Trillion

— Eric Pomboy (@epomboy) November 6, 2020

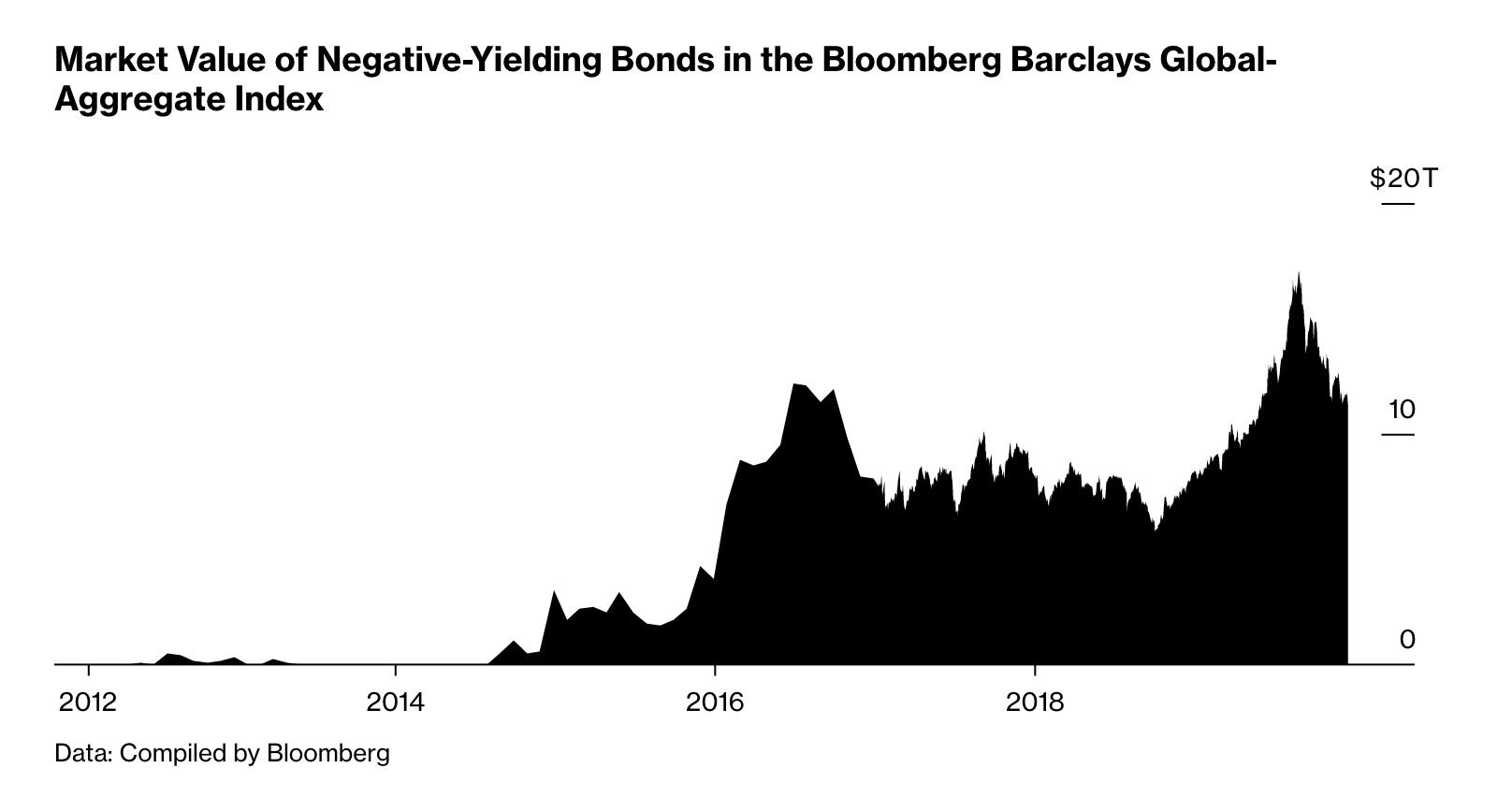

The world is filled with big numbers these days, but I don't think you should let this big number skirt by. Seventeen TRILLION dollars worth of money that has been misallocated by central banks, the unelected unofficial economic planning committees of the world, is criminal. This is a problem that has ballooned out of control in a very short amount of time too. Here's a chart from a year ago that brings more context to the pace of growth of negative-yielding debt throughout the last decade.

Remember freaks, this is a relatively new phenomena that has reared its head in the era of extremely low interest rates. The policies that are being pursued inevitably lead to interest rates breaking the zero-bound and entering negative territory. This is due to the doom loop nature of a global economy built on excessive debt run by bureaucrats who are addicted to spending money.

This is a problem that seems to be spiraling out of control. Especially once you consider that the amount of negative yielding debt globally was around $0 less than a decade ago. We are currently approaching the $20T range. Something is terribly off. Many mention things happening gradually then suddenly a lot these days. Usually attempting to describe something they believe will happen in the future. The negative yielding debt problem seems like a gradually then suddenly event unfolding right before our eyes that many are missing. And if they're not missing it, they seem to be neglecting or remain unaware of the terrible signal this is sending the world. The pricing mechanisms of the world are completely broken and States are woefully incompetent when it comes to issuing debt and allocating capital.

Bitcoin waits for anyone who recognizes this insanity and wants to opt out.

Final thought...

Mobile hotspots have strong range these days.