Let's do a quick roundup.

It's been a minute since we did a Smorgasbord issue and there are a few things that have come across my radar that I think are important to relay to you freaks. So, here we are. Congregating around this dirty, low-brow section of the Internet to talk about some of the happenings that piqued my interest recently.

After many iterations (including the recent even-R change), it looks like the PR for BIP340 (Schnorr signature) in libsecp256k1 is getting close to being mergeable: https://t.co/r8JooTYzFD

— Pieter Wuille (@pwuille) August 31, 2020

If anyone feels like reviewing/ACKing, feel free!

First up, Pieter Wuille announced last night that a crucial pull request (PR) for getting BIP 340 implemented and Schnorr Signatures compatible with libsecp256k1, a library that enables users to create private/public key pairs using ECDSA signatures, is close to being mergeable. Pieter has issued a call to action. If you are willing/able to review this particular PR, he is looking for more eyes. Bitcoin Core contributor Greg Maxwell has already given the PR an ACK, signaling that he believes it is ready to be merged. However, more capable eyes looking at this PR certainly cannot hurt.

Slowly but surely, the lines of code are aligning to enable the activation of Schnorr signatures within Bitcoin. One of the looming questions that remains is, how exactly will it be activated?

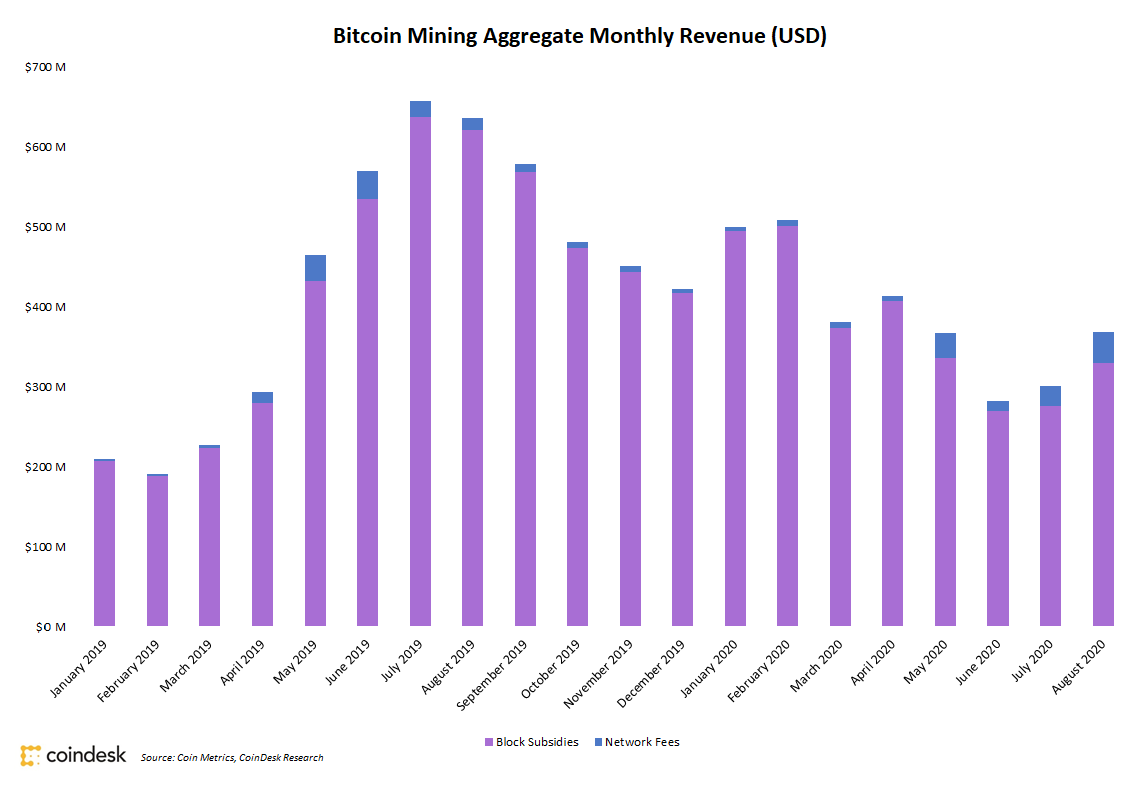

August was a good month for miners. After two months of depressed revenue following the block subsidy halving on May 11th, revenue rebounded in August as miners raked in ~$368M in revenue with fees making up ~11% of the total rewards collected throughout the month. This is very encouraging to see only a few months after an event that many suspected would lead to the decline of the mining industry.

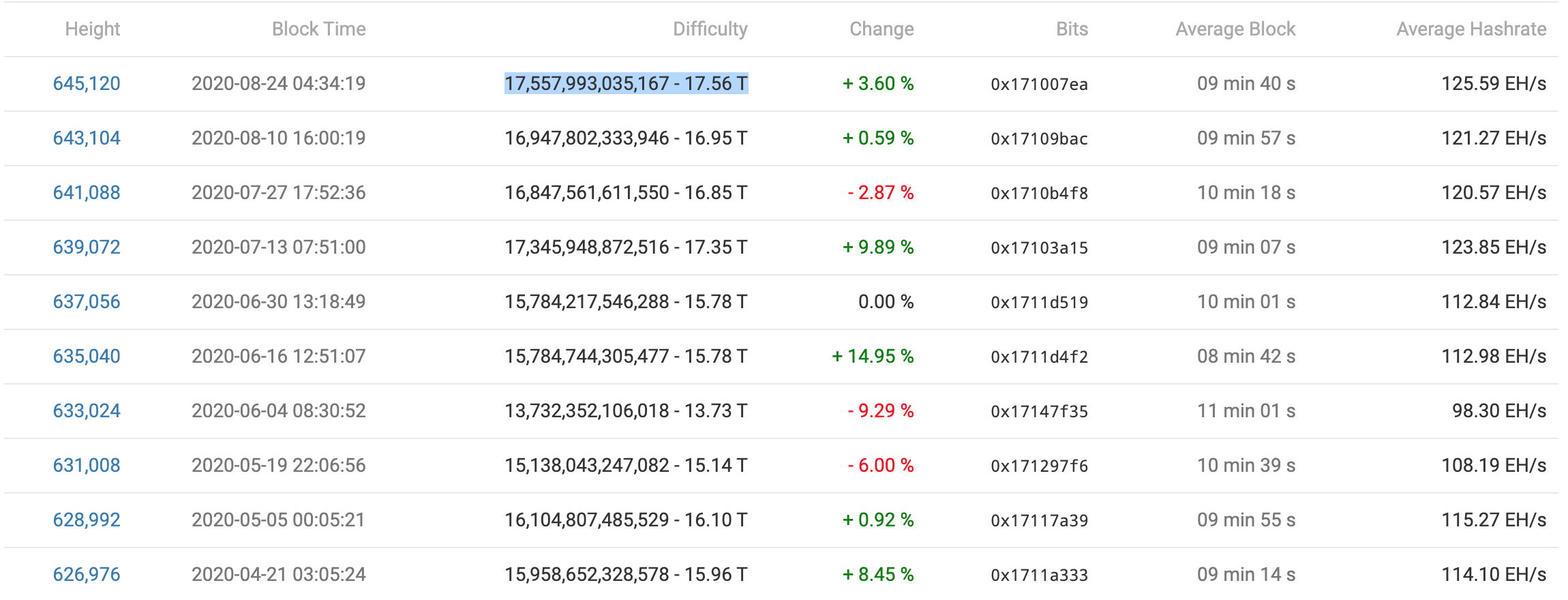

While we're on the subject of mining, it would be remiss of your Uncle Marty to not mention the fact that mining difficulty hit an all time high after the last difficulty adjustment on August 24th. The amount of computing power dedicated to mining bitcoin is at its all time high if you use difficulty to gauge that moving target. As of writing we are currently 842 blocks away from the next difficulty adjustment which is currently estimated to be a 2.0% downward adjustment on September 7th. We won't officially find out if we retreat from the difficulty all time high until block 647,136. Stay tuned to find out how much estimated hash has left or joined the network!

The Fed now owns almost a third of bonds backed by home loans in the U.S. https://t.co/GAFLyNxpZQ

— Lisa Abramowicz (@lisaabramowicz1) September 1, 2020

Shifting our focus to traditional markets, here is something that is totally reasonable, beneficial and indicative of a market that is totally not manipulated; the Fed now owns 30% of outstanding agency bonds and they plan to purchase MOAR. Nothing to see here, freaks. Capitalism is alive and well. The ability for non-manipulated price discovery has never seen better days. Our problems totally stem from lower and middle class racists and not a systemic fleecing of the lower and middle class by unelected academics who think they can micromanage a global economy. Move the fuck along and stop gawking at this headline, plz.

That was this week's Smorgasbord! We'll be back with another whenever we feel like it.

Final thought...

There has been a fly taunting me all day. I will have my revenge.