Let's take a look at some charts...

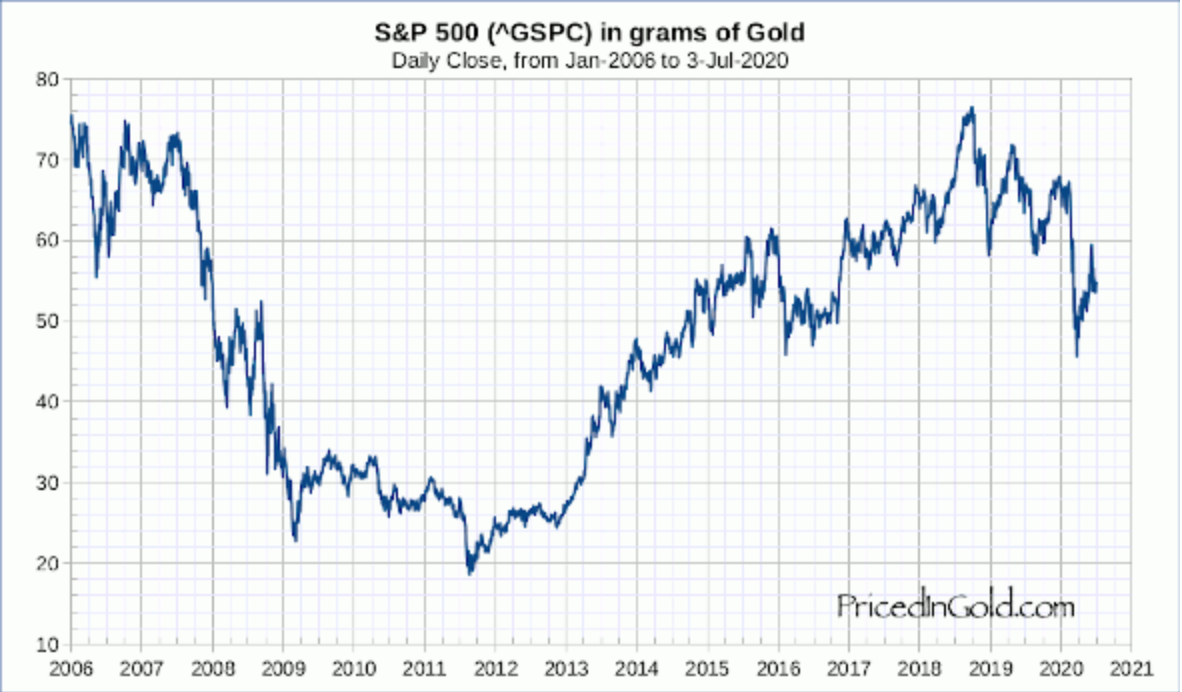

Here's a chart you freaks should be paying attention to if you want to track inflation without having to depend on the grossly manipulated CPI; the S&P 500 priced in grams of gold over time. As you can see from the second chart above, the S&P 500 seems to fairing extremely well since the beginning of 2006. The index is up nearly 150% is January 20th, 2006 when indexed to US Dollars. However, as you can see from the first chart, the S&P is down by more than 25% when priced in grams of gold over the same time frame.

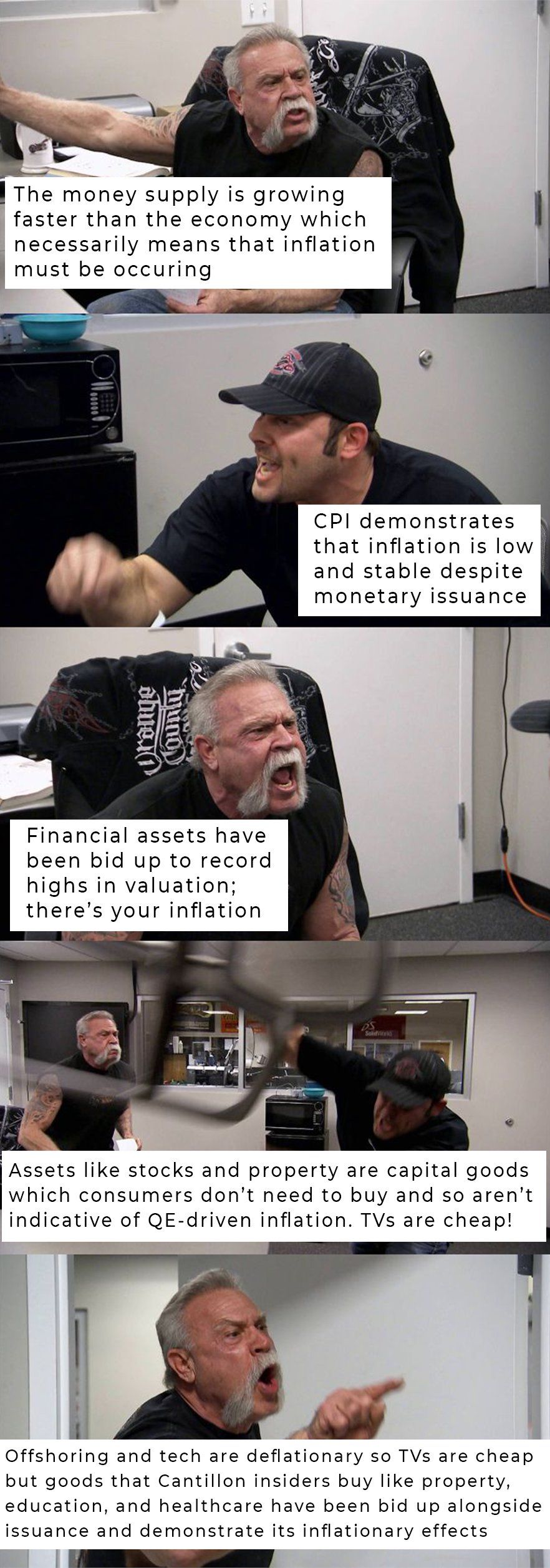

What seems like an insane rally to most is actually a decade and a half of subpar performance against a hard asset like gold. Inflation disguised as a face ripping stock market rally. Rampant inflation is here and it has been around for a while. Many finance and fed economists types will try to shoot down this fact by claiming that stock indices and other financial assets cannot and should not be included in any inflation measures because they are not goods that consumers need to buy. This is a cop out and borderline criminal misdirection because when these financial assets are bid up by individuals close to the creation of the Fed's monetary spigot they are able to leverage those gains to bid up other *essential* assets like homes, healthcare and education. Our boy Nic Carter has done a good job of distilling this injustice in a meme.

The global cabal of central bankers, the governments that take their inflation metrics seriously, and the complicit media jockeys who parrot these bunk metrics are doing the world a massive disservice. They will stare you straight in the soul and claim that inflation is subdued. They'll even go as far as to say inflation is not as high as it should be. These people should be publicly shamed because anyone with any common sense and an ability to look at some charts knows this is a blatant lie.

Deep down, the Common Man feels this injustice. The rent is too damn high. However, he has been unable to identify the entity responsible for forcing his rent higher; an unaccountable Federal Reserve system that has been robbing him blind for over a century. As the Fed turns its printers on blast, pouring trillions more into the system, you can expect this inflation to become more rampant. This is a sad reality of our current condition that most aren't aware of.

Fix the money, fix the world.

Final thought...

Hot July summer days; not the best for this Irish skin.