Do you understand bitcoin?

I don't know why we have to continue rehashing this conversation, and I'm not going to torture you with a screed on the subject. Bitcoin isn't priced in because most of the world doesn't understand bitcoin.

The market hasn't internalized the change in supply because the market, broadly speaking, still doesn't understand bitcoin. Almost at all. The market for bitcoin is not some static entity.

— Sean Lavery (@SeanPLavery) January 5, 2020

At 668 tonnes, net purchases of #gold by Central Banks in 2019 touched the highest level since the 1970s. pic.twitter.com/QNhCzXOaUC

— Strategic Wealth Preservation (@SWPGold) January 2, 2020

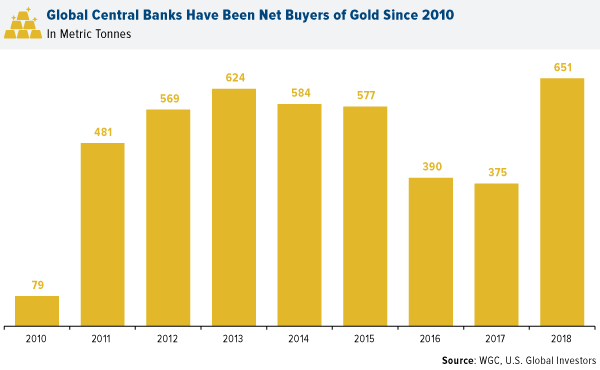

About nine months ago we covered the heavy accumulation of gold by China and Russia over the last two decades. Well, it seems that other central bankers from around the world have joined their dash to acquire the barbarous relic as 2019 net purchases of gold by central banks reached levels not seen since the 1970s. Here's what the trend has looked like since 2010:

A fascinating trend that coincides with the largest coordinated monetary expansion the world has ever seen. Why are these institutions hoarding an asset many deride as a useless tool of the past? Why do financial journalists and mainstream pundits belittle individuals as "preppers" when they make the personal decision to add gold to their balance sheets just as the central banks are?

And most importantly, why do these institutions feel the need to acquire gold at such a rapid pace?

Final thought...

Still need to make my bed.