Bitcoin mining difficulty dropped.

Seems like as good a day as ever to do a little check up on the state of Bitcoin mining. As you may be able to tell from the tweet above, the Bitcoin network experienced its largest downward difficulty adjustment (-7.1%) since last December.

Bitcoin mining difficulty dropped the most since Dec 2018 after the last adjustment on 8th Nov 2019 (-7%)

— Alistair Milne (@alistairmilne) November 11, 2019

... seems to confirm the cost of mining (on average) is ~$8000 https://t.co/vKiJgaxzZh

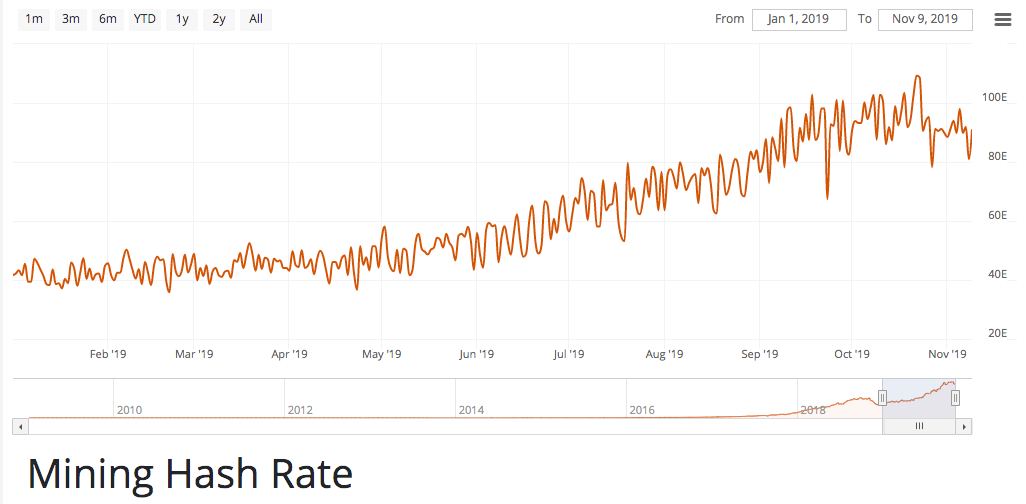

Word on the street is that Bitmain's S9s are at the end of their lifecycle and miners are shutting them off and selling them for pennies on the dollar as they become unprofitable. Who would buy these, you ask? Lucky bastards with free electricity somewhere on this planet who are able to plug them in and mine with no costs other than the initial investment in the miners at clearance prices. With that note in mind, let's take a look at network hash rate:

A cursory eyeball test shows that hash rate has plateaued a bit over the last month. Again, this may be a product of the S9s being phased out and upgraded for newer, more efficient hardware. Despite the recent mini-plateau, hash rate has more than doubled so far this year. With my node currently estimating 94.85 Eh/s. It will be interesting to see how the next difficulty adjustment goes. Are miners who have just received their new Whatsminers M20s going to expedite their operations to take advantage of the decrease in mining difficulty? Will we continue to lose hash rate as old miners are phased out? Right now, BTC.com is estimating a 5% downward adjustment. We'll know for sure in 1,486 blocks.

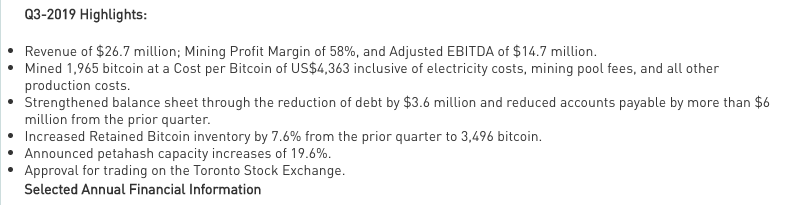

Regardless of what happens with the next adjustment, here's something from the mining world that I found particularly interesting; Hut 8's Q3 financial statements.

For those of you freaks who are unaware of Hut 8, it is a Canadian mining company that recently went public. They've been around for a while in Bitcoin-terms and seem to have really nailed down their operations. For a company with only about a dozen employees, $14.7M in EBITDA a quarter at a 58% mining profit margin ain't too shabby. Especially considering many people who invest in Bitcoin companies avoid investing in mining operations like the plague. Is Hut 8 proving the haters wrong? Or are they an anomaly that cannot be replicated?

Final thought...

Time to crack the knuckles and dive into some boring documents. Wish me luck.