Bitcoin is the Sistine Chapel

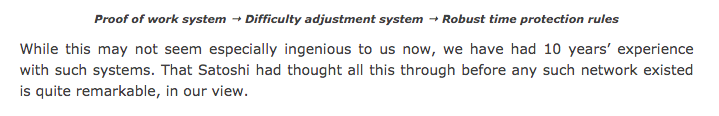

On the 11th anniversary of the emergence of Bitcoin as an idea on a cypherpunk mailing list I'd like to take a moment to bask in the brilliance of Satoshi's design. The screenshots above come from this incredible post published by the BitMEX Research team yesterday. They dive into the importance of timestamping within Bitcoin and the intricacies of the actual mechanism, which was designed in such a way that miners cannot manipulate the mechanism in an attempt to increase the speed at which they mine bitcoins.

On the 11th anniversary of the emergence of Bitcoin as an idea on a cypherpunk mailing list I'd like to take a moment to bask in the brilliance of Satoshi's design. The screenshots above come from this incredible post published by the BitMEX Research team yesterday. They dive into the importance of timestamping within Bitcoin and the intricacies of the actual mechanism, which was designed in such a way that miners cannot manipulate the mechanism in an attempt to increase the speed at which they mine bitcoins.

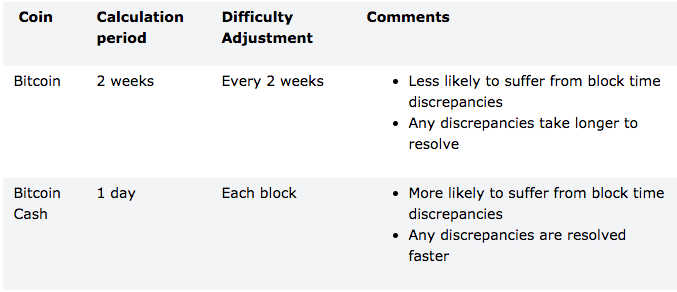

Since the Genesis block, the defensive design of the timestamping mechanism has proven formidable. Keeping miners at bay and the network churning, practically unabated, for more than a decade. What's more, due to the nature of SHA256 mining, Bitcoin Cash was forced to change their difficulty adjustment lest they sit back and watch their chain grind to a halt due to a vast majority of the SHA256 hash rate being pointed towards Bitcoin. The change they made to their difficulty adjustment threw the balance of the timestamping function out whack. Making their chain more likely to suffer from block time discrepancies. Even though their discrepancies can be solved faster than Bitcoin, the impact of a large block time discrepancy on Bitcoin Cash has much more of an impact.

The hastily constructed fix to Bitcoin Cash's difficulty adjustment has made it so the Bitcoin Cash chain is about 5,000 blocks ahead of the Bitcoin blockchain. Put another way, it is 5,000 closer to its next block reward halving, at which point the profits miners making mining the chain are cut in half unless the price doubles. It will be interesting to see what Bitcoin Cash miners do after its next halving. Presumably, Bitcoin, the more valuable chain, will still have 5,000 more blocks with 12.5BTC as the coinbase reward. Will they continue to mine Bitcoin Cash during this period after their block reward goes from ~$3,600 per block to ~$1,800 per block? Barring a crazy price rise, Bitcoin Cash may be in trouble after its next halving.

Very minute details like this highlight just how thorough Satoshi was from a design perspective. His code may not have been very good, but the system incentives he designed are as beautiful as the Sistine Chapel.

Final thought...

I'm terrible at Halloween.