A lot is going on in Europe

A theme we've been covering around these parts for the last few months is the deteriorating economic health of Europe. Things seem to be off kilter as the German 10-Year Bund continues to fall further into negative territory and as Deutsche Bank's stock continues its march towards zero dollars. The situation only seems to be getting worse by the day as more data hits the market.

Big, important thread alert:

— Raoul Pal (@RaoulGMI) July 7, 2019

There is a lot going on in Europe that feels like it's coming to a head soon... probably by the end of the summer. The EU economy is in mild recession... pic.twitter.com/OZPM6qfMKa

Luckily for us, Raoul Pal took to Twitter yesterday to layout a monster thread on the current state of Europe's financial affairs and the ominous likelihood of some turmoil on the horizon, especially for banks. Definitely take some time to check out Raoul's musings when you get the chance (if you haven't already). He illustrates a pretty scary reality in which the ECB has been backed into a corner and will be forced to cut rates and drum up the printing machines to reach inflation targets. All of this happening at a time when countries will be scrambling to acquire US Dollars to fund obligations, giving the Dollar relative strength and exacerbating the fickle situation in Europe.

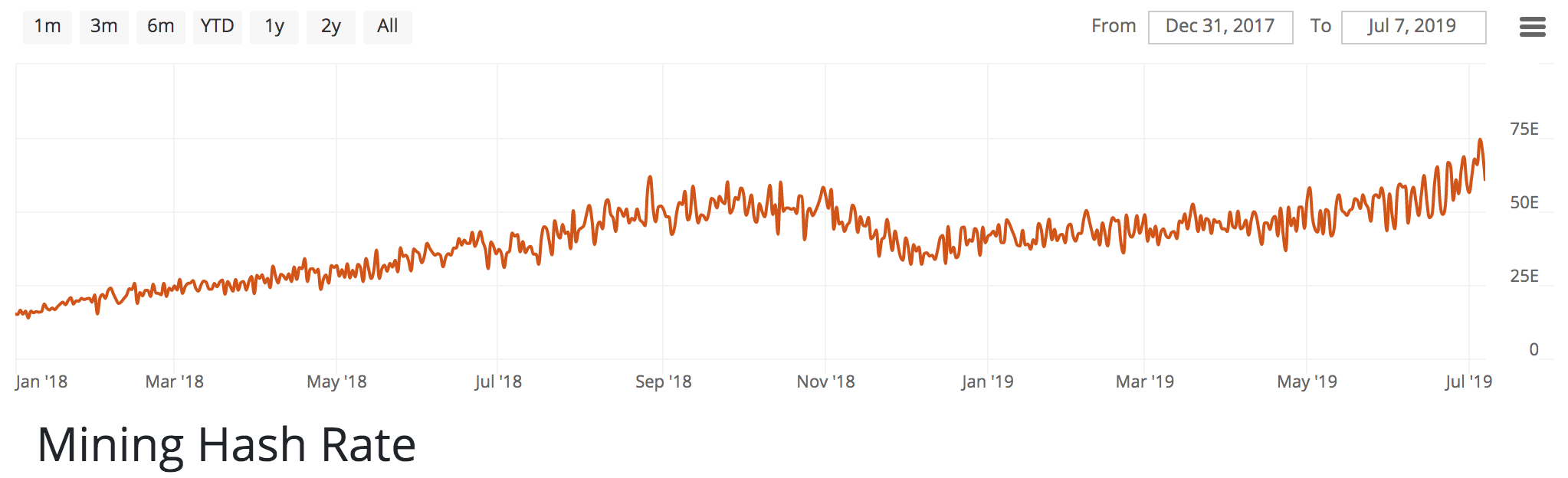

This is why we Bitcoin, freaks. To hedge ourselves against the folly of modern monetary experiments that seem to be going terribly awry. The world is in desperate need of a metric system for monetary value that cannot be manipulated by bureaucrats. Bitcoin provides this solution. It's just a matter of time before people's understanding of this need and the perfect solution that Bitcoin provides before Bitcoin's true value is accurately priced by the market. Will you be prepared when that great awakening comes?

It looks like some wily entrepreneurs are front running the awakening.

Final thought...

Paw patrol. Paw patrol.