An arms race of central banks around the world is on to devalue their currencies.

We'll end the week on some Macro Talk here at the Ƀent as it seems that every central bank around the world is ready to restart the race to see who can devalue their currency the most. As you can see, the US Federal Reserve seems primed to begin cutting rates and reigniting asset purchases in an attempt to "stoke economic growth" (lol).

And so it begins...

— Brendan Bernstein (@BMBernstein) June 20, 2019

An arms race of central banks around the world competing to devalue their currencies

Fiat will leak into scarce assets. And the scarcest asset in the world will disproportionately benefit.

It's like they're conspiring to pump BTC

Thank you for your service https://t.co/mcoo2pVGBE

Here is @neelkashkari epic flip-flopping in action:

— zerohedge (@zerohedge) June 21, 2019

May 31: "I’m not quite there yet" on need for rate cut.

(Since then Mexican trade war was resolved and financial conditions eased dramatically)

June 21: I advocated for a 50-basis-point rate cut"

On top of this, at the same time, we have Mario Draghi from the ECB coming out and signaling that he may need to cut rates further and that more asset purchases may be in order. These comments made our president very unhappy here in the US. So unhappy that The Donald went as far to say that the ECB is using interest rates and asset purchasing as an economic weapon. (Ughhhh, ya think?!)

The euro slides and German bond yields hit a fresh record low in reaction to ECB President Mario Draghi’s comments indicating a possibility of new rate cuts or asset purchases https://t.co/UTcsQQ4DPD pic.twitter.com/aMqNAJkT3V

— Reuters Top News (@Reuters) June 18, 2019

All of this is going on while negative-yielding debt is hitting all-time highs across the board.

As negative yielding bonds have reached to levels of $10 trillion, Japan has been the largest issuer of negative-yielding debt, while Switzerland has been the smallest. #negative #yield #Government #bonds #Japan

— Michael A. Gayed, CFA (@leadlagreport) June 21, 2019

Get award winning research weekly https://t.co/mYYdpZfJh5 pic.twitter.com/SEkrERJvW1

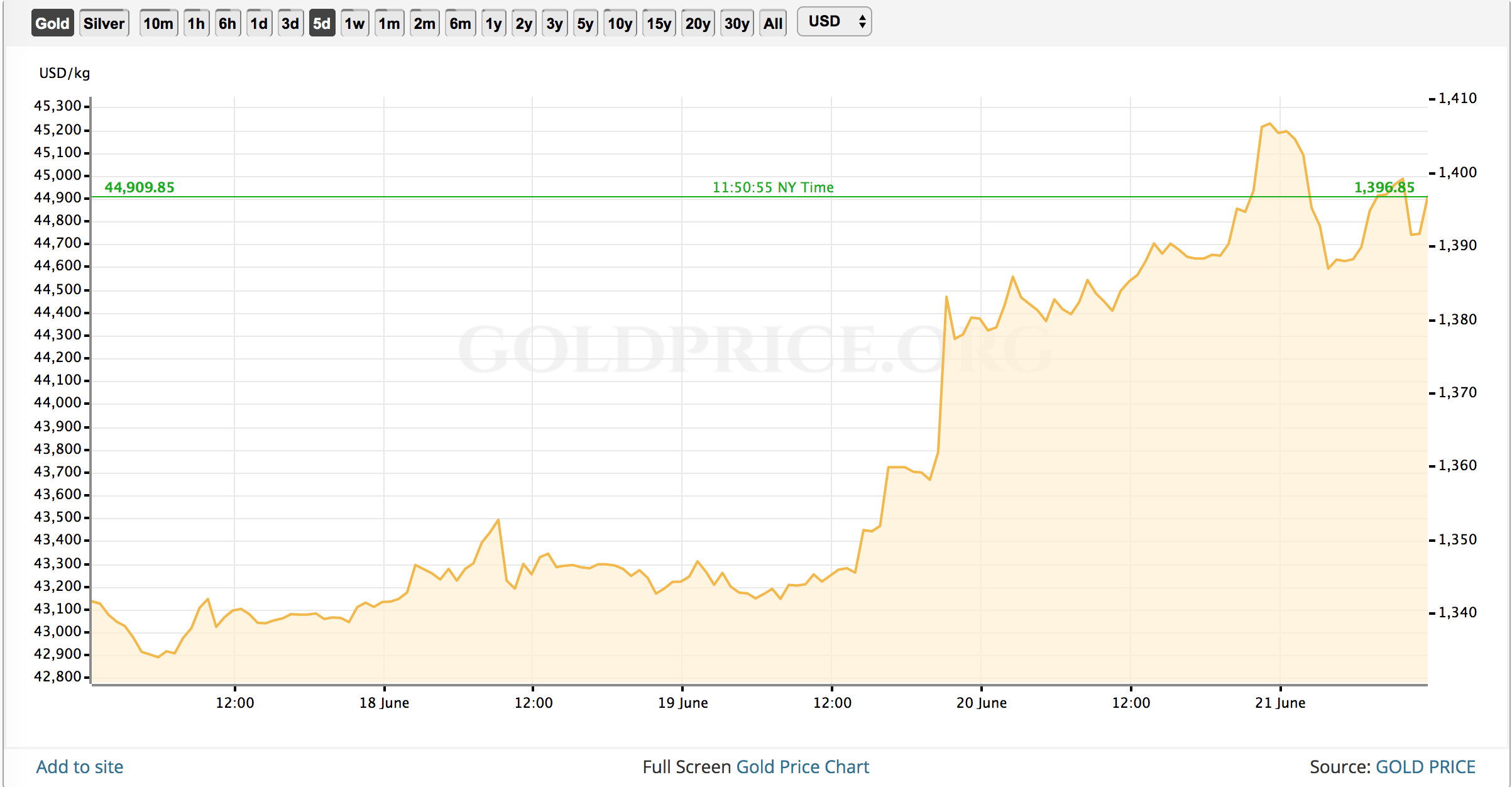

It's an absolute shit show out there, freaks. And through it all, it feels as if (at least to me) people are beginning to realize how absolutely asinine it is that our money is run in this fashion. As the dick flexing via interest rate manipulations and asset purchases begins to pick up in earnest, as our good friend Brendan points out, we should see flows into scarce assets like Bitcoin and Gold. In fact, we already are.

Stay vigilant out there. Uncle Marty thinks things are only just starting to heat up on the global stage.

Final thought...

How does San Francisco just stand by as their city turns into a zombie wasteland?

Enjoy your weekend, freaks.