The economy is in trouble

It seems as though we are at an all too familiar juncture here in America; the point at which we can no longer continue to raise the Fed Funds Rate nor sustain elevated levels lest we "put the economy in a precarious situation". The warning bells seem to be going off on the back of the raging trade war as certain Fed governors have come out posturing that rate cuts may be on the horizon. The question this time around is, how low can we go?

ST. LOUIS FED'S BULLARD: INTEREST RATE CUT MAY BE "WARRANTED SOON" ON TRADE, INFLATION RISKS

— Jennifer Ablan (@jennablan) June 3, 2019

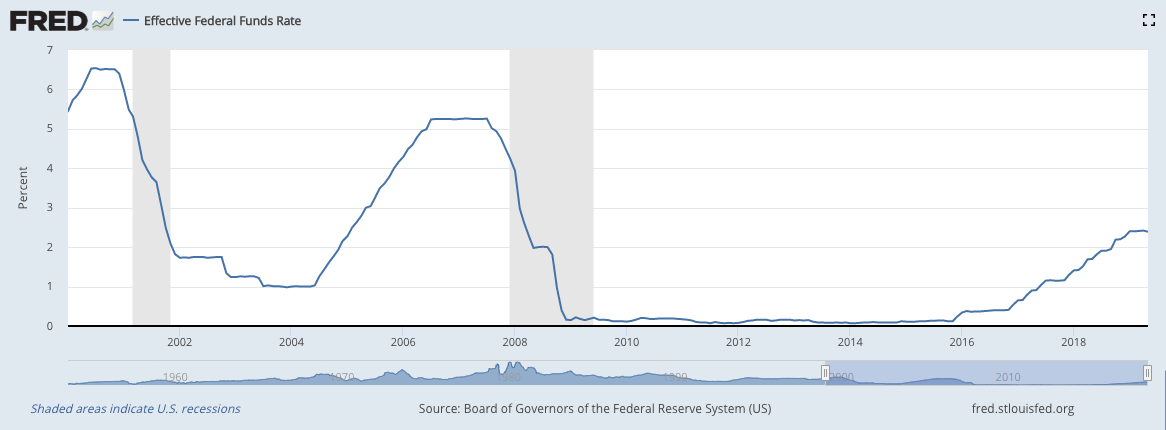

After keeping rates below 0.25% for seven years, we've slowly trended towards the ceiling we are currently brushing up against with the Fed Funds Rate peaking at 2.42%. I believe the lowest point that was reached during the last easing period was 0.07% (or 7bps for those who are uninitiated). Pretty hard to go much lower than that without breaking through the x-axis. Is NIRP coming to the Land of the Free quicker than most people expect? Maybe.

The chart above only captures the Fed's rate-setting history so far this century. If you go back two more decades to the 1980s, you will notice that the FFR has been making lower highs and lower lows on its drift towards 0.00% and below as the Fed becomes more and more helpless against the consequences of its monetary experiment.

To me, the writing on the wall seems to be pretty clear. With a completely depleted arsenal of tools and actions that can no longer be utilized, the Fed's hand will soon be forced to revert to Quantitative Easing and experimenting with negative rates.

The normalization campaign is already well under way.

The normalization of NIRP is in full force.

— Marty Bent (@MartyBent) March 7, 2019

Essentially an immediate tax on an individual's bank deposits to make up for the folly of modern monetary policy.

Keep your hard earned money safe from these incompetent kleptocrats. Buy Bitcoin. https://t.co/7UFnNkvWFX

Final thought...

Never been a big "lake guy". The ocean is a far superior mistress.