Russia & China are buying a lot of gold.

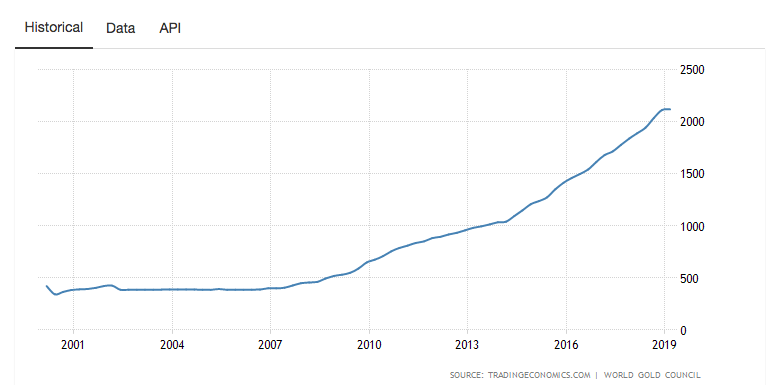

Yesterday, I was perusing my TweetDeck when I came across this tweet, which highlights the fact that Russia recently increased its total gold holdings to 2168 tonnes, continuing their decade-long accumulation phase. This stat piqued my interest so I decided to head over to TradingEconomics.com to peep some charts because charts tell interesting stories.

I was fascinated to find the two charts above in particular. The staircase-looking chart up top is China and the bottom chart is the aforementioned government of Russia. As we can see, it seems as if these two bedfellows have been in a heavy accumulation phase for the last couple of decades, with China increasing their stash by more than 4.5x and Russia more than 5x'ing their bag. This heavy accumulation begs the question, why?

Did they simply think their holdings were too small and wanted to get on par with the other superpowers of the world? Are they worried about a global currency crisis? Are they worried about their own economic houses and preparing for the worst? Preparing for potential sanctions?

Something seems to be afoot, and if I had to take a stab at guessing their intentions, it would be a combination of all of the above coupled with this.

Economists only found this NOW, after central banks bought $20 trillion in assets and pushed rates to negative? https://t.co/EjKhzq3mJH

— zerohedge (@zerohedge) April 22, 2019

A search for a hard asset in the midst of a central bank-fueled asset bubble the likes of which mankind has never witnessed. Do you think they're buying bitcoin too?

Final thought...

I think I'm officially a designer now.