The most poignant part of this thread is at the end when Yassine quotes Mircea Popescu, claiming that any country subjected to private central banking is not really sovereign and that Bitcoin, and Bitcoin alone is sovereign.

Another week, another flaming hot thread from our boy Yassine. It's as if he's unknowingly fighting for the throne of 🔥threads in the Ƀent with Brendan Berstein. This particular thread of Yassine's dives into the history of the formation of modern central banks and the Federal Reserve more specifically. We say it around these parts every once in a while, but it's important to know your history, freaks. Especially when it comes to the history of the institutions that unfairly control the world's money supply.

2/ "In order to understand the Federal Reserve, we must first understand its origins and context. We must deconstruct the puzzle."

— Yassine Elmandjra (@yassineARK) October 19, 2018

4/ It wasn't obvious how England was going to fund the rebuilding. King William III lacked credit and public funds were minimal.

— Yassine Elmandjra (@yassineARK) October 19, 2018

In comes Scottish Banker William Patterson with a proposal.

6/ Sure, it was named the Bank of England. But it was NOT a government entity. "It was a private bank owned by private shareholders for their private profit with a charter from the king that allowed them to print the public’s money out of thin air and lend it to the crown."

— Yassine Elmandjra (@yassineARK) October 19, 2018

8/ Fast forward nearly 100 years when in 1781, the U.S. came under severe financial distress. Desperate to find a way to finance the end stages of the war, Congress turned to Robert Morris, a wealthy shipping merchant.

— Yassine Elmandjra (@yassineARK) October 19, 2018

The first time the Federal Reserve's inception was explained to me, I was flabbergasted by how overtly corrupt and slimy the whole process was. The secret meeting on Jeykll Island, the late night vote around Christmas, and the abrupt nature of it all make it hard to see how we are able to continue to imbue legitimacy on this institution. Yassine does a great job of putting the Fed's inception in the context of centuries of central banking evolution.

The most poignant part of this thread is at the end when Yassine quotes Mircea Popescu, claiming that any country subjected to private central banking is not really sovereign and that Bitcoin, and Bitcoin alone is sovereign. Once you begin to get a firm grasp on the history of central banking and the fuckery that has ensued since their inception, it becomes abundantly clear that Bitcoin is a truly unique beast that is the complete opposite of this system and is undeniably fairer.

Make sure you go peep Yassine's thread and click through the links if you're interested in diving into this subject. You freaks are only seeing the first quarter of the thread above.

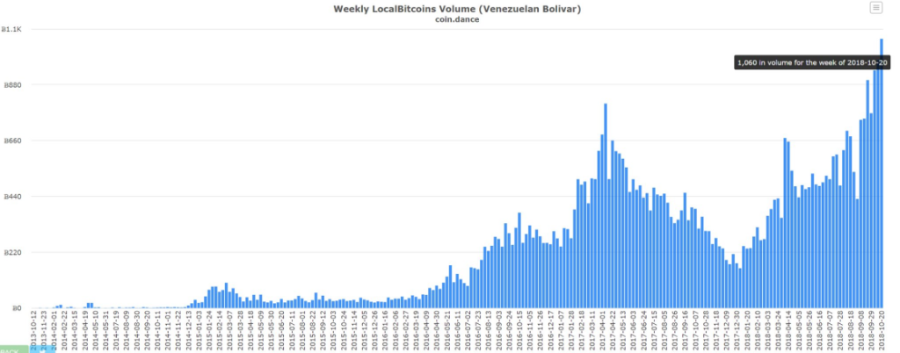

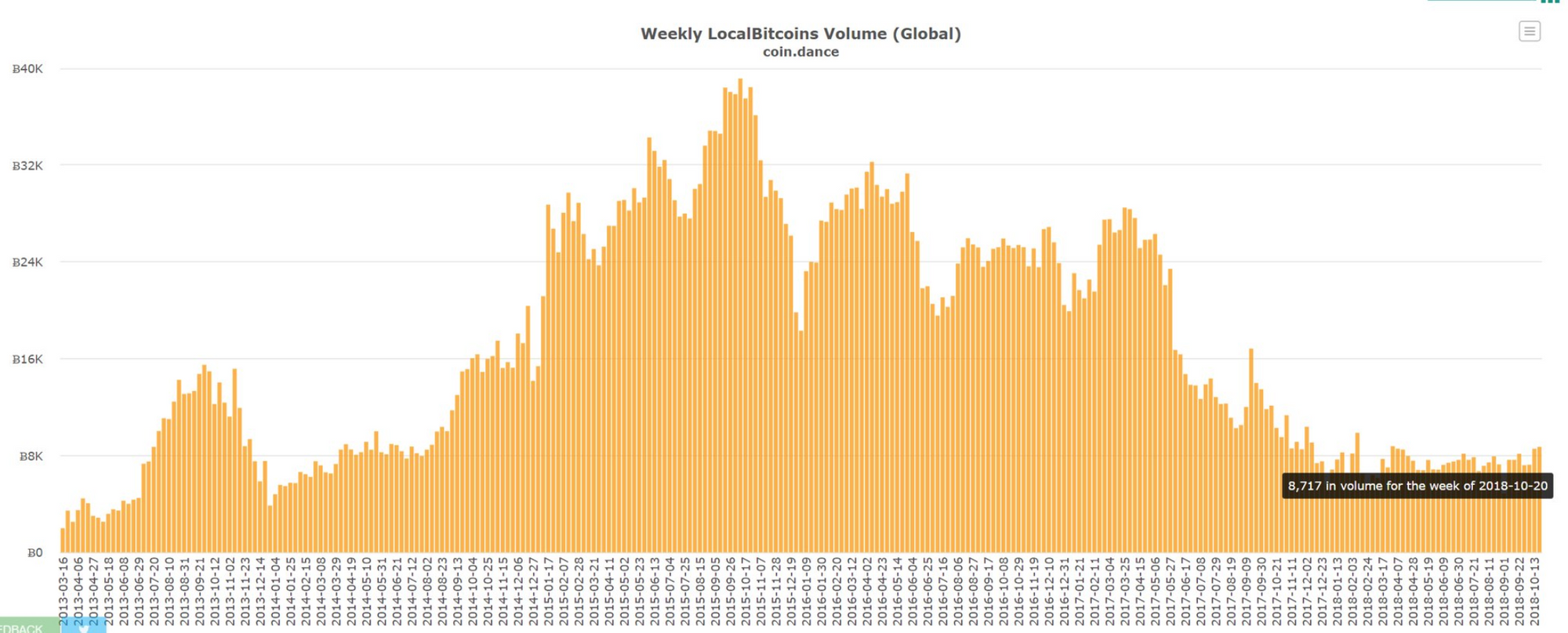

VZ LBC vol was accounted for 12% of all LBC vol worldwide last week - more than USA pic.twitter.com/vdkwiCmr2O

— Original Tweeter (@CarpeNoctom) October 24, 2018

Before you get your panties in the bunch; yes, I know the first chart says "Venezuelan Bolivar", but it's a mistake and the volumes are in BTC.

This is the most interesting developing story in Bitcoin IMO. For a while now, I've been saying that Bitcoin's path to mass adoption may be led by countries with extremely poor currencies + economies. It looks as if Bitcoin is definitely catching on in Venezuela. As always, we here at the Ƀent will keep you posted as things continue to develop.

Final thought...

Is Fila still a brand?