This is an incredible competitive advantage for Bitcoin in the long-run.

Here's another great read from our boy NikBhatia that I recommend you freaks check out before checking out for the weekend on this mid-July day. It's a great follow up to his first article, The Time Value of Bitcoin. In it, Nik compares Bitcoin's potential risk spectrum with traditional finance's risk spectrum.

Traditionally, USD holders invest in a risk spectrum that ranges from US-Treasury Bonds (conservative, low-risk) to Venture Capital (aggressive, high-risk), with each investment class having a different interest rate associated with it depending on where it falls on the risk-spectrum. The higher the asset class falls on the risk-spectrum, the higher the interest rate is as the risk premium increases from point to point on the spectrum.

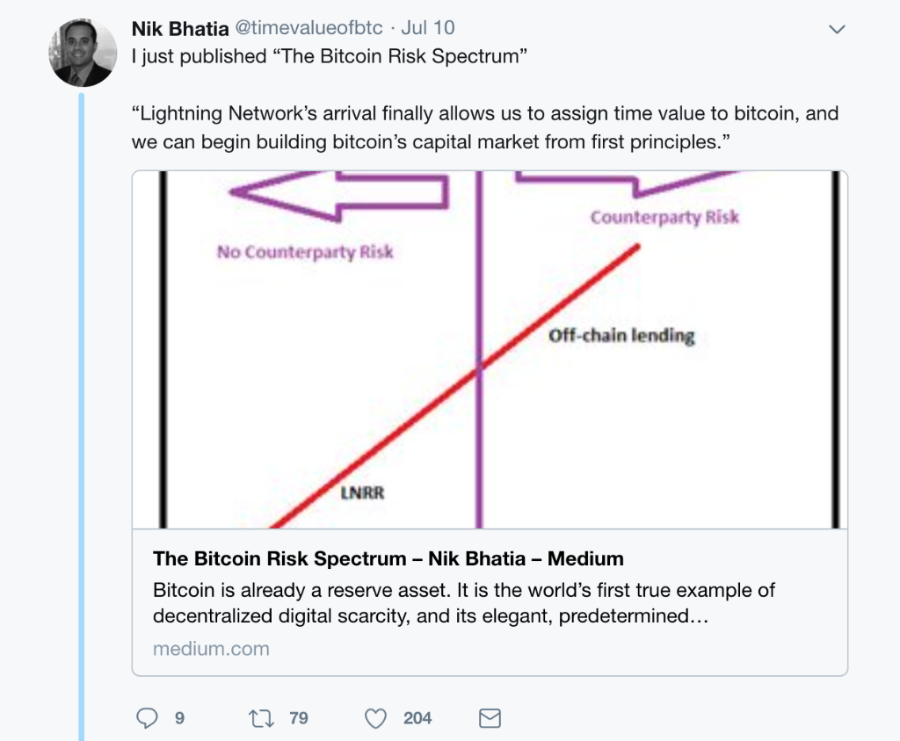

Currently, there is an emerging risk spectrum on Bitcoin that ranges from Bitcoin in cold storage (low risk, no interest) to the off-chain lending of Bitcoin (higher-risk, high interest). This risk spectrum is in no way mature at the moment, but it is important to start having these conversations so we know what to look for when these markets do begin to mature and gain legitimacy. Hence, why Nik is writing these articles.

What's most interesting about Bitcoin's risk spectrum is that it splits at a certain point when users move their coins from personal custody to 3rd party custody. Bitcoiners have a luxury that people using the USD don't in that they can participate in these revenue creating activities (staking BTC on Lightning to gain interest via channel fees) while having full custody of their assets with relative ease. This is an incredible competitive advantage for Bitcoin in the long-run.

Final thought...

Sup, Texas?