The decision you make today will severely impact how many sats you have years down the line. Choose wisely.

BREAKING: There it is, @Grayscale wins their lawsuit against the SEC. DC Circuit court of appeals is vacating SEC's denial of $GBTC's conversion into an ETF. pic.twitter.com/gqFvMpmfnm

— James Seyffart (@JSeyff) August 29, 2023

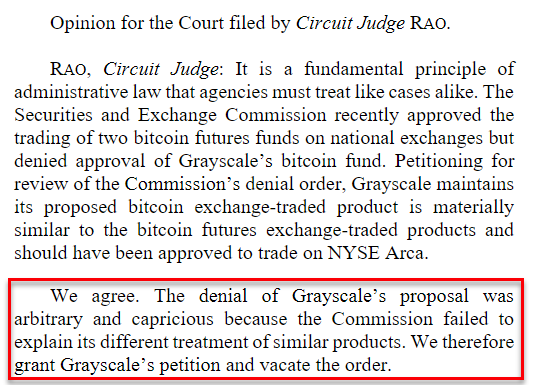

Woooo doggie. The long drawn out battle between the SEC and anyone who has ever attempted to launch a spot bitcoin ETF seems to have hit a crescendo this morning when an appeals court ruled in favor of Grayscale Investments, which has been trying to convert their GBTC product to an ETF for years. Here's the most important line from the judge's ruling:

In the judge's mind, the SEC has been arbitrarily denying spot bitcoin ETFs, and more specifically Grayscales, using double standards that don't map to the process they've used in the past to green light similar products. This is a big blow to the SEC's credibility and increases the liklihood that a spot ETF will be approved in the near term. However, it should be made clear that this does not mean that an ETF has been immediately approved. The SEC must take this ruling and react appropriately, which likely means that they will stick their tail between their legs and begrudgingly approve the ETFs from this point forward unless they come up with some other excuse that hasn't been used up to this point.

This is certainly bullish for the price of bitcoin. There is a ton of money sitting on the sidelines that has been waiting for a product like this to launch so that it can pour into bitcoin via a familiar investment vehicle. However, the point of this letter isn't to pump you all full of moon juice. It's to serve as a warning about limiting your bitcoin exposure via an ETF.

If you truly believe that bitcoin's only usecase is a gold-like store of value that will be used as an inert savings vehicle to protect and grow purchasing power over time then, yes, a spot bitcoin ETF may be the product for you. With that being said, I strongly believe that this is very myopic view when it comes to bitcoin and its potential role in our economy moving forward. It is so much more than digital gold and if your only exposure to bitcoin is via an ETF product you are either going to miss out on the utility the network provides or realize that utility after paying a significant cost.

To understand this better it is important to break bitcoin into two parts; the scarce asset and the distributed network being built out in layers. The fact that there will only ever be 21,000,000 bitcoin is the most important aspect of the network. Being able to opt-in to a monetary system with a strict supply cap is revolutionary. However, the things you can do with that scarce monetary good by leveraging the layered distributed network that it runs on is where things get truly interesting. Permissionless cross-border payments, final settlement within an hour (on-chain) or instantaneously (over the lightning network), micropayments, and automated spending when certain conditions are met are but a few of the benefits one gets from leveraging bitcoin directly.

You will not be able to leverage any of that utility if you get indirect exposure to bitcoin via an ETF. You will own shares in a heavily regulated financial product that will make it extremely hard for you to take possession of your bitcoin when you finally realize that you should. The only way you'll be able to get direct, meaningful exposure is to sell your ETF shares, pay the taxman, and then buy bitcoin back via a broker that allows you to take self-custody with ease.

You may not realize it now, but you will want to use bitcoin beyond a dumb savings vehicle at some point in the future. Yes, as bitcoin continues to monetize it probably makes more sense to treat it as a savings vehicle and keep it locked up off the market. However, it is becoming undeniable that the layered stack being built on top of the protocol level is enabling economic interactions that have never been possible before. If you think there is a chance that you would want to partake in those types of economic transactions in the future it is imperative that you get exposure to bitcoin in the correct way right now. A way that will enable you to take possession of your bitcoin without taking on a massive tax bill. Getting exposure via an ETF does not enable you to do this. This is something to think about if you're one of the individuals who has been on the sidelines waiting to get in. You may be familiar with ETFs, but they are extremely restrictive and your future self will wish you took the time to become more familiar with the utility the bitcoin network provides beyond access to a scarce digital money. The decision you make today will severely impact how many sats you have years down the line. Choose wisely.

Final thought...

A cloudy day trip to the amusement park is in order.