Something to keep an eye on.

boom. https://t.co/kGkkJxhX4w pic.twitter.com/i3O8mr35Hd

— Dylan LeClair 🟠 (@DylanLeClair_) August 17, 2023

Is everyone okay out there? There's nothing like a 10% bitcoin price plunge in 10-minutes to get the juices flowing. As our friend Dylan predicted, the Summer of stagnant price movement has finally been met with some volatility. The implied volatility of bitcoin was at historic lows and it was only a matter of time before something broke up or down. This quiet period ended up with a pretty epic dump to $26,000, which has people wondering, "What caused the dip?"

I'm not going to pretend to understand what the exact trigger of this decline in price was. However, I am curious to see and will be observing whether or not the thesis that bitcoin is the only free market alarm system out there right now rings true. Many consider bitcoin to be an alarm system because of the fact that it is very liquid and trades internationally 24/7/365. For those unaware of the theory, there are many who believe that volatility to the downside in bitcoin is a canary in the coal mine for volatility to come in other markets. People who are allocated to both bitcoin and traditional financial assets come to find that there is likely to be immense stress on the traditional side of their portfolio (usually debt instruments) and they quickly liquidate bitcoin into cash in preparation to service liabilities and margin requirements elsewhere.

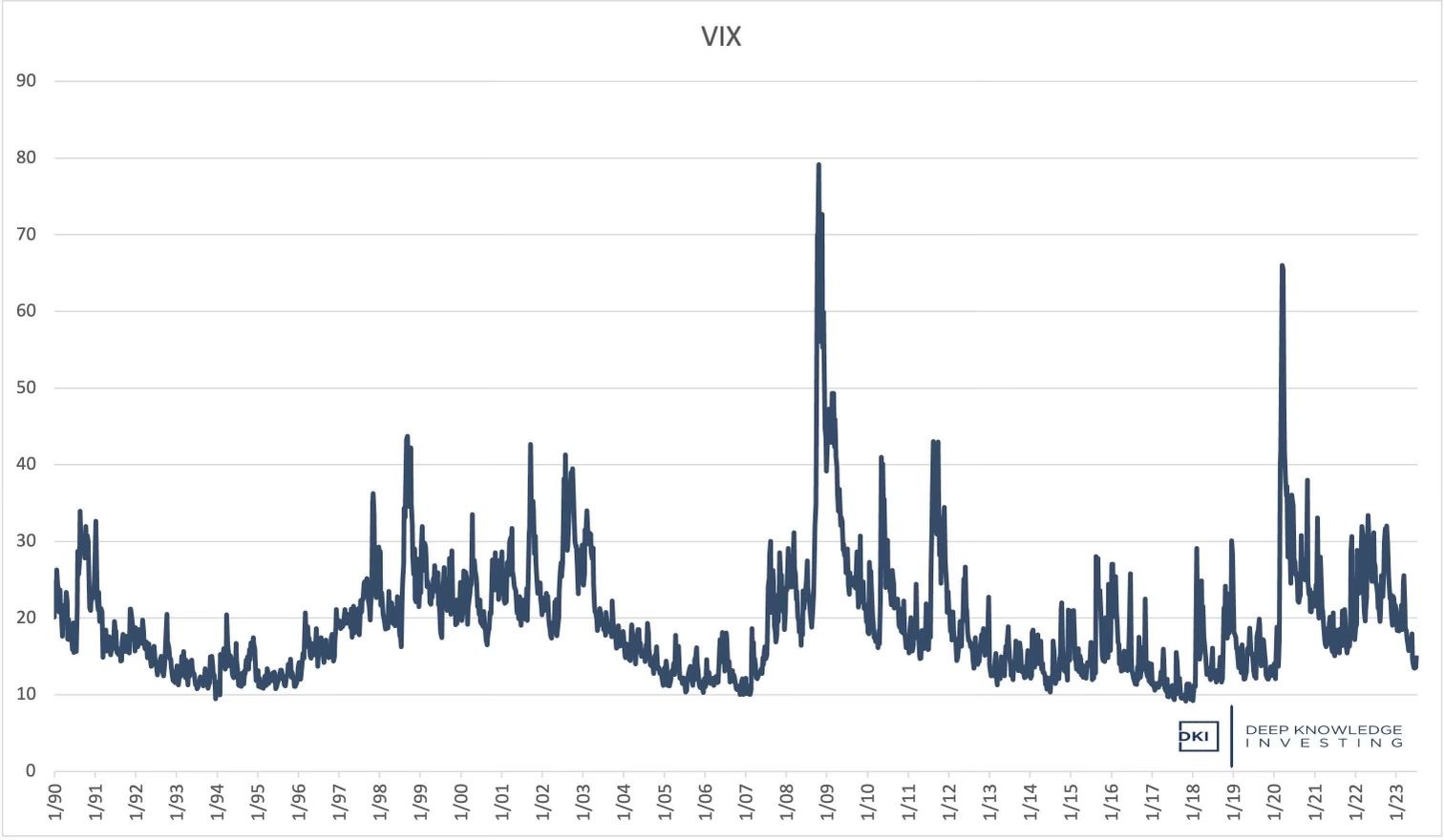

The chart above shows the bitcoin volatility index. For reference, let's take a look at the VIX, which measures forward looking volatility for the S&P 500.

Things are pretty quiet on the VIX front at the moment. And when you consider the headlines of the last few weeks...

WeWork bonds yield almost 90%

— Joe Consorti ⚡ (@JoeConsorti) August 8, 2023

When they mature in 2025, WeWork will have to borrow again... at 90% — or, sell its assets to make ends meet.

Does that sound like a 'soft landing' for US office space? pic.twitter.com/ybvc7Ei0wV

Evergrande, one of China’s real estate giants, just filed Chapter 15 bankruptcy.

— The Kobeissi Letter (@KobeissiLetter) August 18, 2023

Meanwhile, China’s HY real estate index is down a massive 82% in just over 2 years.

This puts the index back down to 2008-levels.

All while China just “unexpectedly” cut interest rates.

Is China… pic.twitter.com/p3yuIqPmxL

100 year old Yellow trucking goes bust pic.twitter.com/1NbQKdBfGA

— Peter St Onge, Ph.D. (@profstonge) August 8, 2023

🇯🇵 An horrible 20-year JGB auction today tailed the most since 1987, showing that investors require a higher yield to buy JGBs.

— Althea Spinozzi (@Altheaspinozzi) August 17, 2023

Rising JGB yields threaten bonds worldwide, so we see EU and US sovereign yields accelerating their rise this morning.@saxobank @SaxoUK pic.twitter.com/He6NOo6IFr

... it isn't hard to imagine that we may be on the cusp of a massive credit event that sends the VIX soaring like the BVIV did yesterday.

Something to keep an eye on.

Final thought...

Cracked the iPad screen just in time to get my laptop back. Nice.

Enjoy your weekend, freaks.