On June 20th, the Bank of International Settlements released it's blueprint for the future monetary system. I read the 25-page breakdown so you don't have to.

On June 20th, the Bank of International Settlements released it's blueprint for the future monetary system. I read the 25-page breakdown so you don't have to. Though, you probably should read it so that you know your enemy and what they're planning.

Overall, the report isn't really that surprising. It's filled with all of the hubris, assumptions, and Orwellian overreach one would expect to come out of a report written by the BIS. With that said, it is funny to see how they're thinking and where they have blind spots. If I were to summarize the blueprint in a single sentence it would be, "The BIS seems to want an Ethereum-like 'platform' complete with interoperability and robust smart contracting capabilities that will allow them to granularly control the global monetary system."

Here are the sections that stood out to me accompanied with some commentary.

The BIS is OBSESSED with the concept of tokenisation. They seem to think it is the Holy Grail of technological innovation that will enable the global monetary system to make the upgrade it needs as we transition further into the digital age. As I got further through the report it became clear to me that the BIS is completely missing the mark. Whether that's due to incompetence or misdirection is yet to be seen. I do think these people actually think they are productive members of society who provide value to the world in the form of acting as the Nanny of the global monetary system, so I would imagine their misunderstandings of tokenisation stem from pure incompetence.

In short, they believe that the blow ups in the crypto market over the last couple of years signal that it is doomed to fail because of a coordination problem that arises from the fractured nature of crypto networks, their liquidity profiles, and the fact that they're run by egregious scammers. While this is all true, they believe the solution to this problem is a CBDC because it can provide the network effect and liquidity profile they deem as necessary to have a successful digital currency. They completely miss that crypto doesn't work because of the fact that it is a cottage industry of affinity scams trying to replicate bitcoin's success.

Ha! This snippet can be found on page two of the blueprint and it renders anything written after it completely irrelevant because it proves that the BIS is operating under the assumption that central banks are trustworthy institutions and that they alone can provide the market with a functioning monetary system. Again, this report is filled with the hubris one would expect from the BIS. They completely gloss over the fact that bitcoin was created in response to the inability of central banks to be trusted with the stewardship of monetary systems.

"Crypto is obviously a shit show. We're here to clean it up and provide you with the solution that leverages the same faulty technological assumptions that industry is built on." Interestingly enough, the BIS doesn't mention bitcoin once in this blueprint. More on that later.

The phrase "unit of account" came up a lot throughout this blueprint, and I believe we will start to hear those pushing the CBDCs using it a lot more moving forward as a form of propaganda to make people believe that a unit of account can only be issued by an interconnected central banking apparatus. Keep an ear out for this in the coming years as the push for CBDCs heats up.

Unsurprisingly, the CBDC will only work if it's via avenues that have "proper oversight and supervision" and operate within the "standards" set forth by the central banks. This is consultant speak for, "If we don't like what you try to do with our CBDC you will not be allowed to use it." This is where I remind you freaks that the criminals running the international central banking system should have no control over who can do what with their money. Money is a tool that should be agnostic to the user or use case. Any form of enforcement of crimes should be driven by processes that are external to the functions of money.

Again with the unit of account appeal to authority. They're going to try to claim that a digital currency can only work if its tethered to a currency that is currently an accepted unit of account in the eyes of the BIS.

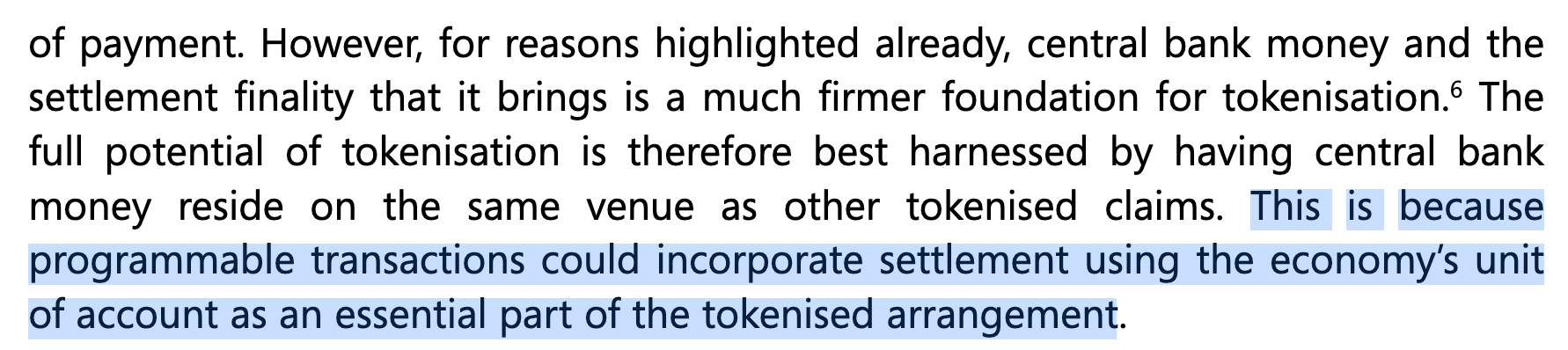

It seems that the BIS has already been running trial projects of CBDC experiments in paralell with a number of central banks who are participating in the "BIS Innovation Hub" program. I found the list of central banks participating in these trials interesting because of who is not listed. It doesn't seem like the ECB or Federal Reserve have participated in any of these projects. At least not publicly.

Here they admit that crypto has been successful in allowing people to evade onerous and anti-human KYC/AML laws that put people in harms way. In the CBDC world they envision this won't be possible because the system will somehow be leveraging the existing regulatory and supervisory frameworks that financial institutions already have in place.

I found these two paragraphs particularly telling. If you squint hard enough and hold your breath you can hear the BIS make a soft admission that the incumbent system is doomed to fail and they need a complete overhaul the maintain control. They cleverly hide this admission behind the idea that anchoring their CBDC in the legacy system architecture is likely unfeasible. The short-term costs and disruptions caused by coordinating the transition will be worth it in the long run. They want to cut bait and start fresh.

This is where they tell you that you will be locked into socialized losses if your bank mismanages its balance sheet and people decide they want to take their money elsewhere. "It's not even worth thinking about taking all of your money out of the bank because we'll retroactively claw back your money using state of the art smart contracts if others make the same decision and the bank goes under as a result."

Another nod to their intent to ensure the CBDC is fully KYC'd and that every transaction comes accompanied with personally identifying information of the parties involved. Don't worry though, the Aurora project in the innovation hub is exploring how privacy-enhancing technologies and advanced analytics might be leveraged to combat money laundering across financial institutions. Are they also exploring how to prevent insiders from creating white-listed accounts that can "launder" money with impunity in the way Deutsche Bank and JP Morgan did for Jeffrey Epstein? Who watches the watchmen?

You had to know a BIS blueprint for a CBDC would include environmental virtue singaling via "green investment". In the utopian CBDC future, when your government decides to throw hundreds of millions of dollars at the next Solyndra you'll be able to invest directly and watch as your investment evaporates from the comfort of your CBDC investment app!

Don't worry, pleb. The CBDC will be properly governed by central banks and private participants who will collaborate to ensure the integrity of the system. Don't worry about making a pull request with a suggested change to the system, this small group of kleptocrats is going to handle all of that for you. Just sit back and relax in your pod, throw on your VR goggles and dip that hand into your bucket of fried crickets.

This is the section that includes the veiled threat to countries who aren't comfortable with all of this, yet want the ability to receive cross border payments. There will be "significant harmonisation efforts across jurisdictions". Put another way, "If you don't play ball, your economy will be cut off from this system. I hope you don't plan on sourcing raw materials from one of the member countries!"

Tell me you don't understand how digital data storage works without telling me you don't understand how it works. Apparently the BIS is promising a CBDC that will have the ability to delete personally identifiable data within a smart contract. Someone always has access to the data at the end of the day. This line is very contradictory with the rest of the blueprint, which promises a hyper regulated platform wrought with KYC data that must be shared between participants to facilitate transactions.

Say it with me now freaks, "Cyber. Resilience." The money, banking and finance industry that has brought you data breech after data breech is finally going to make an "appropriate level of investment in cyber resilience and security" to ensure that those pesky hackers can't attack their CBDC platform.

Here's the final section I took a screenshot of and would like to end this note on while allowing myself to address the elephant in the room; there is not a single mention of bitcoin in this blueprint. The BIS has taken a look at the crypto "industry" at large, bucketed everything into the same broad brush category, and come to the conclusion that it is the only institution that can coordinate the technological and financial transition necessary to usher us into the era of digital currency. The era of the Central Bank Digital Currency. Even though I said earlier that the effort being put forth by the BIS to make CBDCs a thing is mainly driven by hubris and incompetence, it is very interesting that bitcoin wasn't mentioned by name and that it has seemingly been lumped in with the rest of crypto.

They either don't think it's a threat, don't understand the difference between bitcoin and crypto, or are intentionally not mentioning it because they recognize it is a massive threat to their existence. The only threat to their existence as it stands today because the bitcoin network achieves everything the BIS is claiming it can solely achieve in the highlighted sentence above.

Within the bitcoin network there is a singleness of money that attains payment finality roughly every ten minutes at the base layer. It is an open source software project that anyone can contribute to, plug into, build layers upon, and verify without asking for permission. It brings sound money back to a world that has gone mad with money printing. It ensures that the money of the world cannot be controlled by a select few men and women in positions of power who are prone to engage in corruption and criminality with impunity. It is an emergent system that anyone can opt into. It is the stick that is being thrust through the spokes of their wheel as they're going 100 miles per hour toward their dystopian destination.

Luckily for us, after reading the blueprint I do not think their CBDC will be successful in the long run. There is too much complexity and they are willingly walking into a prototypical second-system effect where they try to re-architect a whole new system from scratch. They may fool some people into using their system at first, but I do not believe they will be able to pull off what they have laid out in their blueprint. They will certainly try and they will certainly paper over defects in their system by conjuring new monetary units out of thin air, but at the end of the day bitcoin will only be getting stronger in parallel. And when you juxtapose bitcoin with the blueprint for the CBDC it is destined to win because the human spirit always prevails and there is nothing human about the system the BIS wants to erect.

Final thought...

Didn't plan on staying up late to write a 2,000 word synopsis of a BIS paper, but here we are.