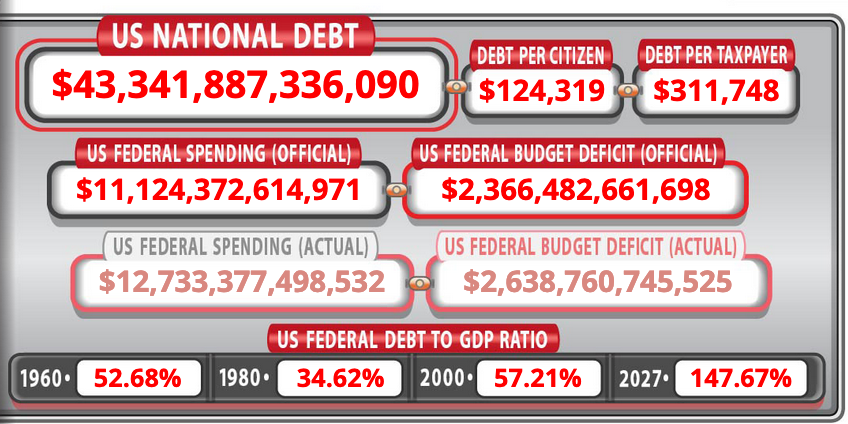

At this rate, the national debt will reach $43.34T by the year 2027 and the debt to GDP ratio will be around 150%.

US National Debt has now increased by over $1 trillion since the debt ceiling was suspended last month. pic.twitter.com/EFqcnwcj9k

— Charlie Bilello (@charliebilello) July 7, 2023

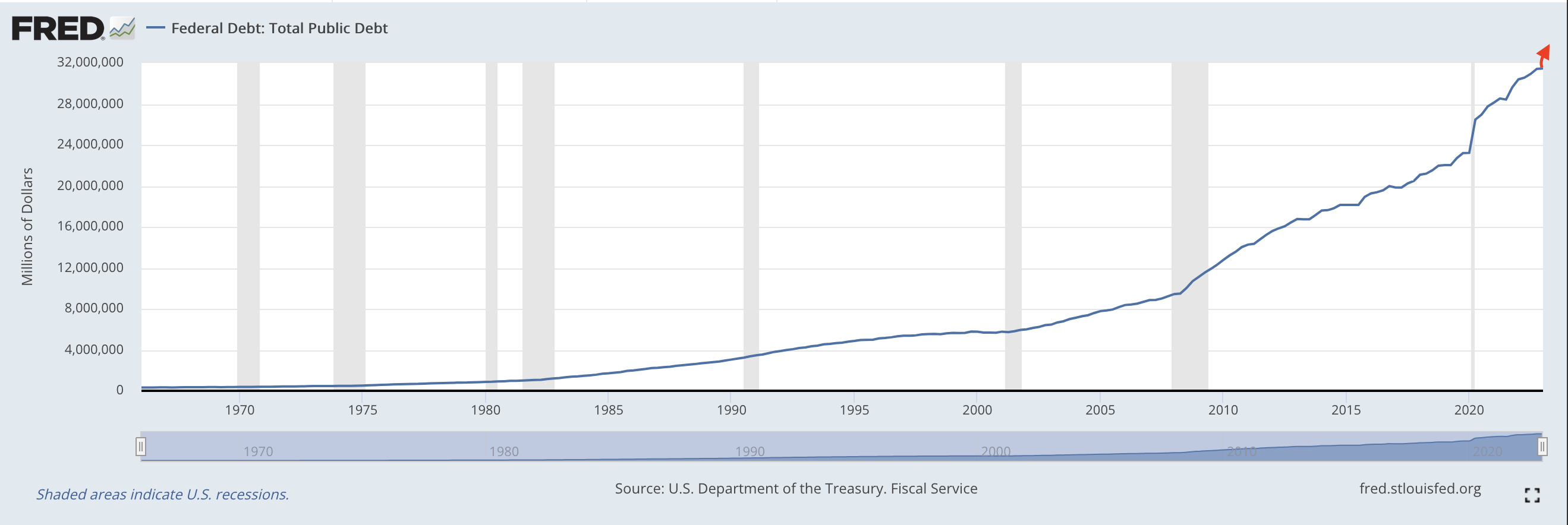

It took just 34 days for another $1 TRILLION to get added to the national debt after the debt ceiling was suspended in early June. Rising from $31.46T to $32.47T, or 3.2%. Mind you, the debt ceiling deal that was reached last month completely removed the cap on the debt the federal government is allowed to rack up on behalf of the American people until January of 2025. It seems that the removal of the cap has emboldened our wasteful government to double down on their spending. When there is no cap to worry about it is much easier for the government to not even pretend like they're trying to be frugal by weighing opportunity costs and allocating accordingly. Everything that needs funding will get funding... through more debt.

At this rate, the national debt will reach $43.34T by the year 2027 and the debt to GDP ratio will be around 150%.

One has to wonder if this estimate is even accurate. The US Debt Clock organization is using current growth rates to arrive at this number. It isn't hard to imagine that this number could increase dramatically as the estimate is only factoring in one month of 3.2% growth. If the government keeps up the $1T per month pace they just set we could hit $43T by this time next year. And with a recession looming, US workforce disability claims hitting astronomical levels, a labor shortage becoming more pronounced, the war drums beating louder and louder, a commercial real estate market on the ropes, and the interest payments on the debt we've already accrued approaching $1T (among other things) it isn't hard to see the need for increased government intervention (debt issuance) in an attempt to stem the cracks in the dam.

It feels like we've crossed over an event horizon of run away debt creation and very few people realize how quickly things can escalate.

The compounding effects of the promises made by an empire that has overextended itself both home and abroad are clearly becoming insurmountable. The blow back that is going to ensue when the broader populace awakens to the reality of the situation is going to be unlike anything we've seen in history and people are going to demand a response.

Unfortunately, most people are likely going to look to the government that got us into this mess in the first place. It's important to realize that we're dealing with a uni-party government disguised as a system of two parties that compete with each other. Jumping from the blue team to the red team will do nothing to solve any of the systemic problems that have allowed our debt situation to become untenable. Each party has been at the helm every time the can has been kicked down the road.

The way out of this is for a critical mass of individuals to take agency over their own lives, stop depending on the government and/or central bank to bail them out, and begin taking back control of the money via bitcoin. There is no voting your way out of this problem via the incumbent political apparatus. You must vote f0r a separation of money and state with bitcoin.

Final thought...

Island life is the best kind of life.