Everywhere one looks things look absolutely terrible for the US financial system. This feels like the endgame.

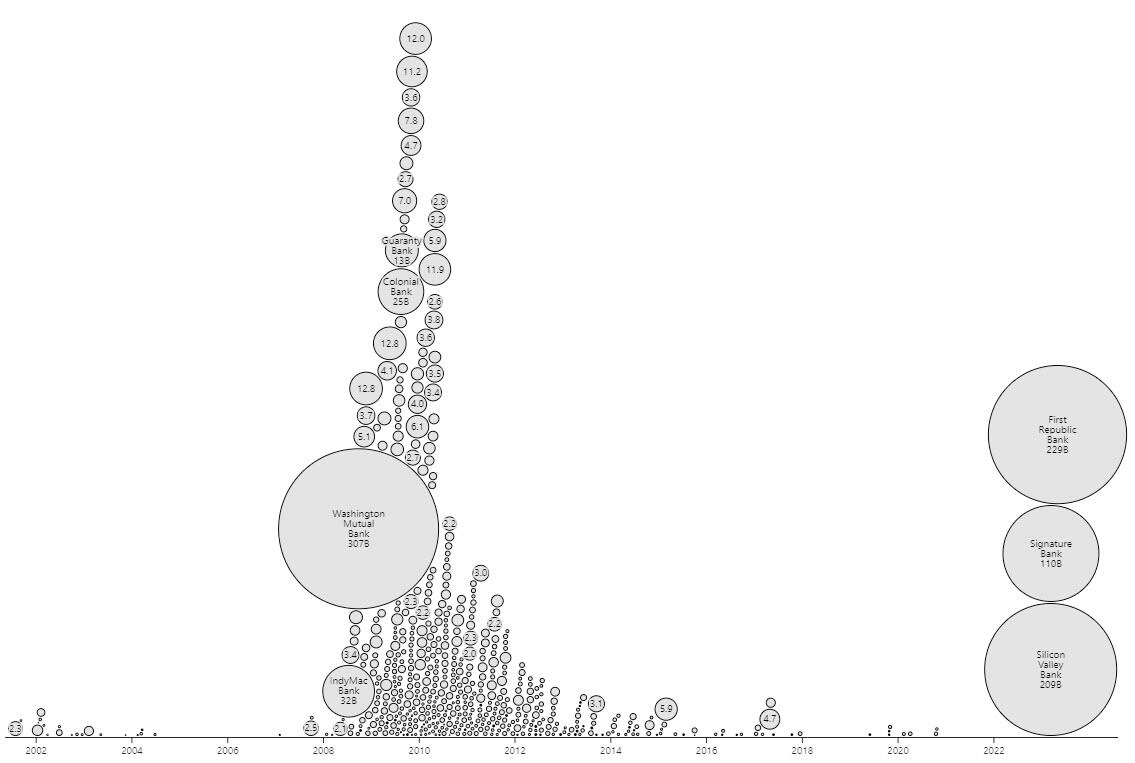

The chart above is about to add another relatively large bubble when PacWest Bancorp is forced into receivership and inevitably acquired by a bigger bank. With $41B in assets it will be the fifth largest bank failure in US history and the fourth bank failure in 2023. And it will come less than a week after the failure of First Republic bank, the second largest bank to fail in US history.

If it wasn't abundantly clear to you already, we are in the middle of a systemic banking crisis the likes of which we have never experienced in this country. Despite this glaringly obvious fact Jamie Dimon, Joe Biden, Janet Yellen and Jerome Powell have all had the gall to "reassure" the American people that the banking system is stable. Jerome Powell uttered the phrase, "the banking system is sound and resilient" literally two hours before PacWest announced that they were looking to get acquired by another bank.

*PACWEST SAID TO WEIGH STRATEGIC OPTIONS, INCLUDING SALE

— zerohedge (@zerohedge) May 3, 2023

To JP Morgan? here we go again....

After the markets closed rumors began to swirl that the Treasury and the FDIC plan to make an announcement that they would backstop all of the deposits in the banking system.

SCOOP: Senior banking execs tell @FoxBusiness that they believe @SecYellen @FDICgov are moving toward either an explicit or de facto guarantee of deposits above the $250k limit to stem the regional banking crisis now threatening a new set of mid sized institutions developing

— Charles Gasparino (@CGasparino) May 3, 2023

Unfortunately for the government this type of guarantee is going to be ineffective. They basically gave a similar guarantee in the aftermath of Silicon Valley Bank's collapse less than two months ago. And if those promising to backstop every single dollar held as a deposit in the banking system had any common sense they would realize that this type of statement is counterproductive. It signals that something is terribly wrong in the banking system and highlights that the Treasury and Fed can work together to print money out of thin air to create that backstop.

To make matters worse, the US is less than a month away from hitting the debt limit as tax receipts have come in well below expectations. On the heels of this reality, the Treasury announced today that they are launching the first treasury buyback program since 2000 at some point next year when a material block of treasuries is set to roll over. Signaling that demand for US debt is so low that the US is being forced to Japanify itself to prop up the market for treasuries.

Everywhere one looks things look absolutely terrible for the US financial system. This feels like the endgame. I find it hard to believe there is anything that can be done to restore confidence in the system. No amount of backstopping, money printing, buybacks, consolidation, or World Wars will be able to put this genie back in the bottle. The Fed and the Treasury will try their hardest to make the public believe otherwise, but this is simply too much all at once. The scars of 2008 are still healing and people will naturally ask, "Well if all of that didn't work and, not only that, put us in a worse position, why will it work this time?" All of the money printing and bailouts seem to have created a bigger problem as is evidenced by the magnitude of the bank failures we have seen in rapid succession.

What you are witnessing is the consolidation and nationalization of the banking system in real time. The powers that be have lost control and the only solution is rolling the regional banking system up to the systemically important too big too fail banks where things can be more tightly controlled. A competitive system made up of thousands of independent banks isn't easy to control. Consolidation is the most direct path to the type of control they desire.

Whether or not their grasp for control is driven by some evil intent to effectively enslave the population in a digital panopticon where everything is tightly monitored and controlled or the simple wish to maintain the mirage of legitimacy does not matter. What matters is that it's happening and you need to act.

There is no future that exists where the system as we know it can persist without turning into an overtly Orwellian hellscape where people's money is tightly controlled and it loses any connection to the actual definition of money. You can choose to continue barrelling down the path of digital slavery with the federal government and Federal Reserve, or you can make the decision to opt-out by adopting a form of money that is controlled by no one, easily secured without counterparty risk, and auditable at any moment in time.

The government isn't going to save you. In fact, the only option the government has if it wants to maintain control is to further enslave you in their monetary system. It is becoming abundantly clear that they have lost control of that system and the only option left on the table for them is to cattle herd you into a more tightly controlled system where they can do whatever they want. The endgame is in play and you are currently standing at a fork in the road with one path leading to misery and the other leading to freedom. Choose wisely.

Final thought...

We're going to win.