Maybe it's a low-key veiled endorsement of the next reserve currency of the world.

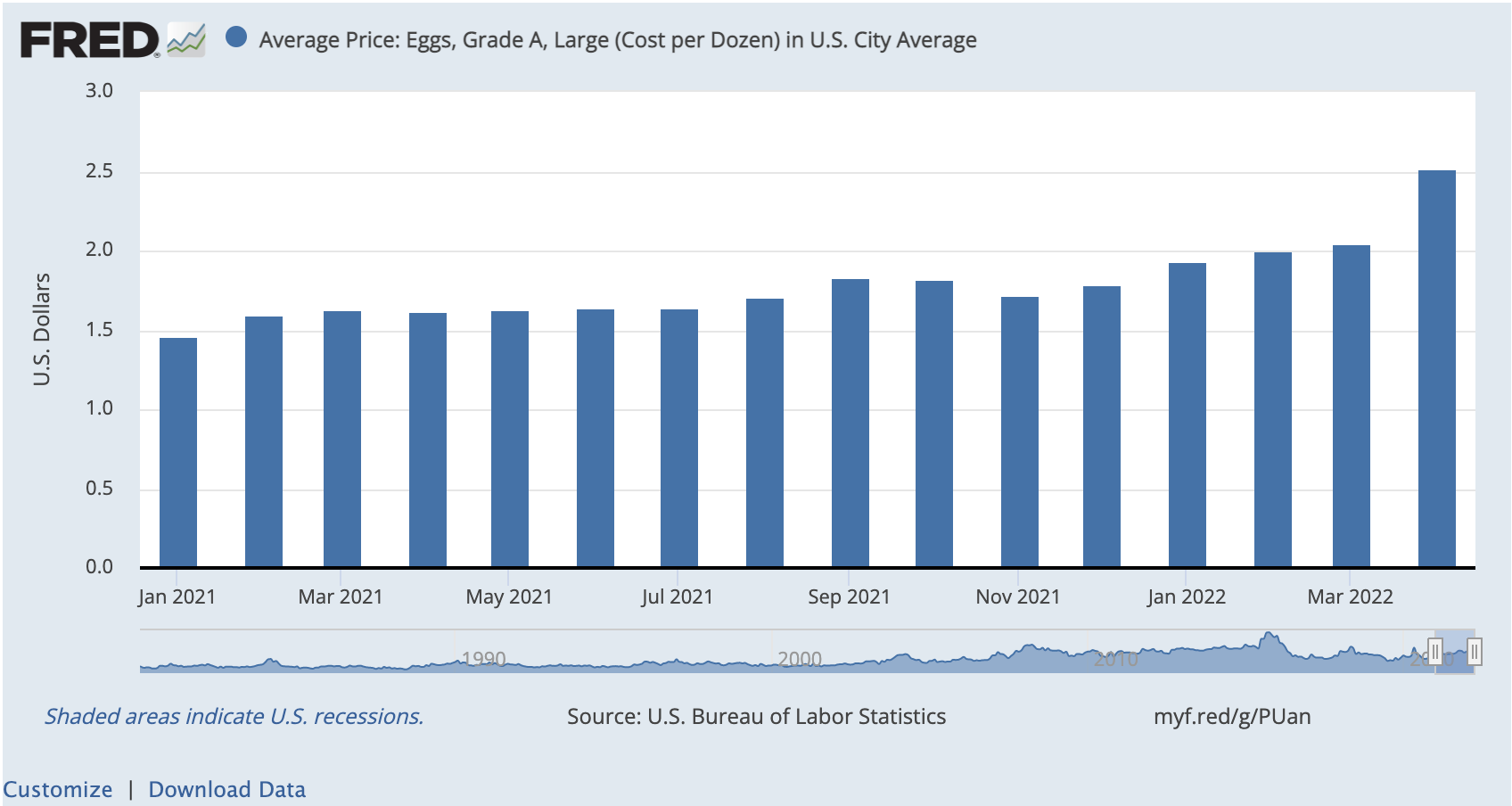

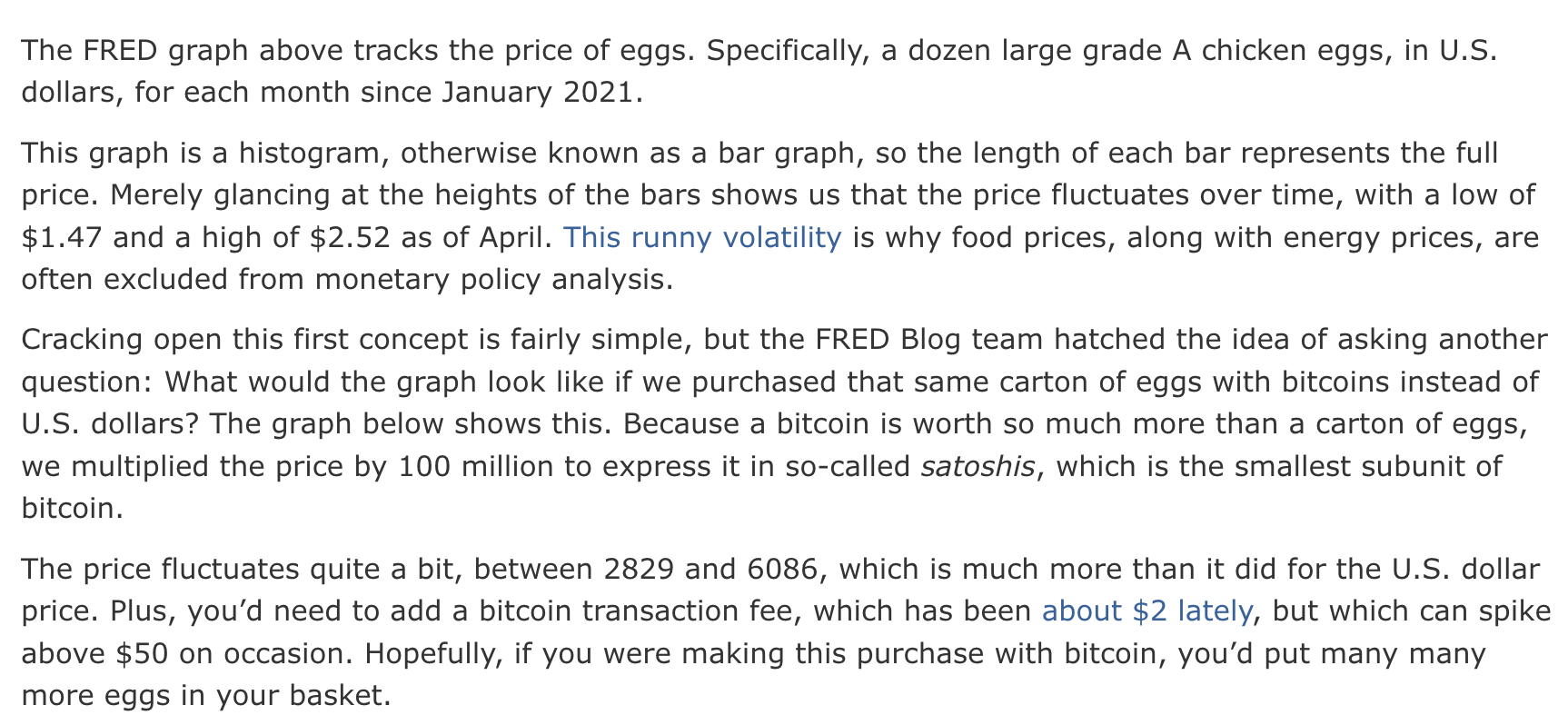

The comedians over at the St. Louis Fed dropped a blogpost earlier today that compared the fluctuation of eggs prices in US dollars and sats from the beginning of 2021 through April of this year. It seems like an attempt to dunk on bitcoin, but if you look closely at the charts you'll see that the overall inflation rate of eggs over the cherrypicked timeframe is lower in sats (44.3%) than it is in dollars (71.9%). Sure, bitcoin's price did fluctuate more rapidly over the timeframe, but if the Fed is going to cherrypick data, we here at TFTC are going to do so as well to prove why this isn't the most accurate representation of the situation.

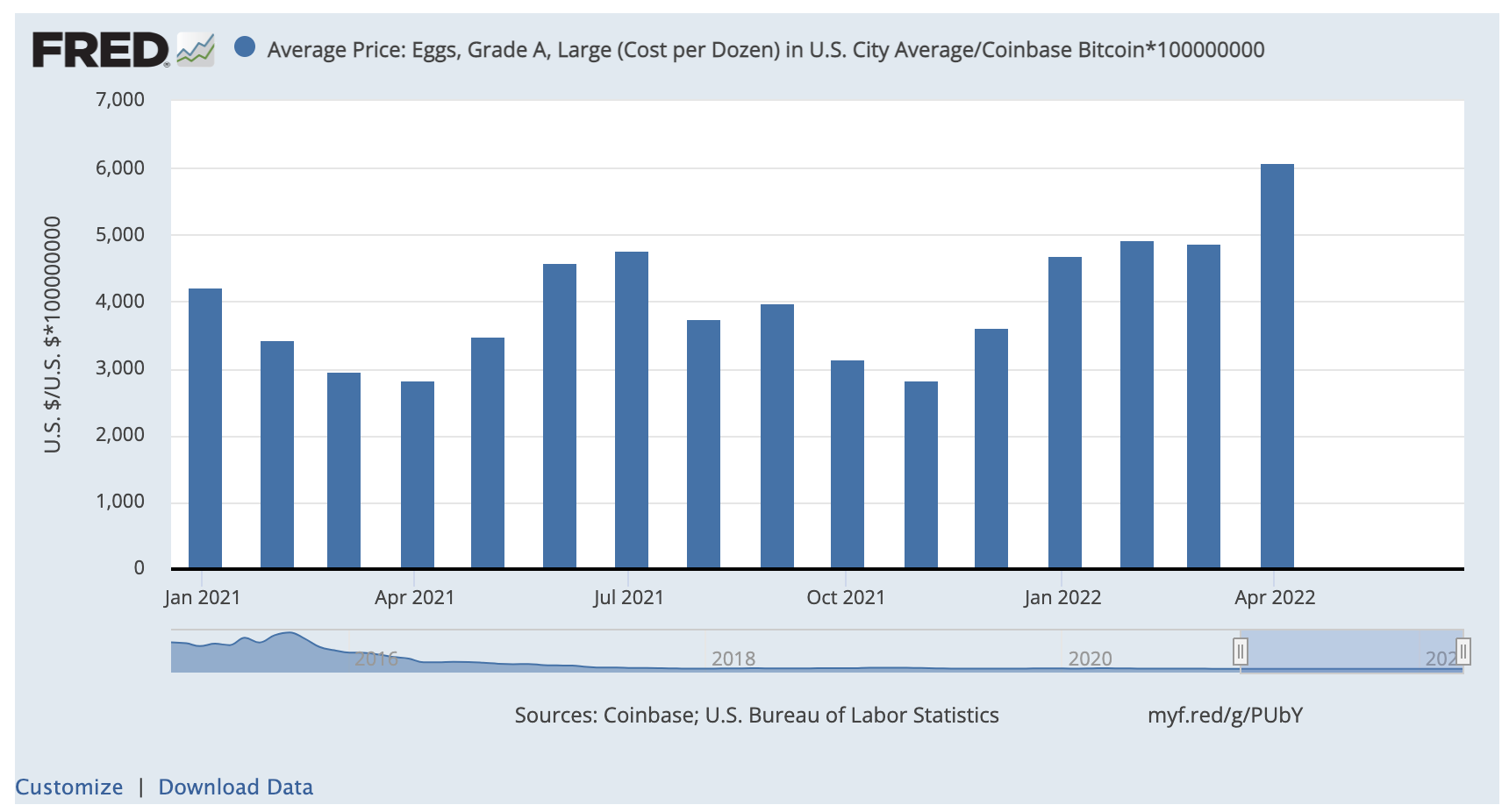

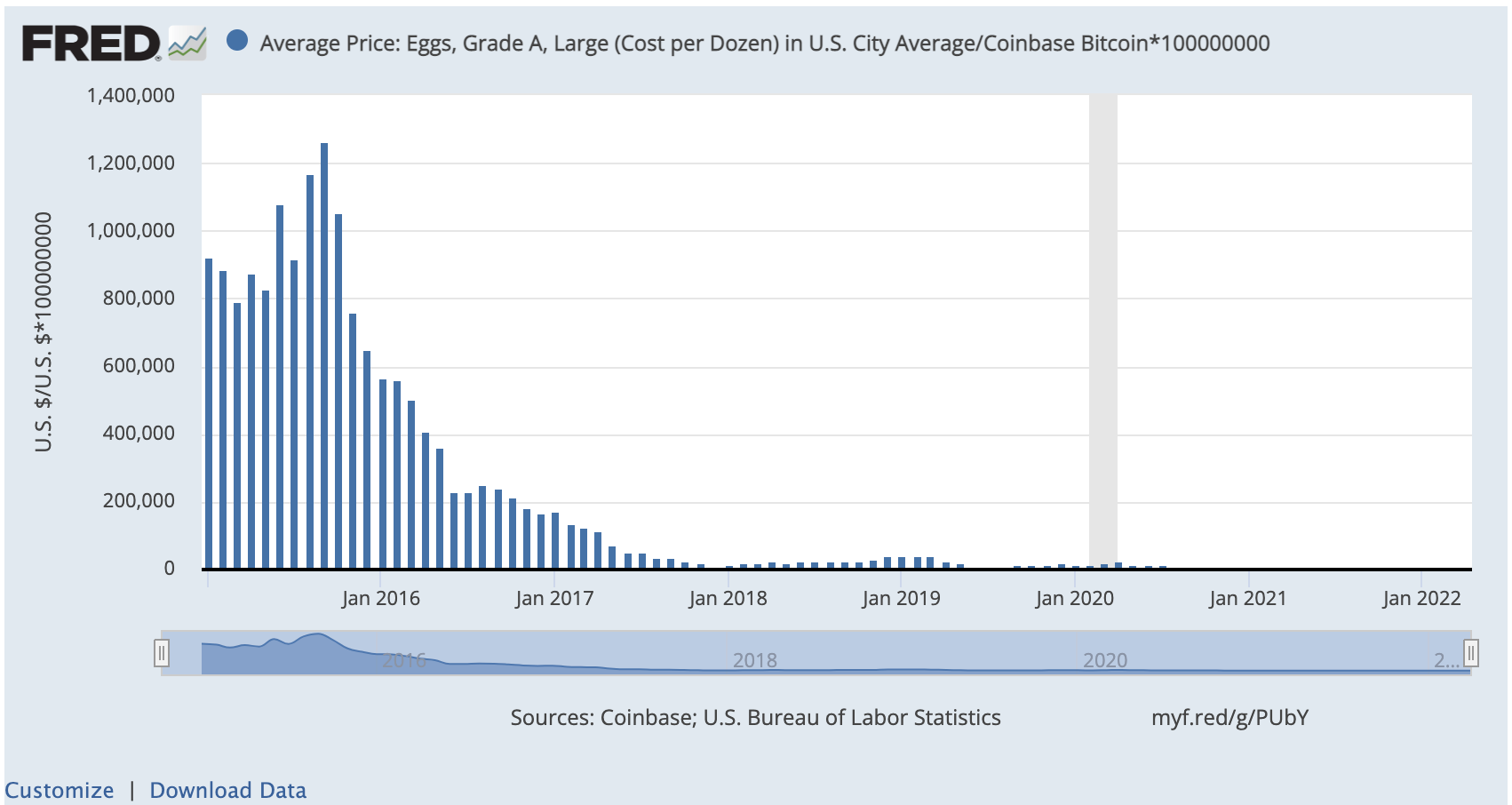

If the Fed were to be more honest - and get their heads out of the gutter of short-termism - they would share what they shared above, but also zoom out a bit (as is made possible on the very page of the attempted dunk) to give their readers a more accurate depiction of the deflationary tendencies of bitcoin over longer periods of time and compare it to the US dollar. Since they were unwilling to do it in their blogpost, we will share that information with you in our rag today.

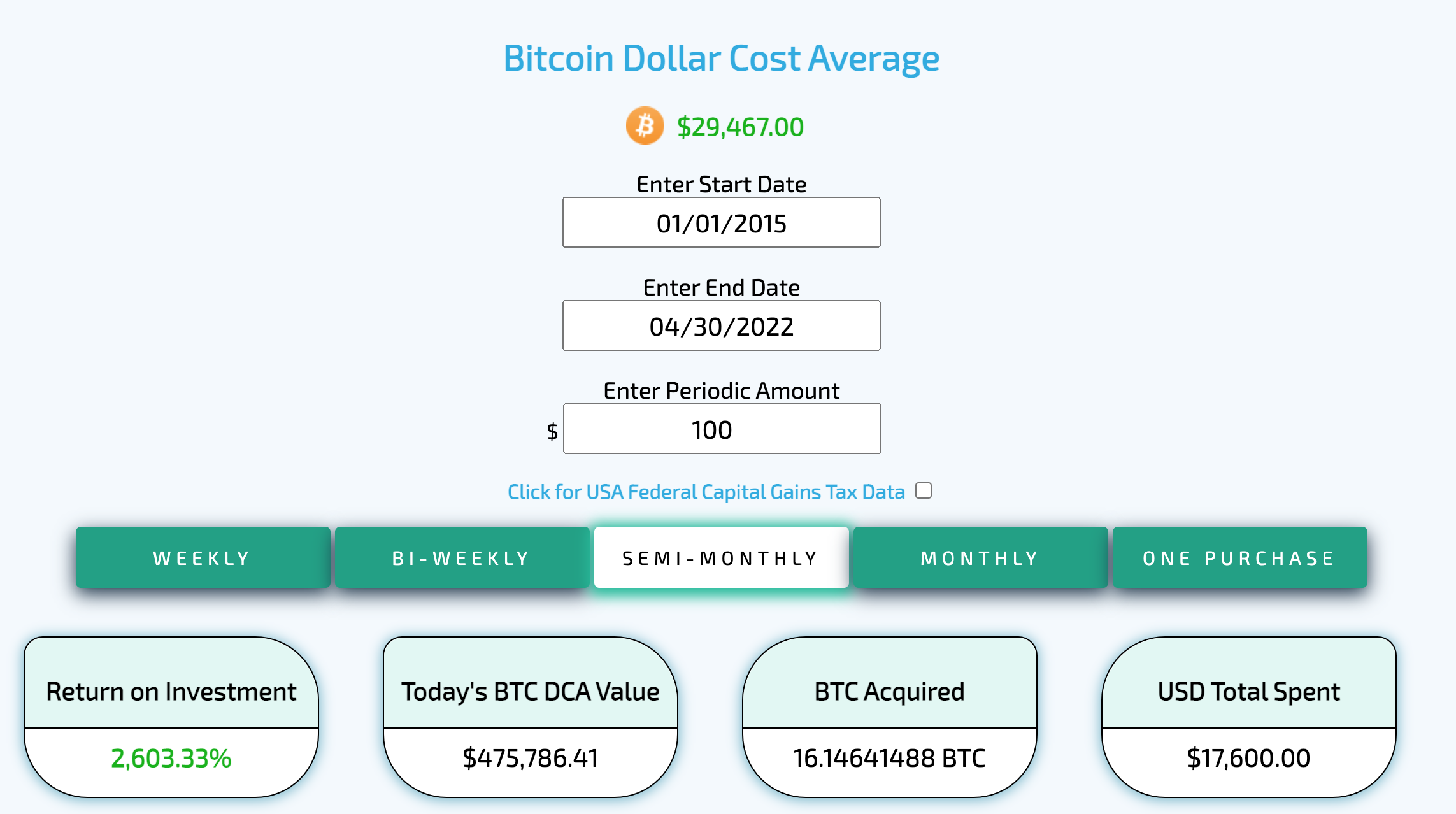

As you can see by zooming out, the price of eggs as measured in sats fell by *checks notes* 99.3% since January 2015 (when the Fed started tracking bitcoin data) while rising by 19.2%. Sure there was some volatility along the way, but over the course of 76 months an individual's purchasing power increased significantly if they were holding bitcoin. To visualize this increase in purchasing power another way, here's what it would look like if an individual were to take $100 per paycheck since the beginning of 2015 to save in bitcoin.

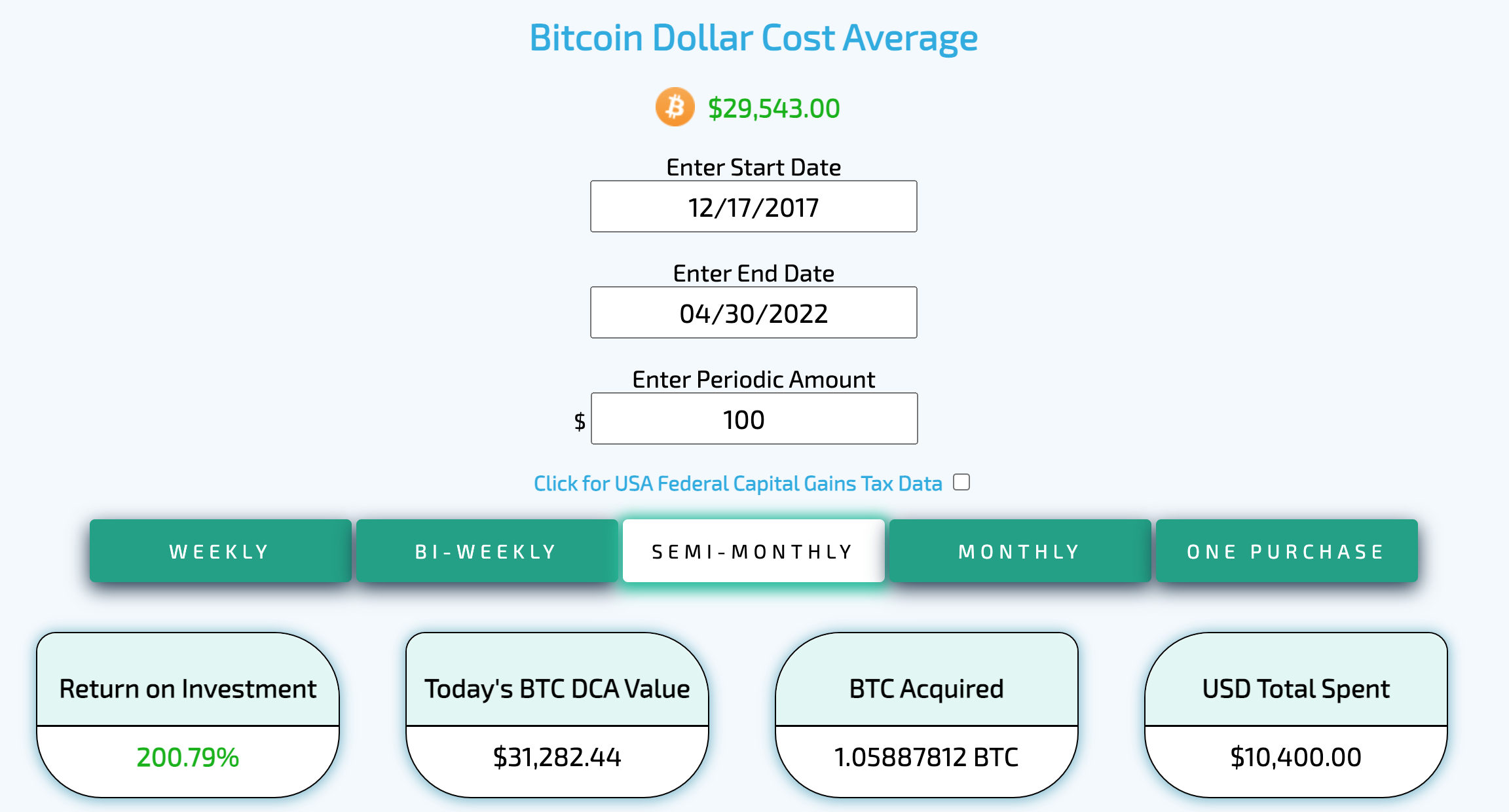

Talk about superior savings technology! And for those of you skeptics out there seething because bitcoin was trading at $250 near that cycle's bear market lows on January 1st, 2015 , here's what it would look like if you began saving $100 worth of sats per paycheck beginning at the bull market top of late 2017.

Still a very impressive display from the superior savings technology.

A bit odd that the academics working at the St. Louis Fed office would attempt to score dunking points on bitcoin in this fashion. Maybe it's a low-key veiled endorsement of the next reserve currency of the world. A subtle signal that people should begin considering bitcoin as their monetary good of choice. Is the St. Louis Fed breaking ranks and acting as a fifth column actor attempting to undermine the dollar's status from within?! Nothing would surprise your Uncle Marty at this point. It would be very admirable if this is the case.

Final thought...

Had four staples injected into my skull yesterday after an accident at the playground while playing with my son. Always have your head on a swivel for low hanging monkey bars. Felt good to bleed though. And the staples were in my head within 40 minutes of the incident. A true testament to the superiority of urgent care in some situations. Bashed my head, had my very pregnant wife pick me (and my embarrassed son) up, drive me to urgent care, get the staples, and walk out within 50-minutes. I was ready for the post-nap pool session. Dad strength is real.