At this point, the money may literally be broken beyond repair. Prepare accordingly.

We've been keeping track of Weimar signs in this rag since April of last year when it became evident that we were headed into an extended lockdown that included artificially restricted economic activity and money printing. Yesterday's rag was an example of a Weimar sign because it highlights the fact that the administration currently in charge of the federal government is beginning to point fingers at industry for causing rising prices instead of showing a bit of introspection, assessing the massive overreach the government and central banks have embarked on over the last two years (and five decades really), and raising their hand to admit they might be at fault to at least some degree.

This is from a well known bike shop in Brooklyn, NY. It’s exactly how inflation morphs into hyperinflation.

— Alpha Zeta (@alphaazeta) December 16, 2021

I’ve seen similar messages from shops in different sectors and I’m having nightmares of reliving the economic disaster of Brazilian hyperinflation of the 80s. pic.twitter.com/Su47Q6hlPp

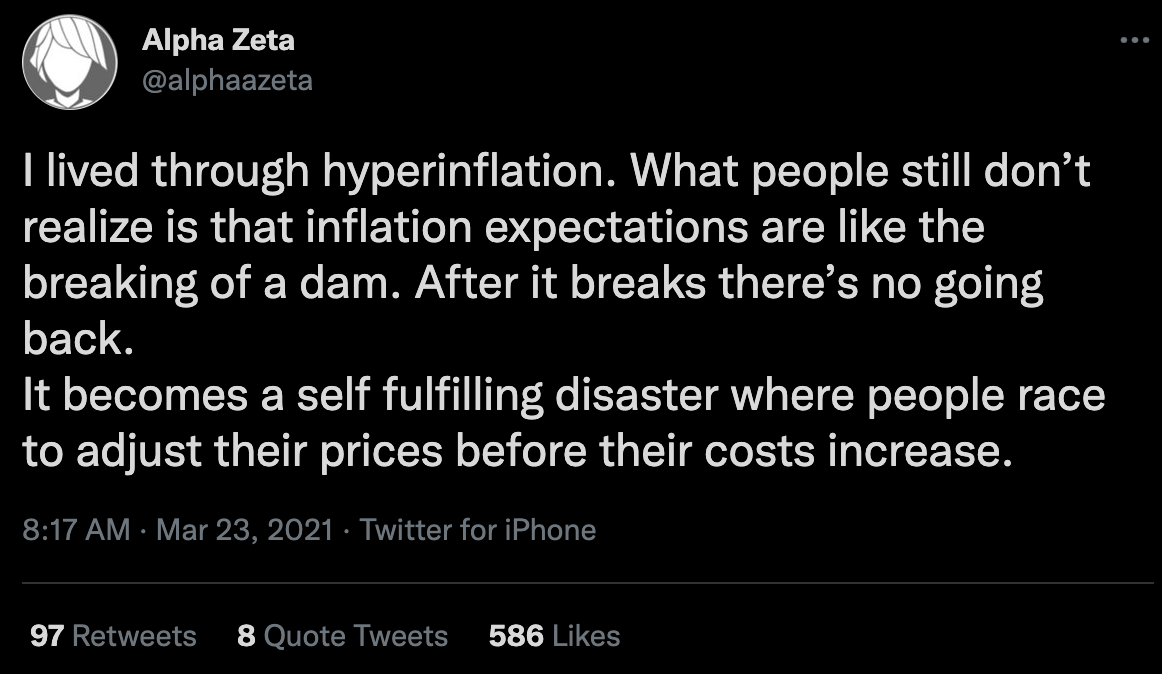

Today, we are here to highlight another Weimar sign that was surfaced by our friend Alpha Zeta and highlights what's going on for small businesses on the ground. Having personally lived through a hyperinflationary event in Brazil, Alpha Zeta has had his antennae perked to recognize some pattern recognition between what he lived through in Brazil and what is happening at the moment in the US. As you can see from the email above sent by a boutique bike shop in Brooklyn, small businesses are beginning to panic and are actively warning their customers that they should buy sooner rather than later if they want to purchase their goods at relatively reasonable prices. This is not a good sign and highlights the one part of high inflation and hyperinflation that many in the mainstream financial media and think-sphere tend to dismiss; the social contagion that breaks out when people expect prices to rise.

I hope we're not at the point where the dam has broken and the self fulfilling disaster isn't in motion, but it's hard not to believe otherwise. The first sign of the dam being broken came in September when a NY Fed survey showed that consumers were expecting inflation to run higher than projections. A few months after that we're beginning to see small businesses panic in a way that makes it seem like the doom loop is well in motion.

At this point, the money may literally be broken beyond repair. Prepare accordingly.

Final thought...

Beck is a great band.