This does not look good for the economy.

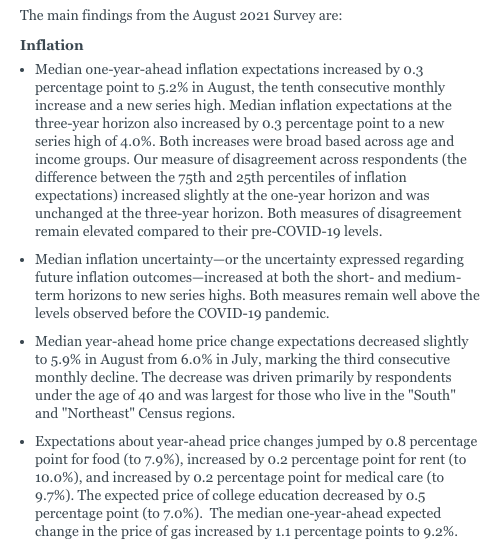

The New York Federal Reserve released the results of their August 2021 Survey of Consumer Expectations and it appears that consumers (at least those who responded to this survey) have high expectations of inflation between now and at least 2023. As you can see above, the public expects to see price increases at the grocery store, the gas pump, the doctor's, and rent. The rosiest change in year-ahead inflation expectations was with education, which experienced a 0.5% decrease. Falling to... +7.0%. Let me say that again a little differently; the most optimistic response from this survey is that consumers think the price of education is only going to rise 7.0% YoY. With their expectations for the price of food, gas, and rent to increase by 8-10%. Wild.

Now, this is only a survey and it's hard to say whether the expectations of these consumers will come to pass. However, it comes on the heels of something weird we discussed last week; damage control/propaganda from National Economic Council Brian Deese who attempted to convince the public that there isn't any inflation if you remove beef, pork, and poultry from your grocery cart. What this says to me is that the inflation discussion is beginning to become all encompassing.

Obviously, this is a trend we've been covering here in the dark corner of the Internet for years, but it feels like something is beginning to shift and the inflation conversation is inescapable for the Common Man and those running businesses. Here's another anecdotal data point from the field by way of comments from 3M's CFO this morning.

3M CO CFO SAYS INFLATION IS HIGHER THAN WE EVEN THOUGHT IN Q3, WE ARE SEEING INFLATION OUTSTRIP PRICE-MORGAN STANLEY LAGUNA CONF

— *Walter Bloomberg (@DeItaone) September 13, 2021

Prices are rising, they are rising quickly, people are starting to notice, they believe prices will continue to rise at multiples above the Fed's historical 2.0% target, and there are significant supply chain headwinds staring down the global economy at the moment. The combination of material price increases of every day things and many individuals in the economy feeling faux-rich because of skyrocketing financial and real estate asset inflation, it seems like we are experiencing another Weimar tremor.

Sounds a lot like this....

"As the old virtues of thrift, honesty and hard work lost their appeal, everybody was out to get rich quickly, especially as speculation in currency or shares could palpably yield far greater rewards than labour." https://t.co/1ZrrsI7iXH

— MacroScope (@MacroScope17) September 12, 2021

Be aware, freaks! There are two aspects to monetary debasement and hyperinflation. The first is a rapid expansion of the monetary base and the second is completely social; do people trust that those at the helm of the monetary system are competent enough to steward it?

We can say without at shadow of a doubt that there has been a significant expansion of the global monetary base over the last thirteen years. Even though that has been very apparent, until very recently, the second criteria for an inflationary event that spirals out of control was not present. But as prices for a wide range of goods and services continue to rise on a monthly basis and businesses and individuals alike begin to publicly complain while some others believe they are getting filthy rich, it's getting harder to argue that the social aspect isn't starting to solidify itself.

If the New York Fed's survey responses are truly indicative of the beliefs of the Common Man as they purport them to be, the Common Man has begun to factor high inflation into his every day life. With the money printer humming, supply chains only getting more congested, and scarcity of many goods increasing it's hard not to believe that very high inflation - orders larger than what we are experiencing at the moment - isn't programmed into the economy. Time will tell.

Your Uncle Marty could be very wrong. But this feels like one of those Weimar tremors we've been on the lookout for recently.

Final thought...

West winds on my village by the sea can be double edged swords. They always bring with them a very clean and crisp ocean, but they sometime bring the black flies with them.