Bitcoin wins again.

It's been almost exactly two months since we last checked in on the great mining migration out of China. At the end of June, the Bitcoin network was anticipating its largest adjustment ever (up or down). That adjustment fell on July 3rd and dropped difficulty by ~28%. Many were a bit uneasy as there was a lot of uncertainty about what would happen after that. Were miners making it out of China?

The China mining ban was an incredible stress test of the Bitcoin network. It passed with flying colors. This hasn't been accurately priced in yet.

— Marty Bent (@MartyBent) August 25, 2021

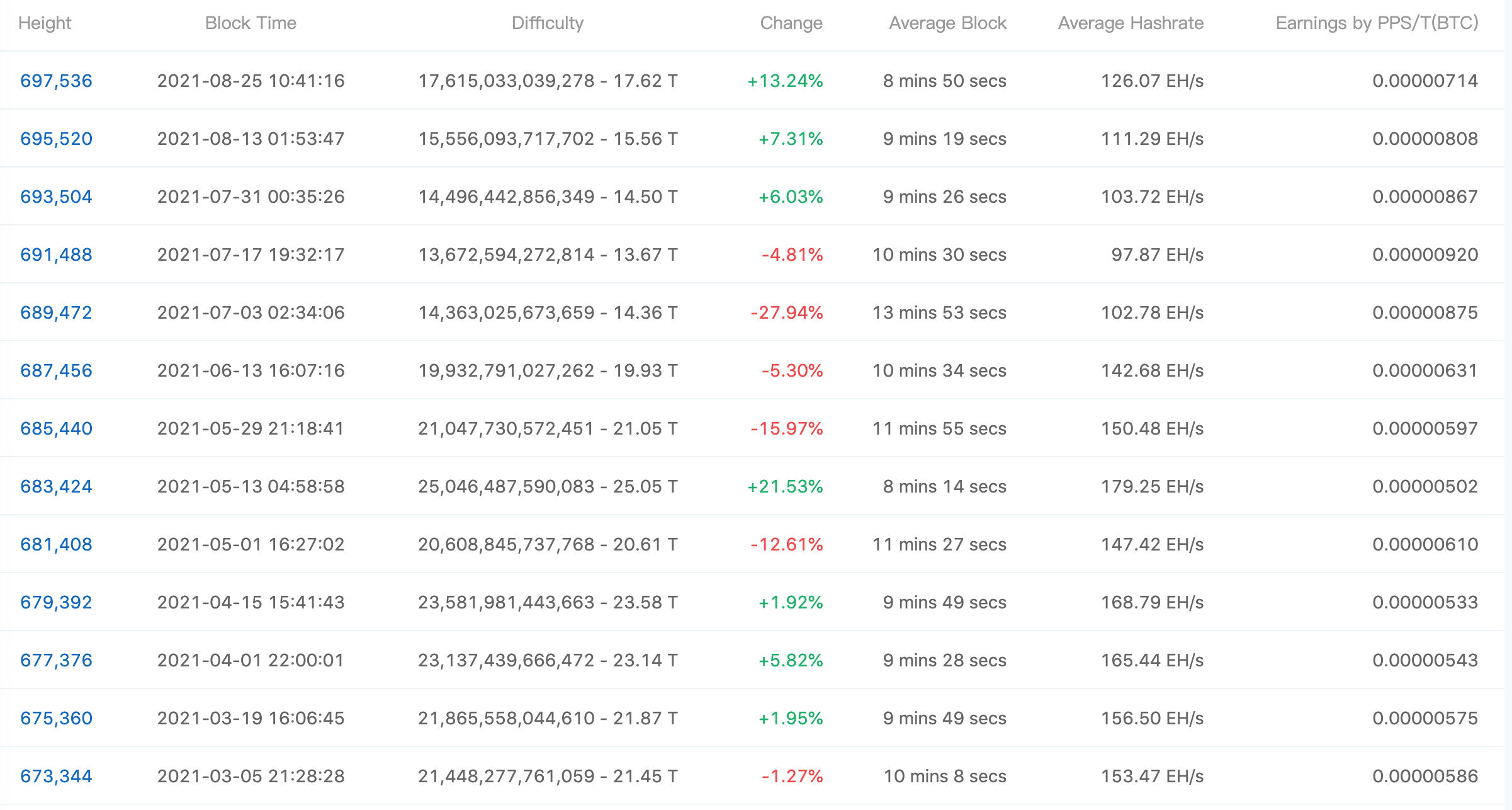

Would the CCP attempt to confiscate hardware at the border and attempt to 51% attack the network? Well, I think it's safe to say that those worries, while legitimate, did not materialize into real-world actions. Here's what recent difficulty adjustments have looked like:

The network difficulty is still ~30% off the all time high reached in mid-May, but it is also ~29% higher than it was in mid-July when it reached levels not seen since January 2020 as miners in China turned their machines off en masse and began moving their equipment across the planet. Pretty impressive if you ask your Uncle Marty. And not only is it impressive, it is a validation of the resiliency of the Bitcoin network.

Think about it, freaks. One of the world's "strongest super powers" that was housing a majority of network hashrate made it illegal to mine bitcoin, miners unplugged, hashrate fell by 40-50%, the difficulty adjusted, miners moved or sold their equipment, and hashrate is beginning to rebound materially in relatively quick fashion. The only effect on the network was blocks being produced above the 10-minute target for a short period of time. This was a massive stress test of the network and Bitcoin passed with flying colors. We don't like to dabble in too much price talk in this rag, but it seems to me that markets haven't fully appreciated the magnitude of this test and the fact that the network essentially shrugged it off like a college student asked to recite their ABCs.

The resiliency of the network wasn't the only thing that this stress test highlighted. It also highlighted how entrepreneurial and ruthlessly capitalistic the mining industry is. When the axe came down, Chinese miners quickly moved to get their machines unplugged, shipped, and plugged back in somewhere else (or sold). And those around the world who recognized the opportunity moved to accommodate their needs in very short order.

Most of the world is unaware of the how big of a deal this is in terms of validating Bitcoin as a network that is capable of facilitating the distribution, accounting, and security of the global reserve currency.

Final thought...

Having flashbacks to my college club lacrosse days as I write this from a dingy hotel on the side of a highway in Houston.