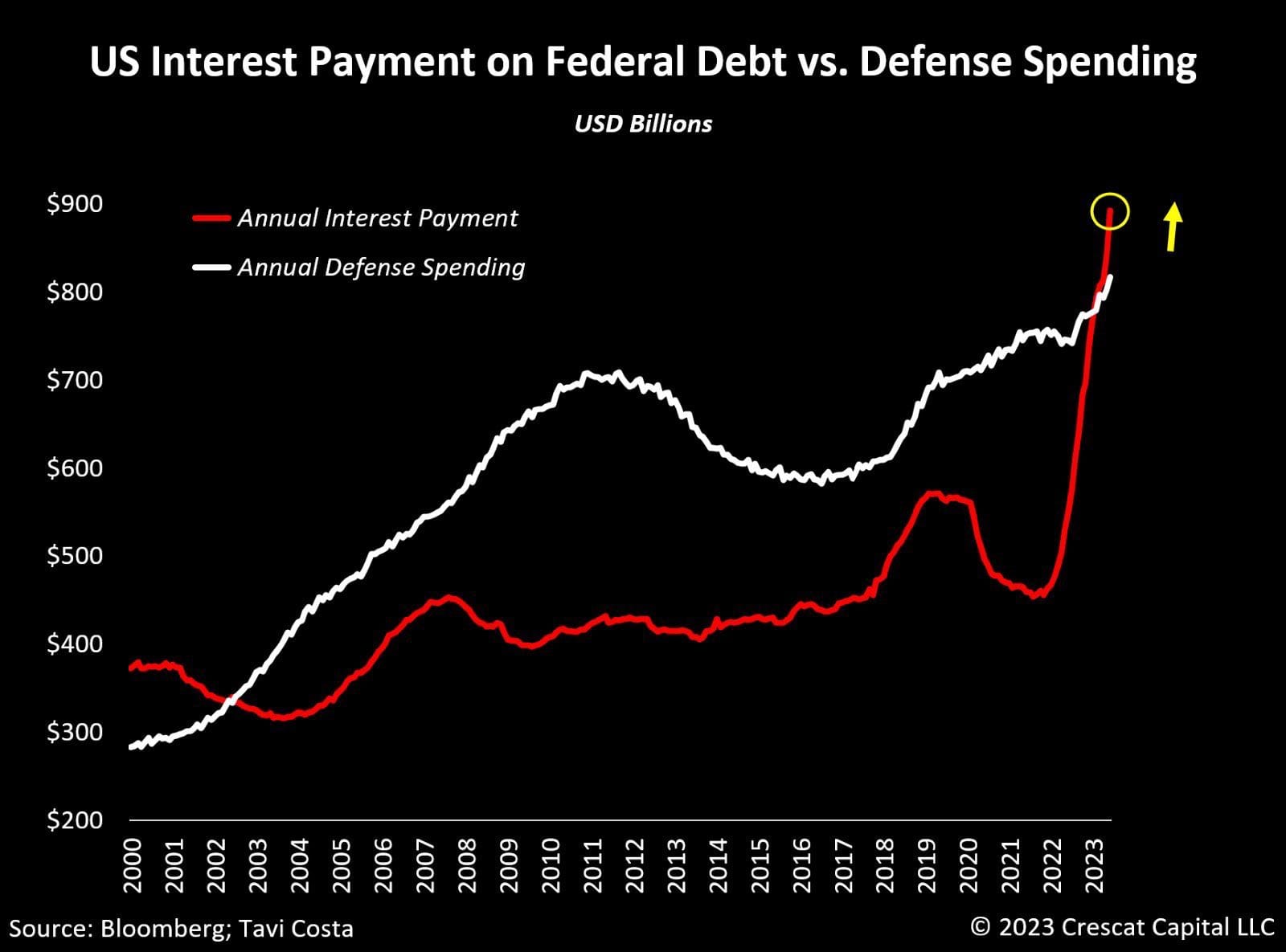

The last instance of comparable interest payment burden to the present was in the late 1984 to early 1985 period.

In the period from 1981 to 1988, the United States experienced significant economic expansion. Interest payments were considered burdensome, yet the economy thrived, with falling interest rates, soaring stock prices, and rising living standards. During this time, the federal government managed to borrow sufficiently to service its debt.

The last instance of comparable interest payment burden to the present was in the late 1984 to early 1985 period. The subsequent devaluation of the dollar, particularly post-Plaza Accord, saw a decline of 25% from February to September 1985, eventually leading to over a 40% drop by early 1987. However, current conditions differ substantially, with the US trade and fiscal deficits larger, and the net international investment position of the US being significantly more negative.

Weakening the dollar to address economic challenges presents risks. The current trade deficit and net international investment position indicate that attracting foreign capital through dollar devaluation will be challenging. A weaker dollar could potentially fuel nominal growth and inflation. The US debt-to-GDP ratio has ballooned to 120%, up from approximately 30% in the 1980s. This suggests that the US might struggle to sustain higher growth rates without resorting to measures like quantitative easing or financial repression.

The strength of the US dollar has implications for global economic stability. With $13 to $14 trillion in offshore dollar-denominated debt, a strong dollar strains foreign debt servicing and can slow global growth while exacerbating US deficits. The net international investment position of the US suggests a significant dollar reserve held by foreigners, which could be liquidated in challenging times, potentially destabilizing the Treasury market.

Oil prices have been subject to fluctuations, with recent downturns reflecting expectations of economic weakness. However, the concept of "peak cheap oil" continues to underscore the positive long-term outlook for oil. Interest rate hikes have adversely affected alternative energy projects, indicating that substantial growth in alternative energy necessary to curb fossil fuel usage may not materialize if financial conditions remain tight.

The US needs a productivity boost that could be facilitated by technological advancements. Possibilities include small modular nuclear reactors and AI, with the latter having potential socioeconomic impacts, particularly in employment. The pace of development and implementation will be crucial, as rapid technological change could lead to political instability due to job displacement.

Demographic trends worldwide have complex implications for economic growth and political stability. While youthful populations can drive economic vitality, they also pose a risk of political unrest if economic opportunities do not materialize. Conversely, aging populations may lead to political stability due to lower propensity for disruption, despite the potential economic challenges associated with supporting an older demographic.

The current economic landscape is marked by complex interactions between interest rates, dollar value, demographic shifts, and technological advancements. While historical parallels provide some guidance, the distinct differences in today's economic and geopolitical context require careful consideration of the potential outcomes of policy decisions and market responses. As the US navigates these challenges, the implications for global economic stability will be significant.