This article examines the historical context of global economic downturns, highlighting the interconnected nature of the world's financial systems.

Recent updates on the US Gross Domestic Product (GDP) for the fourth quarter indicate economic strength. In contrast, recessions are spreading across the globe. This divergence has led to discussions about the decoupling of the US economy from the rest of the world. However, a closer examination of economic history reveals that the global economy is deeply interconnected, and the concept of a globally synchronized cycle is not a new phenomenon.

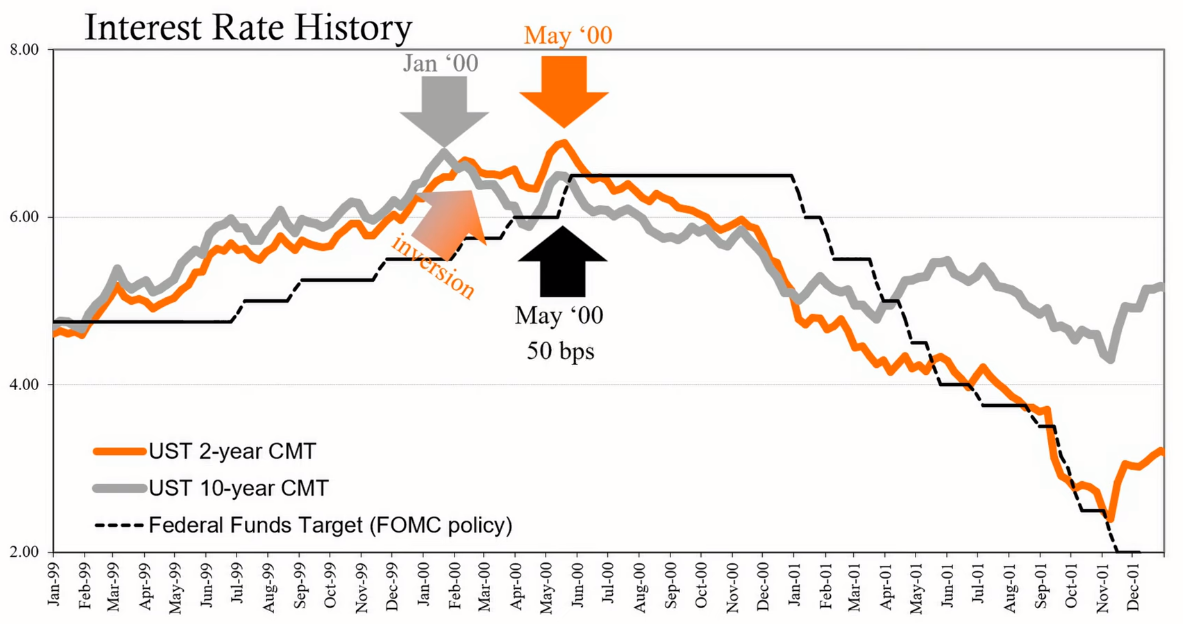

Looking back to 2001, the world experienced what may be considered the first instance of quantitative easing (QE) in response to a global recession. The US economy entered a shallow recession in the second quarter of 2001, with significant events such as the dot-com bust and the September 11 tragedy contributing to economic downturns. However, the global weakness, including a slowdown in the Japanese economy, played a significant role.

The Bank of Japan, in March 2001, recognized the pause in economic recovery due to the global downturn and implemented QE measures in an attempt to address weak demand and deflationary pressures. Despite these efforts, Japan's economy saw negative GDP in the subsequent three quarters of 2001.

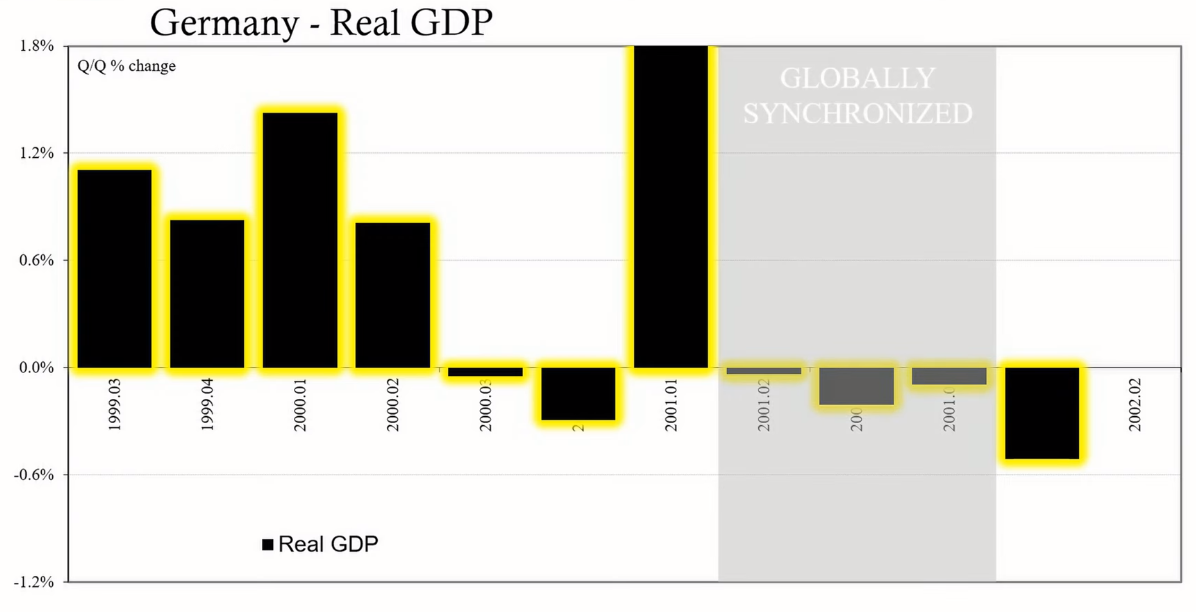

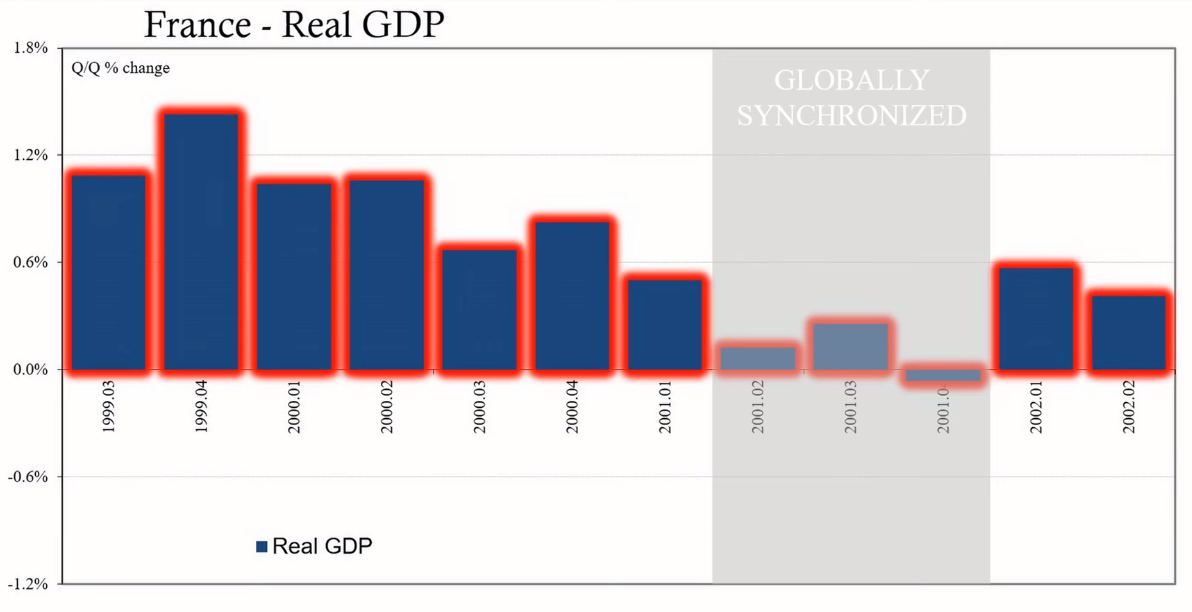

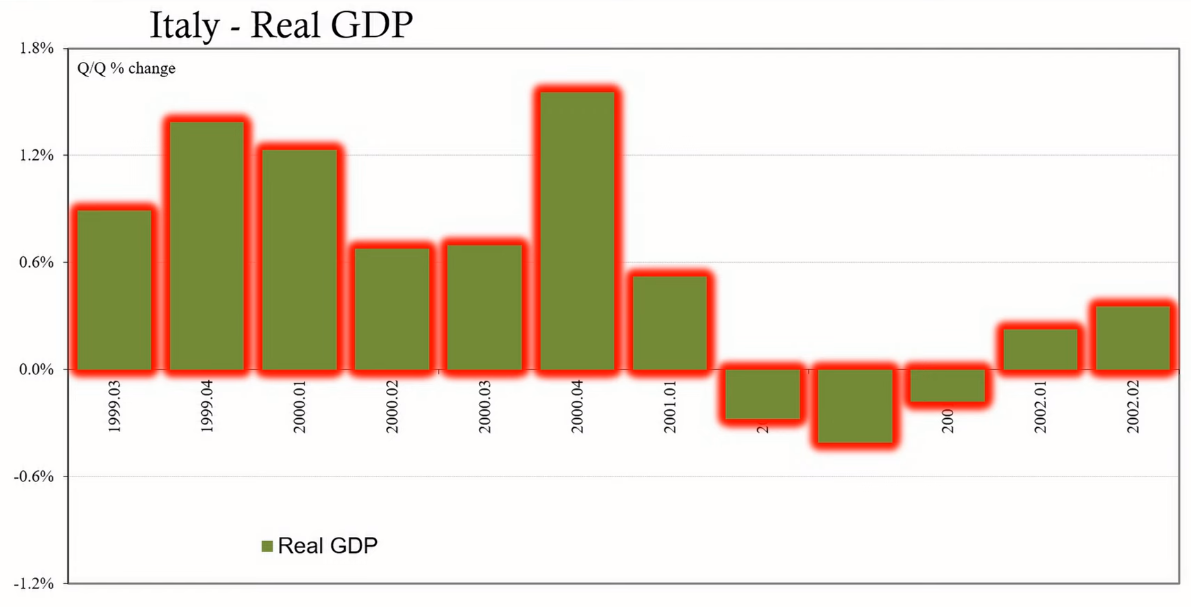

In Europe, the European Central Bank (ECB) faced questions about stimulating growth to counter the global slowdown. ECB President Willem Duisenberg acknowledged the impact of global developments on the European economy but emphasized that it was not Europe's role to act as a global growth engine. Various European countries experienced recessions during this period, with Germany, Italy, and France recording negative growth in several quarters.

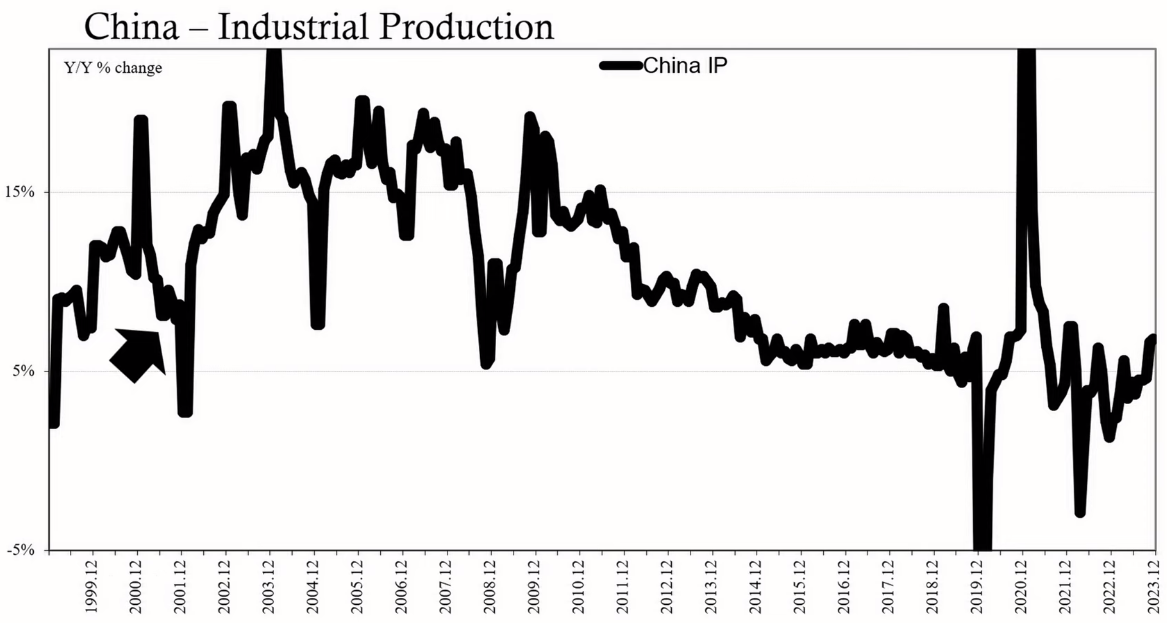

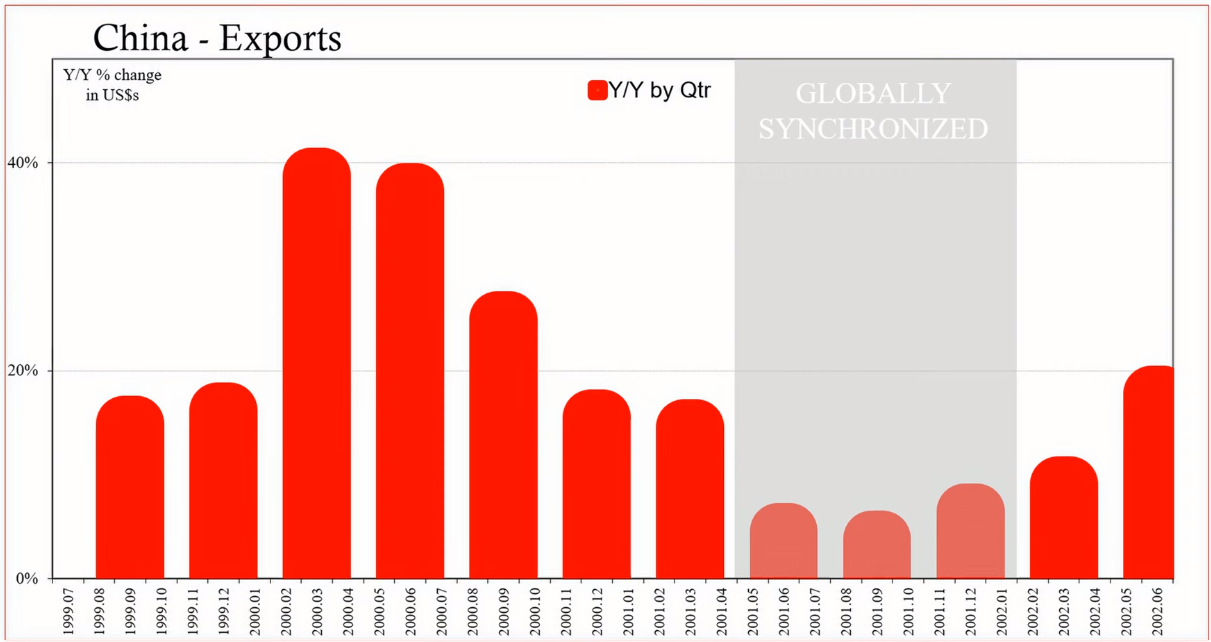

Emerging markets, including China, were not immune to the global recession. Even with continued investment, China's industrial production and export growth significantly slowed, demonstrating the pervasive impact of the global economic downturn.

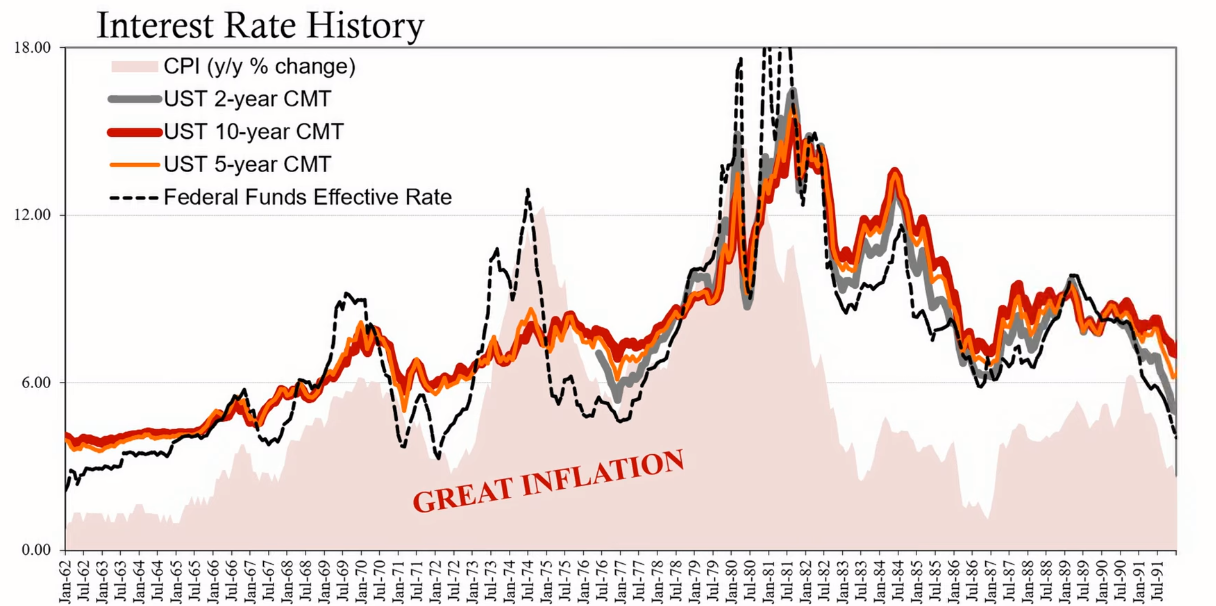

The 1970s showcased another instance of globally synchronized economic challenges. The great inflation was a worldwide phenomenon, culminating in a deep global recession in the early 1980s. The majority of countries saw declines in output, with many experiencing extended negative growth.

The interconnectedness of the modern global economy means that a recession in one region can have ripple effects across the world. Trade, financial markets, and business sentiment are all channels through which economic troubles can spread internationally.

Despite robust US GDP figures, other economic indicators suggest that the US is not entirely insulated from the global downturn. The synchronization of economic cycles implies that as more countries enter recessions, the likelihood of a global impact increases.

The history of globally synchronized economic cycles underscores the reality that the world economy operates as a cohesive system. While the timing of recessions may not be perfectly aligned, the spread of economic weakness serves as a warning to all countries. Current indicators, including feelings of recession among the population, suggest that the global economy remains on a downswing, and the US is not exempt from these developments.