It's the money, stupid.

While newly minted tariff experts and tech founders turned macro analysts lambast the Trump administration and its economic policy moves over the last week - slapping tariffs on everything that has a pulse outside of the United States of America - I think it's important to consider another potential catalyst for the jump in 10Y US Treasury yields; massively levered hedge funds.

"Shut up, Trump Stan! Don't make excuses for him!"

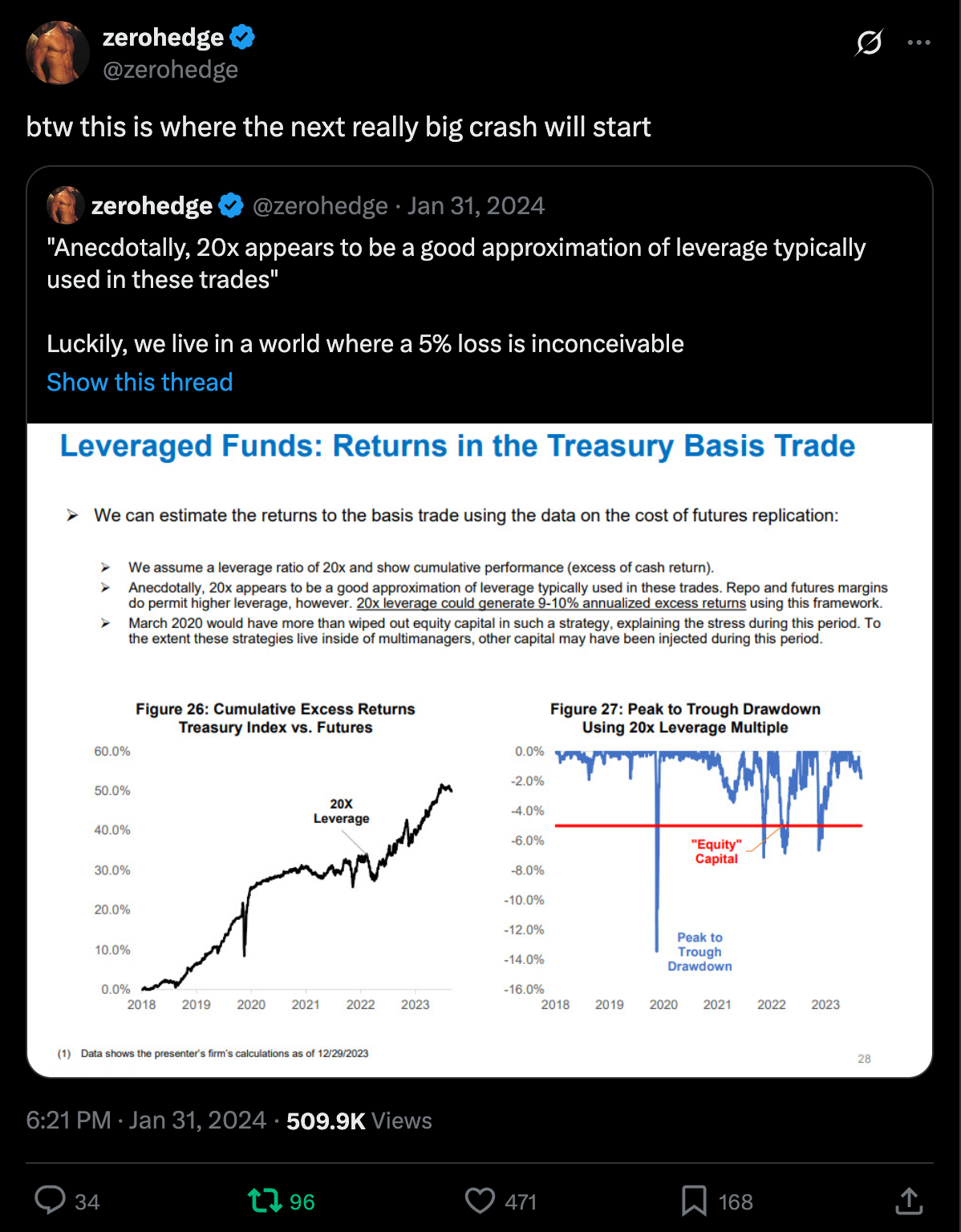

If you whispered this under your breath while reading the first sentence, just hear me out. Zerohedge wrote and incredibly detailed and compelling piece last night for their premium subscribers (archived version here, but you should subscribe) that highlights the extremely leveraged basis trade that many of the largest multi-strat hedge funds have been riding for years now. The forced unwinding of this basis trade was a part of the problem in September 2019 when the overnight repo market spas'd out and in early 2020 when COVID fears began to rise. Unfortunately for us, this time around it looks like all of the big funds (Millennium, Point72, Citadel, Balyasny and others) are even more levered than they were the last time this trade blew up.

As it stands at the time of writing, the 10Y US Treasury yield just cut above 4.5% like a hot knife through butter. Many are beginning to speculate that this basis trade may be the reason why.

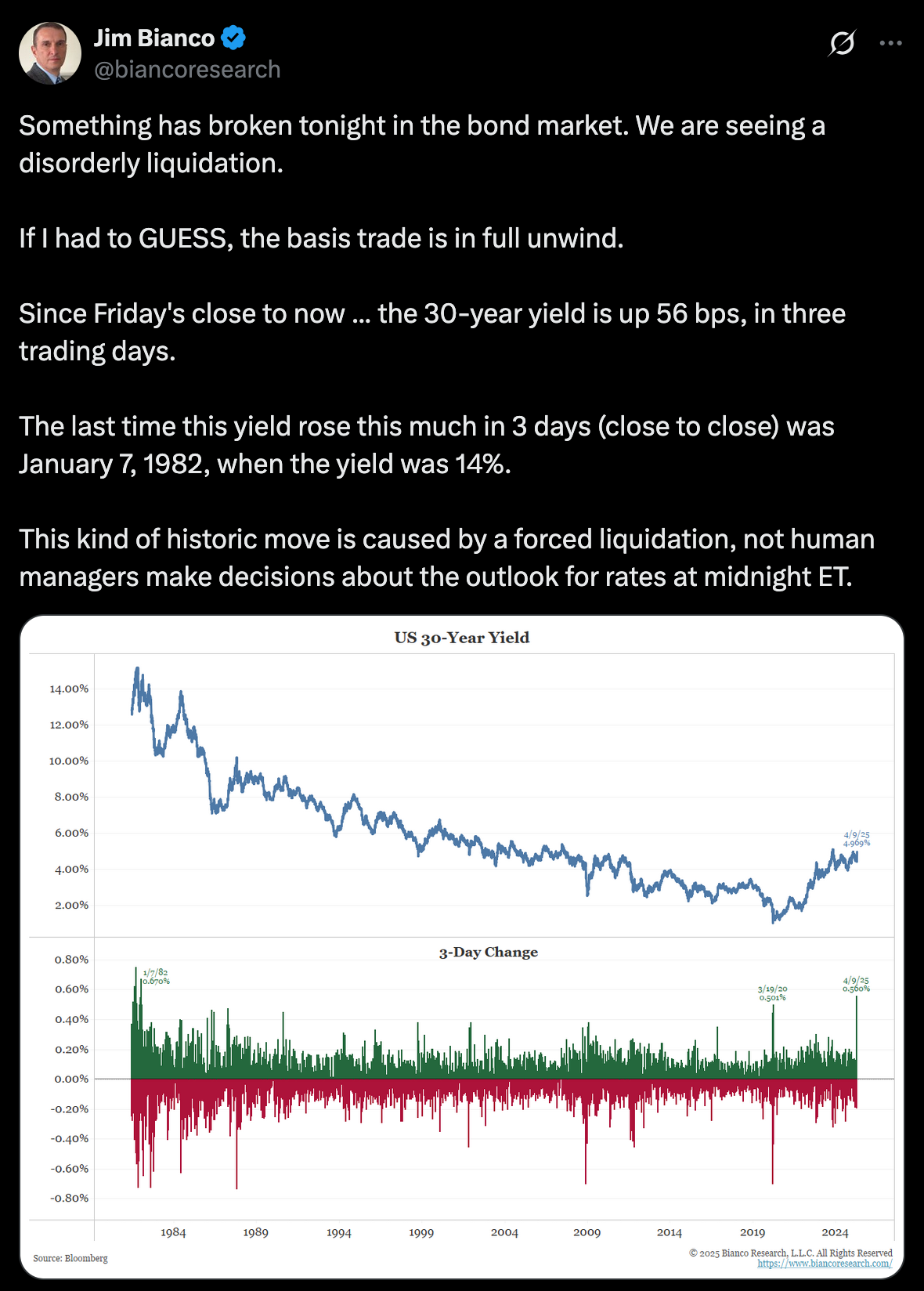

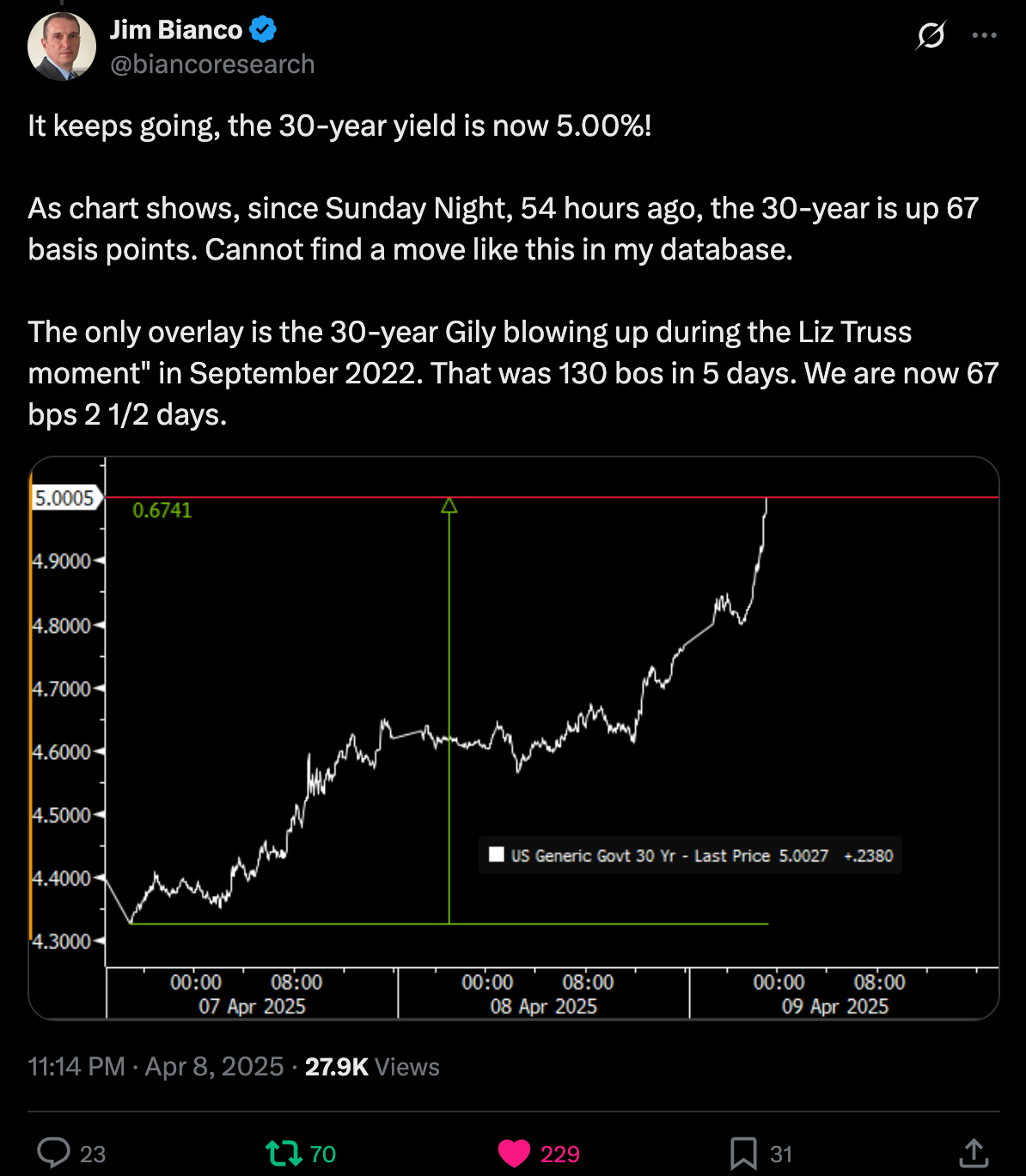

Throughout the day many people have been surmising that China has been dumping US Treasuries en masse in response to the 104% tariffs that Trump slapped on them for not bending the knee in negotiations. That certainly may be the case, but I think it's important to consider that the 20x+ levered exposure that these multi-strat funds have on this basis trade may be the big driver of this surge in yields throughout the night. If the trade really is blowing up then it means they are being forced to liquidate their treasuries to raise cash to buy the swaps they shorted on the other side of the trade.

Another data point that would suggest this is the move in 30Y US Treasuries, which have made their largest 3-day move up since 1972, when yields were at 14%.

Now, if this is actually what's going on right now one can argue about whether or not this trade would have blown up if Trump decided to be less aggressive with his tariff policies or decided not to levy tariffs at all, but I think any sane person would have to recognize that these hedge funds going levered to the tits on this basis trade and only leaving a margin of error of 5% is extremely irresponsible. The ramifications of a basis trade unwind would likely force the Fed's hand yet again and lead to The Big Print that our good friend Lawrence Lepard has been talking about for years.

The combination of everything going on in the world right now coupled with a liquidity crisis in the darks corners of the plumbing of the system makes me believe that this will really lead to The Big One. Too much uncertainty and too many balls in the air to pull everything together neatly and bring back order in a timely fashion. That's my hunch at least.

And as everyone takes to X to point their fingers at who they believe caused this mess, it will be very important to step back from the fray and recognize that this was all inevitable. There is simply too much debt, not enough dollars, and Triffin's dilemma has run its course. The mechanics of the global monetary system dictate that blow ups like this are inevitable. Yes, you can argue about how the blow ups are brought about and managed, but you must always admit to yourself that they are inevitable. This is the way of the high velocity trash economy.

You can try to galaxy brain it by pin pointing the exact catalyst or you can simplify your life by repeating the phrase, "there's too much debt and not enough dollars" over and over and over and over again. Speaking from experience, this is a much better way to go through life.

You can try to blame Trump, the hedge funds, the Chinese or the Europeans, but you will fall short of identifying the core of the problem; it's the money, stupid.

This is why bitcoin is so important.

Fix the money, fix the world.

Tom Luongo made a compelling case that Trump's tariffs are strategically targeting what he calls "durable trade advantages" - persistent trade surpluses that countries maintain through non-tariff barriers and regulations. These advantages create what economists call "rent" or unearned profit, and Trump aims to claw back $500-700 billion of this trade deficit through tariff implementation. The goal isn't protectionism for its own sake, but addressing artificial imbalances that free markets would naturally correct.

"When you see a trade imbalance like that...it's because something's getting in the way." - Tom Luongo

We're already seeing companies respond positively, with Ford announcing plans to increase US manufacturing and paper mills in Maine ramping up production. As I've witnessed these developments firsthand, it's become clear that other countries rely on the American consumer market far more than we depend on their goods. China specifically, amid their economic contraction, simply can't sustain their economy without access to US consumers, giving America significant leverage in this economic chess match.

Check out the full podcast here for more on the European financial crisis, Bitcoin's role in energy markets, and how the Treasury debt rollover strategy is playing out in real time.

Musk Defends Tesla Against Navarro's Claims - via X

Marjorie Taylor Greene's Market Dip Purchases Stir Debate - via X

China Considers Ban on U.S. Films Amid Trade Tensions - via X

Trump Runs Crypto Scams While DOJ Halts Investigations - via X

The first months of the new administration have sparked an unprecedented push for cost- cutting and efficiency within the federal government—but DOGE Can't Fix The Dollar. Join us on April 16th to hear PhD economist Peter St. Onge explain how bitcoin brings true efficiency to governments while protecting your generational wealth. With macro uncertainty driving a dip in bitcoin prices, now is the time to understand the fundamentals driving the global shift to sound money.

Ten31, the largest bitcoin-focused investor, has deployed $150M across 30+ companies through three funds. I am a Managing Partner at Ten31 and am very proud of the work we are doing. Learn more at ten31.vc/invest.

Final thought...

My body is ready.

Get this newsletter sent to your inbox daily: https://www.tftc.io/bitcoin-brief/

Subscribe to our YouTube channels and follow us on Nostr and X: