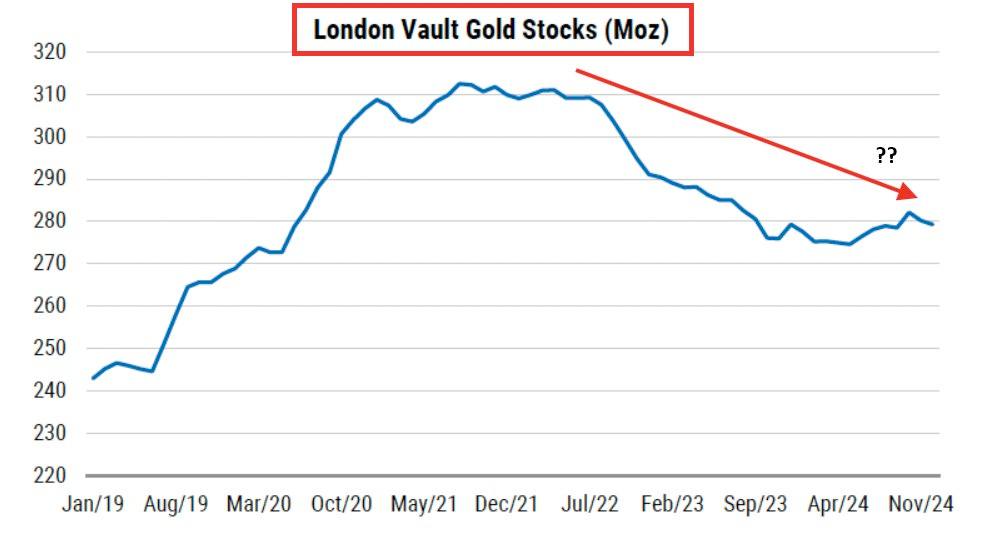

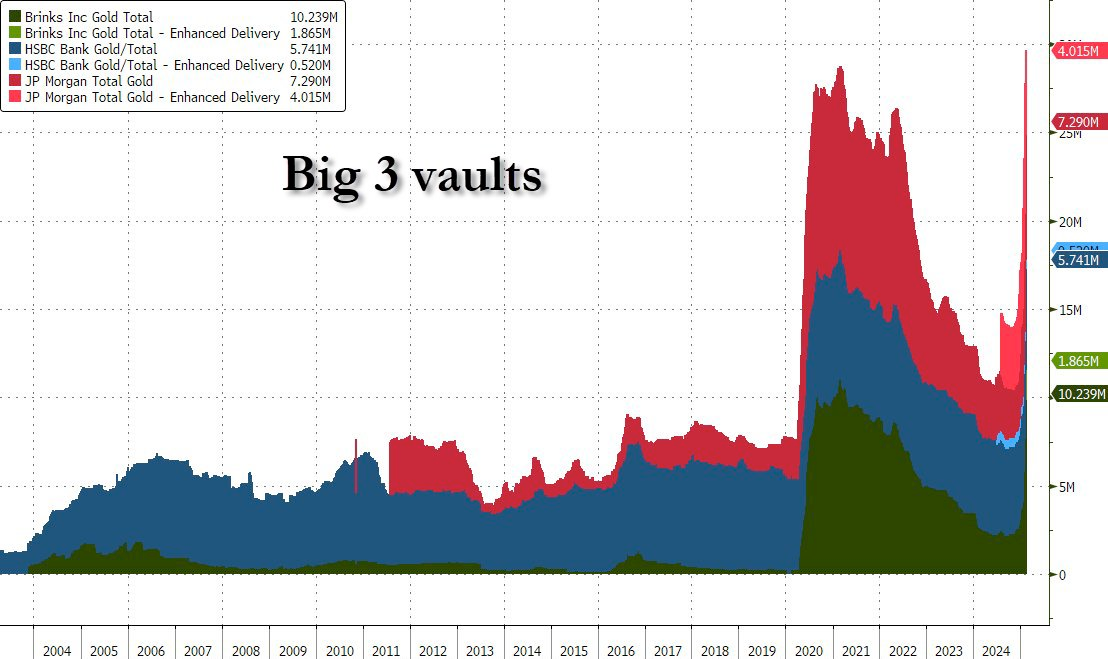

Gold is flooding out of London and into the US. Institutions and governments are rushing into physical gold in preparation for... something.

While this is a bitcoin focused rag, I think it is important for any of you who read this to begin paying attention to gold markets if you haven't already. There has been an ongoing exodus of physical gold from London vaults and a rapid acceleration of gold being moved to the three biggest vaults in the United States in recent weeks. More gold has flooded into the US vaults over the first two months of this year than at the peak of the flight to safety during the beginning of the COVID lock downs.

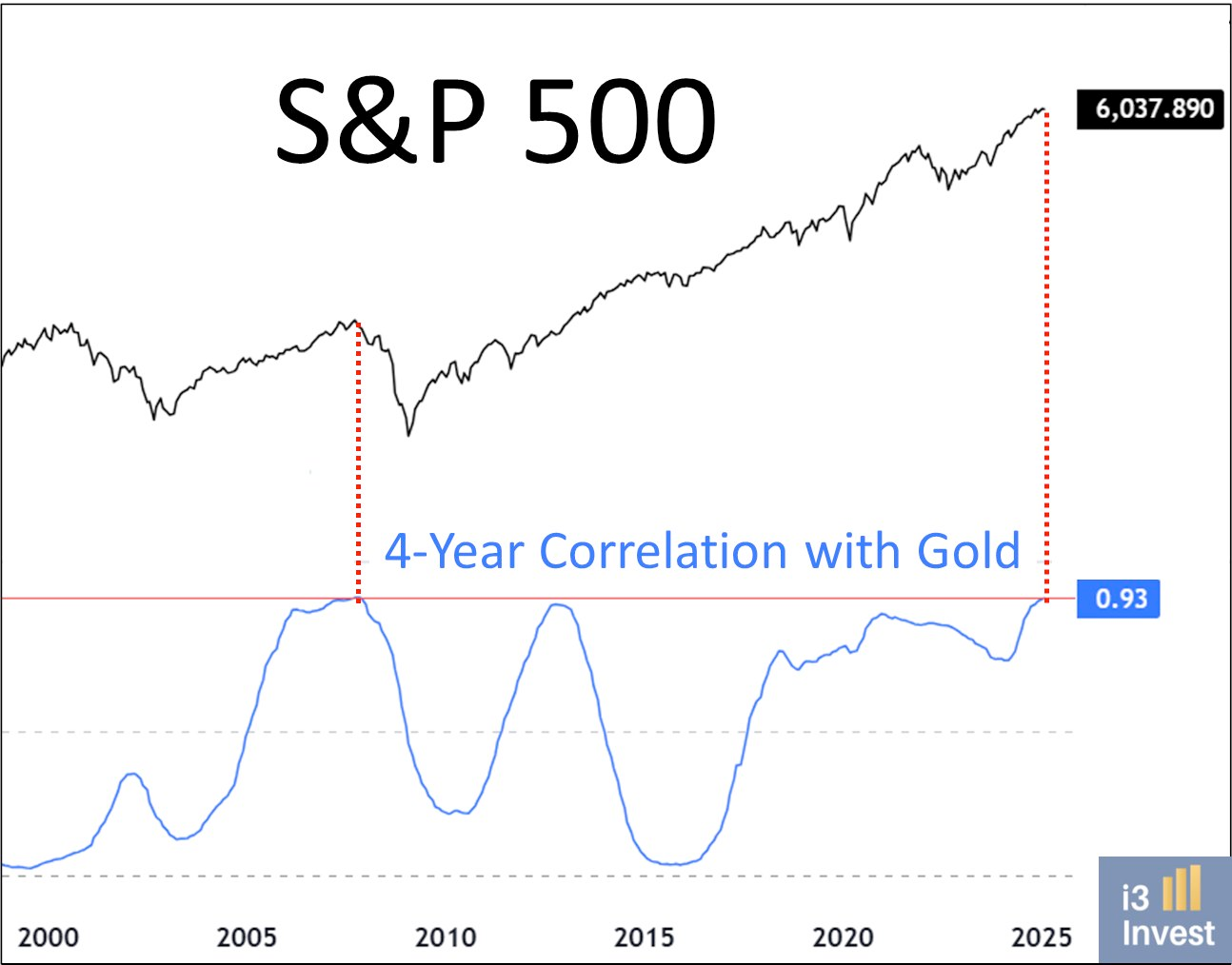

This is particularly perplexing considering the fact that equities are flat or up on the year, depending on the index you like to follow. Gold outperformed the S&P 500 significantly in 2024 and its momentum hasn't slowed down a bit in 2025 as the precious metal consistently hits new all time highs. The current correlation to the S&P 500 has only happened two times in history; right now and October of 2007.

Institutional investors and nation states are piling into gold at an unprecedented pace. This signals that they are preparing for something to break. The catalysts for the exodus of gold from London to the US and from paper gold to physical gold are fears over Trump's tariffs, institutions and governments preparing for a potential monetary reset, and fears of a looming liquidity crisis as liquidity in the reverse repo market dries up. Uncertainty and chaos rule the day and we are witnessing a flight to safety.

Many of you are probably asking, "Why isn't bitcoin moving?!" That's a good question. Considering everything mentioned above one would think that bitcoin would be on the move toward new all time highs as well. Having been following bitcoin for twelve years your Uncle Marty has developed some pattern recognition when it comes to this market. Upward bitcoin price movements typically happen in a staircase fashion. Meaning that it trends up and to the right over the long-run with quick bursts to higher levels followed by small corrections and consolidation periods. If I had to guess, we are currently in a consolidation period that should come to an end at some point in the next few months. In recent years, gold has moved higher first and bitcoin has followed. Typically outperforming gold significantly. I find it hard to believe that this relationship is going to end any time soon. Especially considering the geopolitical and economic backdrop.

During my recent conversation with Luke Gromen, he raised a sobering point about the velocity of monetary regime changes. Drawing from historical examples, including a Ukrainian family who saw their savings devalue from "five cars to one month's groceries" over a single weekend, Luke emphasized that Americans are uniquely blind to how quickly these transitions can occur. The current stress in our financial system - from Treasury market dynamics to global trade tensions - suggests we're approaching a similar inflection point.

"What if they do it on Friday night like they did with Trump coin and you wake up and gold's up 1,000% by the time you're up on Saturday morning, what are you going to do? You're going to sell your bonds and buy gold on Saturday?" - Luke Gromen

This warning shouldn't be taken lightly. Those waiting for clear signals before acquiring bitcoin may find themselves locked out of the transition entirely. Luke's analysis suggests that rather than a gradual shift, we're more likely to see a compressed timeframe where major monetary changes happen over days or weeks, not months or years. The recent Trump coin phenomenon, while different in nature, demonstrates how quickly markets can move when sentiment shifts dramatically.

TLDR: Major monetary changes happen fast - don't wait to stack sats.

Check out the full podcast here for more on DeepSeek's impact on AI markets, Colombia's trade negotiations, and Scott Percent's three arrows for economic reform.

U.S. Faces $1.67B Annual Cost Spike on Single Bond Rollover - via X

BlackRock: Bitcoin is Monetary Hedge, Ethereum is Tech Play - via X

Lummis: SBR Could Slash U.S. Debt by 50% in Two Decades - via X

Fold Launches Bitcoin Rewards Visa Credit Card - via Bussines Wire

Obscura VPN launches with a MacOS product - via nobsbitcoin.com

The SegWit (Segregated Witness) upgrade in August 2017 made two key changes to Bitcoin. First, it moved transaction signatures to a separate part of the data, fixing "transaction malleability" by preventing nodes from modifying transaction IDs. Second, it increased effective block capacity by introducing "weight units" that gave signature data a 75% discount, allowing blocks to grow from 1MB to about 1.8MB.

As a "soft fork," SegWit remained compatible with older Bitcoin software. The upgrade activated at block 481,824 after 95% of miners signaled support. This approach allowed Bitcoin to increase capacity and fix technical issues while maintaining network compatibility.

ICYMI Fold opened the waiting list for the new Bitcoin Rewards Credit Card. Fold cardholders will get unlimited 2% cash back in sats.

Get on the waiting list now before it fills up!

$200k worth of prizes are up for grabs.

Ten31, the largest bitcoin-focused investor, has deployed $150M across 30+ companies through three funds. I am a Managing Partner at Ten31 and am very proud of the work we are doing. Learn more at ten31.vc/funds.

Subscribe to our YouTube channels and follow us on Nostr and X: