As the year 2023 comes to a close, it’s fascinating to reflect on the dynamism of international trade, the underpinnings of our financial systems, and the looming concerns around currency strength and sovereign debt.

As the year 2023 comes to a close, it’s fascinating to reflect on the dynamism of international trade, the underpinnings of our financial systems, and the looming concerns around currency strength and sovereign debt. With the world becoming increasingly interconnected, the ripple effects of geopolitical tensions and economic policies are more pronounced than ever. Let's explore some of these complexities including, global trade routes, the potential impacts of the New Eurasian Land Bridge, the precariousness of the reverse repo market, and the intricate dance between bond markets and currency strength.

The question of how much the New Eurasian Land Bridge can compensate for trade disruptions in the Red Sea is a pertinent one. The Suez Canal, a critical chokepoint, has been a subject of concern for global logistics. While I don't have a definitive answer, it's clear that the rail lines connecting Europe and Asia play a minuscule role compared to the vast seaborne freight operations. However, considering the geopolitical implications, the inability of the US Navy to interdict rail-borne freight across Eurasia is a significant strategic shift. This has been a long-standing concern for China, which has been working on diversifying its trade routes since recognizing its ‘Malacca Dilemma’ in 2003.

The Belt and Road Initiative and other infrastructure projects are part of China's strategy to circumvent potential blockades. While these efforts may not completely offset the naval power of the United States, they represent a significant adjustment in the balance of economic and military strategy. The conversation often overlooks the extent of China's preparations, and it’s high time this aspect is brought into mainstream discussions.

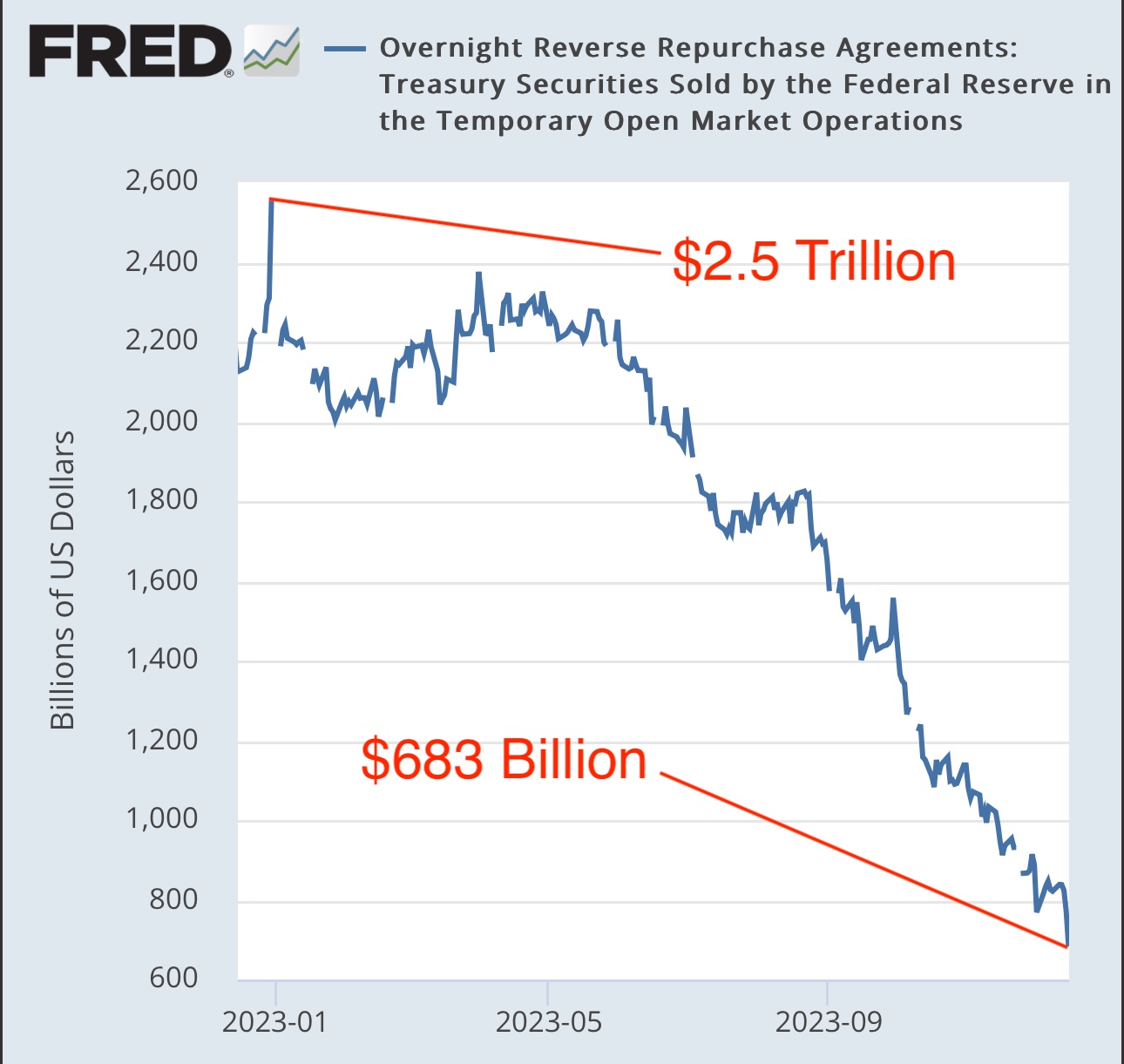

Turning to domestic financial mechanisms, the reverse repo market is an area of intrigue. The reverse repo balances have been acting as a form of sterilized quantitative easing, mitigating the Treasury supply-demand imbalance exacerbated by a strong dollar and higher Treasury issuance. As Janet Yellen shifts issuance to the front end, this has increased T-bill issuance and affected the reverse repo dynamics. What happens when reverse repo hits zero is a matter of conjecture, but the implications could be significant, potentially leading to increased volatility in the dollar, Treasury yields, and broader financial markets.

Nevertheless, it's essential to consider the broader context. Potential mitigating factors such as a weaker dollar, Treasury buyback programs, and the Fed's expanded standing repo facility could influence outcomes. The central clearing of Treasuries and changes in bank capital requirements could also play roles in how this scenario unfolds. It is imperative to avoid black-and-white thinking and understand the nuanced interplay of these financial instruments and policies.

The bond market and currency strength are inextricably linked. A strong dollar can lead to Treasury market dysfunction as foreign holders of U.S. debt, faced with a need for more dollars, may liquidate their assets, including Treasuries, thus increasing yields. This mechanism highlights the importance of the U.S.'s net international investment position, which has shifted dramatically over the past few decades from a creditor to a debtor nation. With foreigners owning significant U.S. assets, a strong dollar can trigger asset sell-offs, impacting the Treasury market.

When it comes to the ultimate choice between sacrificing the bond market or the currency, history suggests that governments tend to choose the latter. In a fiat currency system, the ability to print money often leads to currency devaluation as a means to manage debt obligations, rather than defaulting on bonds or shrinking government size. The implications are profound – a balancing act between maintaining a level of inflation that doesn't spiral out of control while ensuring that sovereign debt remains serviceable.

As we wrap up the year, these topics underscore the systemic fragility and interconnected nature of the global financial system. It's a system where the flow of goods, the strength of currencies, and the stability of sovereign debt are all part of a delicate equilibrium that can be disrupted by a range of factors. From the strategic moves of nations to the arcane workings of financial markets, the implications for investors and policymakers alike are substantial. Ensuring a broad understanding of these dynamics is crucial as we navigate an increasingly uncertain economic landscape.