The Federal Reserve's financial stability report reveals significant economic vulnerabilities, highlighting overvalued stock markets, deteriorating credit conditions, and commercial real estate uncertainties.

The Federal Reserve (Fed) recently released its semi-annual financial stability report, shedding light on the health of the financial system and highlighting various risks, particularly those related to the stock market and credit markets. The report indicates a disconnect between an ostensibly booming economy and certain financial indicators that suggest otherwise.

The report outlines several key risks in the stock market, with a particular focus on valuation measures. It acknowledges that stock prices may be overstretched, as indicated by high price-to-earnings (P/E) ratios. A significant risk is that if the economy does not perform as expected, these elevated valuations could lead to a market correction.

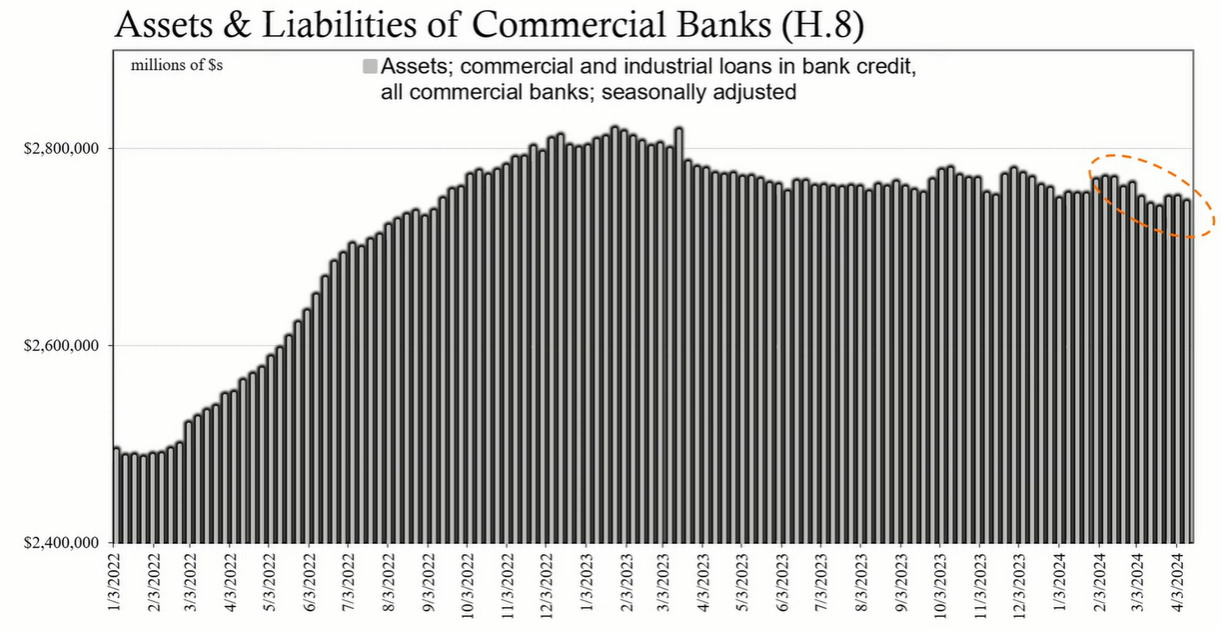

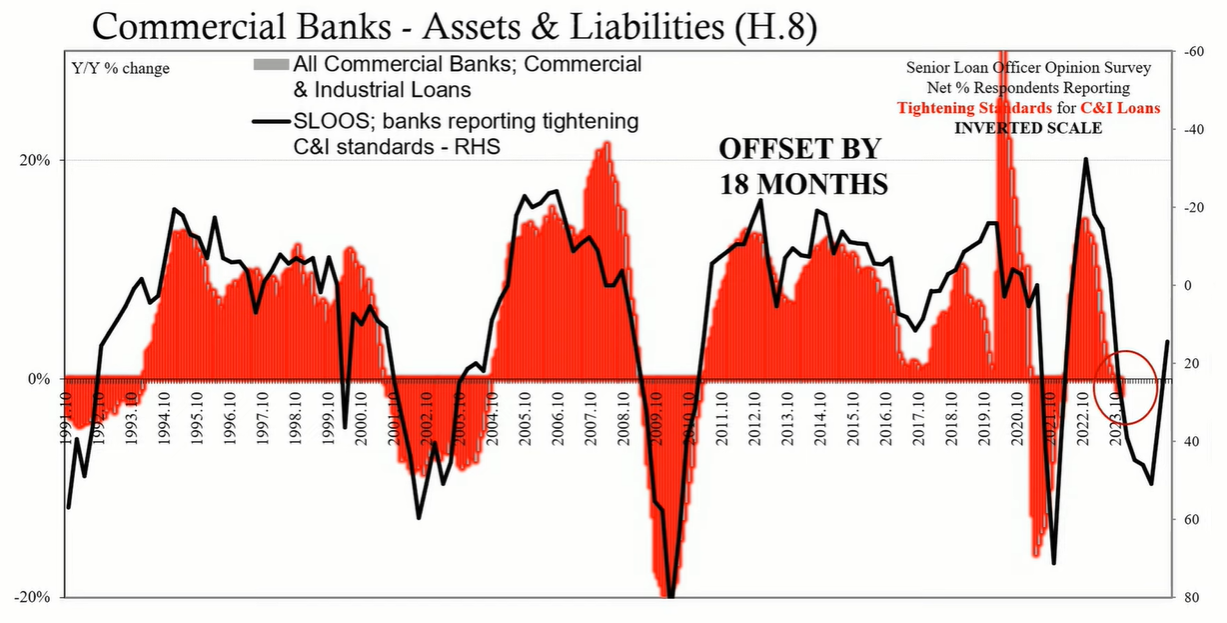

The Fed's report also notes a deterioration in credit and lending markets, with declines in both consumer lending and commercial and industrial (C&I) lending. These trends are tightly correlated with the unemployment rate, and the recent patterns suggest a potential increase in unemployment in the near future.

Commercial real estate (CRE) is another area of concern. The report points to continued declines in CRE prices and suggests that the market lacks price discovery due to owners delaying property sales in hopes of more favorable conditions. This uncertain landscape for CRE could lead to significant losses for banks and investors with concentrated exposures, which might reduce credit availability and weigh on the broader economy.

Despite the report's reassurance of a strong banking system, evidence suggests that banks are becoming more cautious. They are scaling back credit, a move that reflects their concerns about potential CRE issues and broader economic challenges. This behavior is indicative of a lack of confidence in a soft landing for the economy.

The H.8 statistical release from the Fed provides a more updated and detailed picture of the banking and credit environment. It shows a recent downturn in total lending, with a particular emphasis on consumer loans and C&I loans. The data aligns with the senior loan officer opinion survey, which predicts a lagged impact on C&I loans and subsequently the unemployment rate.

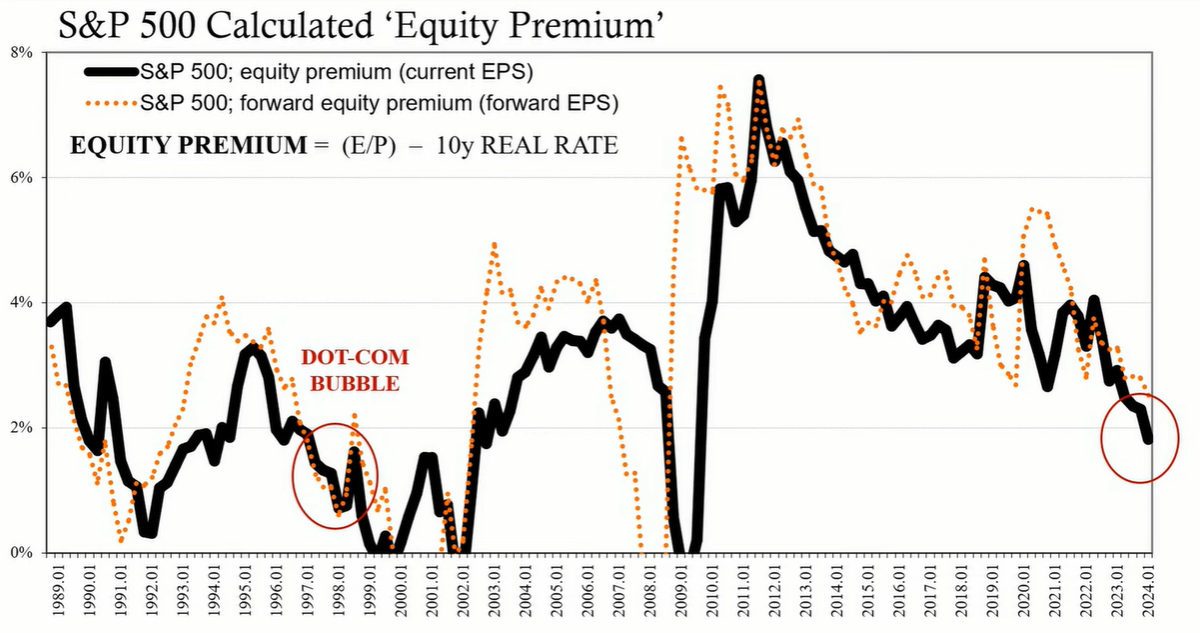

The Fed's report also discusses the equity risk premium, comparing the forward earnings yield of stocks to the real yield of "risk-free" bonds such as ten-year Treasury notes. The current low levels of the equity risk premium indicate that stocks are highly valued relative to historical norms and suggest limited support for current price levels in the event of a downturn.

The Fed's financial stability report highlights several areas of risk within the financial system. The stock market shows signs of overvaluation, and there is a disconnect between the ostensibly robust economy and the tightening credit environment. Commercial real estate remains a concern, with potential implications for the banking sector and credit availability. Although the banking system is reported to be resilient, the data suggests that financial institutions are preparing for a less favorable economic landscape. The correlation between credit conditions and unemployment rates reinforces the importance of monitoring these indicators for future economic health.