The U.S. economy shows underlying struggles with modest employment gains and struggling consumer spending, suggesting a discrepancy between narratives and actual economic conditions.

Mainstream metrics show strength in the economy, which has prompted Federal Reserve officials to adopt an aggressive stance in fear of consumer prices spiraling out of control. The primary concern is inflation, which is typically interpreted as a sign of an overheating economy.

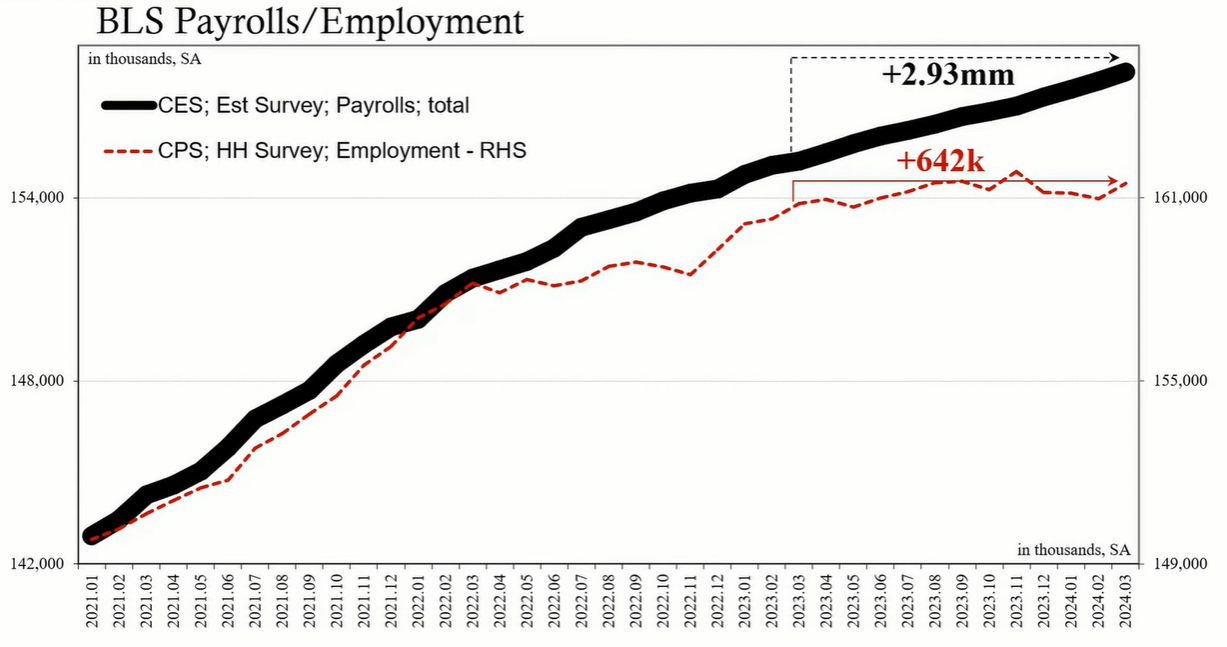

However, the Federal Reserve's Beige Book for April 2024 presents a more nuanced view. It indicates that employment has risen at a slight to modest pace, with variances across different districts. Reports suggest increases in labor supply and the quality of job applicants, improved retention at some firms, yet also mention staff reductions at others. This dichotomy contrasts with consistently high expectations for payroll reports, suggesting that the labor market may not be as robust as headline numbers imply.

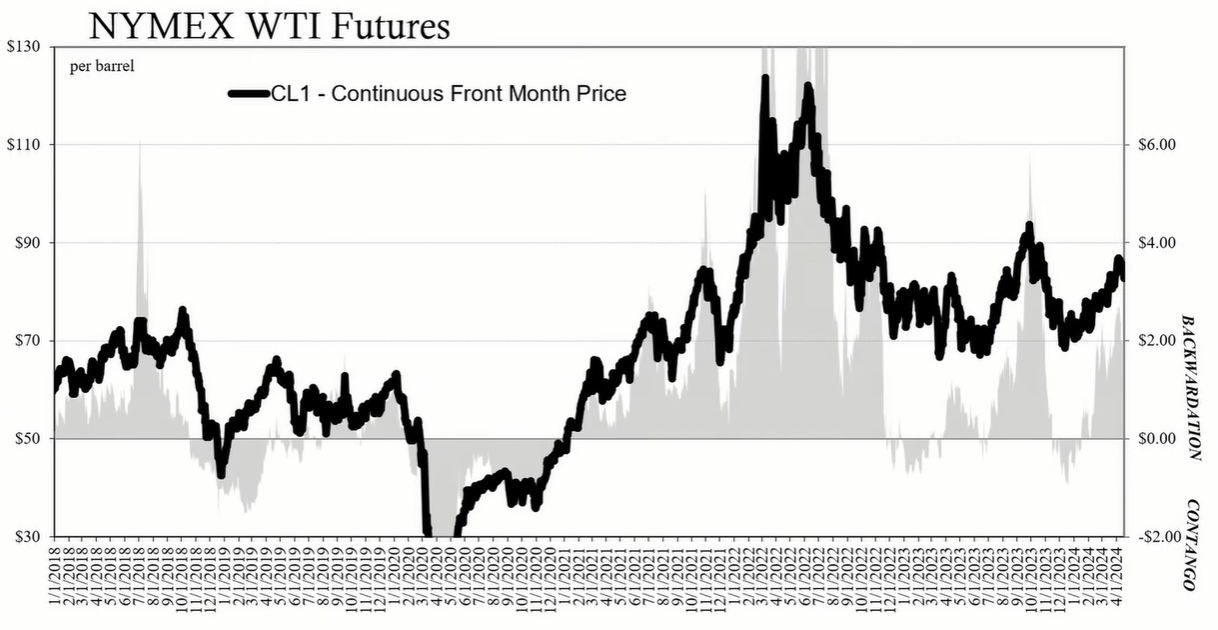

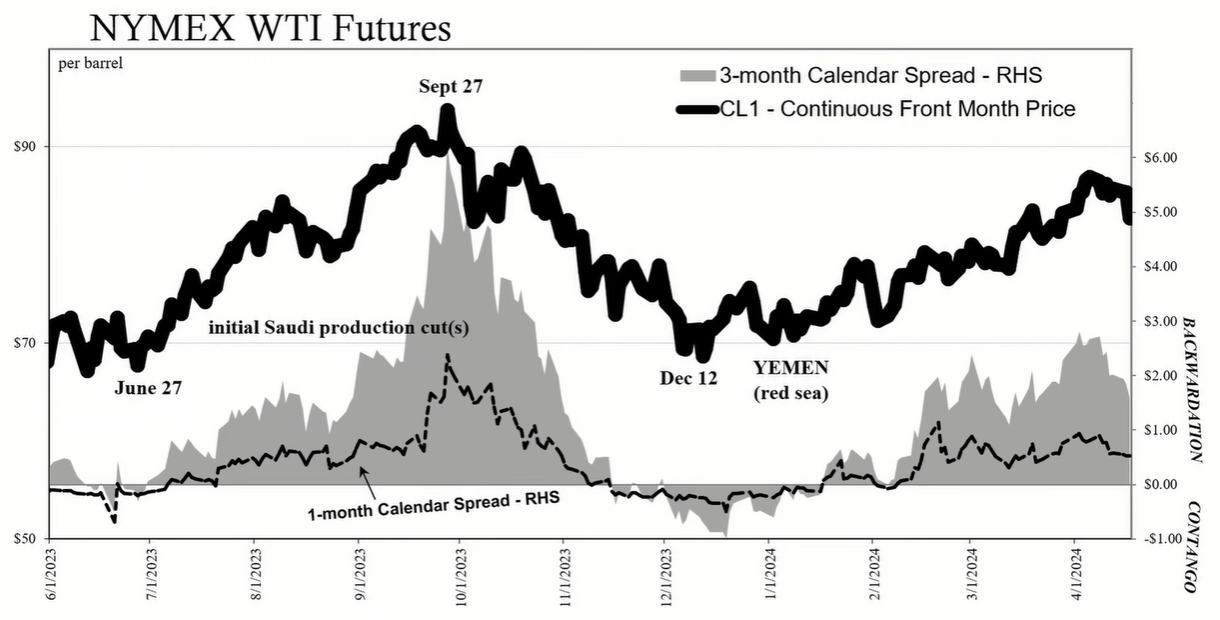

The Consumer Price Index (CPI) is a crucial point of analysis. A high CPI is commonly associated with a strong economy, but current CPI levels may be misleading. The inflation that is perceived to indicate economic strength is primarily driven by shelter and oil prices. Rents, contrary to the CPI's depiction, are reportedly flat to slightly lower in many areas, and developers are struggling to fill new projects. Additionally, oil prices appear to be influenced more by geopolitical tensions rather than actual demand, which casts doubt on the narrative of a booming economy.

Consumer spending patterns reveal further economic strain. The Beige Book mentions that spending is barely increasing, with discretionary spending suffering due to elevated price sensitivity among consumers. When inflation outpaces wage growth, it forces consumers to cut back on discretionary purchases, potentially leading to disinflationary pressures.

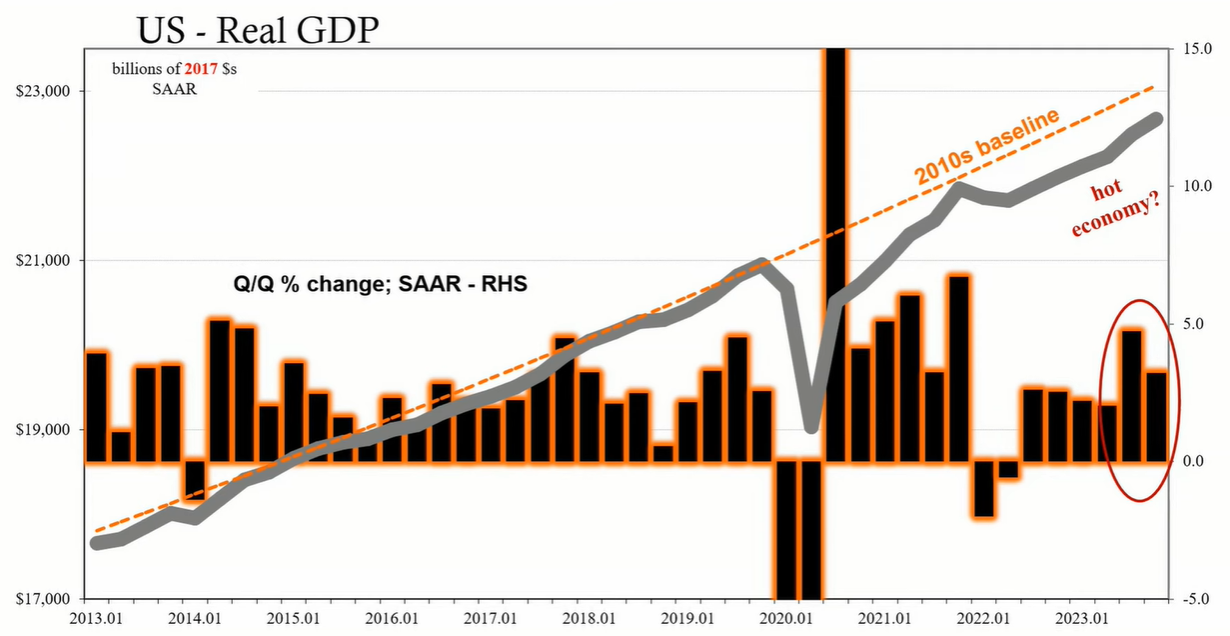

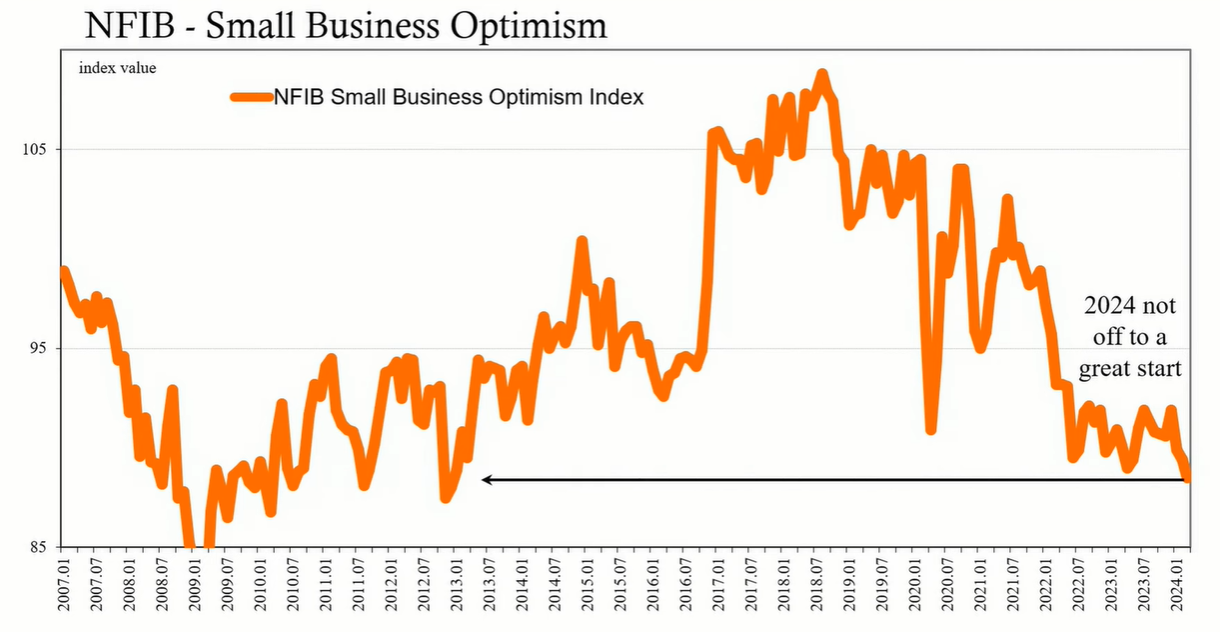

Gross Domestic Product (GDP) numbers have been positive, but inventory builds may be inflating these figures. As companies face a situation where stockpiles grow without corresponding consumer demand, the potential for an inventory glut increases, which could lead to an economic downturn. Small business optimism is at a low, with many businesses facing cost pressures and declining sales, which further contradicts the positive outlook presented by some economic indicators.

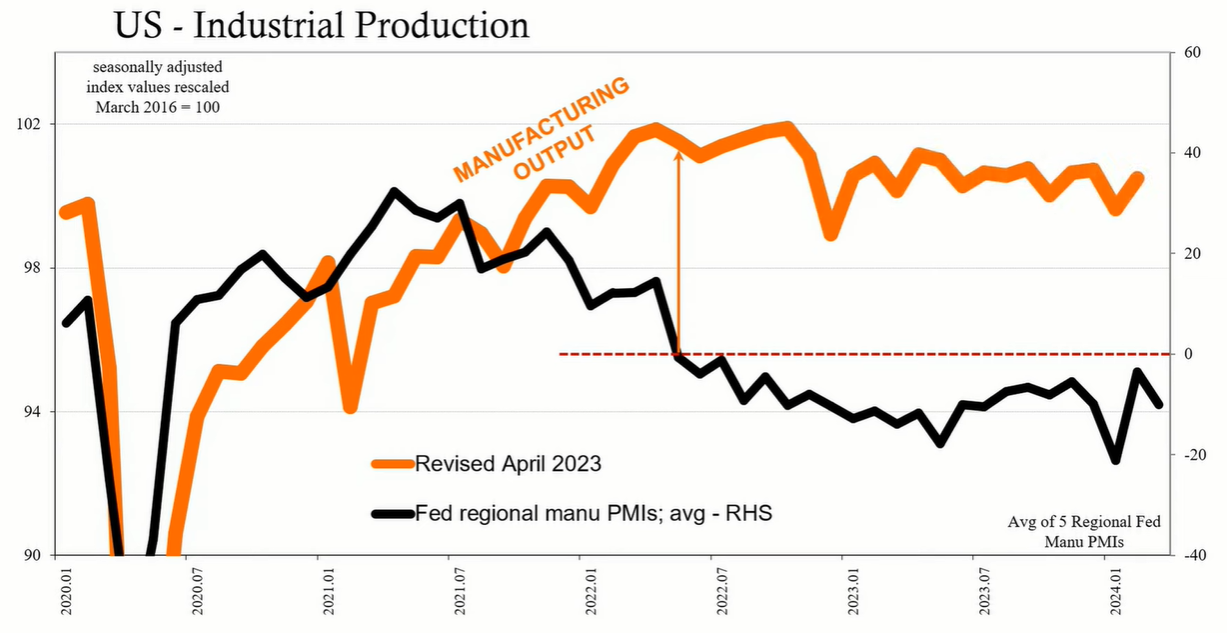

Regional Federal Reserve manufacturing surveys also hint at an economic inflection point, with slowing growth that could be exacerbated by rising oil prices. The Beige Book itself points out that the overall economic activity has expanded slightly, a far cry from the booming economy narrative.

The juxtaposition of strong headline economic numbers against more concerning detailed reports and surveys suggests that the U.S. economy is at a crossroads. While nominal GDP figures and payroll data appear healthy, the real economic conditions reflected in consumer spending, small business sentiment, and regional data paint a picture of an economy that is not experiencing the growth implied by certain statistics. Inflation, driven by factors other than consumer demand, may not be the reliable indicator of economic health it is often assumed to be.