There is no stopping an idea whose time has come.

Last week the team at Bitcoin Park in Nashville, Tennessee hosted the Nashville Energy and Mining Summit. As you may be able to tell by the name of the summit, professionals from across the mining and industries congregated to discuss a wide range of topics. I still have a bunch of the discussions from the end of last week ping ponging in my mind, so I figured I'd write down some of the things I took away from the event and share them with you all here. The summits at Bitcoin Park follow Chatham House rules, so I won't be able to attribute any of the takeaways to particular individuals.

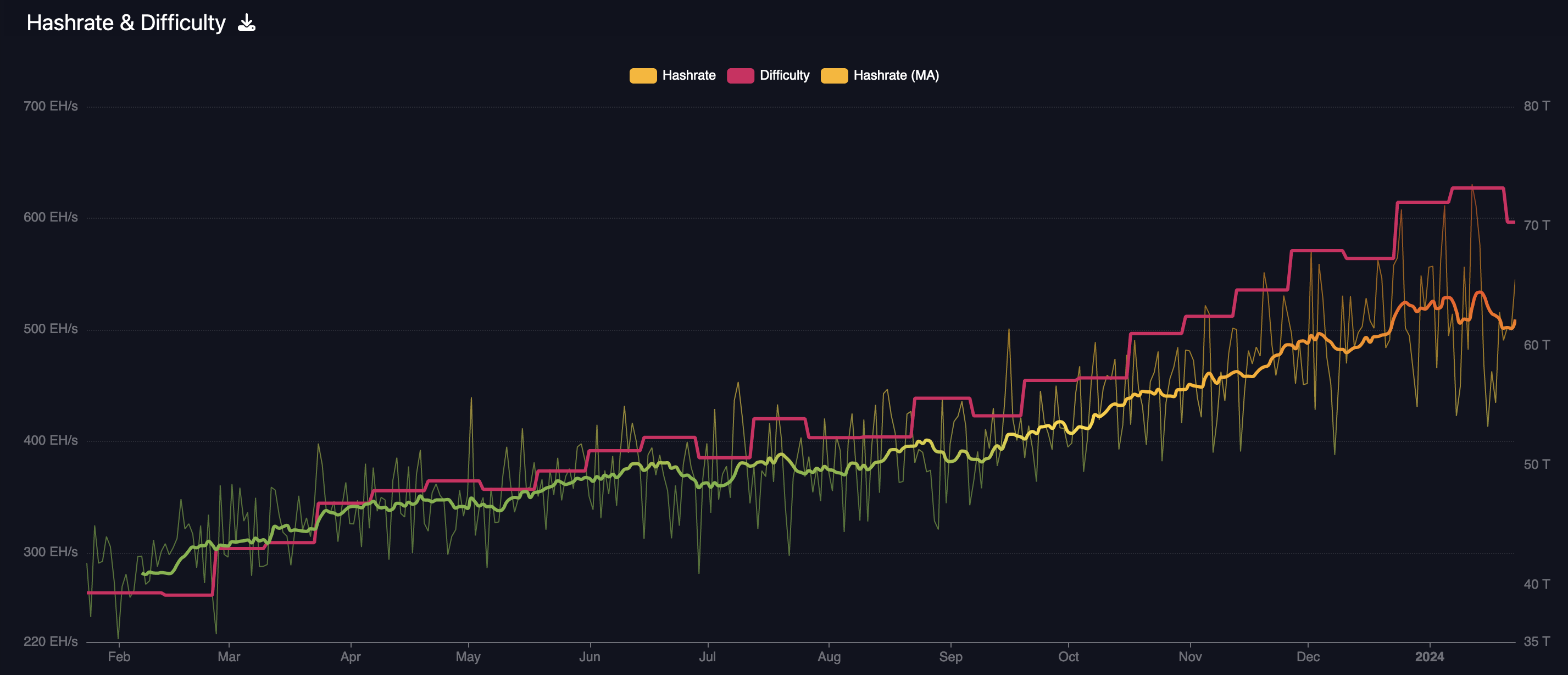

After the Chinese Communist Party decided to ban mining within China in the middle of 2021, a material amount of hashrate migrated to the United States. Current estimates state that anywhere from 35-40% of bitcoin's network hashrate is operating in the United States. With a large chunk of that located in the state of Texas. It was funny that the summit was happening last week because there was a polar vortex that devoured the Southern part of the United States, which spike the demand for energy on grid systems and forced miners accounting for gigawatts worth of power to wind down to ensure the grids remained stable. At one point, ~25% of the total network hashrate came offline, with some saying that Texas miners alone sent 2 gigawatts worth of electricity they would have used back to the grid.

25% of bitcoin hashrate is offline!

— Braiins (@BraiinsMining) January 17, 2024

Down from 525 EH to 395 EH in just few days. Caused by freezing weather in the US - miners turning off to save the grid.

The grid needs the energy for heating households so miners switch off automatically. Demand response at its best🤌 pic.twitter.com/vVTBN8f545

This showed up in the difficulty adjustment over the weekend, which came in at -3.9%.

While it is exciting to see that miners are playing a crucial role to stabilize grids during periods of peak demand, it is not ideal to have this amount of hashrate concentrated in the United States. This shouldn't be surprising considering the fact that Americans, despite the collectivists who make up our federal government, are extremely entrepreneurial, have access to the most mature capital markets in the world, and the most robust energy infrastructure in the world (again, despite what the collectivists have done to destroy these advantages).

Luckily for those of us who worry about geographic hashrate centralization, the discussions during the summit have made me extremely optimistic that hashrate is about to enter another phase of rapid geographic distribution. It is becoming clear that energy rich countries in the Middle East are becoming well aware of the opportunity bitcoin mining presents for them to take advantage of their cheap electricity and stranded energy sources. At the same time, advancements in ASIC water cooling technology have reached the point where it is becoming viable to run mining operations in extremely hot geographies.

On top of this, bitcoin mining is proving to be a great way to bootstrap energy systems in areas across Africa that do not have the correct economic incentives in place to justify build outs. A consistent buyer of first and last resort solves the zero to one problem.

Expect mining activity to pick up in the Middle East, Africa and South America.

With Bitmain's aggressive pricing of their s21 series of miners ($14/Th) out of the gate it is clear that the largest bitcoin miner manufacturer in the world is attempting to use its economies of scale to muscle out their competition. It will be interesting to see if the pricing moves are able to suffocate the smaller ASIC manufacturers. I think MicroBT should be safe, but the others are probably sweating. If the s21 series from Bitmain proves to provide the market with durable and reliable hardware, we could see the bitcoin mining hardware market turn into an entrenched duopoly. Though, it is encouraging to see hardware providers catering to home miners like FutureBit seeing a lot of success in the market.

It is becoming abundantly clear that the stock firmware offered by Bitmain and MicroBT is not meeting the demands of the market. Miners located in different environments and in different economic situations demand different outputs from their machines. The ability to tap into the firmware running on the machines is essential to running a mining operation as efficiently as possible to ensure the long-term health and financial viability of a mining fleet. Miners have had to turn to after-market firmware like Braiins OS+ to reap these benefits.

Unfortunately, to even get after-market firmware like Braiins OS+ to the market it takes a Herculean effort for the firmware producers to jailbreak the machine and make it so their firmware is compatible. I think it is very clear that something needs to happen to create a mining firmware standard of sorts to make it as easy as possible for third party firmware producers to bring better products to market. A return to the open source standards set by a project like CGMiner would be a step in the right direction in my opinion.

As the landscape in mining becomes more cut throat due to the sheer amount of competition that is entering the arena (nation states, utilities companies, power plants), the ability for most miners to depend solely on mining revenues is going to falter. It is imperative for any sizable miner to - if they haven't already - begin thinking about incorporating alternative revenue streams into their business plans. Miners engaged in demand response are already doing a good job of this. The profit margin squeeze is coming as low cost energy producers and nation states who can operate at a loss for longer begin to enter the market at scale. I am more convinced than ever that miners will begin to consolidate with large energy producers and utilities companies to drive their costs down to rates that will ensure they remain competitive. Well actually, it will be a mixture of consolidations, energy companies incorporating their own mining operation, and miners acquiring energy assets.

The Energy and Mining Summit was particularly exciting for me because it was the first mining event I've been to over the last six years that convinced me that top-notch operators and professionals from the energy sector have fully groked bitcoin mining and see an opportunity to leverage their skills and expertise to throw jet fuel on the mining industry. To date, miners have been fighting an uphill battle against their lack of experience with power markets and infrastructure build outs. Even though the mining industry has matured considerably over the last few years, I believe this has been an outcome predominately driven by pure grit, determination, and a deep understanding of an asymmetric opportunity. Even though miners deeply understand the asymmetric opportunity that bitcoin mining presents in the world of electricity price arbitrage, the last five years or so have been a pure baptism by fire in the energy sector. Filled with miners making mistakes when signing power purchase agreements, not understanding the logistics that go into energy infrastructure build outs, and not knowing the nuances of the power generation side of things that can trip them up at some point.

The industry has certainly learned a ton in a short period of time and the overall level of understanding will continue to increase. However, the reinforcements have arrived on the front lines in the form of power and infrastructure professionals who have come to understand the asymmetric opportunity at play and are now focused on using their decades of experience to teach miners the right way of doing things. Structuring power purchase agreements the right way. Aligning incentives with power producers to ensure long-term partnerships materialize. Cutting down the time it takes to build infrastructure and facilities. All of that knowledge is coming to the bitcoin mining arena and I could not be more bullish.

Despite all of the vitriol toward bitcoin mining and bitcoin more generally coming out of Washington DC, it doesn't seem that miners are that fazed. Again, they understand a massive opportunity and they aren't going to allow some screeching Karens to make them back away from the action. This is the way. There is too much at stake and the collectivists aren't sending their best. The bitcoin mining industry has more data to combat the baseless FUD than ever before and the vibe shift is well under way. I don't think there is any need to cater to those screeching from their pedestals in DC. In fact, I think the numbers are speaking for themself that the benefits bitcoin mining provides companies, grid systems and energy producers are undeniable. One of the largest power providers in the country attended the summit and made it clear that miners are a net benefit to their operations. We have just reached the point where the benefits have piqued the interest of the power providers where they deem it necessary to lean in and begin working more closely with the mining industry to better understand what we need and where we can be the most beneficial to their operations.

There is no stopping an idea whose time has come.

Final thought...

Modernity is filled with hideous aesthetics.