It's the money, stupid.

One of my biggest pet peeves these days revolves around the housing affordability crisis. We've covered it in recent weeks, but I want to keep hammering this point home because I think many otherwise intelligent people are missing the forest for the trees. The idea that we can solve a problem stemming from central planning - houses are unafforable because they are used as store of value assets - with more central planning - build more houses! - completely neglects the reality of the incentives driving new home construction.

Nothing makes this clearer than the video above, which highlights the poor quality of many new home builds. Even those that are deemed to be "luxury builds". Just look at this $3,500,000 "luxury" build that has never had a tenant. The quality of the build is so bad that I find it hard to believe it would be bought by someone who was actually planning to live in it. MAYBE it could find someone who wants to rent it out, but even that seems far fetched.

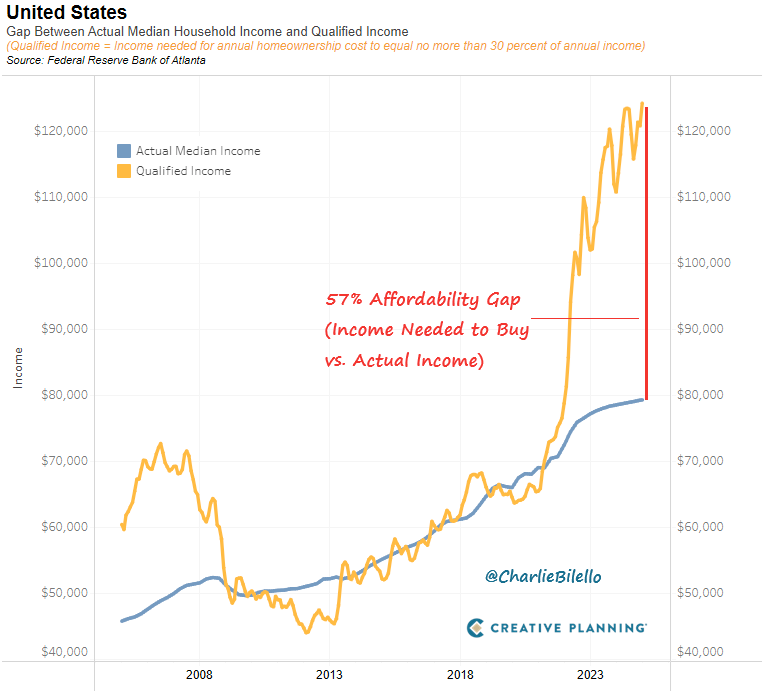

What you're looking at is an example of destroyed capital created by malincentives introduced by easy money. Over the course of many decades, due to the increasing inflationary pressures there has been a precipitous decline in quality. Higher quality building materials have been replaced with lower quality materials so that builders can build faster to get houses to the market and flip them to new home buyers and because real estate has turned into the savings vehicle of choice for many Americans, they are pushing them on the market at higher and higher prices. Selling the (pipe) dream of a housing market that only goes up and to the right in terms of real estate values. The United States economy is reaching the point where the numbers simply do not make sense.

It seems like a correction is necessary to bring back some semblance of sanity to real estate markets in the US. In the short term, a necessary correction would likely be facilitated by a deep recession that forces homeowners to sell their assets at lower prices so that they can raise cash to weather economic turbulence. In the long term, a reversion to the mean of sensible real estate prices will be driven by individuals slowly but surely moving the monetary premium that currently exists in the real estate market and into bitcoin. Real estate should be priced at it's building cost with embedded profit margin for the builder, a premium for aesthetics, and an additional premium on location (determined by schools in the area, crime rates, local economy, municipal services, etc.). The monetary premium, which makes up a lion's share of real estate values today should revolve into bitcoin.

More on that tomorrow. Make sure you subscribe to the newsletter and share it with friends and family.

Structured Bitcoin products create bridges for risk-averse investors who want exposure without volatility anxiety. On a recent episode of TFTC, Pierre Rochard and I explored how these products can transform Bitcoin adoption, particularly among traditional financial advisors and institutions. As Pierre pointed out, Bitcoin's volatility has been a significant barrier for those on the "left side of the curve" – investors conditioned by a financial system where volatility is artificially dampened through central bank intervention.

"The median Bitcoin held is two years. That number has been going up and will continue to go up, especially with products that allow people to use Bitcoin as an asset they can borrow against." - Pierre Rochard

Products like MicroStrategy's treasury strategy and proposed BitBonds are early exemplars of this approach. By removing Bitcoin from the market for set periods within structured vehicles, we create certainty about selling pressure. This predictability can actually lower Bitcoin's volatility over time, creating a virtuous cycle that makes Bitcoin more attractive to mainstream investors – all while preventing forced liquidations that historically exacerbate market downturns.

Check out the full podcast here for more on Bitcoin's monetary nature vs. DeFi, the Strategic Bitcoin Reserve concept, and how Bitcoin can recapitalize the global credit system.

Bitcoin Policy Institute Releases It's Bitcoin Bond Proposal - Via X

Strategy Acquires Another 22,048 Bitcoin - via X

2.1m Non-Citizens Received Social Security Benefits in 2024 - via X

BlackRock Warns USD Dominance is at Risk - via X

French Firm Amasses 620 BTC as Europe Embraces Bitcoin - via X

Trump Backs Lummis for Crypto-Friendly America - Via X

Trump Slaps 25% Tariff on All Foreign-Made Cars - Via X

ICYMI Fold opened the waiting list for the new Bitcoin Rewards Credit Card. Fold cardholders will get unlimited 2% cash back in sats.

Get on the waiting list now before it fills up!

$200k worth of prizes are up for grabs.

Ten31, the largest bitcoin-focused investor, has deployed $150M across 30+ companies through three funds. I am a Managing Partner at Ten31 and am very proud of the work we are doing. Learn more at ten31.vc/funds.

Final thought...

The Rodeo is an incredible example of Americana.

Get this newsletter sent to your inbox daily: https://www.tftc.io/bitcoin-brief/

Subscribe to our YouTube channels and follow us on Nostr and X: