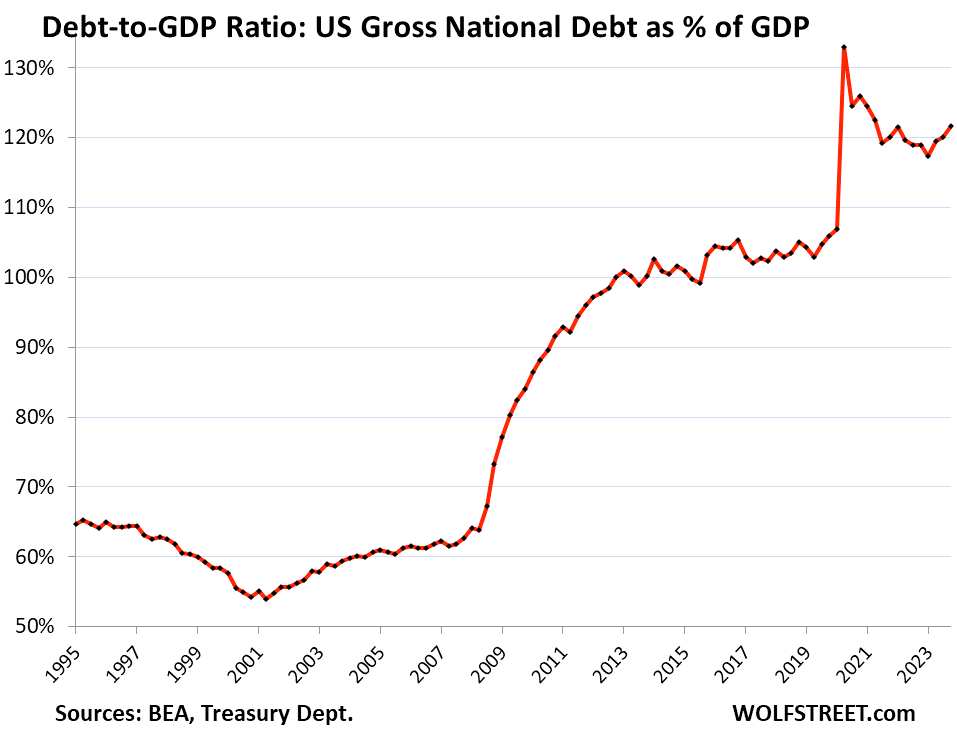

Historically, when a country's debt to GDP ratio goes above 120% things go downhill in a hurry. The US currently has a debt to GDP ratio of 123%.

Larry Lepard laid out a compelling case for why our current monetary system is approaching a breaking point. The system's fundamental requirement for inflation to service existing debt has created an unsustainable spiral, with debt-to-GDP ratios now at 120% - far beyond the 30% level when Volcker tackled inflation in the 1980s. This mathematical reality, as Larry emphasized, means we can't simply raise rates to fix the problem like Volcker did. The Federal Reserve's response to each crisis has required increasingly larger money printing, with Powell printing $6 trillion in just 18 months compared to Bernanke's years-long process to reach similar numbers.

"The system is structured to require inflation. It's just math. Without inflation, we've got debt. Our money system is based on debt." - Lawrence Lepard

The evidence of this systemic breakdown is already visible in the markets. Larry pointed out that since 2020's major money printing began, gold has risen 200% against bonds while bitcoin has surged 2000%. This dramatic shift away from traditional "risk-free" government bonds signals a sovereign debt crisis that can't be ignored. As I discussed with Larry, these aren't just abstract numbers - they represent a fundamental breakdown in the foundation of our monetary system.

TLDR: Math shows our debt-based money system is breaking. Signs everywhere.

Check out the full podcast here for more on Trump's monetary policy plans, the future of US Treasury markets, and nation-state Bitcoin adoption.

A block in bitcoin is a collection of transactions added to the blockchain through mining, where miners gather transactions into candidate blocks with metadata headers.

To add a block, miners must find a special number (nonce) that, when combined with the header and hashed, produces a result below a network-determined target value. Once solved, the block's transactions are added to the blockchain, and miners begin working on the next block.

Don't look now, but the liquidity in the reverse repo market fell below $100B earlier this week. This is a chart to follow in the coming months. Many are speculating that a draining of the reverse repo market is what would cause a liquidity crisis and force the Fed to kick start QE again.

Bitcoin Tracker Monitors State & Federal Reserve Bill Progress - via X

Bitcoin Drops with Tech Stocks Despite No DeepSeek Connection - via MarketWatch

OpenSecret Launches Maple AI, an End-to-End Encrypted AI Chat Bot - via Nostr

Ray Dalio Owns Bitcoin, "That's my diversifier." - via X

Block Launches "Codename Goose", an Open Source on-machine AI Agent - via Nostr

Turn your everyday purchases into a way to stack sats. With new gift card options, earn bitcoin rewards for everything from rides to groceries with Fold.

Ten31, the largest bitcoin-focused investor, has deployed $150M across 30+ companies through three funds. I am a Managing Partner at Ten31 and am very proud of the work we are doing. Learn more at ten31.vc/funds.

Subscribe to our YouTube channels and follow us on Nostr and X: