This article provides a comprehensive analysis of the growing stresses in the commercial real estate market, highlighting its far-reaching implications.

The commercial real estate (CRE) market is experiencing significant stress, which has implications that extend beyond individual regional banks' asset write-downs or potential failures. The impact of these stresses could have a ripple effect across global financial markets and economies.

Recent data indicates troubling signs in the commercial real estate sector. In Japan and Germany, banks have reported substantial losses connected to U.S. CRE investments, highlighting the global reach of the issue. This is reminiscent of previous financial crises where real estate played a central role.

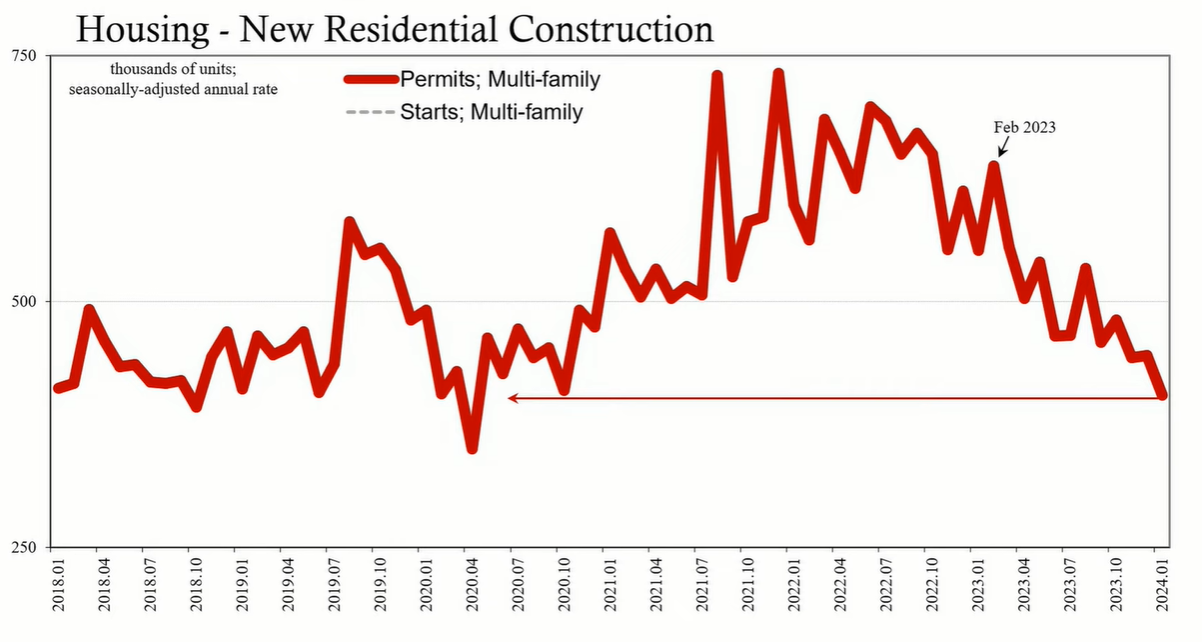

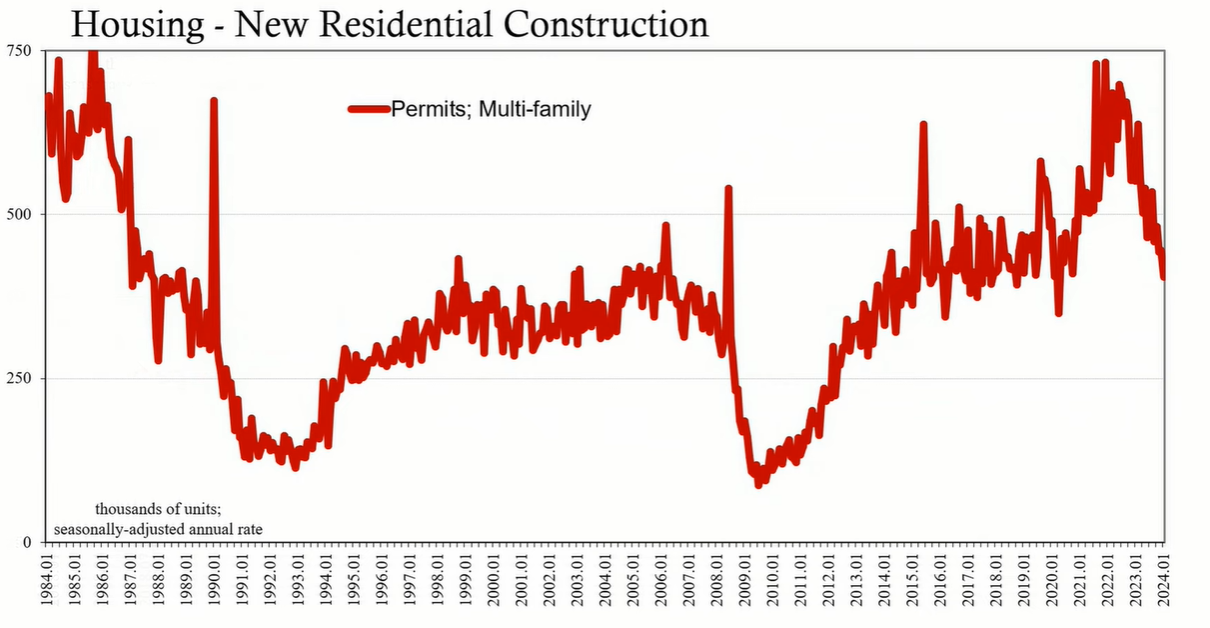

The U.S. Census Bureau's recent data on multifamily construction gives a glimpse into the state of the CRE market. In January 2024, multifamily permits plummeted to a seasonally adjusted annual rate of 405,000, the lowest since April 2020. This followed an unusually high peak of nearly 750,000 permits in late 2021 and early 2022. The sharp decline in permits, coupled with a similar downturn in construction starts, which dropped to 314,000 in January, suggests a potential financing issue affecting apartment construction.

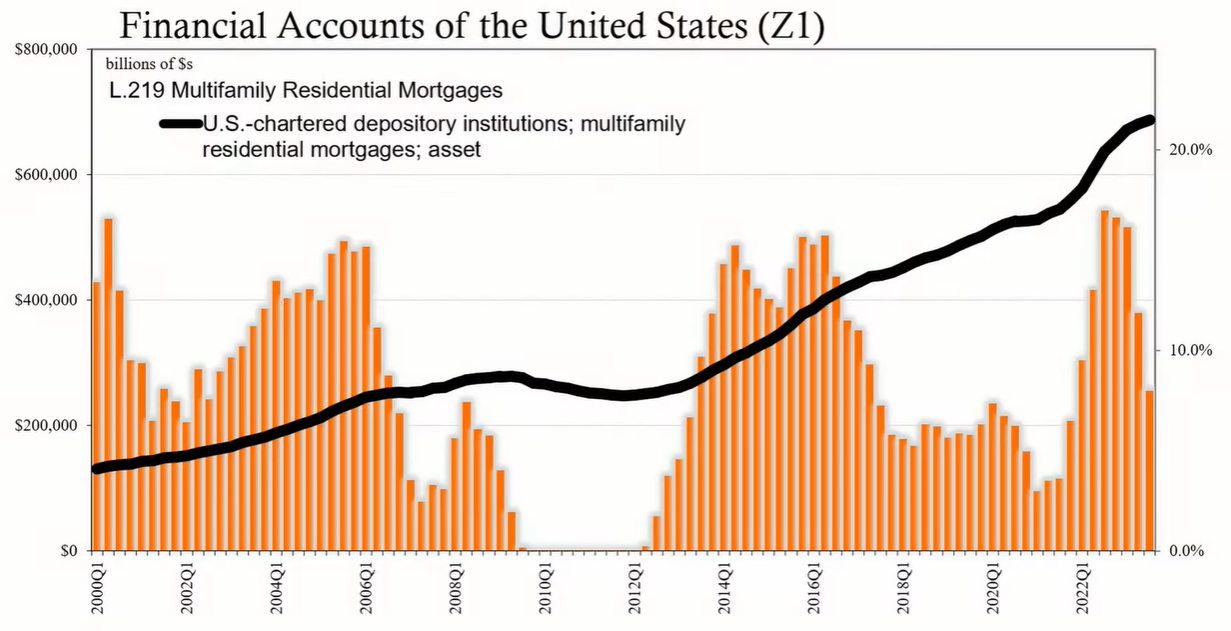

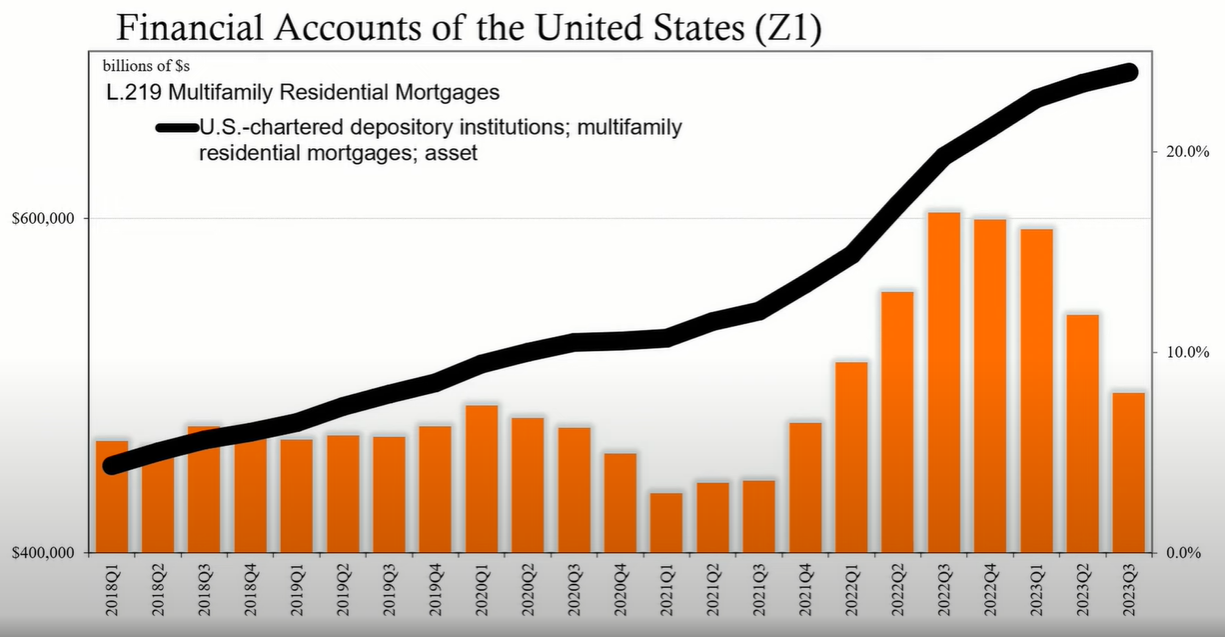

Examining the broader CRE debt landscape, Federal Reserve statistics reveal a rapid escalation in debt levels. The financial accounts of the United States show that combined commercial and multifamily mortgage debt swelled from approximately $4.6 trillion in 2020 to $5.6 trillion at the end of 2022. This represents a $1 trillion increase on a $4.6 trillion base within a short time frame, an aggressive expansion driven by assumptions that are now being called into question.

The CRE market has traditionally been supply inelastic, meaning it does not readily adapt to sharp increases in demand. When demand surged due to the influx of debt financing, the only adjustable factor was prices, which led to a substantial increase. This price surge created an enormous market imbalance, with a trillion-dollar scale behind the current CRE problem.

The full implications of the CRE market stress are not yet clear. The scale of the problem is significant, and the misalignment between debt assumptions and market realities poses a risk to financial stability. However, the market has not reached a crisis point, indicating there may be opportunities to address these issues before they escalate further. The CRE market is facing a period of uncertainty, with potential consequences for the broader economy. Understanding the nuances of this sector is crucial for investors and stakeholders.