Show some self respect and avoid Coinbase.

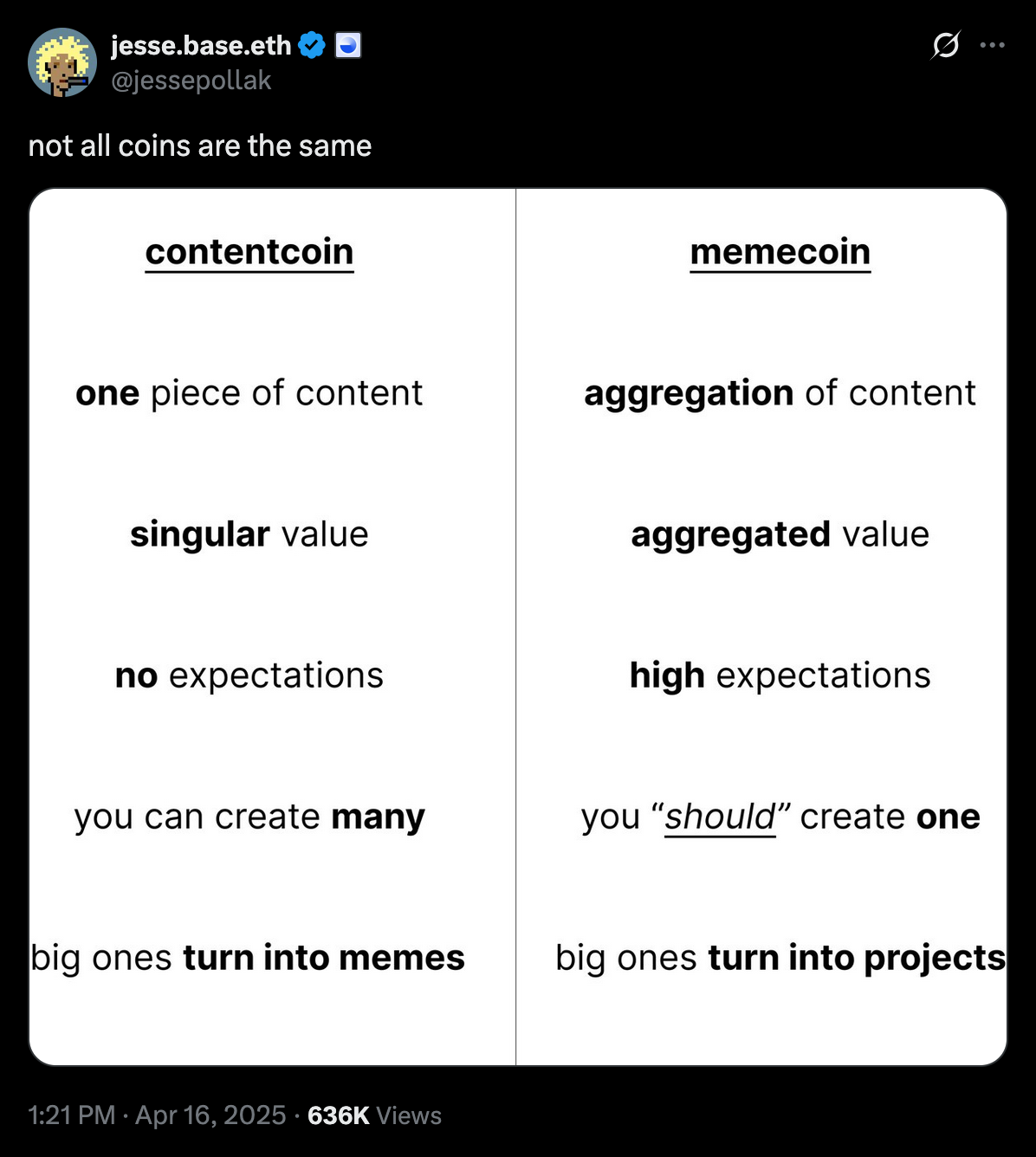

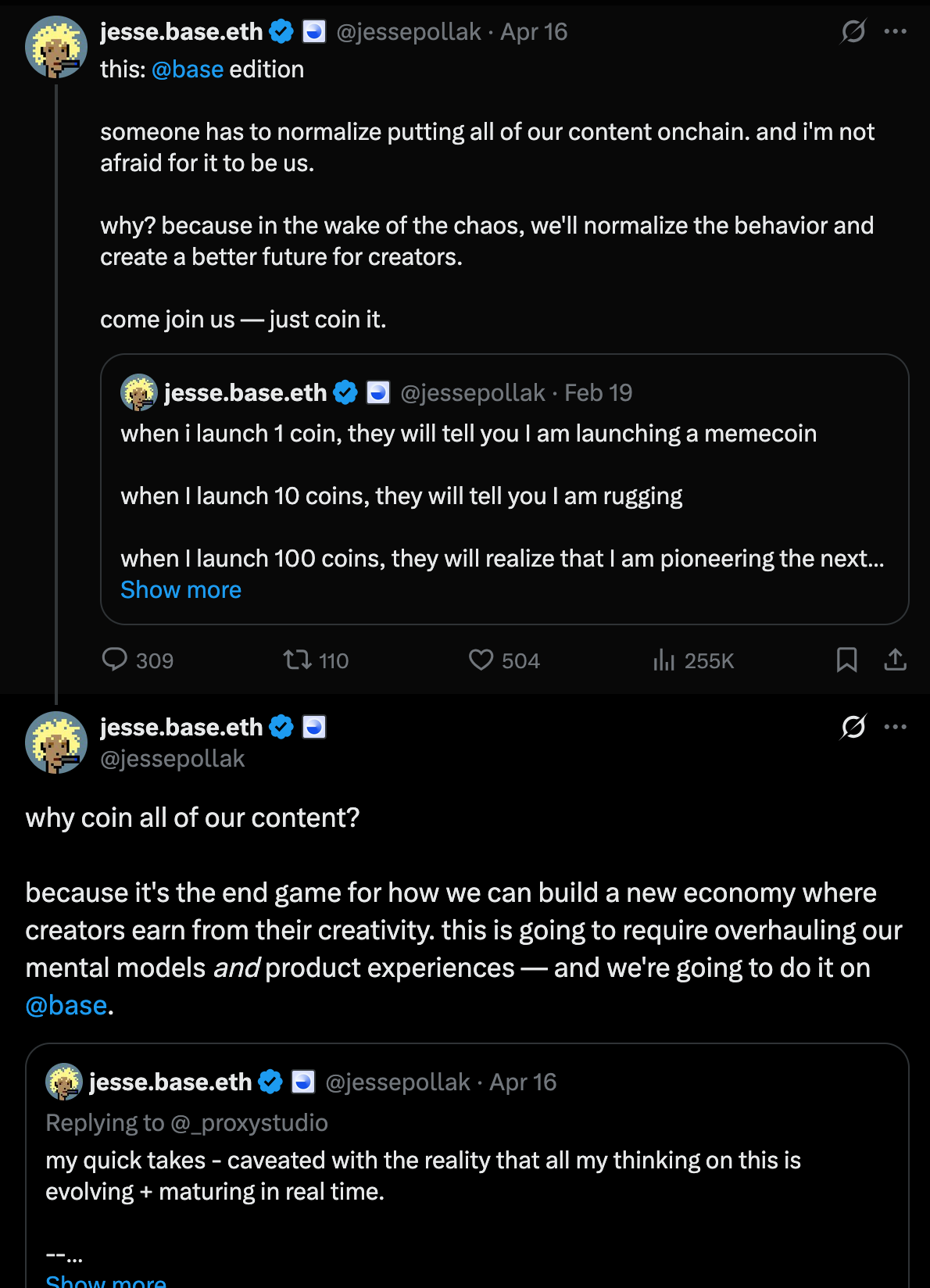

Yesterday Coinbase's Base team launched a couple memecoins they're referring to as a "contentcoins" in an attempt to manufacture hype around their Ethereum layer 2 protocol. The coins quickly pumped, subsequently dumped, recovered a bit over night and then dumped again throughout the day today. While this was a relatively small pump-n-dump that peaked at a $15m market cap, it's a pump-n-dump nonetheless and it was orchestrated by Coinbase - which is supposed to be one of the "mature actors" in the industry.

None of this is surprising to me, but for those who are new to this newsletter or have been somewhat neutral on Coinbase I feel compelled to recommend that you stay away from the exchange and make plans to move your bitcoin off of their exchange if you have some sitting there. Take your hard money and put it in cold storage or, at the very least, move it to a more reputable exchange that is focused on bitcoin and avoids crypto entirely.

I won't go as far to say that Coinbase is in danger of failing any time soon. However, it is clear that their team is economically illiterate and so completely lost that it would be irresponsible of me to not warn you about this. We're 16 years into bitcoin and after 4-5 waves of altcoin scams over the course of the last 14-15 years - which have proven undoubtedly that there is no product-market fit for "crypto" outside of degenerate gambling and long-term economic extraction by insiders feeding off of retail investors - Coinbase has only decided to lean in harder to the scams. To the point where they have launched their own and have started launching more.

The first being Base itself, which is a solution that no one wants for problems no one has.

*Creator here*

1.) What?

Could you imagine a world in which every creator is creating an individual token for an individual piece of content? Why in the hell would anyone who consumes that content want to buy that token with the knowledge that there are millions of other creators putting out millions of pieces of content collectively per day? Does Coinbase's c-suite not see the dilution effect of the mechanisms they're aiming to create and foster?

It's completely nonsensical, as is the notion that anything but money needs to be tracked on a blockchain. I've said it many times, but I'll say it again: the confused hoard of crypto bros fundamentally misunderstand the nature of the "assets" they're trying to force on the market. They are viewed by crypto bros as some sort of tech breakthrough that enables economic efficiency when they are in fact the exact opposite. They are monetary goods competing in the market on the merits of their monetary properties and nothing in crypto comes close to competing with bitcoin's properties.

The crypto bros are creating a digital bartering system that forces users to constantly weigh the opportunity cost of parking their value in one of the thousands of coins that are being launched every day. They are enabling a game of hot potato that leads to the destruction of value for the individuals who play the game. They are deeply confused, immoral, or both.

Worse yet, they distract their users from finding and harnessing the true economic freedom that comes with bitcoin by giving them hope that they can ride the wave of "the next bitcoin". Setting them back materially when they spend years holding on to dog shit crypto tokens they think they're going to ride to Valhalla. Nothing makes this clearer than the long-term ETH back holders enthusiastically going down with the ship right now.

Reality check pic.twitter.com/KkOojvaSQQ

— Pledditor (@Pledditor) April 16, 2025

I'm going on a bit of a ramble now, so I'll wrap up with this; stay away from Coinbase if you've already done so successfully up to this point and run away as soon as you can if you're still a customer. Its executive suite is filled with economic illiterates who are damaging the long-term viability of their company by spreading their resources thin to support the exponential rise of crypto scams, launching scam coins themselves, and completely misunderstanding the market they're playing in from first principles.

The looming debt maturity wall Michael Howell described in our conversation represents one of the most significant yet under-discussed threats to market stability. COVID-era debt issued at historically low interest rates is now approaching maturity, creating a refinancing tsunami set to hit markets between 2025-2027. This massive rollover event will force borrowers to refinance at interest rates potentially 4-5 times higher than their original terms, creating enormous pressure on corporate balance sheets and market liquidity.

"The debt that was turned out in 2020, 2021 at nearly zero interest rates is now coming back to be refinanced in 2025, 26, 2027 at much higher interest rates." - Michael Howell

What makes this particularly concerning is how this refinancing activity will absorb liquidity from the broader financial ecosystem. As Howell explained, when massive amounts of capital get redirected toward debt refinancing, that's liquidity that can't support other asset prices. This liquidity drain will likely impact everything from stocks to Bitcoin, potentially triggering significant market corrections as the wall approaches. The timing couldn't be worse, with Fed liquidity already projected to decline and Treasury refinancing demands at historic highs.

Check out the full podcast here for more on repo market stress signals, China's gold strategy, and why investor positioning is at extreme defensive levels not seen since 2009.

Powell Signals Mainstream Shift for Crypto - via X

Former SEC Chair Gensler Reveals Bitcoin Maximalist Stance - via X

White House Claims Tech Can Manipulate Space-Time - via X

OpenAI Launch Codex CLI for Open-Source Coding - via X

Looking for the perfect video to push the smartest person you know from zero to one on bitcoin? Bitcoin, Not Crypto is a three-part master class from Parker Lewis and Dhruv Bansal that cuts through the noise—covering why 21 million was the key technical simplification that made bitcoin possible, why blockchains don’t create decentralization, and why everything else will be built on bitcoin.

Ten31, the largest bitcoin-focused investor, has deployed $150M across 30+ companies through three funds. I am a Managing Partner at Ten31 and am very proud of the work we are doing. Learn more at ten31.vc/invest.

Final thought...

Ready for some sleep.

Get this newsletter sent to your inbox daily: https://www.tftc.io/bitcoin-brief/

Subscribe to our YouTube channels and follow us on Nostr and X: