This year's surge in gold acquisitions by central banks has been a remarkable 34% increase compared to the previous year, propelling their holdings beyond the pre-Nixon era levels—a significant milestone given the historical context.

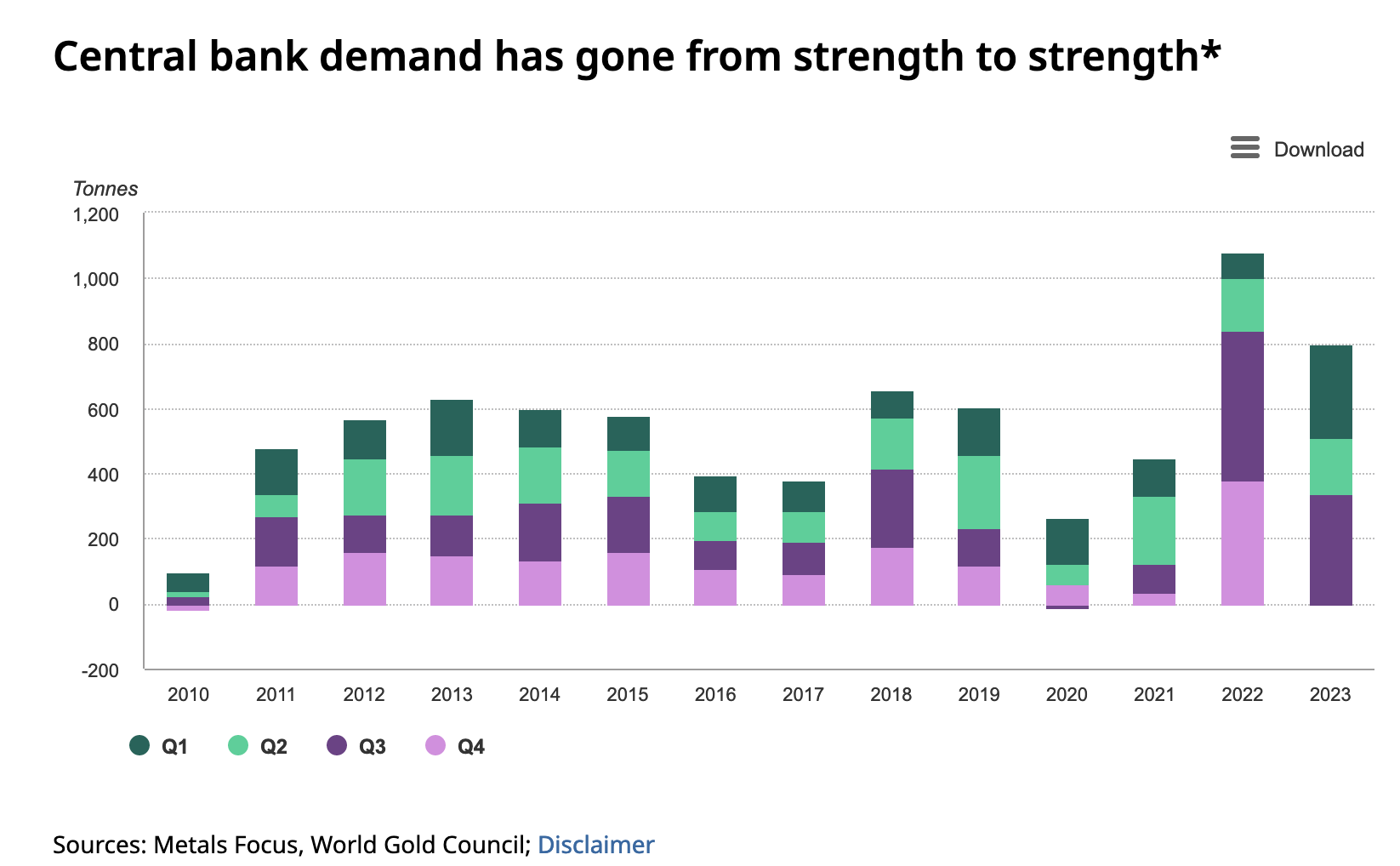

In a recent development that has sent ripples through the financial world, central banks globally have been observed amassing gold reserves at an accelerated pace, a trend that has raised eyebrows and incited speculation about potential looming economic uncertainties. This year's surge in gold acquisitions by central banks has been a remarkable 34% increase compared to the previous year, propelling their holdings beyond the pre-Nixon era levels—a significant milestone given the historical context.

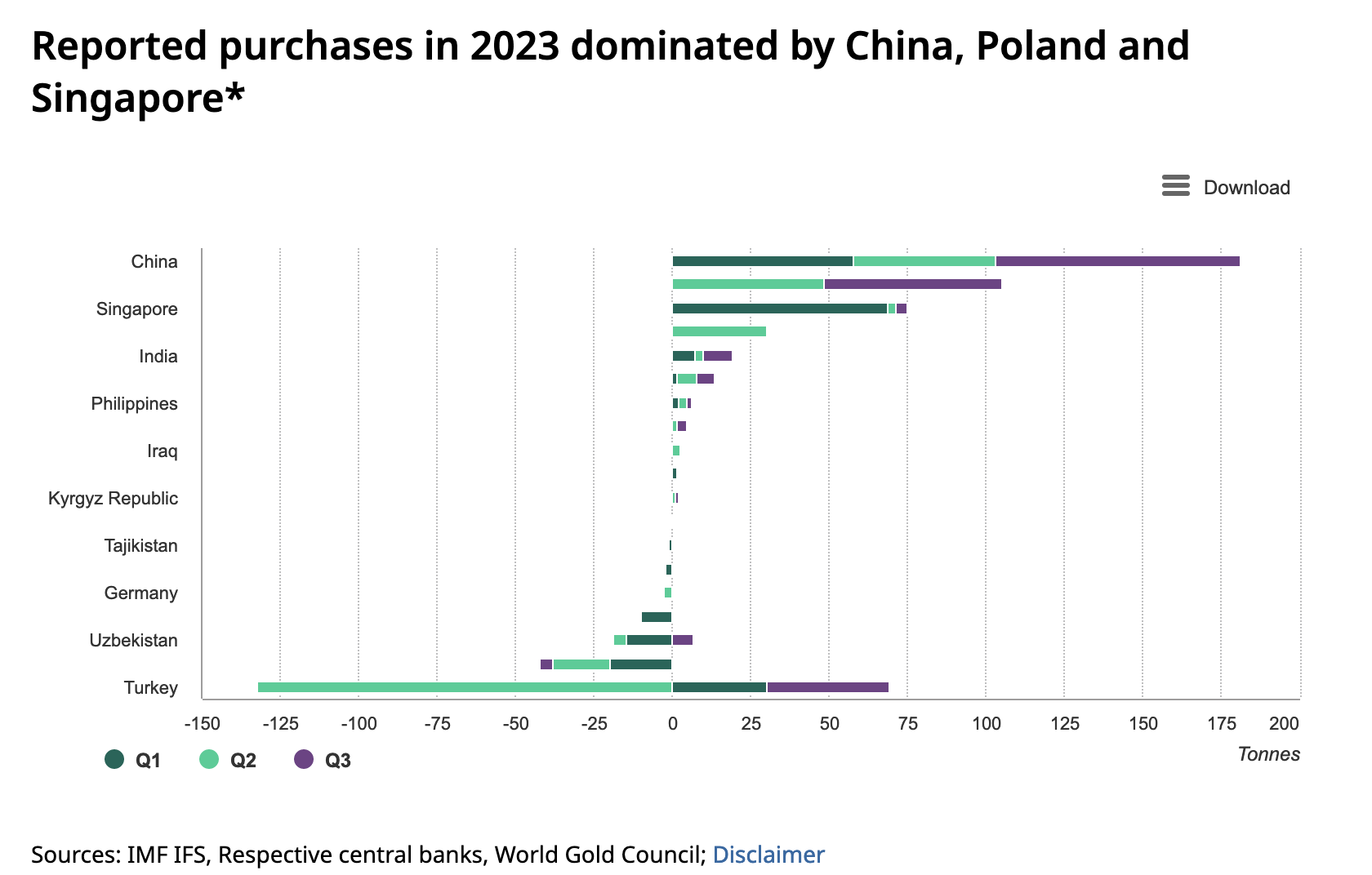

The fervor for gold is not limited to any particular economic class of nations; both affluent and developing countries are eagerly participating in this trend. Leading the pack in this gold rush are China, Singapore, and India, with European nations also notably increasing their purchases.

This phenomenon is not entirely new. Since the 2008 financial crisis, central banks have been discreetly but consistently bolstering their gold reserves, despite public messages of reassurance. This divergence between their spoken confidence and actual investment strategy suggests that central banks harbor concerns about the stability of the global financial system.

Traditionally, central banks have preferred to park their money in government bonds, given their liquidity and abundance. However, in a stark departure from decades of disfavor following the abandonment of the gold standard in 1971, gold has now regained its status as a key asset among central banks' reserves.

Recent admissions from central bank officials have shed light on this strategic pivot toward gold. An official from the Dutch central bank, for instance, indicated that gold serves as a crucial hedge in scenarios of financial collapse. This candid acknowledgment reinforces the notion that central banks view gold as both a safeguard and a potential mechanism for reinstating a form of gold standard, should the need arise.

Moreover, there is a growing belief that central banks' current gold reserves could support a re-monetization of gold more easily than presumed. Trust in a central bank's ability to maintain low inflation and redeem gold could pave the way for such a transition, with a consequential surge in gold's value.

While central banks are still in the phase of accumulating gold as insurance rather than moving towards immediate implementation of a gold-based financial system, the continuous upward trajectory of government spending and inflation could precipitate a shift. Nations may seek refuge in more stable currencies or assets, with some potentially turning to the US dollar and others considering a move back to gold.

Observers and analysts are keeping a watchful eye on these developments, recognizing that the central banks' rush to gold is a harbinger of turbulent times ahead. The implications for the global economy could be profound, and the situation warrants close scrutiny in the coming period.

Central banker admits they're buying up gold as insurance in case "everything collapses."

— Peter St Onge, Ph.D. (@profstonge) December 12, 2023

Central banks have been hoovering up gold ever since the 2008 financial crisis, and it's now accelerating -- up 34% in one year.

Their press releases say everything is fine. Their behavior… pic.twitter.com/AclxMFtDAj